Scalper1 News

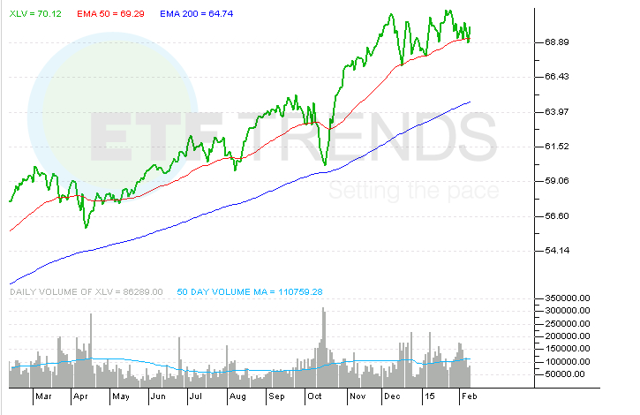

Summary The Healthcare sector could continue to perform this year. Fundamental factors continue to contribute to growth. Biotech is the leading sub-sector in the healthcare industry. The Healthcare sector exchange traded funds have been outpacing the broader markets and could remain healthy as rising profits diminish concerns over frothy valuations. Over the past year, the Health Care Select Sector SPDR ETF (NYSEARCA: XLV ) rose 25.2%, while the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) gained 17.1%. Year-to-date, XLV is up 2.5% and SPY is 0.6% higher. Specialized drug treatments, an aging population and industry-wide consolidation, among other factors, will continue to help healthcare stocks, reports Eric Platt for Financial Times . “More than any other sector, healthcare is benefiting from strong demographic and secular trends: aging population, expanding insurance coverage, growing middle-class around the world, new product launches,” Dubravko Lakos-Bujas, equity strategist with J.P. Morgan, said in the Financial Times article. Strong earnings results will support the healthcare sector ‘s rising prices. Healthcare companies reported organic growth of all sectors, including 11% revenue growth and 22% earnings growth over the fourth quarter. Looking ahead, S&P Capital IQ projects S&P 500 healthcare earnings per share to rise 8.9% in 2015 year-over-year, compared to a 1.7% gain in the broader blue-chip index. Barclays strategists also point out that the biotech sub-sector has been a significant contributing factor to earnings growth within the healthcare industry. Over the past year, the iShares Nasdaq Biotechnology ETF (NASDAQ: IBB ) rose 27.2% and the Market Vectors Biotech ETF (NYSEARCA: BBH ) increased 21.9%. The biotech sub-sector makes up 20.3% of XLV’s holdings. “Our conviction level is high on the industry given what we believe will be another strong year for biotech innovation and a differentiated earnings growth profile versus the broader markets,” Geoffrey Meacham, an analyst with Barclays, said in the Financial Times article. Moreover, merger and acquisition (M&A) activity will strengthen valuations. As the market anticipates more deals ahead , consolidations have provided a floor on share prices. Fueling further M&A activity, Marshall Gordon, senior healthcare analyst at ClearBridge Investments, argues that large companies still need to acquire more products, especially as large blockbuster drug patents expire, and financing remains inexpensive. Health Care Select Sector SPDR ETF (click to enlarge) Max Chen contributed to this article . Disclosure: The author is long SPY. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The Healthcare sector could continue to perform this year. Fundamental factors continue to contribute to growth. Biotech is the leading sub-sector in the healthcare industry. The Healthcare sector exchange traded funds have been outpacing the broader markets and could remain healthy as rising profits diminish concerns over frothy valuations. Over the past year, the Health Care Select Sector SPDR ETF (NYSEARCA: XLV ) rose 25.2%, while the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) gained 17.1%. Year-to-date, XLV is up 2.5% and SPY is 0.6% higher. Specialized drug treatments, an aging population and industry-wide consolidation, among other factors, will continue to help healthcare stocks, reports Eric Platt for Financial Times . “More than any other sector, healthcare is benefiting from strong demographic and secular trends: aging population, expanding insurance coverage, growing middle-class around the world, new product launches,” Dubravko Lakos-Bujas, equity strategist with J.P. Morgan, said in the Financial Times article. Strong earnings results will support the healthcare sector ‘s rising prices. Healthcare companies reported organic growth of all sectors, including 11% revenue growth and 22% earnings growth over the fourth quarter. Looking ahead, S&P Capital IQ projects S&P 500 healthcare earnings per share to rise 8.9% in 2015 year-over-year, compared to a 1.7% gain in the broader blue-chip index. Barclays strategists also point out that the biotech sub-sector has been a significant contributing factor to earnings growth within the healthcare industry. Over the past year, the iShares Nasdaq Biotechnology ETF (NASDAQ: IBB ) rose 27.2% and the Market Vectors Biotech ETF (NYSEARCA: BBH ) increased 21.9%. The biotech sub-sector makes up 20.3% of XLV’s holdings. “Our conviction level is high on the industry given what we believe will be another strong year for biotech innovation and a differentiated earnings growth profile versus the broader markets,” Geoffrey Meacham, an analyst with Barclays, said in the Financial Times article. Moreover, merger and acquisition (M&A) activity will strengthen valuations. As the market anticipates more deals ahead , consolidations have provided a floor on share prices. Fueling further M&A activity, Marshall Gordon, senior healthcare analyst at ClearBridge Investments, argues that large companies still need to acquire more products, especially as large blockbuster drug patents expire, and financing remains inexpensive. Health Care Select Sector SPDR ETF (click to enlarge) Max Chen contributed to this article . Disclosure: The author is long SPY. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News