Scalper1 News

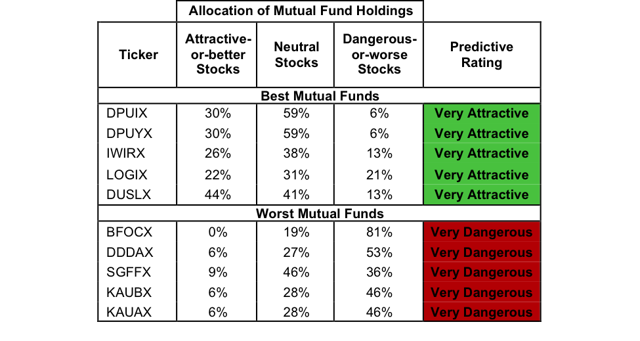

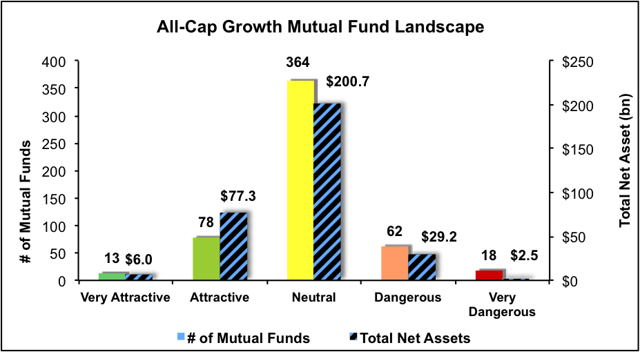

Summary All Cap Growth style ranks fifth in 2Q15. Based on an aggregation of ratings of 517 mutual funds. DPUIX is our top rated All Cap Growth mutual fund and KAUAX is our worst rated All Cap Growth mutual fund. The All Cap Growth style ranks fifth out of the 12 fund styles as detailed in our 2Q15 Style Ratings report . It gets our Neutral rating, which is based on an aggregation of ratings of zero ETFs and 517 mutual funds in the All Cap Growth style. Figure 1 shows the five best rated and the five worst rated All Cap Growth mutual funds. Not all mutual funds are created the same. The number of holdings varies widely (from 20 to 2140). This variation creates drastically different investment implications and, therefore, ratings. Investors seeking exposure to the All Cap Growth style should buy one of the Attractive-or-better rated mutual funds from Figure 1. Figure 1: Mutual Funds with the Best & Worst Ratings – Top 5 (click to enlarge) * Best mutual funds exclude mutual funds with TNAs less than $100 million for inadequate liquidity. Strategic Funds Dreyfus U.S. Equity (MUTF: DPUIX ) is our top-rated All Cap Growth mutual fund, and gets our Very Attractive rating. Over 30% of the stocks within this fund are rated Attractive or better. Even more impressive, 0% of the fund’s assets are allocated to Very-Dangerous-rated stocks. One of our favorite stocks in this fund is Target (NYSE: TGT ). Target has long been a staple of American consumer retail. It operates as a general merchandise retailer, selling everything from grocery goods to furniture to electronics and clothing. In fiscal 2015, Target saw strong growth in both revenues and after tax profits ( NOPAT ). Total sales grew 2% in 2014 and comparable store sales grew over 1%, showcasing strength in Target’s existing stores. Target also increased its return on invested capital ( ROIC ) to 9% in 2015, up from 8% the prior year. Best of all is the fact that Target has generated positive economic earnings every year for the past 17 years, showcasing its ability to consistently earn a return greater than its cost of doing business and to generate value for shareholders. At its current price of $80/share, Target has a price to economic book value ( PEBV ) ratio of only 1.1. This ratio implies that the market expects Target’s NOPAT to grow by only 10% from current levels. Meanwhile, if Target can grow NOPAT by only 4% compounded annually for the next eight years , the stock is worth $92/share today – a 15% upside. Federated Kaufmann Fund (MUTF: KAUAX ) is our worst rated All Cap Growth mutual Fund. It earns a Very Dangerous rating. One of the worst stocks in the fund is Actavis plc (NYSE: ACT ). In 2014, Actavis saw disappointing results in regards to ROIC and NOPAT growth. Actavis’ ROIC declined from 4% in 2013 to just 1% in 2014. NOPAT also declined 28% in 2014. The long-term trends for the company do not look promising either. Over the past decade, the company has never earned a ROIC above 7%. In 2004, NOPAT margin was 11% but has declined to just 3% in 2014. Due to the deteriorating fundamentals of the business, we believe the stock is overpriced. To justify its current price of ~$301/share, the company would need to grow NOPAT at a compounded annual rate of 36% for the next 13 years . This seems unreasonable given that the company has grown NOPAT by only 8% compounded annually over the past decade. Figure 2 shows the rating landscape of all All Cap Growth mutual funds. Figure 2: Separating the Best Mutual Funds From the Worst Funds (click to enlarge) Sources Figure 1-2: New Constructs, LLC and company filings D isclosure: David Trainer and Allen L. Jackson receive no compensation to write about any specific stock, style, style or theme. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary All Cap Growth style ranks fifth in 2Q15. Based on an aggregation of ratings of 517 mutual funds. DPUIX is our top rated All Cap Growth mutual fund and KAUAX is our worst rated All Cap Growth mutual fund. The All Cap Growth style ranks fifth out of the 12 fund styles as detailed in our 2Q15 Style Ratings report . It gets our Neutral rating, which is based on an aggregation of ratings of zero ETFs and 517 mutual funds in the All Cap Growth style. Figure 1 shows the five best rated and the five worst rated All Cap Growth mutual funds. Not all mutual funds are created the same. The number of holdings varies widely (from 20 to 2140). This variation creates drastically different investment implications and, therefore, ratings. Investors seeking exposure to the All Cap Growth style should buy one of the Attractive-or-better rated mutual funds from Figure 1. Figure 1: Mutual Funds with the Best & Worst Ratings – Top 5 (click to enlarge) * Best mutual funds exclude mutual funds with TNAs less than $100 million for inadequate liquidity. Strategic Funds Dreyfus U.S. Equity (MUTF: DPUIX ) is our top-rated All Cap Growth mutual fund, and gets our Very Attractive rating. Over 30% of the stocks within this fund are rated Attractive or better. Even more impressive, 0% of the fund’s assets are allocated to Very-Dangerous-rated stocks. One of our favorite stocks in this fund is Target (NYSE: TGT ). Target has long been a staple of American consumer retail. It operates as a general merchandise retailer, selling everything from grocery goods to furniture to electronics and clothing. In fiscal 2015, Target saw strong growth in both revenues and after tax profits ( NOPAT ). Total sales grew 2% in 2014 and comparable store sales grew over 1%, showcasing strength in Target’s existing stores. Target also increased its return on invested capital ( ROIC ) to 9% in 2015, up from 8% the prior year. Best of all is the fact that Target has generated positive economic earnings every year for the past 17 years, showcasing its ability to consistently earn a return greater than its cost of doing business and to generate value for shareholders. At its current price of $80/share, Target has a price to economic book value ( PEBV ) ratio of only 1.1. This ratio implies that the market expects Target’s NOPAT to grow by only 10% from current levels. Meanwhile, if Target can grow NOPAT by only 4% compounded annually for the next eight years , the stock is worth $92/share today – a 15% upside. Federated Kaufmann Fund (MUTF: KAUAX ) is our worst rated All Cap Growth mutual Fund. It earns a Very Dangerous rating. One of the worst stocks in the fund is Actavis plc (NYSE: ACT ). In 2014, Actavis saw disappointing results in regards to ROIC and NOPAT growth. Actavis’ ROIC declined from 4% in 2013 to just 1% in 2014. NOPAT also declined 28% in 2014. The long-term trends for the company do not look promising either. Over the past decade, the company has never earned a ROIC above 7%. In 2004, NOPAT margin was 11% but has declined to just 3% in 2014. Due to the deteriorating fundamentals of the business, we believe the stock is overpriced. To justify its current price of ~$301/share, the company would need to grow NOPAT at a compounded annual rate of 36% for the next 13 years . This seems unreasonable given that the company has grown NOPAT by only 8% compounded annually over the past decade. Figure 2 shows the rating landscape of all All Cap Growth mutual funds. Figure 2: Separating the Best Mutual Funds From the Worst Funds (click to enlarge) Sources Figure 1-2: New Constructs, LLC and company filings D isclosure: David Trainer and Allen L. Jackson receive no compensation to write about any specific stock, style, style or theme. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News