Scalper1 News

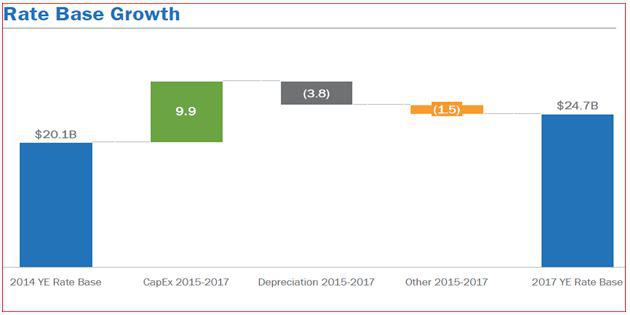

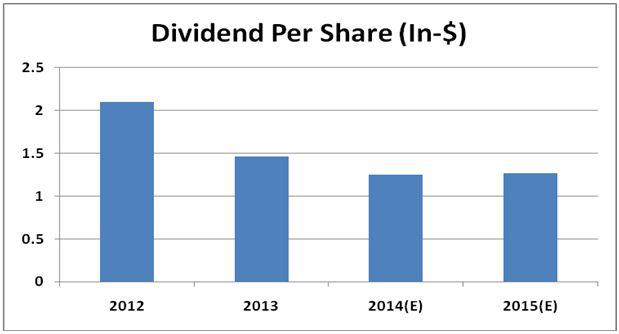

Summary EXC’s strategic investments in regulated operations and recent acquisitions will trigger decent growth and stability in revenue, earnings and cash flows. EXC will better support its dividend payments to remain an attractive pick for dividend-seeking investors. Stock offers attractive dividend yield of 3.3%. Owing to volatility in natural gas and power prices, Exelon Corporation’s (NYSE: EXC ) competitive business operations have been hurting its earnings growth prospects. In its efforts to fight back the challenges in its competitive power operations, the company has started pursuing an intelligent strategic growth formula that focuses on strengthening its regulated operations. As a matter of fact, these strategic initiatives, focused on diversifying its power generation portfolio through strategic acquisitions and through the sale of its competitive assets, will strengthen its long-term growth prospects. I believe that by increasing regulated operations, the company will create stable earnings and a secure cash flow base, which will ensure the security of its attractive dividend payment policy in the long term. EXC Making Right Moves to Grow In Long Run The company has a large operational base with both competitive and regulated operations. Competitive business operations contribute more than 40% towards its total earnings. Weakness in the company’s competitive business operations in recent years due to low and volatile power prices has hurt EXC’s consolidated earnings growth prospects. In its efforts to overcome the backdrops of its competitive operations, the company has carved out an intelligent strategic growth plan to divest most of its competitive assets and grow its power generation portfolio through acquisitions. The company has signed definitive contracts to sell the non-core assets of its generation segment for $1.4 billion . And out of these $1.4 billion proceeds, approximately $1 billion will be used to fund the acquisition of Pepco Holdings Inc. (NYSE: POM ). The POM-EXC merger agreement, which recently reached a settlement in a hearing before NJ BPU (New Jersey Board of Public utilities), is expected to close in the second or third quarter of 2015. Upon its completion, the merger will increase the scale of EXC’s regulated operations. An increase in regulated operations and completion of the merger will bring stability to its cash flow base. Along with that, the combined utility business is expected to have a rate base of approximately $26 billion , which will portend well for its future sales growth. Also, I believe the $6.8 billion POM-EXC merger will positively affect its earnings growth rate, and EXC is expected to enjoy an earnings growth rate of 4%-6% in the long term. Moreover, EXC is working to improve its electricity generation portfolio and reduce its operational risks. The company completed the acquisition of Integrys Energy, which will strengthen its operations. Since many of Intergrys’ customers are in the same regions where EXC has significant power generation operations, the acquisition will benefit the company by matching generation with load capacity. Talking about the significance of the acquisition, Kenneth Cornew, the president and CEO of Exelon Generation, said : “The combination creates a stronger, more diverse business that is well positioned to compete for customers in retail electricity and gas markets across the country. It vastly expands our gas portfolio increasing our load by 150 BCF annually.” Owing to the potentials of the company’s strategic growth efforts, I believe the management’s expected rate base growth of $24.7 billion by the end of 2017 is achievable, which will add well towards its sales and earnings numbers in the long-run. The following chart shows the company’s expected rate base growth from 2014 to 2017. Source: Company’s Earnings presentation In addition to the successful acquisitions, EXC is considering options to close its nuclear power operations. Although the company has a widely extended nuclear power generating portfolio, but owing to their cost-competitive nature, its nuclear facilities are putting EXC at a disadvantage as compared to its peers. The company has highlighted the need for government support on nuclear plants in its recent statement on a power plant closure in Illinois. Although the government hasn’t responded to this statement yet, I believe that if the state doesn’t pursue the Regional Green House Gas Initiative (RGGI) or comparable market based programs to support carbon-free nuclear energy in Illinois, EXC should shut three out of its eleven nuclear plants in the state. Potential rewards for Income-Seeking Investors EXC has returned a significant proportion of its annual cash flows to its shareholders through healthy dividend payments. The company currently offers an attractive dividend yield of 3.30% . Given the fact that the POM acquisition will soon raise its level of regulated operations, EXC will remain attractive for its dividend-seeking investors due to the attainment of a stable cash flow base. As a matter of fact, a stable cash flow base will provide sustainability and security to the company’s long term dividends. The following chart shows EXC’s dividend per share payments in the last two years and for future years, based on my estimates. Source: Company’s Yearly Earnings Reports & Equity Watch Estimates Risks With an increase in the level of regulated operations, the company will be exposed to the risk of increases in regulatory restrictions by federal and state regulators. Moreover, EXC’s competitive assets will continue to face the risk of volatility in power prices. In addition to that, failure to integrate new acquisitions may undermine the company’s expected earnings growth potentials. Conclusion Owing to the company’s strategic investments in regulated operations and recent acquisitions, I believe EXC will witness decent growth and stability in its revenue, earnings and cash flows. Moreover, the company will be able to better support its dividend payments to remain an attractive pick for dividend-seeking investors. The stock currently offers an attractive dividend yield of 3.3%. Also, analysts have anticipated a decent next five-year earnings growth rate of 4.40% for the company. Scalper1 News

Summary EXC’s strategic investments in regulated operations and recent acquisitions will trigger decent growth and stability in revenue, earnings and cash flows. EXC will better support its dividend payments to remain an attractive pick for dividend-seeking investors. Stock offers attractive dividend yield of 3.3%. Owing to volatility in natural gas and power prices, Exelon Corporation’s (NYSE: EXC ) competitive business operations have been hurting its earnings growth prospects. In its efforts to fight back the challenges in its competitive power operations, the company has started pursuing an intelligent strategic growth formula that focuses on strengthening its regulated operations. As a matter of fact, these strategic initiatives, focused on diversifying its power generation portfolio through strategic acquisitions and through the sale of its competitive assets, will strengthen its long-term growth prospects. I believe that by increasing regulated operations, the company will create stable earnings and a secure cash flow base, which will ensure the security of its attractive dividend payment policy in the long term. EXC Making Right Moves to Grow In Long Run The company has a large operational base with both competitive and regulated operations. Competitive business operations contribute more than 40% towards its total earnings. Weakness in the company’s competitive business operations in recent years due to low and volatile power prices has hurt EXC’s consolidated earnings growth prospects. In its efforts to overcome the backdrops of its competitive operations, the company has carved out an intelligent strategic growth plan to divest most of its competitive assets and grow its power generation portfolio through acquisitions. The company has signed definitive contracts to sell the non-core assets of its generation segment for $1.4 billion . And out of these $1.4 billion proceeds, approximately $1 billion will be used to fund the acquisition of Pepco Holdings Inc. (NYSE: POM ). The POM-EXC merger agreement, which recently reached a settlement in a hearing before NJ BPU (New Jersey Board of Public utilities), is expected to close in the second or third quarter of 2015. Upon its completion, the merger will increase the scale of EXC’s regulated operations. An increase in regulated operations and completion of the merger will bring stability to its cash flow base. Along with that, the combined utility business is expected to have a rate base of approximately $26 billion , which will portend well for its future sales growth. Also, I believe the $6.8 billion POM-EXC merger will positively affect its earnings growth rate, and EXC is expected to enjoy an earnings growth rate of 4%-6% in the long term. Moreover, EXC is working to improve its electricity generation portfolio and reduce its operational risks. The company completed the acquisition of Integrys Energy, which will strengthen its operations. Since many of Intergrys’ customers are in the same regions where EXC has significant power generation operations, the acquisition will benefit the company by matching generation with load capacity. Talking about the significance of the acquisition, Kenneth Cornew, the president and CEO of Exelon Generation, said : “The combination creates a stronger, more diverse business that is well positioned to compete for customers in retail electricity and gas markets across the country. It vastly expands our gas portfolio increasing our load by 150 BCF annually.” Owing to the potentials of the company’s strategic growth efforts, I believe the management’s expected rate base growth of $24.7 billion by the end of 2017 is achievable, which will add well towards its sales and earnings numbers in the long-run. The following chart shows the company’s expected rate base growth from 2014 to 2017. Source: Company’s Earnings presentation In addition to the successful acquisitions, EXC is considering options to close its nuclear power operations. Although the company has a widely extended nuclear power generating portfolio, but owing to their cost-competitive nature, its nuclear facilities are putting EXC at a disadvantage as compared to its peers. The company has highlighted the need for government support on nuclear plants in its recent statement on a power plant closure in Illinois. Although the government hasn’t responded to this statement yet, I believe that if the state doesn’t pursue the Regional Green House Gas Initiative (RGGI) or comparable market based programs to support carbon-free nuclear energy in Illinois, EXC should shut three out of its eleven nuclear plants in the state. Potential rewards for Income-Seeking Investors EXC has returned a significant proportion of its annual cash flows to its shareholders through healthy dividend payments. The company currently offers an attractive dividend yield of 3.30% . Given the fact that the POM acquisition will soon raise its level of regulated operations, EXC will remain attractive for its dividend-seeking investors due to the attainment of a stable cash flow base. As a matter of fact, a stable cash flow base will provide sustainability and security to the company’s long term dividends. The following chart shows EXC’s dividend per share payments in the last two years and for future years, based on my estimates. Source: Company’s Yearly Earnings Reports & Equity Watch Estimates Risks With an increase in the level of regulated operations, the company will be exposed to the risk of increases in regulatory restrictions by federal and state regulators. Moreover, EXC’s competitive assets will continue to face the risk of volatility in power prices. In addition to that, failure to integrate new acquisitions may undermine the company’s expected earnings growth potentials. Conclusion Owing to the company’s strategic investments in regulated operations and recent acquisitions, I believe EXC will witness decent growth and stability in its revenue, earnings and cash flows. Moreover, the company will be able to better support its dividend payments to remain an attractive pick for dividend-seeking investors. The stock currently offers an attractive dividend yield of 3.3%. Also, analysts have anticipated a decent next five-year earnings growth rate of 4.40% for the company. Scalper1 News

Scalper1 News