Scalper1 News

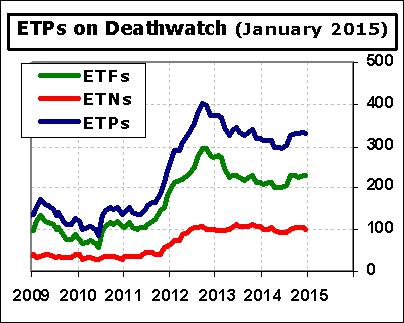

ETF Deathwatch begins 2015 with 322 products on the list, consisting of 222 ETFs and 100 ETNs. Fourteen names joined the lineup this month and nineteen exited. Just nine came off due to improved health, while the other ten met their death and no longer exist. Despite the closure of about 450 ETFs and ETNs over the past decade, there are still 322 zombie products remaining, and they average just $6.4 million in assets. The average age of these products is 47 months, more than enough time to attract a little investor interest. Clearly, these products are neither desired by investors nor profitable for their sponsors, making one tend to wonder why they still exist. The fourteen new names on the list this month include a dozen based on MSCI indexes, nine ‘quality’ ETFs from State Street SPDRs, and two ‘low volatility’ products from BlackRock iShares. There are dozens of successful products tracking MSCI indexes, carrying SPDR and iShares brands, and pursuing factor-based strategies, yet these new additions are struggling. The recipe for success obviously requires more than just having the right ingredients. Thirty-six brand names appear on ETF Deathwatch, and two of these brands have their entire product line on the list. All five Columbia ETFs are included. These actively managed funds have been on the market about five years, yet none have gathered more than $10 million in assets. QuantShares is the sponsor of four ETFs, all more than three years old, all with less than $4 million in assets, and all on ETF Deathwatch. It’s now 2015, which means a second calendar year has come and gone without the iPath Short Enhanced MSCI Emerging Markets Index ETN (NYSEARCA: EMSA ) registering a single trade. November 9, 2012 was the last time EMSA saw any action, and there were only 100 shares traded that day. It was just one of eight products going the entire month of December without a transaction. Additionally, 145 products failed to register any volume on the last day of the year. Here is the Complete List of 322 Products on ETF Deathwatch for January 2015 compiled using the objective ETF Deathwatch Criteria . The 14 ETPs added to ETF Deathwatch for January: First Trust ISE Global Platinum (NASDAQ: PLTM ) iPath Bloomberg Industrial Metals ETN (NYSEARCA: JJM ) iShares MSCI Asia ex Japan Minimum Volatility (NYSEARCA: AXJV ) iShares MSCI Emerging Markets Consumer Discretionary (NASDAQ: EMDI ) iShares MSCI Europe Minimum Volatility (NYSEARCA: EUMV ) SPDR MSCI Australia Quality Mix (NYSEARCA: QAUS ) SPDR MSCI Canada Quality Mix (NYSEARCA: QCAN ) SPDR MSCI EAFE Quality Mix (NYSEARCA: QEFA ) SPDR MSCI Emerging Markets Quality Mix (NYSEARCA: QEMM ) SPDR MSCI Germany Quality Mix (NYSEARCA: QDEU ) SPDR MSCI Japan Quality Mix (NYSEARCA: QJPN ) SPDR MSCI Spain Quality Mix (NYSEARCA: QESP ) SPDR MSCI United Kingdom Quality Mix (NYSEARCA: QGBR ) SPDR MSCI World Quality Mix (NYSEARCA: QWLD ) The 9 ETPs removed from ETF Deathwatch due to improved health: First Trust Developed Markets x-US Small Cap AlphaDEX (NYSEARCA: FDTS ) First Trust Managed Municipal (NASDAQ: FMB ) Global X Junior MLP ETF (NYSEARCA: MLPJ ) iPath Pure Beta Broad Commodity ETN (NYSEARCA: BCM ) iShares Currency Hedged MSCI EAFE ETF (NYSEARCA: HEFA ) PowerShares DB Crude Oil Short ETN (NYSEARCA: SZO ) ProShares Global Listed Private Equity (BATS: PEX ) RevenueShares ADR (NYSEARCA: RTR ) Teucrium Soybean (NYSEARCA: SOYB ) The 10 ETPs removed from ETF Deathwatch due to delisting: Market Vectors Bank and Brokerage (NYSEARCA: RKH ) Market Vectors Colombia (NYSEARCA: COLX ) Market Vectors Germany Small-Cap (NYSEARCA: GERJ ) Market Vectors Latin America Small-Cap (NYSEARCA: LATM ) Market Vectors Renminbi Bond (NYSEARCA: CHLC ) Teucrium Natural Gas (NYSEARCA: NAGS ) Teucrium WTI Crude Oil (NYSEARCA: CRUD ) EGShares Emerging Markets Dividend Growth (NYSEARCA: EMDG ) EGShares Emerging Markets Dividend High Income (NYSEARCA: EMHD ) Direxion Daily Gold Bear 3x Shares (NYSEARCA: BARS ) ETF Deathwatch Archives Disclosure covering writer, editor, and publisher: No positions in any of the securities mentioned . No positions in any of the companies or ETF sponsors mentioned. No income, revenue, or other compensation (either directly or indirectly) received from, or on behalf of, any of the companies or ETF sponsors mentioned. Scalper1 News

ETF Deathwatch begins 2015 with 322 products on the list, consisting of 222 ETFs and 100 ETNs. Fourteen names joined the lineup this month and nineteen exited. Just nine came off due to improved health, while the other ten met their death and no longer exist. Despite the closure of about 450 ETFs and ETNs over the past decade, there are still 322 zombie products remaining, and they average just $6.4 million in assets. The average age of these products is 47 months, more than enough time to attract a little investor interest. Clearly, these products are neither desired by investors nor profitable for their sponsors, making one tend to wonder why they still exist. The fourteen new names on the list this month include a dozen based on MSCI indexes, nine ‘quality’ ETFs from State Street SPDRs, and two ‘low volatility’ products from BlackRock iShares. There are dozens of successful products tracking MSCI indexes, carrying SPDR and iShares brands, and pursuing factor-based strategies, yet these new additions are struggling. The recipe for success obviously requires more than just having the right ingredients. Thirty-six brand names appear on ETF Deathwatch, and two of these brands have their entire product line on the list. All five Columbia ETFs are included. These actively managed funds have been on the market about five years, yet none have gathered more than $10 million in assets. QuantShares is the sponsor of four ETFs, all more than three years old, all with less than $4 million in assets, and all on ETF Deathwatch. It’s now 2015, which means a second calendar year has come and gone without the iPath Short Enhanced MSCI Emerging Markets Index ETN (NYSEARCA: EMSA ) registering a single trade. November 9, 2012 was the last time EMSA saw any action, and there were only 100 shares traded that day. It was just one of eight products going the entire month of December without a transaction. Additionally, 145 products failed to register any volume on the last day of the year. Here is the Complete List of 322 Products on ETF Deathwatch for January 2015 compiled using the objective ETF Deathwatch Criteria . The 14 ETPs added to ETF Deathwatch for January: First Trust ISE Global Platinum (NASDAQ: PLTM ) iPath Bloomberg Industrial Metals ETN (NYSEARCA: JJM ) iShares MSCI Asia ex Japan Minimum Volatility (NYSEARCA: AXJV ) iShares MSCI Emerging Markets Consumer Discretionary (NASDAQ: EMDI ) iShares MSCI Europe Minimum Volatility (NYSEARCA: EUMV ) SPDR MSCI Australia Quality Mix (NYSEARCA: QAUS ) SPDR MSCI Canada Quality Mix (NYSEARCA: QCAN ) SPDR MSCI EAFE Quality Mix (NYSEARCA: QEFA ) SPDR MSCI Emerging Markets Quality Mix (NYSEARCA: QEMM ) SPDR MSCI Germany Quality Mix (NYSEARCA: QDEU ) SPDR MSCI Japan Quality Mix (NYSEARCA: QJPN ) SPDR MSCI Spain Quality Mix (NYSEARCA: QESP ) SPDR MSCI United Kingdom Quality Mix (NYSEARCA: QGBR ) SPDR MSCI World Quality Mix (NYSEARCA: QWLD ) The 9 ETPs removed from ETF Deathwatch due to improved health: First Trust Developed Markets x-US Small Cap AlphaDEX (NYSEARCA: FDTS ) First Trust Managed Municipal (NASDAQ: FMB ) Global X Junior MLP ETF (NYSEARCA: MLPJ ) iPath Pure Beta Broad Commodity ETN (NYSEARCA: BCM ) iShares Currency Hedged MSCI EAFE ETF (NYSEARCA: HEFA ) PowerShares DB Crude Oil Short ETN (NYSEARCA: SZO ) ProShares Global Listed Private Equity (BATS: PEX ) RevenueShares ADR (NYSEARCA: RTR ) Teucrium Soybean (NYSEARCA: SOYB ) The 10 ETPs removed from ETF Deathwatch due to delisting: Market Vectors Bank and Brokerage (NYSEARCA: RKH ) Market Vectors Colombia (NYSEARCA: COLX ) Market Vectors Germany Small-Cap (NYSEARCA: GERJ ) Market Vectors Latin America Small-Cap (NYSEARCA: LATM ) Market Vectors Renminbi Bond (NYSEARCA: CHLC ) Teucrium Natural Gas (NYSEARCA: NAGS ) Teucrium WTI Crude Oil (NYSEARCA: CRUD ) EGShares Emerging Markets Dividend Growth (NYSEARCA: EMDG ) EGShares Emerging Markets Dividend High Income (NYSEARCA: EMHD ) Direxion Daily Gold Bear 3x Shares (NYSEARCA: BARS ) ETF Deathwatch Archives Disclosure covering writer, editor, and publisher: No positions in any of the securities mentioned . No positions in any of the companies or ETF sponsors mentioned. No income, revenue, or other compensation (either directly or indirectly) received from, or on behalf of, any of the companies or ETF sponsors mentioned. Scalper1 News

Scalper1 News