Scalper1 News

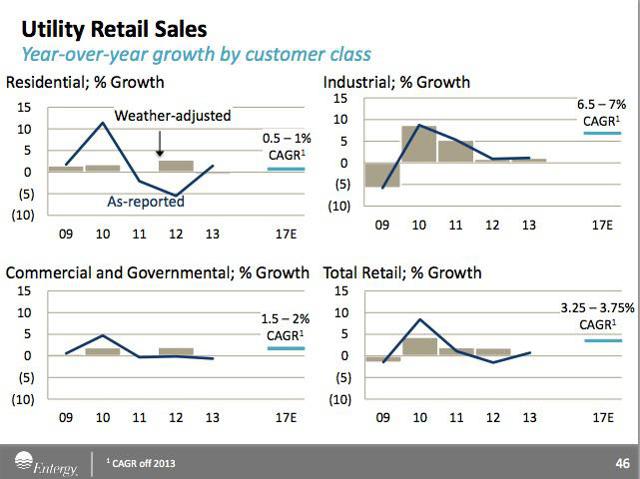

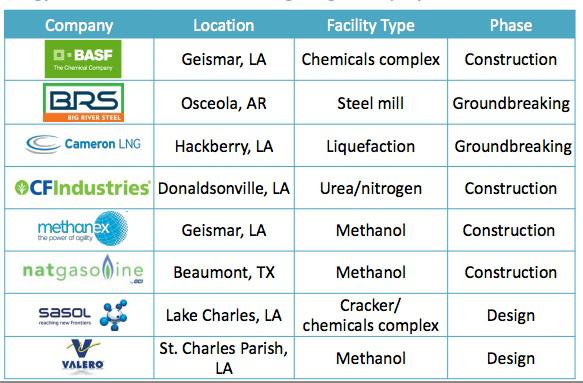

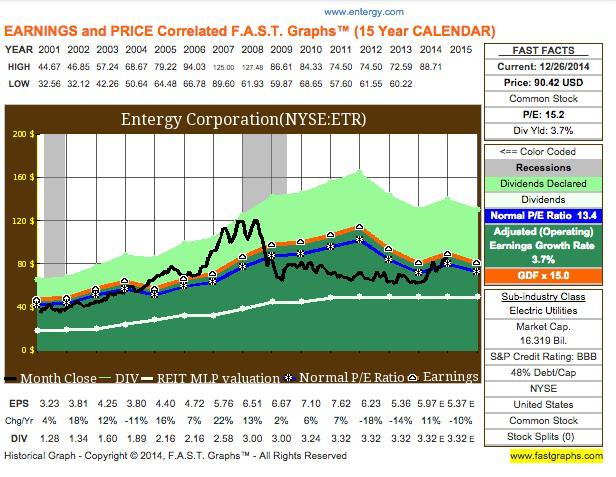

Summary Entergy is building a new power plant and has plans to build new transmission infrastructure. Load demand, not price hikes, is driving earnings growth. Shares are up considerably but I believe they still have a ways to run. It’s difficult to like utilities these days. With interest rates so low, utilities typically yield under 4%. To make matters worse, most states now have ‘renewable energy mandates,’ which means that utility companies are effectively mandated to invest in new energy infrastructure even when load demand is static. This leaves utilities with little choice but to raise rates in the coming years merely to recoup the cost of investment. On August 15th I wrote an article on Entergy Corporation (NYSE: ETR ), a Louisiana-based utility which I thought was the best alternative to the renewable energy hurdle facing US utilities today. Unlike most other states, Louisiana has opted out of renewable energy mandates. Louisiana’s economy is also benefitting greatly from an unprecedented boom in the petrochemicals industry along the gulf coast. This building boom includes everything from chemical plants, NGL crackers, steel mills and LNG export facilities. Since August 15th, Entergy has soared along with the rest of the space. Entergy has leapt from $72 per share to $91, thanks largely to falling interest rates. Right now, most US utilities are trading somewhere above their average P/E multiples, Entergy included. Does that mean it’s time to sell the stock and call it a day? That is what this article will try to answer. Load growth (click to enlarge) Courtesy of Entergy Corp Investor Relations This graphic pretty well sums up what Entergy expects in the coming three years. Residential use is expected to rise modestly, but industrial use will increase by around 6.75% per year, which will drive overall retail load growth by around 3.5% year on year. Utilities love industrial load growth, because it often begets residential load growth, which in turn brings commercial and governmental load growth. The petrochemical boom along the Gulf Coast could bring a decade of good times for utilities such as Entergy, which has business all throughout Louisiana and also in the Texas Gulf Coast. Utility companies must always consider replacing old generation and transmission infrastructure, but it’s easiest to do so when load growth is increasing, because the costs to build more capacity can be spread out on a larger customer base. Entergy is constructing another plant in Louisiana, one which the company believes will support economic growth in the region with low energy prices for years to come. The new power plant, named Ninemile 6, is a gas turbine. Ninemile 6 is scheduled to be ready by the first of next year, and it is the earliest of a very robust construction plan from Amite Parish in southern Louisiana to the Texas Gulf Coast around Houston. Through 2021, Entergy will build transmission lines for the new Cameron LNG plant and a new steel plant. New transmission lines will go up along the Gulf Coast, and eventually the company will upgrade its southeast Louisiana terminal equipment too. Next year, Entergy will spend $665 million. All the while, load demand increases and a focus on the most economical generation sources will keep rates down. With a kilowatt per hour cost of just 7.7 cents, Louisiana has the fourth lowest electricity cost in the nation (behind Kentucky, West Virginia and Washington state). A list of industrial projects underway on the Gulf Coast. Projects range from steel mills to LNG export terminals, and include several world-class companies. Courtesy of Entergy Corporation Investor Relations Valuation As I mentioned earlier, shares of Entergy have jumped up with the rest of the sector. Shares were somewhat below fair value back in August, but they are now just slightly above. Let’s take a look at FAST Graphs for a bigger picture. Courtesy of FAST Graphs In August, shares were well below their fair value and average P/E ratio. Now, however, shares are 13.4% above average P/E and just about at the Graham-Dodd ‘Fair Value’ number. (FAST Graphs measures this by trailing twelve-month earnings.) While Entergy may not be a great deal right here, I would also say that it is way too early to sell shares. Entergy’s 3%-4% retail electricity demand growth makes the company a better choice than most other utility names. Entergy is a multi-year play and I believe this stock has way more room to run. At twenty times trailing earnings Entergy would trade at $120. Given the company’s solid growth prospects, I think twenty times earnings would be a place to consider hopping off. For now, however, I believe that Entergy should be allowed to run for awhile. Conclusion Entergy is in the right place at the right time, and it is one of the only utilities I would consider owning right now. (In fact, it is the only utility which I currently own shares in.) Unlike most other utilities, Entergy is largely unburdened with the need to supply more expensive renewable energy to its customers. The petrochemical boom is fueled by a supply of cheap input costs in natural gas and natural gas liquids. This gives US petrochemical companies an advantage over the rest of the world, and this input cost advantage does not look to be going away anytime soon. Entergy is a relatively low-risk ‘derivative play’ for the petrochemical boom, and I believe shares have a good bit more ways to run before an investor should even consider taking anything off the table. Scalper1 News

Summary Entergy is building a new power plant and has plans to build new transmission infrastructure. Load demand, not price hikes, is driving earnings growth. Shares are up considerably but I believe they still have a ways to run. It’s difficult to like utilities these days. With interest rates so low, utilities typically yield under 4%. To make matters worse, most states now have ‘renewable energy mandates,’ which means that utility companies are effectively mandated to invest in new energy infrastructure even when load demand is static. This leaves utilities with little choice but to raise rates in the coming years merely to recoup the cost of investment. On August 15th I wrote an article on Entergy Corporation (NYSE: ETR ), a Louisiana-based utility which I thought was the best alternative to the renewable energy hurdle facing US utilities today. Unlike most other states, Louisiana has opted out of renewable energy mandates. Louisiana’s economy is also benefitting greatly from an unprecedented boom in the petrochemicals industry along the gulf coast. This building boom includes everything from chemical plants, NGL crackers, steel mills and LNG export facilities. Since August 15th, Entergy has soared along with the rest of the space. Entergy has leapt from $72 per share to $91, thanks largely to falling interest rates. Right now, most US utilities are trading somewhere above their average P/E multiples, Entergy included. Does that mean it’s time to sell the stock and call it a day? That is what this article will try to answer. Load growth (click to enlarge) Courtesy of Entergy Corp Investor Relations This graphic pretty well sums up what Entergy expects in the coming three years. Residential use is expected to rise modestly, but industrial use will increase by around 6.75% per year, which will drive overall retail load growth by around 3.5% year on year. Utilities love industrial load growth, because it often begets residential load growth, which in turn brings commercial and governmental load growth. The petrochemical boom along the Gulf Coast could bring a decade of good times for utilities such as Entergy, which has business all throughout Louisiana and also in the Texas Gulf Coast. Utility companies must always consider replacing old generation and transmission infrastructure, but it’s easiest to do so when load growth is increasing, because the costs to build more capacity can be spread out on a larger customer base. Entergy is constructing another plant in Louisiana, one which the company believes will support economic growth in the region with low energy prices for years to come. The new power plant, named Ninemile 6, is a gas turbine. Ninemile 6 is scheduled to be ready by the first of next year, and it is the earliest of a very robust construction plan from Amite Parish in southern Louisiana to the Texas Gulf Coast around Houston. Through 2021, Entergy will build transmission lines for the new Cameron LNG plant and a new steel plant. New transmission lines will go up along the Gulf Coast, and eventually the company will upgrade its southeast Louisiana terminal equipment too. Next year, Entergy will spend $665 million. All the while, load demand increases and a focus on the most economical generation sources will keep rates down. With a kilowatt per hour cost of just 7.7 cents, Louisiana has the fourth lowest electricity cost in the nation (behind Kentucky, West Virginia and Washington state). A list of industrial projects underway on the Gulf Coast. Projects range from steel mills to LNG export terminals, and include several world-class companies. Courtesy of Entergy Corporation Investor Relations Valuation As I mentioned earlier, shares of Entergy have jumped up with the rest of the sector. Shares were somewhat below fair value back in August, but they are now just slightly above. Let’s take a look at FAST Graphs for a bigger picture. Courtesy of FAST Graphs In August, shares were well below their fair value and average P/E ratio. Now, however, shares are 13.4% above average P/E and just about at the Graham-Dodd ‘Fair Value’ number. (FAST Graphs measures this by trailing twelve-month earnings.) While Entergy may not be a great deal right here, I would also say that it is way too early to sell shares. Entergy’s 3%-4% retail electricity demand growth makes the company a better choice than most other utility names. Entergy is a multi-year play and I believe this stock has way more room to run. At twenty times trailing earnings Entergy would trade at $120. Given the company’s solid growth prospects, I think twenty times earnings would be a place to consider hopping off. For now, however, I believe that Entergy should be allowed to run for awhile. Conclusion Entergy is in the right place at the right time, and it is one of the only utilities I would consider owning right now. (In fact, it is the only utility which I currently own shares in.) Unlike most other utilities, Entergy is largely unburdened with the need to supply more expensive renewable energy to its customers. The petrochemical boom is fueled by a supply of cheap input costs in natural gas and natural gas liquids. This gives US petrochemical companies an advantage over the rest of the world, and this input cost advantage does not look to be going away anytime soon. Entergy is a relatively low-risk ‘derivative play’ for the petrochemical boom, and I believe shares have a good bit more ways to run before an investor should even consider taking anything off the table. Scalper1 News

Scalper1 News