Scalper1 News

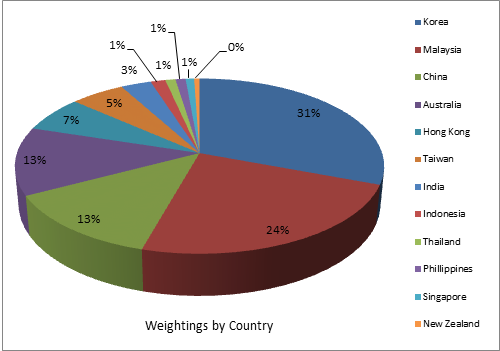

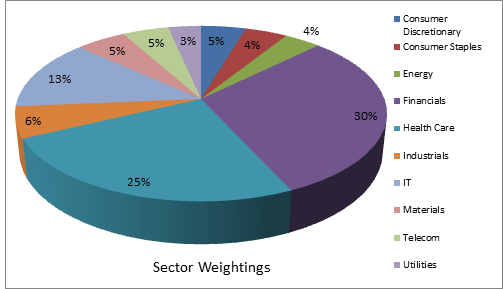

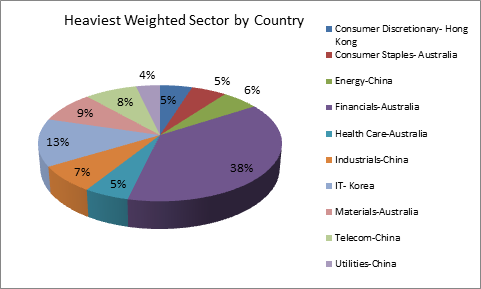

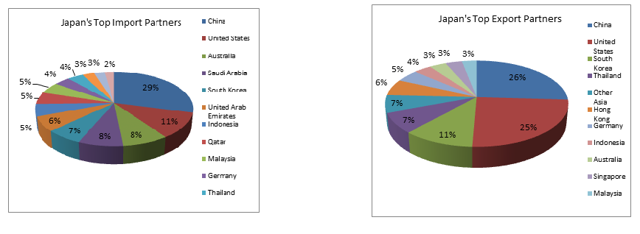

Heavily weighted towards cyclically sensitive sectors. The fund has holdings in top Asia-Pacific companies, excluding Japan. The exclusion of the Japanese economy doesn’t seem to serve any purpose. From its recovery after an ill-conceived, devastating global conflict, Japan underwent a complete restructuring under the leadership of Prime Minister Hayato Ikeda in the 1950s. The constitution was rewritten and modernized, heavy industry and infrastructure was reconstructed, bank regulations were eased and protectionist policies were instituted in order to focus on rebuilding the economy, organically. By the 1960s, referred to by economist as Japan’s ‘golden 60s’, the economy took off and continue to expand, from about $91 billion in 1965 to well over an astonishing $1 trillion by 1985. However, as often happens when left unchecked, growth became unsustainable leading to an asset bubble, which collapsed in 1989. For the next 25 years the economy was trapped in deflationary stagflation, during which time, plan after plan failed to re-inflate the economy. During this same period, the People’s Republic of China was in the process of transitioning from a communist agrarian economy to a more global free market industrial economy with great success. Other countries in the region benefited from the commodity demand generated; Australia, India, Korea, Taiwan, Singapore, India and New Zealand, to name a few. Indeed, Japan still plays a leading role on the Asia Pacific stage, but is no longer the sole regional super-economy. In our present time the Asia-Pacific region has developed into an astonishingly productive and efficient contributor to the entire global economy, with several regional trillion dollar economies. So the question becomes, how well do the Asian Pacific funds perform when Japan is removed from the equation? First, using the Seeking Alpha ETF Hub, and filtering Global/Intl Equities by positive one-year performance results with several ‘ex-Japan’ funds. Excluding ‘specialized’ funds, like ‘Ultras’, ‘Small Cap’, ‘Enhanced’ and the like leaves a few plain vanilla, Asia ex-Japan funds summarized in the table below. ( Data from respective fund websites ) In this category, the Deutsche X-Tracker MSCI Asia Pacific ex Japan Hedged EquityETF ( DBAP ) , as the name suggests includes Asia Pacific economies, excluding Japan. Although hedged, this does not entirely eliminate currency risk, but will dampen currency volatility. (Data from X-Trackers) The fund is most heavily weighted in Financials, 30%, followed by Information Technology, 25%; Industrials, 6%; Materials, 5%; Telecom Services, 4%; Consumer Discretionary, 5%; Consumer Staples, 4%; Energy, 4%; Utilities, 3% and Healthcare at 13%. (Data from X-Trackers) It’s also interesting to note the heaviest sector weightings by country. Australia has the heaviest weightings in Consumer Staples, Financials, Health Care and Materials. China holds the heaviest weightings in Energy, Industrials, Telecom, and Utilities. Hong Kong leads the way in Consumer Discretionary and Korea weights most in the IT sector. This is important to note. China and Australia are major trade partners. Slowing demand in China means a slower Australian economy. Australia has its heaviest weightings are mostly defensive with just one very cyclical sector, Materials. (Data from X-Trackers) At this point, a few words need to be said for the trade dynamic in the region. Japan’s major export partners in the region are China, South Korea, Thailand, Hong Kong, Indonesia, Australia, Singapore and Malaysia. Top export products include Cars, Vehicle Parts, Industrial Printers, Specialized Machinery, Construction Equipment and numerous other industrial products. Hence, by omitting Japan, a major industrial manufacturer, supplier and regional economic contributor, that is to say, a potential major contributor to the fund’s performance is omitted. Excluding the Asia-Pacific region, Japan’s second largest import partner is the United States. Even a slow US economy will conduct sizable trade with Japan, particularly in durable goods. Hence, by omitting Japanese industry from the fund, a major factor is omitted. (It should be noted that other non-Asia-Pacific top export partners include Germany, Mexico, Russia, Canada and the U.K.). (click to enlarge) (Data from OEC) Japan is an integral part of the Asia-Pacific region. Even if the Japanese economy is excluded, its presence implicitly impacts the region, hence the fund, to some extent. China, Australia, Singapore, Hong Kong, New Zealand, South Korea and Indonesia, are developed or recently emerged economies. So excluding Japan does not make this an ’emerging market’ fund, nor can it be really be considered a ‘regional economy’ fund without Japan. The fund seems to be structured on the premise that Japan is the leading economy in the region, whose metrics overwhelm the other regional economies. However, by any measure, Japan fits right in with the locals. The point being is that when compared to its regional neighbors, there is nothing overly exceptional nor detracting about the Japanese economy which dominates the region, necessitating its exclusion. (click to enlarge) The fund trades in a rather strong premium to NAV range: mostly 0.5% to 1.0% and at times as much as 1.5% to 2.0% of NAV, rarely trading at a discount to NAV. Also, management fees are slightly on the high side with a net expense ratio of 0.60%. The fund has been trading since October of 2013. Naturally, before making any investment, it’s always worth reading the fund’s prospectus . Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: “CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.” Scalper1 News

Heavily weighted towards cyclically sensitive sectors. The fund has holdings in top Asia-Pacific companies, excluding Japan. The exclusion of the Japanese economy doesn’t seem to serve any purpose. From its recovery after an ill-conceived, devastating global conflict, Japan underwent a complete restructuring under the leadership of Prime Minister Hayato Ikeda in the 1950s. The constitution was rewritten and modernized, heavy industry and infrastructure was reconstructed, bank regulations were eased and protectionist policies were instituted in order to focus on rebuilding the economy, organically. By the 1960s, referred to by economist as Japan’s ‘golden 60s’, the economy took off and continue to expand, from about $91 billion in 1965 to well over an astonishing $1 trillion by 1985. However, as often happens when left unchecked, growth became unsustainable leading to an asset bubble, which collapsed in 1989. For the next 25 years the economy was trapped in deflationary stagflation, during which time, plan after plan failed to re-inflate the economy. During this same period, the People’s Republic of China was in the process of transitioning from a communist agrarian economy to a more global free market industrial economy with great success. Other countries in the region benefited from the commodity demand generated; Australia, India, Korea, Taiwan, Singapore, India and New Zealand, to name a few. Indeed, Japan still plays a leading role on the Asia Pacific stage, but is no longer the sole regional super-economy. In our present time the Asia-Pacific region has developed into an astonishingly productive and efficient contributor to the entire global economy, with several regional trillion dollar economies. So the question becomes, how well do the Asian Pacific funds perform when Japan is removed from the equation? First, using the Seeking Alpha ETF Hub, and filtering Global/Intl Equities by positive one-year performance results with several ‘ex-Japan’ funds. Excluding ‘specialized’ funds, like ‘Ultras’, ‘Small Cap’, ‘Enhanced’ and the like leaves a few plain vanilla, Asia ex-Japan funds summarized in the table below. ( Data from respective fund websites ) In this category, the Deutsche X-Tracker MSCI Asia Pacific ex Japan Hedged EquityETF ( DBAP ) , as the name suggests includes Asia Pacific economies, excluding Japan. Although hedged, this does not entirely eliminate currency risk, but will dampen currency volatility. (Data from X-Trackers) The fund is most heavily weighted in Financials, 30%, followed by Information Technology, 25%; Industrials, 6%; Materials, 5%; Telecom Services, 4%; Consumer Discretionary, 5%; Consumer Staples, 4%; Energy, 4%; Utilities, 3% and Healthcare at 13%. (Data from X-Trackers) It’s also interesting to note the heaviest sector weightings by country. Australia has the heaviest weightings in Consumer Staples, Financials, Health Care and Materials. China holds the heaviest weightings in Energy, Industrials, Telecom, and Utilities. Hong Kong leads the way in Consumer Discretionary and Korea weights most in the IT sector. This is important to note. China and Australia are major trade partners. Slowing demand in China means a slower Australian economy. Australia has its heaviest weightings are mostly defensive with just one very cyclical sector, Materials. (Data from X-Trackers) At this point, a few words need to be said for the trade dynamic in the region. Japan’s major export partners in the region are China, South Korea, Thailand, Hong Kong, Indonesia, Australia, Singapore and Malaysia. Top export products include Cars, Vehicle Parts, Industrial Printers, Specialized Machinery, Construction Equipment and numerous other industrial products. Hence, by omitting Japan, a major industrial manufacturer, supplier and regional economic contributor, that is to say, a potential major contributor to the fund’s performance is omitted. Excluding the Asia-Pacific region, Japan’s second largest import partner is the United States. Even a slow US economy will conduct sizable trade with Japan, particularly in durable goods. Hence, by omitting Japanese industry from the fund, a major factor is omitted. (It should be noted that other non-Asia-Pacific top export partners include Germany, Mexico, Russia, Canada and the U.K.). (click to enlarge) (Data from OEC) Japan is an integral part of the Asia-Pacific region. Even if the Japanese economy is excluded, its presence implicitly impacts the region, hence the fund, to some extent. China, Australia, Singapore, Hong Kong, New Zealand, South Korea and Indonesia, are developed or recently emerged economies. So excluding Japan does not make this an ’emerging market’ fund, nor can it be really be considered a ‘regional economy’ fund without Japan. The fund seems to be structured on the premise that Japan is the leading economy in the region, whose metrics overwhelm the other regional economies. However, by any measure, Japan fits right in with the locals. The point being is that when compared to its regional neighbors, there is nothing overly exceptional nor detracting about the Japanese economy which dominates the region, necessitating its exclusion. (click to enlarge) The fund trades in a rather strong premium to NAV range: mostly 0.5% to 1.0% and at times as much as 1.5% to 2.0% of NAV, rarely trading at a discount to NAV. Also, management fees are slightly on the high side with a net expense ratio of 0.60%. The fund has been trading since October of 2013. Naturally, before making any investment, it’s always worth reading the fund’s prospectus . Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: “CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.” Scalper1 News

Scalper1 News