On Sep 15, we issued an updated research report on fertilizer company CF IndustriesCF .

While CF Industries remains on track with its capacity expansion projects and should gain from healthy demand for nitrogen, it continues to see pricing pressure in its nitrogen business. The company’s profits tumbled roughly 87% in second-quarter 2016, hurt by lower selling prices. Revenues fell by double digits on reduced average selling prices across all segments.

Depressed global energy prices and excess capacity have contributed to a softer nitrogen pricing environment. Global capacity expansion continues to exert pressure on urea and other nitrogen fertilizer prices.

Nitrogen prices are expected to remain under pressure in the near term due to elevated supply. Abundant nitrogen supply driven by new production capacity is expected weigh on global prices in the second half of 2016. CF Industries expects the challenging pricing environment to sustain through 2017. Additional urea and urea ammonium nitrate (“UAN”) production capacity is slated to come on stream in North America in the first or second quarter of 2017.

The broader fertilizer industry remains hamstrung by a slew of headwinds including low prices of nutrients and depressed farm income. The prevailing softness in agricultural commodity pricing remains a concern for fertilizer companies as it is hindering fertilizer use by farmers given the adverse effect of lower crop pricing on growers’ income.

Moreover, the termination of the deal to buy specific assets of Netherlands-based fertilizers and industrial chemicals producer, OCI N.V. represents a setback for the company. CF Industries and OCI ended the planned combination of CF Industries with certain assets of OCI in May 2016 after the U.S. government’s new tax inversion rules scuppered the merger. The combined entity would have emerged as the world’s biggest publicly traded nitrogen company. The combination was also expected to deliver significant synergies.

CF Industries also has a debt-laden balance sheet with long-term debt of roughly $ 5.5 billion at the end of the second quarter, up around 21% year over year. The company also faces intense pricing competition from both domestic and foreign fertilizer producers and volatility in raw material costs.

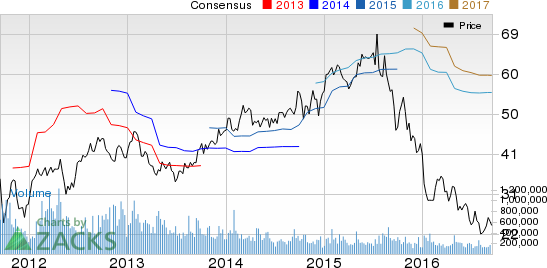

CF Industries is a Zacks Rank #5 (Strong Sell) stock.

CF INDUS HLDGS Price

CF INDUS HLDGS Price | CF INDUS HLDGS Quote

Better-ranked companies in the basic materials space include Innophos Holdings Inc IPHS , Innospec Inc. IOSP and Stepan Company SCL , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks’ best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

INNOPHOS HLDGS (IPHS): Free Stock Analysis Report

INNOSPEC INC (IOSP): Free Stock Analysis Report

STEPAN CO (SCL): Free Stock Analysis Report

CF INDUS HLDGS (CF): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International