A couple of fertilizer companies are scheduled to come up with their quarterly results on Aug 2. The fertilizer industry falls under the broader Basic Materials sector which is among those sectors that are expected to see negative earnings growth in the second quarter, per the latest Earnings Preview report.

The Basic Materials sector is expected to witness a 10.6% year-over-year decline in earnings in Q2, considering the companies that are yet to report. Revenues for the sector are expected to decline 7.6%. Earnings for the sector participants in the S&P 500 index are down 5.9% from the same period last year while revenues have dropped 10.1%, based on the earnings scorecard as of Jul 29.

The fertilizer industry is in a rut and still hamstrung by a slew of headwinds that continue to weigh on the performance of the companies in the space. Fertilizer makers remain exposed to a difficult pricing environment for the nutrients they sale. Potash prices, which are already at their lowest levels since 2007, remain under pressure due to elevated supply. Moreover, depressed global energy prices and higher supply have also contributed to a softer nitrogen pricing environment.

Global capacity expansion continues to exert pressure on urea and other nitrogen fertilizer prices. Elevated supply in the global nitrogen market is hurting prices, causing farmers to delay buying activities. As such, margins of fertilizer producers remain thwarted by a weak nutrient pricing environment.

The agriculture market is also not out of the woods and there is a continuous negative sentiment among agriculture investors. While prices of major crops (such as corn and soybeans) have recovered of late, they remain at their multi-year lows.

The prevailing softness in agricultural commodity pricing is a concern for fertilizer companies as it is hindering fertilizer use by farmers given the adverse effect of lower crop pricing on growers’ income. Lower farm income has a negative influence on growers’ nutrient purchasing decisions.

Moreover, the crop protection market remains under pressure, in part, due to a slowdown in Brazil. Agricultural market conditions remain weak in Brazil impacted by cautious buying by farmers and the uncertain political and economic situation in that country. A challenging currency environment coupled with economic weakness has also contributed to sluggish demand for potash across certain emerging markets.

While some prominent fertilizer companies such as Potash Corp. POT and CVR Partners UAN have already reported their results, a few players in the space are scheduled to report this week.

Let’s take a peek at two fertilizer companies that are warming up to report their Q2 results on Aug 2.

The Mosaic Company MOS will report before the bell. The company has an Earnings ESP of -16.67% and a Zacks Rank #5 (Strong Sell), making it difficult to predict an earnings beat. Mosaic surpassed the Zacks Consensus Estimate in three of the trailing four quarters with an average beat of 13.77%.

Mosaic remains exposed to a difficult business environment and pricing headwinds. Depressed pricing for potash and phosphate are expected to continue to weigh on its results in the to-be-reported quarter. The company’s guidance also indicates a year-over-year fall in sales volumes for phosphate and potash for the second quarter. (Read more: Will Mosaic Q2 Earnings Disappoint on Weak Prices? )

MOSAIC CO/THE Price and EPS Surprise

MOSAIC CO/THE Price and EPS Surprise | MOSAIC CO/THE Quote

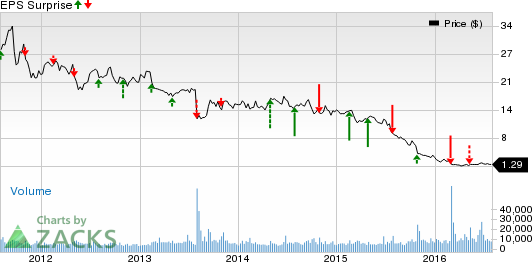

Intrepid Potash, Inc. IPI will report ahead of the bell. It has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate stand at a loss of 15 cents. The company carries a Zacks Rank #4 (Sell), which we caution against ahead of earnings release. Intrepid Potash missed estimates in three of the last four quarters while it beat once.

INTREPID POTASH Price and EPS Surprise

INTREPID POTASH Price and EPS Surprise | INTREPID POTASH Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

POTASH SASK (POT): Free Stock Analysis Report

MOSAIC CO/THE (MOS): Free Stock Analysis Report

INTREPID POTASH (IPI): Free Stock Analysis Report

CVR PARTNERS LP (UAN): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International