Scalper1 News

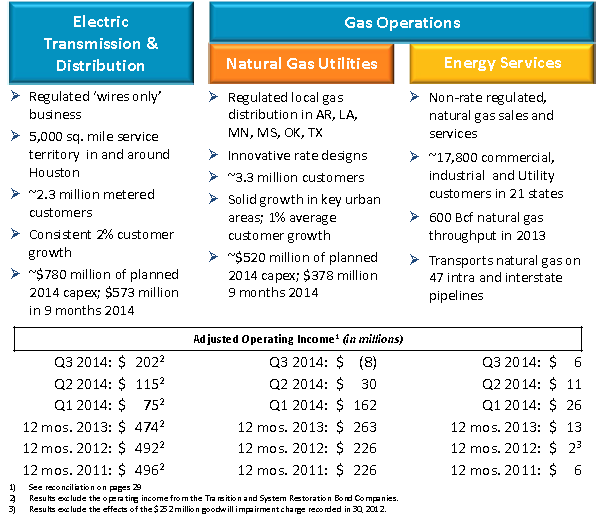

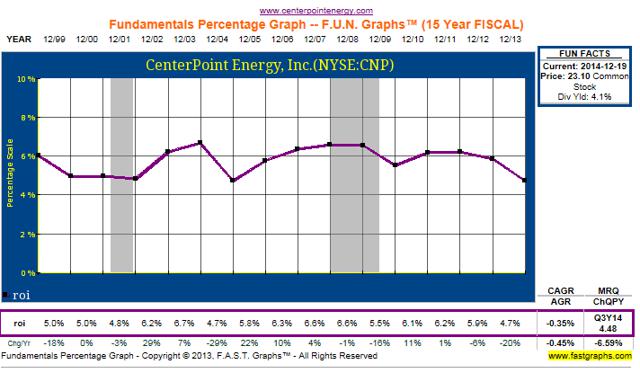

With a 4.1% current yield and dividend growth potential of 8% to 10% annually until at least 2018, CenterPoint should be a darling of the DGI crowd. The extra kicker above the usual regulated utility is its interest in ENBL whereby Centerpoint is part owner of the GP and is entitled to a growing IDR. CenterPoint is a model for the Gabelli-driven transformation of National Fuel Gas. Centerpoint Energy (NYSE: CNP ) is a diversified mid-cap utility headquartered in Houston TX. CNP offers electrical distribution in Houston, natural gas distribution, and majority ownership of its former midstream gas assets now spun-off in a publicly traded MLP. According to its November presentation, management forecasts dividend growth of 8% to 10% annually for the next three years, after a 14% increase in 2014. The forecast is based on a utility growth rate of 4-7% and a 10-12% distribution growth rate from its interest in the MLP. With a current yield of 4.1%, CNP should be in the sweet spot for dividend growth investors. The company serves 5.5 million metered customers primarily in Arkansas, Louisiana, Minnesota, Mississippi, Oklahoma, and Texas. The balance between its electric and gas regulated assets provides stability in earnings and cash flow. Below is a recap of operating income for the regulated utilities, from their latest investor’s presentation (pdf): Fourth quarter 2013 core earnings were $87 million for the electric utility and $92 million for the gas segment. Management forecasts full year 2014 earnings per share in the range of $1.14 to $1.21, including a $0.42 to $0.45 contribution from its midstream interests. In addition to its regulated utility activity, CNP owns 55.5% of Enable Midstream Partners LP (NYSE: ENBL ) and has a 40% interest in the general partner of the partnership. ENBL was formed in a joint venture with EOG Energy (NYSE: EOG ) and private equity firm ArcLight Capital Partners, and went public in April of 2014. While the regulated assets will grow in proportion to the capital investments for upgrades and expansion made over the next few years, ENBL will be a driver of added free cash flow. By the end of 2015, CNP should begin earning higher incentive distribution rights IDR. One strong advantage of most general partnerships is the profitability of IDRs. Usually, the GP earns a growing percentage of cash flow available for distribution to limited partners as an incentive to continue profitably growing the underlying business. CNP is no exception. According to the IPO prospectus , the general partners are eligible to earn as follows: The first $0.331 in quarterly distributions, 100% to the unit holders; From $0.331 to $0.394 in quarterly distributions, 85% to unit holders and 15% to GP (threshold $0.36 to unit holders, $0.034 to GP); From $0.394 to $0.523 in quarterly distributions, 75% to unit holders and 25% to GP (threshold $0.43 to unit holders, $0.093 to GP); Over $0.523 in quarterly distributions, 50% to unit holders, 50% to GP. Stated another way, on an annual basis, unit holders receive the first $1.324 in distributions, then a total of $1.44 of $1.60, then $1.72 of $2.09, then half of any cash over $2.09 per unit available for distribution. With ownership of around 245 million ENBL shares (out of 442 million outstanding) and a 40% interest in the GP and associated IDRs, CNP will reap a steady distribution and IDR cash stream. Morningstar offers a very upbeat assessment of CenterPoint in an article published this month titled, “Utilities’ Dividends: Best of Breed”: We think investors should be able to count on management’s 8%-10% annual dividend growth guidance even though the company’s utility operating earnings are growing at only half this rate. Our confidence is based on the distributions from Enable Midstream Partners, expected to provide the largest component of the cash available for dividends. During its third-quarter earnings call, Enable reiterated its 10%-12% distribution growth guidance for 2014 and 2015 and reaching low general partner splits by the fourth quarter of 2015. Management has reiterated that future dividends will be based on 60%-70% sustainable utility earnings and 90%-100% of after-tax distributions from Enable. Management continues to target 4%-6% annual earnings growth for its utility operations during the next five years, in line with our expectations. However, management did indicate it would probably be back-end-loaded due to the acceleration of capital expenditures and the lag in rates reflecting these investments. Also a drag on earnings growth is the expected reduction in right-of-way revenue to normal levels. Houston Electric’s rate base is expected to grow 7%-8% annually during the next five years, although potential investments like the $300 million Houston Import Project could push rate base growth to 9%-10%. The natural gas utilities’ rate base is projected to increase at 8%-9% annually, but upside could push it to 10%. Morningstar also offers this opinion in another research piece: Bulls Say: The 14.5% common dividend increase in 2014 is a positive signal of the earnings power of CenterPoint’s regulated utilities and anticipated cash distributions from Enable. We expect average annual dividend increases near 9% during the next five years. The formation of Enable will allow CenterPoint to focus capital expenditures on its utilities, resulting in almost 8% rate base growth during the next five years. Houston Electric’s service territory is located in one of the most economically vibrant metro areas in the country with annual customer growth averaging 2%. Bears Say: The Transmission and Distribution segment’s operating earnings have recently benefited from abnormally high transmission right-of-way revenues. These revenues will likely decline in 2014 and beyond. Profitability in the competitive natural gas sales and service business remains challenging, with low basis differentials and severe competition. Low commodity prices and reduced gathering activity continue to pressure earnings from the pipelines and field services infrastructure serving dry gas regions. This will be a headwind for Enable. CNP has generated return on invested capital ROIC slightly ahead of industry average of approximately 5%. Below is a 15-yr graph of ROIC, courtesy of fastgraph.com: (click to enlarge) According to ThatsWACC.com, CNP’s cost of capital is 4.9% versus a 3-yr average ROIC of 5.7% and a 10-yr average ROIC of 5.2%. Unlike many utility peers, CNP management has historically generated returns on its total capital base in excess of its cost of capital. Concerning its regulatory environment, CNP operates in a relatively neutral setting. The important states for regulatory environments are Texas, Arkansas and Minnesota. Less than 9% of gas utility income is generated in Mississippi, Louisiana and Oklahoma. While the categories have changed a bit in 2014, below is a table of the US Utility Regulatory Environment Assessment, according to S&P Credit analysis. There was a shift in category structure in 2014, reducing the effective number from four to three, with Credit Supportive considered neutral prior to 2014 and Strong/Adequate considered neutral post 2014 realignment. Below is a table of the regulatory assessment pre-2014 and post-2014. Source: S&P Credit Dividend growth and utility investors should review CenterPoint Energy as a top quality, core holding. Author’s Note: National Fuel Gas (NYSE: NFG ) has a similar business model to CNP prior to the spinning-off of midstream assets into ENBL. Money-manager Mario Gabelli, who owns about 10% of outstanding NFG shares, is pushing management to split the company, much like Oneok (NYSE: OKE ) and CNP. In the era of maximizing shareholder returns through spinning off assets, NFG may the next in line. More information on NFG can be found in two previous SA articles last Sept and May . Please review important disclaimer in author’s profile. Scalper1 News

With a 4.1% current yield and dividend growth potential of 8% to 10% annually until at least 2018, CenterPoint should be a darling of the DGI crowd. The extra kicker above the usual regulated utility is its interest in ENBL whereby Centerpoint is part owner of the GP and is entitled to a growing IDR. CenterPoint is a model for the Gabelli-driven transformation of National Fuel Gas. Centerpoint Energy (NYSE: CNP ) is a diversified mid-cap utility headquartered in Houston TX. CNP offers electrical distribution in Houston, natural gas distribution, and majority ownership of its former midstream gas assets now spun-off in a publicly traded MLP. According to its November presentation, management forecasts dividend growth of 8% to 10% annually for the next three years, after a 14% increase in 2014. The forecast is based on a utility growth rate of 4-7% and a 10-12% distribution growth rate from its interest in the MLP. With a current yield of 4.1%, CNP should be in the sweet spot for dividend growth investors. The company serves 5.5 million metered customers primarily in Arkansas, Louisiana, Minnesota, Mississippi, Oklahoma, and Texas. The balance between its electric and gas regulated assets provides stability in earnings and cash flow. Below is a recap of operating income for the regulated utilities, from their latest investor’s presentation (pdf): Fourth quarter 2013 core earnings were $87 million for the electric utility and $92 million for the gas segment. Management forecasts full year 2014 earnings per share in the range of $1.14 to $1.21, including a $0.42 to $0.45 contribution from its midstream interests. In addition to its regulated utility activity, CNP owns 55.5% of Enable Midstream Partners LP (NYSE: ENBL ) and has a 40% interest in the general partner of the partnership. ENBL was formed in a joint venture with EOG Energy (NYSE: EOG ) and private equity firm ArcLight Capital Partners, and went public in April of 2014. While the regulated assets will grow in proportion to the capital investments for upgrades and expansion made over the next few years, ENBL will be a driver of added free cash flow. By the end of 2015, CNP should begin earning higher incentive distribution rights IDR. One strong advantage of most general partnerships is the profitability of IDRs. Usually, the GP earns a growing percentage of cash flow available for distribution to limited partners as an incentive to continue profitably growing the underlying business. CNP is no exception. According to the IPO prospectus , the general partners are eligible to earn as follows: The first $0.331 in quarterly distributions, 100% to the unit holders; From $0.331 to $0.394 in quarterly distributions, 85% to unit holders and 15% to GP (threshold $0.36 to unit holders, $0.034 to GP); From $0.394 to $0.523 in quarterly distributions, 75% to unit holders and 25% to GP (threshold $0.43 to unit holders, $0.093 to GP); Over $0.523 in quarterly distributions, 50% to unit holders, 50% to GP. Stated another way, on an annual basis, unit holders receive the first $1.324 in distributions, then a total of $1.44 of $1.60, then $1.72 of $2.09, then half of any cash over $2.09 per unit available for distribution. With ownership of around 245 million ENBL shares (out of 442 million outstanding) and a 40% interest in the GP and associated IDRs, CNP will reap a steady distribution and IDR cash stream. Morningstar offers a very upbeat assessment of CenterPoint in an article published this month titled, “Utilities’ Dividends: Best of Breed”: We think investors should be able to count on management’s 8%-10% annual dividend growth guidance even though the company’s utility operating earnings are growing at only half this rate. Our confidence is based on the distributions from Enable Midstream Partners, expected to provide the largest component of the cash available for dividends. During its third-quarter earnings call, Enable reiterated its 10%-12% distribution growth guidance for 2014 and 2015 and reaching low general partner splits by the fourth quarter of 2015. Management has reiterated that future dividends will be based on 60%-70% sustainable utility earnings and 90%-100% of after-tax distributions from Enable. Management continues to target 4%-6% annual earnings growth for its utility operations during the next five years, in line with our expectations. However, management did indicate it would probably be back-end-loaded due to the acceleration of capital expenditures and the lag in rates reflecting these investments. Also a drag on earnings growth is the expected reduction in right-of-way revenue to normal levels. Houston Electric’s rate base is expected to grow 7%-8% annually during the next five years, although potential investments like the $300 million Houston Import Project could push rate base growth to 9%-10%. The natural gas utilities’ rate base is projected to increase at 8%-9% annually, but upside could push it to 10%. Morningstar also offers this opinion in another research piece: Bulls Say: The 14.5% common dividend increase in 2014 is a positive signal of the earnings power of CenterPoint’s regulated utilities and anticipated cash distributions from Enable. We expect average annual dividend increases near 9% during the next five years. The formation of Enable will allow CenterPoint to focus capital expenditures on its utilities, resulting in almost 8% rate base growth during the next five years. Houston Electric’s service territory is located in one of the most economically vibrant metro areas in the country with annual customer growth averaging 2%. Bears Say: The Transmission and Distribution segment’s operating earnings have recently benefited from abnormally high transmission right-of-way revenues. These revenues will likely decline in 2014 and beyond. Profitability in the competitive natural gas sales and service business remains challenging, with low basis differentials and severe competition. Low commodity prices and reduced gathering activity continue to pressure earnings from the pipelines and field services infrastructure serving dry gas regions. This will be a headwind for Enable. CNP has generated return on invested capital ROIC slightly ahead of industry average of approximately 5%. Below is a 15-yr graph of ROIC, courtesy of fastgraph.com: (click to enlarge) According to ThatsWACC.com, CNP’s cost of capital is 4.9% versus a 3-yr average ROIC of 5.7% and a 10-yr average ROIC of 5.2%. Unlike many utility peers, CNP management has historically generated returns on its total capital base in excess of its cost of capital. Concerning its regulatory environment, CNP operates in a relatively neutral setting. The important states for regulatory environments are Texas, Arkansas and Minnesota. Less than 9% of gas utility income is generated in Mississippi, Louisiana and Oklahoma. While the categories have changed a bit in 2014, below is a table of the US Utility Regulatory Environment Assessment, according to S&P Credit analysis. There was a shift in category structure in 2014, reducing the effective number from four to three, with Credit Supportive considered neutral prior to 2014 and Strong/Adequate considered neutral post 2014 realignment. Below is a table of the regulatory assessment pre-2014 and post-2014. Source: S&P Credit Dividend growth and utility investors should review CenterPoint Energy as a top quality, core holding. Author’s Note: National Fuel Gas (NYSE: NFG ) has a similar business model to CNP prior to the spinning-off of midstream assets into ENBL. Money-manager Mario Gabelli, who owns about 10% of outstanding NFG shares, is pushing management to split the company, much like Oneok (NYSE: OKE ) and CNP. In the era of maximizing shareholder returns through spinning off assets, NFG may the next in line. More information on NFG can be found in two previous SA articles last Sept and May . Please review important disclaimer in author’s profile. Scalper1 News

Scalper1 News