Scalper1 News

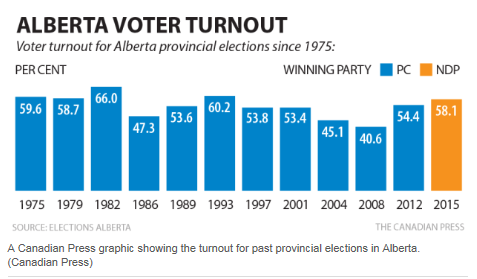

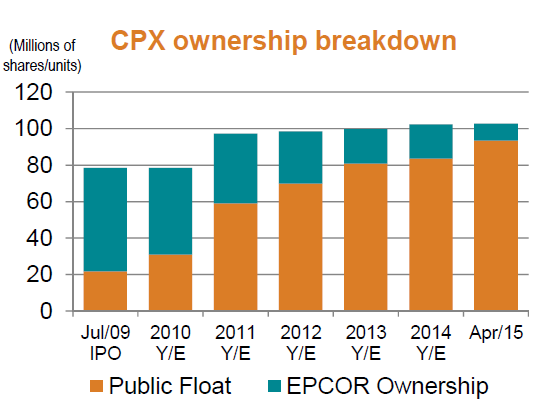

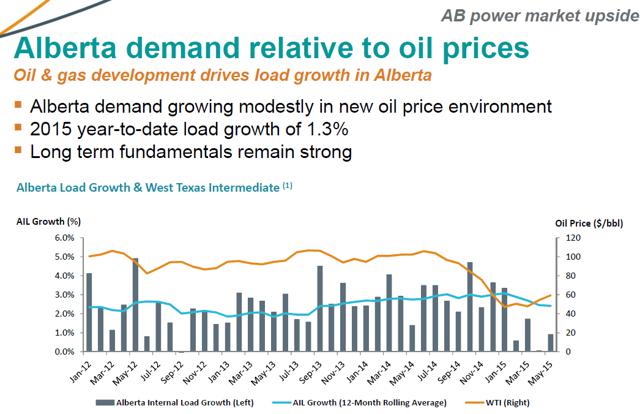

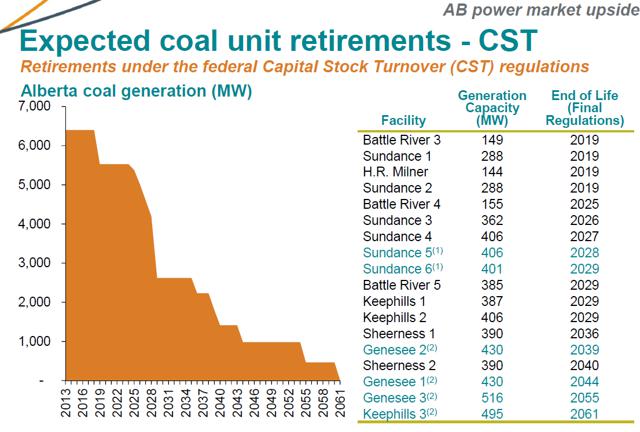

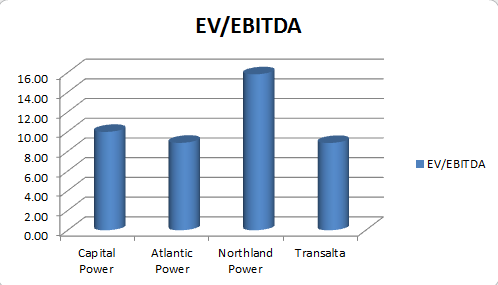

Summary Strong hedges help protect Capital Power from temporary power price weakness in their key market. Strong future growth is expected as new production comes on line, and older coal assets in the province are retired. The market is penalizing Capital Power due to weak electricity prices, weakness in the oil-centric Alberta and political party changes, but all represent temporary issues. New course issuer bid, recent DRIP suspension, coming dissolution of EPCOR’s ownership and low energy prices allow purchase of a solid Canadian Independent Power Producer at a discount. Capital Power Corporation ( OTC:CPXWF ) is an independent power producer (IPP) based in Edmonton, Alberta, Canada. With more than 3,100 MW of power generation capacity through 16 facilities, 371 MW via a Purchase Power Agreement (PPA) and 620 MW of owned generation in development (mostly in Alberta and Ontario) Capital Power is one of the largest IPP’s in Canada, with one of the lowest payout ratios in the industry. Its operations and type of generational facilities are listed in the graphic below: (click to enlarge) Source: Capital Power IR Business Model Capital Power generates electricity and sells that production to local utilities, generally based on contracts with local utilities (Purchase Power Agreements, or PPAs) to lower the operating risks of the business model, and can hedge the production that is sensitive to local market conditions. They also generate and sell non-contracted electricity to drive cash flow and allow it an avenue for growth after entering contracts to cover capital costs and their dividend. Due to weaker than expected demand, warmer weather and a recent increase in supply, the market has been generally weak, allowing Capital Power to trade at levels not seen in some time. With approximately 50% of its 2016 power production hedged at relatively attractive prices, and long-term power agreements for up to 20 years for most of the required capital and dividend costs, Capital Power is suffering under the weight of headline issues, rather than in line with its impressive business fundamentals. With strong operating availability (98% in Q1) and minimal unplanned outages they have been firing on all cylinders lately. Their strong hedges have largely negated the impact of temporarily low Alberta power prices, allowing them to continue towards their FFO guidance of $365-415M. They also recently announced a 5 million share course issuer bid approval by the Toronto Stock Exchange (TSE) and cancellation of their DRIP (eliminating dilution at these low prices). So what is going on with the share price? New Democratic Party (NDP) As a resident of the neighboring province, and closet environmentalist, my siblings and I had a lively discussion regarding this recent development. The provincial NDP, a left-of-center political party, managed to win a majority in the Alberta election. This was to the dismay of almost every major Alberta-based company (and almost every rural resident), as it had long been the friendliest province in Canada (or State in all of North America) to develop oil properties. With low tax rates, strong inflows of qualified workers and lax environmental rules, it was the nearly perfect place to set up shop. This all changed on Election Day. The NDP immediately changed the game with overdue (in the author’s opinion) changes to environmental rules (increase carbon emission taxation), higher taxes on the highest income tax brackets, and a “review” of the royalty policies in Alberta. This has raised some questions regarding the future of business development in Alberta, but I feel these are overblown for a few reasons: Oil is Alberta’s bread and butter – The NDP is excited to finally begin to enact proper environmental regulations in Alberta, but even if they make aggressive moves, they are still playing catch-up to every major state in North America. They will need to push the envelope to an extreme degree to stop being the premier place in Canada (and the Americas) to do business. Taxation Changes are reasonable – The next place in Canada to do business in oil is Saskatchewan, and the effective tax rates are nowhere comparable. There is little fear of businesses relocating anytime soon. A few folks mention relocating to Texas, but Canadian corporate taxes are still very low, and Calgary remains one of the main hubs for oil companies in the Americas. Carbon Tax Fears Overblown – Capital Power, for example, is welcoming the new environmental regulations. The party line is that this is due to their being forward thinking, but when it comes down to it these regulations are going to happen sooner or later. Even the increases announced are almost comically below what is required. Capital Power is actively selling carbon tax offsets from its renewable generating plants. Using these offsets for the Alberta increases (which phase in slowly over time) is not a major business issue for the amount of cash generated by their business, allowing them to postpone any FFO impact until 2020. Perception Change is an Overreaction and Temporary – Arguably the biggest effect was the worry that the change in provincial leadership would result in a massive perception switch within the province. This might be a concern, but Alberta was growing quickly not only because it was business friendly but also because it houses all of the resources. Alberta is holding all the cards. If you want to develop, you follow the rules, and even the changes made so far are well below the required amounts to start actually affecting business decisions. EPCOR relationship EPCOR is a utility company owned by the City of Edmonton, which previously owned Capital Power and spun it off to become its own independent power company. As EPCOR has committed to reducing its stake in the power company to focus on its own operations, it has been actively lowering its ownership in Capital Power since the IPO. Recently, they issued $225M in a secondary offering that lowered EPCOR’s stake in the company to 9% (from 18%). The entire ownership stake is now common shares. Capital Power is also no longer obligated to assist EPCOR in making secondary offerings. With the elimination of the agreement (Registered Rights Agreement) EPCOR plans on selling the remaining interest as market conditions and capital requirements apply. This eliminates a large and ongoing weight on the stock, as they have been slowly unraveling their position through selling and secondary offerings. Source: Q1 Presentation By eliminating this overhang, the public float is now maximized and there is no large third party encouraging equity issuances or selling off their position. Once this ownership is completely done, the stock will lose that unnecessary selling pressure. I feel the time to capitalize is at this moment, rather than awaiting completion, due to weakness from temporary overhangs on the stock from other areas and that the final announcement of EPCOR’s ownership stake going to zero could be a small boon for the company share price in the future, but investors need to be playing the stock first to see that benefit. Power Prices Power prices are very low at the moment, coming in below expectations in Alberta specifically. US power prices have been strong lately, but with so much of its production in Alberta this has an outsized impact on Capital Power. Power prices are being pushed from two sides. Temporarily Lower Demand Alberta has been suffering from lower oil prices, which has been reducing industrial demand. There was a stall in internal load growth in April, but that has reversed as of May, and is expected to continue growing, estimated at approximately 4.4% for the next 5 years: (click to enlarge) Source: Capital Power June Investor Meeting Temporarily High Supply With their newest power plant facility coming online, Capital Power influenced power prices with its incremental power production, though they largely hedged that production for this year. Due to the temporarily lower demand, the 1200MW of generation projects for 2015 are influencing the supply picture. However, there are legislated retirement dates for coal fired plants that will begin to ramp up over the coming years. This is detailed in the graphic produced by Capital Power: (click to enlarge) Source: Capital Power April Investor Meeting This gives a reprieve to the existing suppliers and will remove a supply overhang. The continual construction is in preparation for this eventual decrease in supply, and will result in temporary, and expected, pressures on prices. Valuation To complete this analysis I used data from YCharts and the company’s reported financials. There is a discrepancy between the reported Enterprise Value between the two. In the comparative analysis I utilized their reported values, whereas in the evaluation of Capital Power to its historical prices, I utilized YCharts (as we can assume they calculate it the same way each year). Relative to Competitors Capital Power is currently trading at an EV/EBITDA ratio of 9.98, 84% of its production locked into PPAs for 2016, and 50% of its production hedged at stronger rates and a MW growth rate of 20%. This compares to its competitors rather interestingly. Atlantic Power (NYSE: AT ), a “clean energy” producer (mostly natural gas, no coal) trades at 8.87, has 69% of 2016 production in PPAs, no active price hedging and MW growth of about 3%. Northland Power ( OTCPK:NPIFF ), a relatively clean energy producer (much heavier weight to renewables, no coal) trades at 15.83, has 100% of its production in PP’s, and a MW growth rate of an impressive 48%. Transalta (NYSE: TAC ), a relatively dirty producer (lots of renewable like Capital Power, but higher coal production of 56% versus Capital Power’s 47%) trades at 8.86, has 80% of production in PPAs in 2016, and a MW growth rate of 24%. We can presume that Capital Power should trade at some higher multiple than its low growth, highly leveraged competitor Atlantic Power, and the dirtier cousin Transalta, but is a 12% premium all that’s called for? With its better hedged production, strong growth profile and clean energy credits (allowing it to avoid negative FCF implications of NDP policy changes to 2020) there seems to be little reason to value Capital Power so closely to the listed competition. To see how much we should value Capital Power, we go to historical valuations. Relative to History Utilizing YCharts for the data, we get an average Enterprise Value (EV) of approximately 3773M (for 2015, it is 3085M, compared to a 4182M reported by Capital Power itself). We can then use the Funds from Operation (FFO) generated by the business over the last 5 years to arrive at an EV/FFO multiple of 9.76 that Capital Power historically trades at. Compare this to the existing EV/FFO multiple for 2015 of 7.36 and we arrive at a price target of approximately $29.12, or a return of 32.6%. With a 6% dividend policy, we arrive at a 38.8% total return to year end. Note we assume that increases in the EV will translate into a proportionate increase in share price, as all other values stay constant. To evaluate possible downside, we will use a close comparable. Transalta is the closest of the comparable competitors with similar growth rates, Alberta-heavy assets, large dividend policies, large proportion of “dirty” production and they generally trade in relation to each other. Utilizing the same method of valuing Transalta, we arrive at a five-year average EV/FFO of 11.39. Currently trading at 9.10, we can see that Capital Power trades at a discount to this 5-year relationship by approximately 5%. This brings us a worst-case 5% return as Capital Power approaches parity with this relationship with Transalta. With a 6% dividend we arrive at an 11% return by year end. Again, this is assuming only matching the very low price that Transalta trades at currently, while keeping the historical relationship intact. Risk & Mitigating Factors Hedges Drop Before Prices Recover – Strong hedges are protecting earnings, but they are temporary in nature. A continued downturn in Alberta will begin to affect FFO materially in 2017. To mitigate this risk, Capital Power does have hedges out to 2017 but they believe (and I agree) that prices should show improvement as we approach the end of 2016. A strong improvement in the underlying economy of Alberta is vital to improvement of energy prices. Oil Price Weakness – Collapse in oil prices will affect Capital Power more than most energy producers due to its reliance on the province of Alberta for the majority of its revenue. Alberta is handling the crises better than most expected, but continued low oil prices will put a damper on growth in the region. Capital Power has tremendous financial resources to continue to expand to additional markets, and the capital flexibility to weather low energy prices for some time while awaiting a recovery. NDP Royalty Review – Should the political party change the oil revenue policies to something closer to market, it may further shift investor sentiment against Alberta based companies. In the author’s opinion, it is an increase that is long overdue, but even a marginal change will have an outsized impact on market sentiment. I believe it is unlikely the review results in material changes at this time, due to the extreme circumstances related to oil price weakness, but there is always the risk. Potential Catalysts EPCOR’s Ownership Stake Reduction – As their stake reduces to zero, it will remove a significant overhang on the stock as it removes a major, continual seller/diluter of stock prices. The announcement of EPCOR’s stake reducing to zero should be a boon to the equity price. NDP Policy Shift – As the NDP continue to adapt to their new role they may reduce the pressure on oil and gas companies, allowing investors and executives time to adapt to their new leadership style. There is likely to be a significant decrease in announcements related to oil and gas as most of the policy changes influencing them are currently in progress. Less noise will go a long way in easing investor anxiety regarding this new political change. Market Begins to Put Changes in Perspective – As I have mentioned in the article, there is little reason to fret about the changes made to Alberta’s energy policy changes. They are relatively weak and will do little to influence business practices. Capital Power will only begin to feel the changes in 2020, once their carbon credit offsets finally do not cover the new policies. Oil Price Recovery – Recovery in oil prices are a boon to any Alberta-based stock, regardless of their activity in the oil sands. Capital Power sells a lot of energy to the industrials within the province, so any increase or stabilization of oil prices will help boost demand in the region, strengthening current power prices. Conclusion Trading at historically low multiples, with strong PPAs, well-timed hedges, and a well-covered 6.19% dividend yield, Capital Power is sitting at a very interesting entry point. As investor sentiment overreacts to the latest news and the temporary overhangs on the industry, Capital Power gives investors access to one of the best-regulated power jurisdictions in North America. Investor sentiment may temporarily wreak havoc on the price of Capital Power, it does not influence the underlying value of the company. With solid downside protection, strong potential upside and an impressive dividend, Mr. Market is granting investors a significant margin of safety in a conservative asset class. This may represent a solid opportunity to add exposure to the Alberta energy market at a significant savings for the high-yield portion of an investor’s portfolio. Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in CPX over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: This stock trades with narrower spreads on the Toronto Stock Exchange (TSE) those considering purchase should consider this option, if available through your broker. The author is not a financial advisor, please conduct your own due diligence and consult a trusted financial advisor before making any financial decision. Scalper1 News

Summary Strong hedges help protect Capital Power from temporary power price weakness in their key market. Strong future growth is expected as new production comes on line, and older coal assets in the province are retired. The market is penalizing Capital Power due to weak electricity prices, weakness in the oil-centric Alberta and political party changes, but all represent temporary issues. New course issuer bid, recent DRIP suspension, coming dissolution of EPCOR’s ownership and low energy prices allow purchase of a solid Canadian Independent Power Producer at a discount. Capital Power Corporation ( OTC:CPXWF ) is an independent power producer (IPP) based in Edmonton, Alberta, Canada. With more than 3,100 MW of power generation capacity through 16 facilities, 371 MW via a Purchase Power Agreement (PPA) and 620 MW of owned generation in development (mostly in Alberta and Ontario) Capital Power is one of the largest IPP’s in Canada, with one of the lowest payout ratios in the industry. Its operations and type of generational facilities are listed in the graphic below: (click to enlarge) Source: Capital Power IR Business Model Capital Power generates electricity and sells that production to local utilities, generally based on contracts with local utilities (Purchase Power Agreements, or PPAs) to lower the operating risks of the business model, and can hedge the production that is sensitive to local market conditions. They also generate and sell non-contracted electricity to drive cash flow and allow it an avenue for growth after entering contracts to cover capital costs and their dividend. Due to weaker than expected demand, warmer weather and a recent increase in supply, the market has been generally weak, allowing Capital Power to trade at levels not seen in some time. With approximately 50% of its 2016 power production hedged at relatively attractive prices, and long-term power agreements for up to 20 years for most of the required capital and dividend costs, Capital Power is suffering under the weight of headline issues, rather than in line with its impressive business fundamentals. With strong operating availability (98% in Q1) and minimal unplanned outages they have been firing on all cylinders lately. Their strong hedges have largely negated the impact of temporarily low Alberta power prices, allowing them to continue towards their FFO guidance of $365-415M. They also recently announced a 5 million share course issuer bid approval by the Toronto Stock Exchange (TSE) and cancellation of their DRIP (eliminating dilution at these low prices). So what is going on with the share price? New Democratic Party (NDP) As a resident of the neighboring province, and closet environmentalist, my siblings and I had a lively discussion regarding this recent development. The provincial NDP, a left-of-center political party, managed to win a majority in the Alberta election. This was to the dismay of almost every major Alberta-based company (and almost every rural resident), as it had long been the friendliest province in Canada (or State in all of North America) to develop oil properties. With low tax rates, strong inflows of qualified workers and lax environmental rules, it was the nearly perfect place to set up shop. This all changed on Election Day. The NDP immediately changed the game with overdue (in the author’s opinion) changes to environmental rules (increase carbon emission taxation), higher taxes on the highest income tax brackets, and a “review” of the royalty policies in Alberta. This has raised some questions regarding the future of business development in Alberta, but I feel these are overblown for a few reasons: Oil is Alberta’s bread and butter – The NDP is excited to finally begin to enact proper environmental regulations in Alberta, but even if they make aggressive moves, they are still playing catch-up to every major state in North America. They will need to push the envelope to an extreme degree to stop being the premier place in Canada (and the Americas) to do business. Taxation Changes are reasonable – The next place in Canada to do business in oil is Saskatchewan, and the effective tax rates are nowhere comparable. There is little fear of businesses relocating anytime soon. A few folks mention relocating to Texas, but Canadian corporate taxes are still very low, and Calgary remains one of the main hubs for oil companies in the Americas. Carbon Tax Fears Overblown – Capital Power, for example, is welcoming the new environmental regulations. The party line is that this is due to their being forward thinking, but when it comes down to it these regulations are going to happen sooner or later. Even the increases announced are almost comically below what is required. Capital Power is actively selling carbon tax offsets from its renewable generating plants. Using these offsets for the Alberta increases (which phase in slowly over time) is not a major business issue for the amount of cash generated by their business, allowing them to postpone any FFO impact until 2020. Perception Change is an Overreaction and Temporary – Arguably the biggest effect was the worry that the change in provincial leadership would result in a massive perception switch within the province. This might be a concern, but Alberta was growing quickly not only because it was business friendly but also because it houses all of the resources. Alberta is holding all the cards. If you want to develop, you follow the rules, and even the changes made so far are well below the required amounts to start actually affecting business decisions. EPCOR relationship EPCOR is a utility company owned by the City of Edmonton, which previously owned Capital Power and spun it off to become its own independent power company. As EPCOR has committed to reducing its stake in the power company to focus on its own operations, it has been actively lowering its ownership in Capital Power since the IPO. Recently, they issued $225M in a secondary offering that lowered EPCOR’s stake in the company to 9% (from 18%). The entire ownership stake is now common shares. Capital Power is also no longer obligated to assist EPCOR in making secondary offerings. With the elimination of the agreement (Registered Rights Agreement) EPCOR plans on selling the remaining interest as market conditions and capital requirements apply. This eliminates a large and ongoing weight on the stock, as they have been slowly unraveling their position through selling and secondary offerings. Source: Q1 Presentation By eliminating this overhang, the public float is now maximized and there is no large third party encouraging equity issuances or selling off their position. Once this ownership is completely done, the stock will lose that unnecessary selling pressure. I feel the time to capitalize is at this moment, rather than awaiting completion, due to weakness from temporary overhangs on the stock from other areas and that the final announcement of EPCOR’s ownership stake going to zero could be a small boon for the company share price in the future, but investors need to be playing the stock first to see that benefit. Power Prices Power prices are very low at the moment, coming in below expectations in Alberta specifically. US power prices have been strong lately, but with so much of its production in Alberta this has an outsized impact on Capital Power. Power prices are being pushed from two sides. Temporarily Lower Demand Alberta has been suffering from lower oil prices, which has been reducing industrial demand. There was a stall in internal load growth in April, but that has reversed as of May, and is expected to continue growing, estimated at approximately 4.4% for the next 5 years: (click to enlarge) Source: Capital Power June Investor Meeting Temporarily High Supply With their newest power plant facility coming online, Capital Power influenced power prices with its incremental power production, though they largely hedged that production for this year. Due to the temporarily lower demand, the 1200MW of generation projects for 2015 are influencing the supply picture. However, there are legislated retirement dates for coal fired plants that will begin to ramp up over the coming years. This is detailed in the graphic produced by Capital Power: (click to enlarge) Source: Capital Power April Investor Meeting This gives a reprieve to the existing suppliers and will remove a supply overhang. The continual construction is in preparation for this eventual decrease in supply, and will result in temporary, and expected, pressures on prices. Valuation To complete this analysis I used data from YCharts and the company’s reported financials. There is a discrepancy between the reported Enterprise Value between the two. In the comparative analysis I utilized their reported values, whereas in the evaluation of Capital Power to its historical prices, I utilized YCharts (as we can assume they calculate it the same way each year). Relative to Competitors Capital Power is currently trading at an EV/EBITDA ratio of 9.98, 84% of its production locked into PPAs for 2016, and 50% of its production hedged at stronger rates and a MW growth rate of 20%. This compares to its competitors rather interestingly. Atlantic Power (NYSE: AT ), a “clean energy” producer (mostly natural gas, no coal) trades at 8.87, has 69% of 2016 production in PPAs, no active price hedging and MW growth of about 3%. Northland Power ( OTCPK:NPIFF ), a relatively clean energy producer (much heavier weight to renewables, no coal) trades at 15.83, has 100% of its production in PP’s, and a MW growth rate of an impressive 48%. Transalta (NYSE: TAC ), a relatively dirty producer (lots of renewable like Capital Power, but higher coal production of 56% versus Capital Power’s 47%) trades at 8.86, has 80% of production in PPAs in 2016, and a MW growth rate of 24%. We can presume that Capital Power should trade at some higher multiple than its low growth, highly leveraged competitor Atlantic Power, and the dirtier cousin Transalta, but is a 12% premium all that’s called for? With its better hedged production, strong growth profile and clean energy credits (allowing it to avoid negative FCF implications of NDP policy changes to 2020) there seems to be little reason to value Capital Power so closely to the listed competition. To see how much we should value Capital Power, we go to historical valuations. Relative to History Utilizing YCharts for the data, we get an average Enterprise Value (EV) of approximately 3773M (for 2015, it is 3085M, compared to a 4182M reported by Capital Power itself). We can then use the Funds from Operation (FFO) generated by the business over the last 5 years to arrive at an EV/FFO multiple of 9.76 that Capital Power historically trades at. Compare this to the existing EV/FFO multiple for 2015 of 7.36 and we arrive at a price target of approximately $29.12, or a return of 32.6%. With a 6% dividend policy, we arrive at a 38.8% total return to year end. Note we assume that increases in the EV will translate into a proportionate increase in share price, as all other values stay constant. To evaluate possible downside, we will use a close comparable. Transalta is the closest of the comparable competitors with similar growth rates, Alberta-heavy assets, large dividend policies, large proportion of “dirty” production and they generally trade in relation to each other. Utilizing the same method of valuing Transalta, we arrive at a five-year average EV/FFO of 11.39. Currently trading at 9.10, we can see that Capital Power trades at a discount to this 5-year relationship by approximately 5%. This brings us a worst-case 5% return as Capital Power approaches parity with this relationship with Transalta. With a 6% dividend we arrive at an 11% return by year end. Again, this is assuming only matching the very low price that Transalta trades at currently, while keeping the historical relationship intact. Risk & Mitigating Factors Hedges Drop Before Prices Recover – Strong hedges are protecting earnings, but they are temporary in nature. A continued downturn in Alberta will begin to affect FFO materially in 2017. To mitigate this risk, Capital Power does have hedges out to 2017 but they believe (and I agree) that prices should show improvement as we approach the end of 2016. A strong improvement in the underlying economy of Alberta is vital to improvement of energy prices. Oil Price Weakness – Collapse in oil prices will affect Capital Power more than most energy producers due to its reliance on the province of Alberta for the majority of its revenue. Alberta is handling the crises better than most expected, but continued low oil prices will put a damper on growth in the region. Capital Power has tremendous financial resources to continue to expand to additional markets, and the capital flexibility to weather low energy prices for some time while awaiting a recovery. NDP Royalty Review – Should the political party change the oil revenue policies to something closer to market, it may further shift investor sentiment against Alberta based companies. In the author’s opinion, it is an increase that is long overdue, but even a marginal change will have an outsized impact on market sentiment. I believe it is unlikely the review results in material changes at this time, due to the extreme circumstances related to oil price weakness, but there is always the risk. Potential Catalysts EPCOR’s Ownership Stake Reduction – As their stake reduces to zero, it will remove a significant overhang on the stock as it removes a major, continual seller/diluter of stock prices. The announcement of EPCOR’s stake reducing to zero should be a boon to the equity price. NDP Policy Shift – As the NDP continue to adapt to their new role they may reduce the pressure on oil and gas companies, allowing investors and executives time to adapt to their new leadership style. There is likely to be a significant decrease in announcements related to oil and gas as most of the policy changes influencing them are currently in progress. Less noise will go a long way in easing investor anxiety regarding this new political change. Market Begins to Put Changes in Perspective – As I have mentioned in the article, there is little reason to fret about the changes made to Alberta’s energy policy changes. They are relatively weak and will do little to influence business practices. Capital Power will only begin to feel the changes in 2020, once their carbon credit offsets finally do not cover the new policies. Oil Price Recovery – Recovery in oil prices are a boon to any Alberta-based stock, regardless of their activity in the oil sands. Capital Power sells a lot of energy to the industrials within the province, so any increase or stabilization of oil prices will help boost demand in the region, strengthening current power prices. Conclusion Trading at historically low multiples, with strong PPAs, well-timed hedges, and a well-covered 6.19% dividend yield, Capital Power is sitting at a very interesting entry point. As investor sentiment overreacts to the latest news and the temporary overhangs on the industry, Capital Power gives investors access to one of the best-regulated power jurisdictions in North America. Investor sentiment may temporarily wreak havoc on the price of Capital Power, it does not influence the underlying value of the company. With solid downside protection, strong potential upside and an impressive dividend, Mr. Market is granting investors a significant margin of safety in a conservative asset class. This may represent a solid opportunity to add exposure to the Alberta energy market at a significant savings for the high-yield portion of an investor’s portfolio. Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in CPX over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: This stock trades with narrower spreads on the Toronto Stock Exchange (TSE) those considering purchase should consider this option, if available through your broker. The author is not a financial advisor, please conduct your own due diligence and consult a trusted financial advisor before making any financial decision. Scalper1 News

Scalper1 News