Scalper1 News

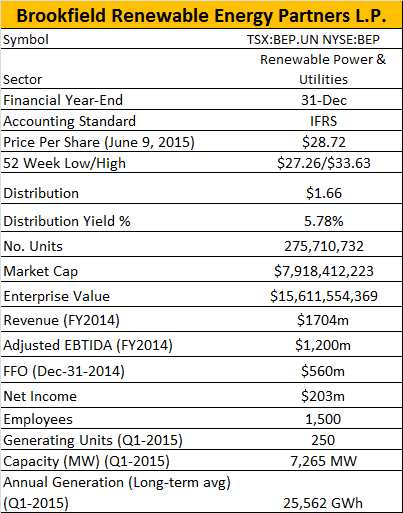

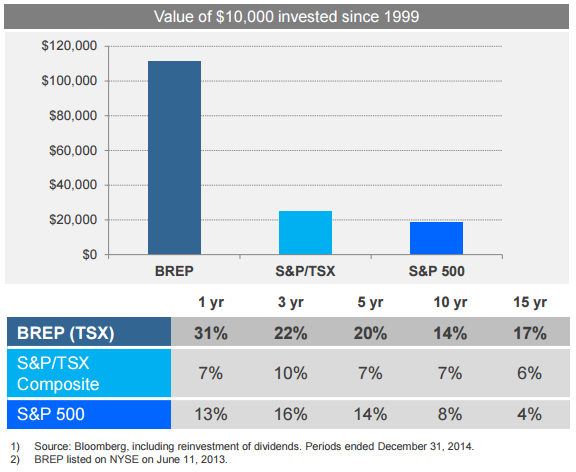

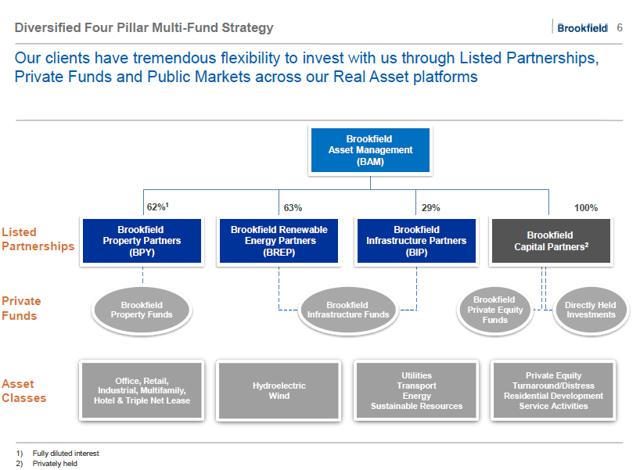

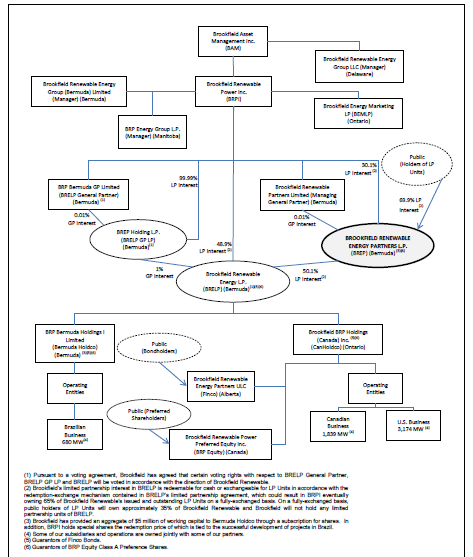

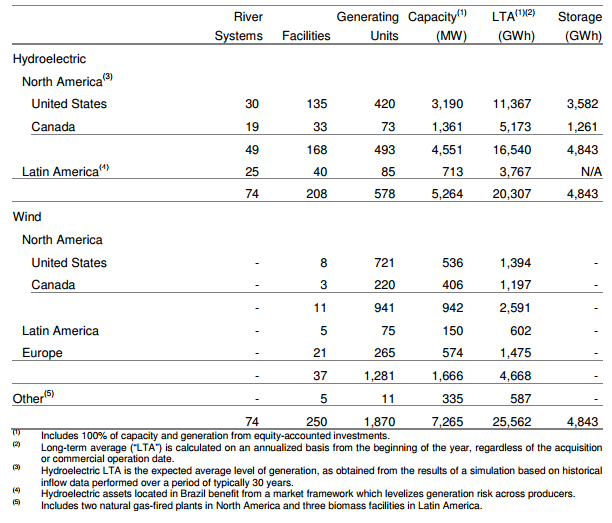

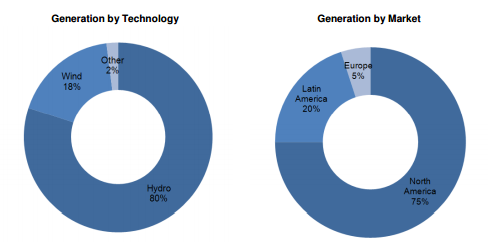

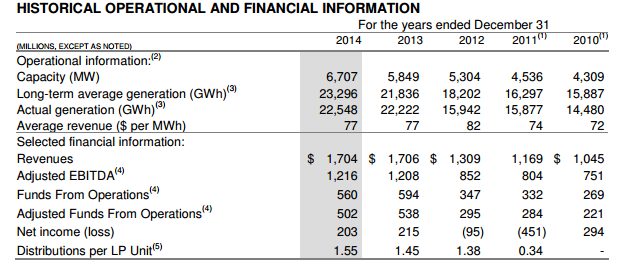

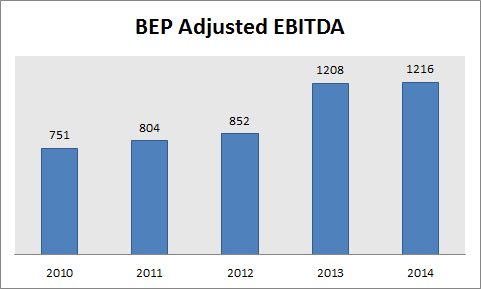

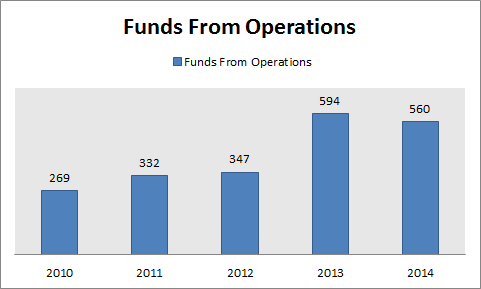

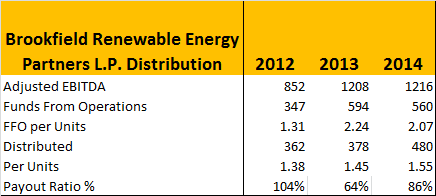

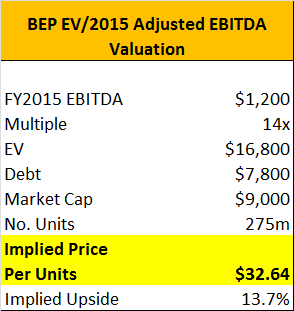

Summary BEP focuses primarily on long-life renewable power assets that provide stable, long-term cash flows, and which are well positioned to appreciate in value over time. The company seeks a distribution growth target of 5-9% per year and a payout ratio of ~65% of funds from operations. BEP invests and owns real assets of high quality and with strong growth prospects. The objective is to deliver long-term gross returns of 12-15% on a portfolio basis. The recent dip in the stock provides a nice entry point. The Brookfield family of products has a great history of value creation. If you are looking for a very long-term safe investment that provides reliable growing dividends and reasonable growth prospects, Brookfield Renewable Energy Partners L.P. ( BEP , TMX: BEP.UN ) should be on your candidate list. BEP focuses primarily on long-life renewable power assets that provide stable, long-term cash flows, and which are well positioned to appreciate in value over time. BEP is one of the largest publicly traded pure-play renewable power platforms in the world. As of March 31, 2015, the company owns and manages 208 hydroelectric generating stations, 37 wind farms, 2 natural gas power plants, and 3 biomass plants, for a total of 250 power-generating facilities. Overall, the assets that it managed or manages have 7,265 MW of generating capacity and annual generation of 25,562 GWh, based on long-term averages. This is a global portfolio with assets across 14 power markets in North America, Latin America and Europe. BEP generates enough electricity from renewable resources to power 4 million homes each year. The structure is a limited partnership established in Bermuda since 2011. Brookfield Asset Management (NYSE: BAM ) owns, directly and indirectly, 63% of BEP. Below is a summary table of the partnership: Thesis Here are some of the mains reasons why I like BEP as a very long-term investment: The company invests and owns real assets of high quality and with strong growth prospects. The objective is to deliver long-term gross returns of 12-15% on a portfolio basis. A solid, experienced management team with a “boots on the ground” approach. Has a history of making disciplined conservative acquisitions. BEP benefits from its strategic partnership with BAM. It has a highly stable cash flow profile sourced from predominantly long-life hydroelectric assets, the vast majority of which sell electricity under long-term power purchase agreements (PPAs). BEP generates significant free cash flow. A portion of this is re-invested, and the other is returned to unitholders. Provides inflation protection (contractual clause for rising prices). A great investment for income seekers. BEP has a history of increasing distribution to unitholders. The company seeks a distribution growth target of 5-9% per year and a payout ratio of ~65% of the funds from operations (FFO). Invest in the renewable power sector (reducing contribution to global climate change). Also, coal is retiring, making room for more expensive generation. BEP has large moat. There are a lot of obstacles in the way if you plan to open a hydro plant tomorrow. Investment-grade balance sheet (BBB credit rating). Maintains a ~40% debt-to-total capital ratio. I like that the cash flow is attached to real long-life assets, instead of, let’s say, to a brand name. I know, to a certain degree of certainty, that the hydro plant and its contract will be providing cash for the next five to ten years. I can’t make that same prediction regarding my favorite brand or store at the mall. Sure, BEP is not a sexy investment, and it’s actually one of the most boring investments one could make. It has all the characteristics of a boring investment: cash-rich, high cash margins, conservative management, real long-life assets etc… It’s hard to have a decent BBQ conversation when you have invested in a bunch of hydro-generating stations and wind farms (Nobody is going to ask you about the hydro inflow rate last quarter or how the wind is blowing in Ireland ). But keep in mind, this is an investment for long-term income and growth. As long as the rivers are flowing and there’s wind in Ireland, you can sleep at night. Source: BEP Investor Profile May 2015 – Slide 6 The performance returns table above demonstrates the superior historical performance of BEP as of December 31, 2014. Of course, that wonderful 15-year historical performance is no guide to the future. However, because of the company’s solid business model and high-quality assets, above-average returns wouldn’t surprise me over the long run. The stock price has been weak of late, likely a function of the rise in bond yields, which has pressured interest rate higher and poor hydrology. Investors, particularly those with a longer-term view who appreciate BEP’s strong dividend growth outlook, should take the opportunity created by the recent pullback to take a position. While the overall business may be fairly valued on the surface at about 13x trailing adjusted EBITDA, the normalization of hydrology, organic growth and accretive acquisitions suggests that BEP could appreciate by 13.7% in 2015. The details of my valuation are below. The Brookfield Asset Management Family To better understand BEP, it’s important to understand the parent company, Brookfield Asset Management. You can’t talk about BEP without talking about BAM, since they are in the same family. BAM is a global manager of real assets with $207 billion AUM ranging from property, renewable energy, infrastructure, private equity and others. Sorting out the Brookfield family can be a challenge. Brookfield Asset Management is the parent company at the top. It has ownership stakes in the three Brookfield public companies and private listings, as demonstrated in the chart below: (click to enlarge) Source: BAM Corporate Profile Slide 6 – Q1-2015 I like the whole Brookfield family. There’s something for everyone. BAM is more for the growth-oriented investor, and the listed partnerships (BPY, BEP, BIP) are interesting for their dividends. A significant portion of BAM’s earnings are from the dividends its listed partnership distributes. The main reason why they don’t roll up the whole structure to BAM is because the market will apply a conglomerate discount (BAM is a former conglomerate with a colorful history). A conglomerate is more complicated to value and more confusing. In its current form, you attract more pure-play investors, since real estate investors can invest in BPY and energy investors can invest in BEP. BAM actually got its start in 1899 in Brazil as a builder and operator of electricity and transport infrastructure. The company’s earlier name of “Brascan” reflected this history (Brascan = Brasil + Canada). It has expanded in different industries, and today, it’s a global manager of real assets with over $207 billion of assets under management, operating with ~30,000 employees in over 20 countries (BEP has 1,500 employees). In 2002, Bruce Flatt, the current CEO and management partner (more on him below), took over BAM. Brascan was a complicated conglomerate with holdings in diverse sectors, including oil, mining, beer (Labatt), real estate, forest products, insurance and power companies with links to the Bronfman family. At its peak in the 1980s, Brascan represented one-third of the stock value of the Toronto Stock Exchange, but imploded during the 1990s real estate recession. Mr. Flatt led a restructuring that simplified BAM by focusing on just three sectors: real estate, renewable power and infrastructure assets like ports. Today, you can perceive BAM and its subsidiaries as the backbone infrastructure of the economy. This is also the favorite stock for many well-known investors, such as well-respected value investor Tom Gayner. Bruce Flatt, in a rare interview with the NYT , was quoted as saying: “We’re not a retail brand, but we rent space in malls to companies,” he says. “We don’t sell coal to anybody, but we own their coal terminal and ship coal out of our coal terminal. And we don’t sell natural gas but we transport natural gas in our pipelines.” For those that are familiar with BAM and its subsidiaries, the company’s approach is not dictated by the receipt of annual fees it charges for managing third-party assets under management. BAM’s approach is based on a strategic view that it should focus (and make any sale decision) not just on an investment’s short-term IRR, but also on maximizing the total returns it achieves from the investments it makes, which may result in a longer-term hold. I know it sounds like a copy-and-paste statement that you would read in any mutual fund brochure, but the company has the track record to back it up. In other words, BAM’s approach means that if a business is a quality business that has an irreplaceable franchise, then one should continue to hold the investment, as compounding at significant rates of return on your capital over a long time can make shareholders very wealthy (again, something you would read in Warren Buffett’s letters or interviews). “Our main investment objective is to put money where money is scarce, ” Bruce Flatt said after the 2015 AGM Brookfield Renewable Energy Partners L.P. Tracing back BEP’s history is not as simple as it sounds. Analyzing the company’s organizational tree and its web of entities, stakes, partnerships and operating companies is torturous. Brookfield Renewable Energy Partners is a limited partnership that was established June 27, 2011 in Bermuda as the result of a combination of different entities. BEP’s sole material asset is a 50.1% limited partnership interest in Brookfield Renewable Energy L.P (BRELP). The chart below was taken from the BEP 2015 Annual Information Form. As you can deduce from the chart, sometimes providing more information is not equivalent to more clarity. Source: BEP 2015 AIF Page 5 – you’re welcome. The corporate web above suggests that there are plenty of inter-corporate relationships. It’s without any hesitation that I leave it to your pleasure to dissect it . Today’s BRELP is the result of Brookfield Renewable Power Fund and Brookfield Renewable Power Inc. being combined in 2011. The current structure is the result of legislation change and BAM’s desire to simplify its structure (yes, this is the simplified corporate structure; just ask anyone on Bay Street that is still around from the ’80s). During the 2000s, income trusts were a popular investment vehicle in Canada because of their flow-through advantages, until the Federal government changed the law that forced the large majority of income trusts to convert to corporations. If you go back further, some investors might remember Great Lakes Hydro Income Fund , the predecessor to Brookfield Renewable Energy Partners. It’s through Great Lakes Hydro Income Fund that Brookfield advanced its interests in the renewable energy sector. Today, BAM controls 63% of Brookfield Renewable Energy Partners. As I mentioned in my intro, BEP is one of the largest publicly traded pure-play renewable power platforms in the world. Below is a table of the company’s operations: Source: BEP Q1-2015 Interim Report Overall, the company owns and manages 250 power-generating facilities with 7,265 MW of generating capacity and annual generation of 25,562 GWh, based on long-term averages. 80% is hydroelectric generation situated on 74 rivers. The bulk of the generation is done in North America, where it has 5,700 MW of generating capacity and ~$16 billion in AUM. That’s followed by Brazil with 980 MW and Europe with 570 MW of capacity. The investment in Europe is recent. Below is the company’s generation profile: Source: BEP Q1-2015 Interim Report BEP’s objective is to deliver long-term gross returns of 12-15% to shareholders. How does it plan on achieving that goal? The company’s approach is focused on the following (from the company website ): Operate a globally diversified portfolio of renewable power-generation assets across continental platforms and to the highest standards. Combine stable, predominantly contracted cash flows with the ability to capture rising prices on uncontracted power in its core markets. Maintain a predominantly hydroelectric focus. Leverage its operating expertise, transaction origination capabilities and funding platforms to acquire assets for value. Advance and replenish its proprietary development pipeline at premium returns. Secure growth opportunities in new technologies. In other words, the strategy is to deploy capital into renewable opportunities globally with a focus on hydro, which provides a highly stable cash flow. With the reinvestment of surplus cash flows, BEP expects the funds from operations to improve further in the long term. BEP depends on the success of this strategy to increase dividend growth to 5-9% annually and to maintain a ~65% payout of the FFO. Below is a statement from Richard Legault on the Q1-2015 earnings call that reiterates the strategy above: Our assets which are predominately hydro, benefit from high-cash margins throughout the cycle and we operate them recognizing that in the short-term, generation volumes are dependent on hydrology but over the long-term have a proven and stable generation profile. The unique nature of these assets combined with our conservative capital structure ensures that we can manage ongoing CapEx, fund our organic growth, service our distributions, and look to pursue new opportunities even in the midst of a low-generation year like we are currently having. This allows our management team to remain committed to focusing on long-term with the view of growing the cash flows on a per share basis and generating 12% to 15% total returns. – Richard Legault, CEO, BEP Management At the top of the BAM food chain, you have Bruce Flatt, CEO and management partner since 2002. In the investing world, Mr. Flatt is one of the top investors, with an excellent performance track record. You can learn a lot by listening to and reading the words of wisdom from Bruce. Since he keeps a low profile, there’s isn’t much material on him, but in his case, it’s not quantity that matters but quality. Sometimes there’s more substance in less words. He’s been dubbed the Warren Buffett of Canada (a term also stamped on Prem Watsa and Paul Desmarais ). The spotlights turned to Flatt when he beat out Simon Properties (NYSE: SPG ) when BAM bought a major ownership stake in bankrupt General Growth Properties (NYSE: GGP ). His strength is spotting distressed assets, and he has a knack for negotiating deals that deliver big, industry-beating returns and stable cash flows. Richard Legault has been the CEO of BEP since 1999, and is a senior managing partner of BAM. He has led the growth of Brookfield’s renewable power operations on a global basis, helping to make Brookfield Renewable one of the world’s largest pure-play renewable power portfolios. Recently, there have been two notable changes for BEP – the appointment of Sachin Shah as president and COO and Nick Goodman as CFO. For the full BEP management team description, click here . Brazil BAM and BEP are actively involved in Brazil, which is a source of anxiety for many investors. Brazil is also responsible for some of the recent hydrology problems cited in the latest results. It’s noteworthy that Brookfield has been an investor and operator in Brazil for over 100 years, operating various assets. The company re-entered the Brazilian power market in 2003, and since then, has grown its hydroelectric asset base significantly to 40 facilities on 25 river systems, totaling 5 wind farms and 3 biomass plants, which generate 980 MW of installed capacity. Regarding Brazil, the bad news is this: Projections indicate that Brazil will suffer its worst contraction in a quarter century this year as the government struggles to shore up its finances and tame inflation to avert a credit rating downgrade. The good news is this: As a result, asset prices in Brazil have dropped, creating opportunities to find bargains. The idea of doing business in Brazil sounds awful considering all the bad news coming out of the country, except if you are BAM. The company has a history of making money in Brazil, thanks to its solid “on the ground” team and its long history in the country. Despite recent market volatility and economic challenges, this fits Brookfield’s mandate of investing where money is scarce or out-of-favor assets (distressed). Brazil remains a large high-growth market with a strong competitive advantage in the production of commodities. On the operation side, the risk of operation shortfall in Brazil is minimized by participation in a hydrological balancing pool administrated by the government of Brazil. The program mitigates hydrology risk by assuring that all participants receive a balanced amount of electricity, irrespective of the actual volume of energy generated. Basically, the program reallocates energy, transferring surplus energy from those who generated an excess to those who generate less. Low precipitation across Brazil had a negative impact on hydrology in the last three quarters of 2014. During that period, BEP expected that a higher proportion of thermal generation would be needed to balance supply and demand in Brazil, potentially leading to higher overall spot market prices. In anticipation of lower hydrology, BEP maintained a lower level of contracted generation, allowing the company to capture the strong power prices. BEP believes that the timing is good for growing investments in Brazil, as the president and COO explained during the Q1-2015 earning call: In Brazil, scarcity of supply has been an issue for the last five years and only recently have we seen the impact of underinvestment. The current drought is highlighting the lack of alternatives in the market and as a result, prices are only now trending to what we believe is needed to drive investment in new supply. As I mentioned previously, we are actively signing new long-term contracts in this market for both existing assets and our development pipeline. Financial Overview Below are BAM’s 5-year financial results. Capacity (MW) and long-term average generation (GWh) have both increased over the last five years. Capacity has increased 55% and the long-term average has increased by 46% since 2010. At the end of Q1-2015, capacity stood at almost 7,300 MW, which 80% is from hydro. Average revenue ($ per MWh) is consistent with 2013, at $77. However, that number is down to $76 MWh for Q1 2015 results, compared to $84 MWh in Q1 2014. The lower revenue is due to a lower pricing environment and US$ appreciation. Revenues for 2014 were flat versus those for 2013. Higher pricing in the U.S. partially offset lower generation. In Brazil, revenues declined $14m because of lower generation, but was partially offset by higher merchant pricing. Overall, hydro and wind generated less than their long-term average. Even though revenue was flat, EBITDA slightly rose due to cost reduction efforts and reduction in power purchased in the open market for co-generation facilities. The historical 5-year EBITDA picture looks good, with a CAGR of 10%. EBITDA is a key valuation metric in the industry, since most assets are acquired on an enterprise value basis. Net income is obviously an important measure of profitability, but because of accounting rules, the presentation of net income will often mask the real cash flow generated. For example, in 2014, FFO was $560m and net income was $203.The primary reason for this is the recognition of a significantly higher level of depreciation for the company’s assets than it is reinvesting in the business as CAPEX. FY2015 EBITDA is estimated to be around the same level. BEP has approximately $20 billion of assets, its debt-to-total capitalization is 42%, and approximately 77% of the company’s borrowings are non-recourse. During Q1 2015, the company completed the refinancing of a Canadian hydro facility, which not only took place at an attractive rate of 2.95%, but also unlocked $20 million in financing proceeds. BEP’s available liquidity at quarter-end includes approximately $1.3 billion of cash and cash equivalents and the available portions of credit facilities. Developments As for recent developments, during Q1 2015, BEP closed two meaningful acquisitions. In Brazil, the company added almost 500 MW of hydro, wind, and biomass to its portfolio. In Portugal, it made the acquisition of a 120 MW portfolio of fully contracted wind assets, with redevelopment potential and some expansion opportunities. From a development perspective, BEP is advancing on a 500-750 MW of pipeline to build out over the next five years. It recently signed three PPAs for almost 75 MW of greenfield hydro in Brazil, at over 200R$ per MW-hour in today’s dollars for 30 years growing at inflation. Full commissioning is expected on all three projects between 2017 and 2018. In Ireland, the company recently achieved full commissioning of two wind projects totaling 125 MW, with another 12 MW facility on track to achieve commercial operation in the summer of 2015. Those projects come with a 15-year contract. Distribution When one sees a high dividend yield, one must ask oneself if it’s sustainable – simply investing because of an attractive yield often leads to trouble. BEP made it an objective to pay a distribution that is sustainable on a long-term basis, while retaining sufficient liquidity for recurring growth capital expenditures. However, having an objective and realizing it are two different things. The company has a target payout ratio of approximately 60-70% of FFO, which should leave it with approximately ~$100m of cash per year to further invest. Funds from operations should improve in the long run with reinvestment of surplus cash flow. BEP also announced that it was raising its distribution target from 3-5% to 5-9% per year. This sends a positive signal of confidence that it can deliver on its target. For 2015, BEP has the intention of distributing $1.66 per unit on annually, or $0.415 per quarter. This represents a 7% distribution increase over 2015 distribution. At today’s prices, this represents a yield of ~5.7%. For Canadian investors, the yield is a little fatter, thanks to the strong U.S. dollar. Distributions are in US$, even for the Canadian units. On the other hand, this FX advantage can turn upside down if the U.S. dollar gets weaker in the future. FY2014 FFO was $560 million. With a distribution of $480m, this represented a payout of 86% – higher than the expected FFO payout range. For 2013, FFO was $594m and distribution was $378, representing a 64% payout ratio – respecting the desired payout ratio. For FY2015, I expect distribution to exceed the payout ratio because of a higher payout per unit, additional units issued and possible lower FFO per unit. The main reason is weaker results resulting from lower hydrology in Brazil. However, in the long run, I expect the situation to normalize once hydrology returns to its long-term average. The yield is supported by the company’s stable cash flow. Liquidity remains strong, with $1b of cash and credit available as of December 31, 2014. By the way, if you try to calculate it yourself, the payout ratio is defined as distributions to Redeemable/Exchangeable partnership units, LP Units and the GP interest, including general partnership incentive distributions, divided by FFO. . Valuation It can be a hard to value any of the Brookfield Assets, because the company buys and sells a lot of things. It also raises capital occasionally. You really need to look at the balance sheet. EV/EBITDA is the preferred valuation metric in the industry, since it eliminates plenty of distortions due to the different capital structures and cash flows. During FY2014, BEP generated $1,216m in adjusted EBITDA. At $28.72, with 275m units, the market cap is approximately $7.8b. Add $7.89b in debt and subtract $196m in cash, and the enterprise value is $15.5b, or 13x trailing adjusted EBITDA. This sounds expensive until one looks at other power & utilities-oriented companies. I’m talking about companies like Algonquin Power ( OTCPK:AQUNF ), trading at 13.5x ttm EBITDA, or Boralex ( OTC:BRLXF ), a renewable energy company that’s trading at 17.5x ttm EBITDA. BEP’s forecast 2015 adjusted EBITDA is expected to remain at $1.2 billion, since 1Q results were weaker than forecast and below consensus due to poor hydrology. Adjusted EBITDA was $338m, compared to $360m in the prior year and below analyst consensus of $350m. Assuming a multiple of 14x EV/Adjusted FY2015 EBITDA, which reflects new growth initiatives, my target for BEP is $32.60 per share. This represents a 13% upside (dividends excluded). This is obviously not a full-blown valuation model, since I just expanded the multiple from 13x to 14x. We can argue that a 14x multiple is rich, but that’s what it costs today for high-quality long-life assets, great management, and reasonable growth and distribution. The truth is that firms, such as pension plans, are willing to pay that amount and more for these kinds of assets. Over time, the EBITDA should increase from BEP’s two-pronged approach (organic growth and M&A), higher capacity, higher pricing and better hydrology. I don’t usually make short-term predictions, and it shouldn’t really matter, since investing in BEP is a multi-year investment. If the target price is not met, or if the stock drops some more, instead of panicking like the reaction of the herb (falling prices means the company is a bad investment, and a company with ever-increasing prices is one you should buy), maybe it’s an opportunity to buy more of BEP at a cheaper price. Forecasting no growth in EBITDA for 2015 is not exciting, and the weak results have already weighed upon the stock. However, it provides an opportunity to enter at a good price, since the hydrology problem is considered to be temporary. Over time, inflow will normalize, and the additional capacity should provide strong results. Positives The BAM family is the backbone infrastructure of the economy. Provides an alternative to traditional equity and fixed-income investments. Long-term PPAs with creditworthy buyers. The Brookfield family has a strong history of wealth creation. BAM has a portfolio of high-quality, well-diversified assets. The portfolio provides stable long-term cash flow, which supports the distribution and is a solid foundation for growth (organic and M&A). Management’s “boots on the ground” approach (i.e., a team with experience in Brazil). The debt associated with the purchase of certain assets are non-recourse to equity investors. Interest rates are low. Ability to finance projects with low rates. BEP provides a shelter from volatility as long as interest rates stay low for the foreseeable future. There’s a contrarian feel to it. The company is plunging into Brazil when a lot of investors are looking to get out, possibly opening up bargains. An excellent management team that includes Bruce Flatt. Hydropower reduces contribution to global climate change. Hydropower is a consistent, reliable and renewable source of clean power. Wind energy is renewable, reliable, efficient and is associated with few adverse environmental effects. BEP reiterated its guidance of 5-9% annual distribution growth, up from 3-5%. Negatives, Concerns & Risks Renewable resources projects have “resource risk” (i.e., if wind won’t blow, low hydrology). The facilities are subject outages or breakdown, planned or unplanned. Rising interest rates are a concern. The market for infrastructure is heating up, with a lot of participants (pension plans, private equity, hedge funds etc.), and as a result, bargains are harder to find. Even though the Brookfield family of companies has simplified their structure over time, it’s still pretty complex. Non-voting units. This can play both ways, but for Canadian investors, the yield is higher partly because of the strong U.S. dollar. The risk is a weaker U.S. dollar versus the Canadian dollar. Infrastructure needs capex and maintenance. (Wind turbines needs to be replaced, etc.) Brazil has issues to deal with. (A weak macro environment, Petrobras (NYSE: PBR )) Catalysts M&A to drive growth. Asset recycling. BEP is exploring the idea of selling hot North American assets to buy cheap Brazilian or European assets. North-American valuations are very high, and there are lots of financial investors in this market who are paying premiums. Because of the wind and biomass addition to the portfolio, BEP now has the ability to look for growth opportunities on a more selective basis. Continental platform in place provides the ability to pursue multiple acquisitions opportunities on three continents (NA, LA, EU). The structure provides BEP the flexibility to direct capital investments to the most lucrative risk-adjusted markets. Strong organic growth prospects. Prices are rising. Investments BEP made in the last five years at cyclical lows will drive cash flow growth in the future. Coal is retiring, and it’s being replaced by more expensive generation. Some states and provinces are considering joining the cap and trade market with California, Ontario and Quebec. This program has attached a premium on non-carbon producing assets. Conclusion BEP is a high-quality company that offers pure exposure to renewable power. It is trading near its 52-week low and down from its all-time highs, offering a good entry point, in my view. BEP provides very limited downside risk and a lot of upside potential. The company has a strong cash position, stable cash flows, excellent assets, and its renewable energy projects have “fixed and indexed” long-term contracts. According to my valuation, in the short term, BEP’s share are worth $32.60, implying a 13.7% return. Sure, BEP is not cheap, and looks fairly valued at the current valuation metrics. However, if you read the whole article, this is not intended to be a quick overnight gain pick. BEP is anything but a trade. The key to making money with the company is to invest over a period of multiple years. It has many qualities long-term investors look for. The assets they hold will be there for the next generation, as well as the PPAs attached with them. And they are considered trophy assets, ones that institutions paid a lot of money for. Yes, the projects are capital-intensive to some degree, but once the hydro plant is built, it’s there forever (with maintenance CAPEX, of course). These capital-intensive projects make it hard for new entrants to pose a challenge. The company has stable, recurring growing revenues and reliable distributions. If you are looking for a buy and hold investment, BEP should be on your radar. Disclosure: The author is long BEP. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: For disclosure purposes, I’m actually long BEP.UN on the TSX but the system won’t permit it. As with all of my articles, the opinions are my own. You should do your homework and make your own best judgments about the company. (I know that this resembles the boilerplate disclosure that you see in every email that you get from your broker but I really mean this and I am not saying it to avoid getting sued.) Scalper1 News

Summary BEP focuses primarily on long-life renewable power assets that provide stable, long-term cash flows, and which are well positioned to appreciate in value over time. The company seeks a distribution growth target of 5-9% per year and a payout ratio of ~65% of funds from operations. BEP invests and owns real assets of high quality and with strong growth prospects. The objective is to deliver long-term gross returns of 12-15% on a portfolio basis. The recent dip in the stock provides a nice entry point. The Brookfield family of products has a great history of value creation. If you are looking for a very long-term safe investment that provides reliable growing dividends and reasonable growth prospects, Brookfield Renewable Energy Partners L.P. ( BEP , TMX: BEP.UN ) should be on your candidate list. BEP focuses primarily on long-life renewable power assets that provide stable, long-term cash flows, and which are well positioned to appreciate in value over time. BEP is one of the largest publicly traded pure-play renewable power platforms in the world. As of March 31, 2015, the company owns and manages 208 hydroelectric generating stations, 37 wind farms, 2 natural gas power plants, and 3 biomass plants, for a total of 250 power-generating facilities. Overall, the assets that it managed or manages have 7,265 MW of generating capacity and annual generation of 25,562 GWh, based on long-term averages. This is a global portfolio with assets across 14 power markets in North America, Latin America and Europe. BEP generates enough electricity from renewable resources to power 4 million homes each year. The structure is a limited partnership established in Bermuda since 2011. Brookfield Asset Management (NYSE: BAM ) owns, directly and indirectly, 63% of BEP. Below is a summary table of the partnership: Thesis Here are some of the mains reasons why I like BEP as a very long-term investment: The company invests and owns real assets of high quality and with strong growth prospects. The objective is to deliver long-term gross returns of 12-15% on a portfolio basis. A solid, experienced management team with a “boots on the ground” approach. Has a history of making disciplined conservative acquisitions. BEP benefits from its strategic partnership with BAM. It has a highly stable cash flow profile sourced from predominantly long-life hydroelectric assets, the vast majority of which sell electricity under long-term power purchase agreements (PPAs). BEP generates significant free cash flow. A portion of this is re-invested, and the other is returned to unitholders. Provides inflation protection (contractual clause for rising prices). A great investment for income seekers. BEP has a history of increasing distribution to unitholders. The company seeks a distribution growth target of 5-9% per year and a payout ratio of ~65% of the funds from operations (FFO). Invest in the renewable power sector (reducing contribution to global climate change). Also, coal is retiring, making room for more expensive generation. BEP has large moat. There are a lot of obstacles in the way if you plan to open a hydro plant tomorrow. Investment-grade balance sheet (BBB credit rating). Maintains a ~40% debt-to-total capital ratio. I like that the cash flow is attached to real long-life assets, instead of, let’s say, to a brand name. I know, to a certain degree of certainty, that the hydro plant and its contract will be providing cash for the next five to ten years. I can’t make that same prediction regarding my favorite brand or store at the mall. Sure, BEP is not a sexy investment, and it’s actually one of the most boring investments one could make. It has all the characteristics of a boring investment: cash-rich, high cash margins, conservative management, real long-life assets etc… It’s hard to have a decent BBQ conversation when you have invested in a bunch of hydro-generating stations and wind farms (Nobody is going to ask you about the hydro inflow rate last quarter or how the wind is blowing in Ireland ). But keep in mind, this is an investment for long-term income and growth. As long as the rivers are flowing and there’s wind in Ireland, you can sleep at night. Source: BEP Investor Profile May 2015 – Slide 6 The performance returns table above demonstrates the superior historical performance of BEP as of December 31, 2014. Of course, that wonderful 15-year historical performance is no guide to the future. However, because of the company’s solid business model and high-quality assets, above-average returns wouldn’t surprise me over the long run. The stock price has been weak of late, likely a function of the rise in bond yields, which has pressured interest rate higher and poor hydrology. Investors, particularly those with a longer-term view who appreciate BEP’s strong dividend growth outlook, should take the opportunity created by the recent pullback to take a position. While the overall business may be fairly valued on the surface at about 13x trailing adjusted EBITDA, the normalization of hydrology, organic growth and accretive acquisitions suggests that BEP could appreciate by 13.7% in 2015. The details of my valuation are below. The Brookfield Asset Management Family To better understand BEP, it’s important to understand the parent company, Brookfield Asset Management. You can’t talk about BEP without talking about BAM, since they are in the same family. BAM is a global manager of real assets with $207 billion AUM ranging from property, renewable energy, infrastructure, private equity and others. Sorting out the Brookfield family can be a challenge. Brookfield Asset Management is the parent company at the top. It has ownership stakes in the three Brookfield public companies and private listings, as demonstrated in the chart below: (click to enlarge) Source: BAM Corporate Profile Slide 6 – Q1-2015 I like the whole Brookfield family. There’s something for everyone. BAM is more for the growth-oriented investor, and the listed partnerships (BPY, BEP, BIP) are interesting for their dividends. A significant portion of BAM’s earnings are from the dividends its listed partnership distributes. The main reason why they don’t roll up the whole structure to BAM is because the market will apply a conglomerate discount (BAM is a former conglomerate with a colorful history). A conglomerate is more complicated to value and more confusing. In its current form, you attract more pure-play investors, since real estate investors can invest in BPY and energy investors can invest in BEP. BAM actually got its start in 1899 in Brazil as a builder and operator of electricity and transport infrastructure. The company’s earlier name of “Brascan” reflected this history (Brascan = Brasil + Canada). It has expanded in different industries, and today, it’s a global manager of real assets with over $207 billion of assets under management, operating with ~30,000 employees in over 20 countries (BEP has 1,500 employees). In 2002, Bruce Flatt, the current CEO and management partner (more on him below), took over BAM. Brascan was a complicated conglomerate with holdings in diverse sectors, including oil, mining, beer (Labatt), real estate, forest products, insurance and power companies with links to the Bronfman family. At its peak in the 1980s, Brascan represented one-third of the stock value of the Toronto Stock Exchange, but imploded during the 1990s real estate recession. Mr. Flatt led a restructuring that simplified BAM by focusing on just three sectors: real estate, renewable power and infrastructure assets like ports. Today, you can perceive BAM and its subsidiaries as the backbone infrastructure of the economy. This is also the favorite stock for many well-known investors, such as well-respected value investor Tom Gayner. Bruce Flatt, in a rare interview with the NYT , was quoted as saying: “We’re not a retail brand, but we rent space in malls to companies,” he says. “We don’t sell coal to anybody, but we own their coal terminal and ship coal out of our coal terminal. And we don’t sell natural gas but we transport natural gas in our pipelines.” For those that are familiar with BAM and its subsidiaries, the company’s approach is not dictated by the receipt of annual fees it charges for managing third-party assets under management. BAM’s approach is based on a strategic view that it should focus (and make any sale decision) not just on an investment’s short-term IRR, but also on maximizing the total returns it achieves from the investments it makes, which may result in a longer-term hold. I know it sounds like a copy-and-paste statement that you would read in any mutual fund brochure, but the company has the track record to back it up. In other words, BAM’s approach means that if a business is a quality business that has an irreplaceable franchise, then one should continue to hold the investment, as compounding at significant rates of return on your capital over a long time can make shareholders very wealthy (again, something you would read in Warren Buffett’s letters or interviews). “Our main investment objective is to put money where money is scarce, ” Bruce Flatt said after the 2015 AGM Brookfield Renewable Energy Partners L.P. Tracing back BEP’s history is not as simple as it sounds. Analyzing the company’s organizational tree and its web of entities, stakes, partnerships and operating companies is torturous. Brookfield Renewable Energy Partners is a limited partnership that was established June 27, 2011 in Bermuda as the result of a combination of different entities. BEP’s sole material asset is a 50.1% limited partnership interest in Brookfield Renewable Energy L.P (BRELP). The chart below was taken from the BEP 2015 Annual Information Form. As you can deduce from the chart, sometimes providing more information is not equivalent to more clarity. Source: BEP 2015 AIF Page 5 – you’re welcome. The corporate web above suggests that there are plenty of inter-corporate relationships. It’s without any hesitation that I leave it to your pleasure to dissect it . Today’s BRELP is the result of Brookfield Renewable Power Fund and Brookfield Renewable Power Inc. being combined in 2011. The current structure is the result of legislation change and BAM’s desire to simplify its structure (yes, this is the simplified corporate structure; just ask anyone on Bay Street that is still around from the ’80s). During the 2000s, income trusts were a popular investment vehicle in Canada because of their flow-through advantages, until the Federal government changed the law that forced the large majority of income trusts to convert to corporations. If you go back further, some investors might remember Great Lakes Hydro Income Fund , the predecessor to Brookfield Renewable Energy Partners. It’s through Great Lakes Hydro Income Fund that Brookfield advanced its interests in the renewable energy sector. Today, BAM controls 63% of Brookfield Renewable Energy Partners. As I mentioned in my intro, BEP is one of the largest publicly traded pure-play renewable power platforms in the world. Below is a table of the company’s operations: Source: BEP Q1-2015 Interim Report Overall, the company owns and manages 250 power-generating facilities with 7,265 MW of generating capacity and annual generation of 25,562 GWh, based on long-term averages. 80% is hydroelectric generation situated on 74 rivers. The bulk of the generation is done in North America, where it has 5,700 MW of generating capacity and ~$16 billion in AUM. That’s followed by Brazil with 980 MW and Europe with 570 MW of capacity. The investment in Europe is recent. Below is the company’s generation profile: Source: BEP Q1-2015 Interim Report BEP’s objective is to deliver long-term gross returns of 12-15% to shareholders. How does it plan on achieving that goal? The company’s approach is focused on the following (from the company website ): Operate a globally diversified portfolio of renewable power-generation assets across continental platforms and to the highest standards. Combine stable, predominantly contracted cash flows with the ability to capture rising prices on uncontracted power in its core markets. Maintain a predominantly hydroelectric focus. Leverage its operating expertise, transaction origination capabilities and funding platforms to acquire assets for value. Advance and replenish its proprietary development pipeline at premium returns. Secure growth opportunities in new technologies. In other words, the strategy is to deploy capital into renewable opportunities globally with a focus on hydro, which provides a highly stable cash flow. With the reinvestment of surplus cash flows, BEP expects the funds from operations to improve further in the long term. BEP depends on the success of this strategy to increase dividend growth to 5-9% annually and to maintain a ~65% payout of the FFO. Below is a statement from Richard Legault on the Q1-2015 earnings call that reiterates the strategy above: Our assets which are predominately hydro, benefit from high-cash margins throughout the cycle and we operate them recognizing that in the short-term, generation volumes are dependent on hydrology but over the long-term have a proven and stable generation profile. The unique nature of these assets combined with our conservative capital structure ensures that we can manage ongoing CapEx, fund our organic growth, service our distributions, and look to pursue new opportunities even in the midst of a low-generation year like we are currently having. This allows our management team to remain committed to focusing on long-term with the view of growing the cash flows on a per share basis and generating 12% to 15% total returns. – Richard Legault, CEO, BEP Management At the top of the BAM food chain, you have Bruce Flatt, CEO and management partner since 2002. In the investing world, Mr. Flatt is one of the top investors, with an excellent performance track record. You can learn a lot by listening to and reading the words of wisdom from Bruce. Since he keeps a low profile, there’s isn’t much material on him, but in his case, it’s not quantity that matters but quality. Sometimes there’s more substance in less words. He’s been dubbed the Warren Buffett of Canada (a term also stamped on Prem Watsa and Paul Desmarais ). The spotlights turned to Flatt when he beat out Simon Properties (NYSE: SPG ) when BAM bought a major ownership stake in bankrupt General Growth Properties (NYSE: GGP ). His strength is spotting distressed assets, and he has a knack for negotiating deals that deliver big, industry-beating returns and stable cash flows. Richard Legault has been the CEO of BEP since 1999, and is a senior managing partner of BAM. He has led the growth of Brookfield’s renewable power operations on a global basis, helping to make Brookfield Renewable one of the world’s largest pure-play renewable power portfolios. Recently, there have been two notable changes for BEP – the appointment of Sachin Shah as president and COO and Nick Goodman as CFO. For the full BEP management team description, click here . Brazil BAM and BEP are actively involved in Brazil, which is a source of anxiety for many investors. Brazil is also responsible for some of the recent hydrology problems cited in the latest results. It’s noteworthy that Brookfield has been an investor and operator in Brazil for over 100 years, operating various assets. The company re-entered the Brazilian power market in 2003, and since then, has grown its hydroelectric asset base significantly to 40 facilities on 25 river systems, totaling 5 wind farms and 3 biomass plants, which generate 980 MW of installed capacity. Regarding Brazil, the bad news is this: Projections indicate that Brazil will suffer its worst contraction in a quarter century this year as the government struggles to shore up its finances and tame inflation to avert a credit rating downgrade. The good news is this: As a result, asset prices in Brazil have dropped, creating opportunities to find bargains. The idea of doing business in Brazil sounds awful considering all the bad news coming out of the country, except if you are BAM. The company has a history of making money in Brazil, thanks to its solid “on the ground” team and its long history in the country. Despite recent market volatility and economic challenges, this fits Brookfield’s mandate of investing where money is scarce or out-of-favor assets (distressed). Brazil remains a large high-growth market with a strong competitive advantage in the production of commodities. On the operation side, the risk of operation shortfall in Brazil is minimized by participation in a hydrological balancing pool administrated by the government of Brazil. The program mitigates hydrology risk by assuring that all participants receive a balanced amount of electricity, irrespective of the actual volume of energy generated. Basically, the program reallocates energy, transferring surplus energy from those who generated an excess to those who generate less. Low precipitation across Brazil had a negative impact on hydrology in the last three quarters of 2014. During that period, BEP expected that a higher proportion of thermal generation would be needed to balance supply and demand in Brazil, potentially leading to higher overall spot market prices. In anticipation of lower hydrology, BEP maintained a lower level of contracted generation, allowing the company to capture the strong power prices. BEP believes that the timing is good for growing investments in Brazil, as the president and COO explained during the Q1-2015 earning call: In Brazil, scarcity of supply has been an issue for the last five years and only recently have we seen the impact of underinvestment. The current drought is highlighting the lack of alternatives in the market and as a result, prices are only now trending to what we believe is needed to drive investment in new supply. As I mentioned previously, we are actively signing new long-term contracts in this market for both existing assets and our development pipeline. Financial Overview Below are BAM’s 5-year financial results. Capacity (MW) and long-term average generation (GWh) have both increased over the last five years. Capacity has increased 55% and the long-term average has increased by 46% since 2010. At the end of Q1-2015, capacity stood at almost 7,300 MW, which 80% is from hydro. Average revenue ($ per MWh) is consistent with 2013, at $77. However, that number is down to $76 MWh for Q1 2015 results, compared to $84 MWh in Q1 2014. The lower revenue is due to a lower pricing environment and US$ appreciation. Revenues for 2014 were flat versus those for 2013. Higher pricing in the U.S. partially offset lower generation. In Brazil, revenues declined $14m because of lower generation, but was partially offset by higher merchant pricing. Overall, hydro and wind generated less than their long-term average. Even though revenue was flat, EBITDA slightly rose due to cost reduction efforts and reduction in power purchased in the open market for co-generation facilities. The historical 5-year EBITDA picture looks good, with a CAGR of 10%. EBITDA is a key valuation metric in the industry, since most assets are acquired on an enterprise value basis. Net income is obviously an important measure of profitability, but because of accounting rules, the presentation of net income will often mask the real cash flow generated. For example, in 2014, FFO was $560m and net income was $203.The primary reason for this is the recognition of a significantly higher level of depreciation for the company’s assets than it is reinvesting in the business as CAPEX. FY2015 EBITDA is estimated to be around the same level. BEP has approximately $20 billion of assets, its debt-to-total capitalization is 42%, and approximately 77% of the company’s borrowings are non-recourse. During Q1 2015, the company completed the refinancing of a Canadian hydro facility, which not only took place at an attractive rate of 2.95%, but also unlocked $20 million in financing proceeds. BEP’s available liquidity at quarter-end includes approximately $1.3 billion of cash and cash equivalents and the available portions of credit facilities. Developments As for recent developments, during Q1 2015, BEP closed two meaningful acquisitions. In Brazil, the company added almost 500 MW of hydro, wind, and biomass to its portfolio. In Portugal, it made the acquisition of a 120 MW portfolio of fully contracted wind assets, with redevelopment potential and some expansion opportunities. From a development perspective, BEP is advancing on a 500-750 MW of pipeline to build out over the next five years. It recently signed three PPAs for almost 75 MW of greenfield hydro in Brazil, at over 200R$ per MW-hour in today’s dollars for 30 years growing at inflation. Full commissioning is expected on all three projects between 2017 and 2018. In Ireland, the company recently achieved full commissioning of two wind projects totaling 125 MW, with another 12 MW facility on track to achieve commercial operation in the summer of 2015. Those projects come with a 15-year contract. Distribution When one sees a high dividend yield, one must ask oneself if it’s sustainable – simply investing because of an attractive yield often leads to trouble. BEP made it an objective to pay a distribution that is sustainable on a long-term basis, while retaining sufficient liquidity for recurring growth capital expenditures. However, having an objective and realizing it are two different things. The company has a target payout ratio of approximately 60-70% of FFO, which should leave it with approximately ~$100m of cash per year to further invest. Funds from operations should improve in the long run with reinvestment of surplus cash flow. BEP also announced that it was raising its distribution target from 3-5% to 5-9% per year. This sends a positive signal of confidence that it can deliver on its target. For 2015, BEP has the intention of distributing $1.66 per unit on annually, or $0.415 per quarter. This represents a 7% distribution increase over 2015 distribution. At today’s prices, this represents a yield of ~5.7%. For Canadian investors, the yield is a little fatter, thanks to the strong U.S. dollar. Distributions are in US$, even for the Canadian units. On the other hand, this FX advantage can turn upside down if the U.S. dollar gets weaker in the future. FY2014 FFO was $560 million. With a distribution of $480m, this represented a payout of 86% – higher than the expected FFO payout range. For 2013, FFO was $594m and distribution was $378, representing a 64% payout ratio – respecting the desired payout ratio. For FY2015, I expect distribution to exceed the payout ratio because of a higher payout per unit, additional units issued and possible lower FFO per unit. The main reason is weaker results resulting from lower hydrology in Brazil. However, in the long run, I expect the situation to normalize once hydrology returns to its long-term average. The yield is supported by the company’s stable cash flow. Liquidity remains strong, with $1b of cash and credit available as of December 31, 2014. By the way, if you try to calculate it yourself, the payout ratio is defined as distributions to Redeemable/Exchangeable partnership units, LP Units and the GP interest, including general partnership incentive distributions, divided by FFO. . Valuation It can be a hard to value any of the Brookfield Assets, because the company buys and sells a lot of things. It also raises capital occasionally. You really need to look at the balance sheet. EV/EBITDA is the preferred valuation metric in the industry, since it eliminates plenty of distortions due to the different capital structures and cash flows. During FY2014, BEP generated $1,216m in adjusted EBITDA. At $28.72, with 275m units, the market cap is approximately $7.8b. Add $7.89b in debt and subtract $196m in cash, and the enterprise value is $15.5b, or 13x trailing adjusted EBITDA. This sounds expensive until one looks at other power & utilities-oriented companies. I’m talking about companies like Algonquin Power ( OTCPK:AQUNF ), trading at 13.5x ttm EBITDA, or Boralex ( OTC:BRLXF ), a renewable energy company that’s trading at 17.5x ttm EBITDA. BEP’s forecast 2015 adjusted EBITDA is expected to remain at $1.2 billion, since 1Q results were weaker than forecast and below consensus due to poor hydrology. Adjusted EBITDA was $338m, compared to $360m in the prior year and below analyst consensus of $350m. Assuming a multiple of 14x EV/Adjusted FY2015 EBITDA, which reflects new growth initiatives, my target for BEP is $32.60 per share. This represents a 13% upside (dividends excluded). This is obviously not a full-blown valuation model, since I just expanded the multiple from 13x to 14x. We can argue that a 14x multiple is rich, but that’s what it costs today for high-quality long-life assets, great management, and reasonable growth and distribution. The truth is that firms, such as pension plans, are willing to pay that amount and more for these kinds of assets. Over time, the EBITDA should increase from BEP’s two-pronged approach (organic growth and M&A), higher capacity, higher pricing and better hydrology. I don’t usually make short-term predictions, and it shouldn’t really matter, since investing in BEP is a multi-year investment. If the target price is not met, or if the stock drops some more, instead of panicking like the reaction of the herb (falling prices means the company is a bad investment, and a company with ever-increasing prices is one you should buy), maybe it’s an opportunity to buy more of BEP at a cheaper price. Forecasting no growth in EBITDA for 2015 is not exciting, and the weak results have already weighed upon the stock. However, it provides an opportunity to enter at a good price, since the hydrology problem is considered to be temporary. Over time, inflow will normalize, and the additional capacity should provide strong results. Positives The BAM family is the backbone infrastructure of the economy. Provides an alternative to traditional equity and fixed-income investments. Long-term PPAs with creditworthy buyers. The Brookfield family has a strong history of wealth creation. BAM has a portfolio of high-quality, well-diversified assets. The portfolio provides stable long-term cash flow, which supports the distribution and is a solid foundation for growth (organic and M&A). Management’s “boots on the ground” approach (i.e., a team with experience in Brazil). The debt associated with the purchase of certain assets are non-recourse to equity investors. Interest rates are low. Ability to finance projects with low rates. BEP provides a shelter from volatility as long as interest rates stay low for the foreseeable future. There’s a contrarian feel to it. The company is plunging into Brazil when a lot of investors are looking to get out, possibly opening up bargains. An excellent management team that includes Bruce Flatt. Hydropower reduces contribution to global climate change. Hydropower is a consistent, reliable and renewable source of clean power. Wind energy is renewable, reliable, efficient and is associated with few adverse environmental effects. BEP reiterated its guidance of 5-9% annual distribution growth, up from 3-5%. Negatives, Concerns & Risks Renewable resources projects have “resource risk” (i.e., if wind won’t blow, low hydrology). The facilities are subject outages or breakdown, planned or unplanned. Rising interest rates are a concern. The market for infrastructure is heating up, with a lot of participants (pension plans, private equity, hedge funds etc.), and as a result, bargains are harder to find. Even though the Brookfield family of companies has simplified their structure over time, it’s still pretty complex. Non-voting units. This can play both ways, but for Canadian investors, the yield is higher partly because of the strong U.S. dollar. The risk is a weaker U.S. dollar versus the Canadian dollar. Infrastructure needs capex and maintenance. (Wind turbines needs to be replaced, etc.) Brazil has issues to deal with. (A weak macro environment, Petrobras (NYSE: PBR )) Catalysts M&A to drive growth. Asset recycling. BEP is exploring the idea of selling hot North American assets to buy cheap Brazilian or European assets. North-American valuations are very high, and there are lots of financial investors in this market who are paying premiums. Because of the wind and biomass addition to the portfolio, BEP now has the ability to look for growth opportunities on a more selective basis. Continental platform in place provides the ability to pursue multiple acquisitions opportunities on three continents (NA, LA, EU). The structure provides BEP the flexibility to direct capital investments to the most lucrative risk-adjusted markets. Strong organic growth prospects. Prices are rising. Investments BEP made in the last five years at cyclical lows will drive cash flow growth in the future. Coal is retiring, and it’s being replaced by more expensive generation. Some states and provinces are considering joining the cap and trade market with California, Ontario and Quebec. This program has attached a premium on non-carbon producing assets. Conclusion BEP is a high-quality company that offers pure exposure to renewable power. It is trading near its 52-week low and down from its all-time highs, offering a good entry point, in my view. BEP provides very limited downside risk and a lot of upside potential. The company has a strong cash position, stable cash flows, excellent assets, and its renewable energy projects have “fixed and indexed” long-term contracts. According to my valuation, in the short term, BEP’s share are worth $32.60, implying a 13.7% return. Sure, BEP is not cheap, and looks fairly valued at the current valuation metrics. However, if you read the whole article, this is not intended to be a quick overnight gain pick. BEP is anything but a trade. The key to making money with the company is to invest over a period of multiple years. It has many qualities long-term investors look for. The assets they hold will be there for the next generation, as well as the PPAs attached with them. And they are considered trophy assets, ones that institutions paid a lot of money for. Yes, the projects are capital-intensive to some degree, but once the hydro plant is built, it’s there forever (with maintenance CAPEX, of course). These capital-intensive projects make it hard for new entrants to pose a challenge. The company has stable, recurring growing revenues and reliable distributions. If you are looking for a buy and hold investment, BEP should be on your radar. Disclosure: The author is long BEP. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: For disclosure purposes, I’m actually long BEP.UN on the TSX but the system won’t permit it. As with all of my articles, the opinions are my own. You should do your homework and make your own best judgments about the company. (I know that this resembles the boilerplate disclosure that you see in every email that you get from your broker but I really mean this and I am not saying it to avoid getting sued.) Scalper1 News

Scalper1 News