Scalper1 News

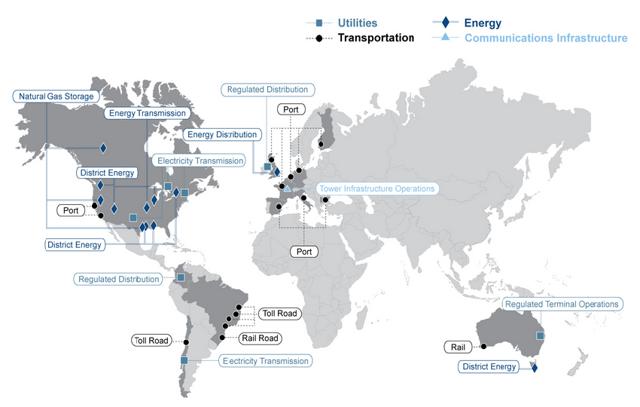

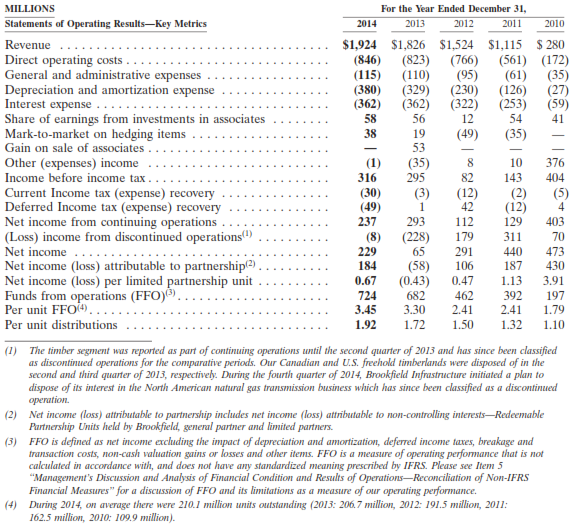

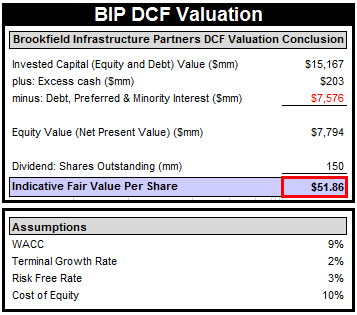

Summary Brookfield Infrastructure Partners is fundamentally undervalued by the market. The market is not fully appreciating its growth prospects and is baking in a higher degree of risk than necessary for its short track record. It has set out on an investment phase with it targeting distressed and undervalued assets that can only accrue in value and ultimately boost cash flow and bottom-line growth. The defensive and/or regulated nature of its geographically diversified asset base reduces volatility. While not risk free the risk/reward equation is skewed in favor of the investor at this time. It is not every day that you find a defensive stock that is undervalued by the market particularly when it is paying a distribution that is yielding almost 5% but this is the case for Brookfield Infrastructure Partners (NYSE: BIP ). The market appears to be taking a conservative view of the partnership’s prospects because of its relatively short track record and less than stellar rack record with the shares up by only 9% over the last year. There are also fears about the overall health and outlook for the global economy which is applying pressure to companies like Brookfield Infrastructure that have global assets and operations in more vulnerable European and emerging markets. Despite this, I believe that Brookfield Infrastructure offers investors a tantalizing mixture of yield coupled with a solid defensive asset base and strong growth prospects. The strengths of its existing operations combined with its growth strategy focused on acquiring high quality assets at reasonable prices and the fact it is undervalued see it offering investors considerable upside at this time. Overview of the investment case Brookfield Infrastructure Partners operates a portfolio of geographically diversified high quality, long-life infrastructure and utilities assets. These assets span four continents and are located both in developed and emerging economies which helps to offset economic risk. They include utilities, energy, transport and communications infrastructure, all of which are highly regulated industries with steep barriers to entry that endows them with a wide economic moat. (click to enlarge) Source: Brookfield Infrastructure Partners. These assets provide essential products and services to the global economy, with the demand for those services being relatively inelastic because they are key components of modern economic activity. Demand for these assets and their utilization rates can only grow as the population grows and when the global economy is expanding. As a result, each of these factors protects Brookfield Infrastructure’s competitive advantage while allowing it to generate stable and growing cash flow while protecting its earnings. It isn’t hard to see how these characteristics have allowed Brookfield Infrastructure to deliver some solid financial results and growth since it was spun off from Brookfield Asset Management (NYSE: BAM ) in 2008. Source: Company filings. As you can see revenue has grown at a healthy clip with an impressive five year compound annual growth rate of 47%, while more importantly funds flow from operations has a five year CAGR of 14%. The value of Brookfield Infrastructure’s assets have also grown over that period with net-tangible-assets having a five year CAGR of 13%. This points to the solid future growth prospects of Brookfield Infrastructure particularly when we examine its growth prospects. Solid growth prospects targeting undervalued and or distressed assets Brookfield Infrastructure is seeking to position itself as a buyer of high quality assets with reliable cash flow while possessing a low cost of capital. To date this strategy is working well for the partnership with it able to leverage off its relationship with Brookfield Asset Management. In late 2014 it lead a consortium that acquired a 50% interest in France’s largest telecommunications tower business TDF for $2.2 billion, with $500 million being its share of the investment. This investment is expected to have a FFO yield of 12% to 15% and has diversified its business into telecommunications infrastructure, which can only support bottom-line growth. Particularly as the Eurozone’s economic recovery picks up steam thanks to the ECB’s stimulus package. It has built a considerable war chest for making further acquisitions and at the end of April 2015 had $3 billion in liquidity. Now with many emerging market governments and companies feeling considerable credit stress, Brookfield Infrastructure is well positioned to fill the gap left in those economies for the development, operations and maintenance of much needed infrastructure. This is one of the prime reasons that Brookfield Infrastructure has developed a solid portfolio of infrastructure, and in particular transportation, assets in South America. It is continuing to target South America as a key growth market, with it eyeing off further acquisitions in Brazil. Now with Brazil caught in an economic crisis and the government feeling the pressures associated with needing to kick start the economy and invest up to another $200 billion in infrastructure there are considerable opportunities for Brookfield Infrastructure. This includes the ability to use its war chest to acquire further distressed or undervalued assets from Brazilian companies that are struggling with significant debt burdens acquired from when they gorged themselves on debt during the boom years. These factors have seen it flag that it is targeting further acquisitions in Brazil with it set to deploy up to $450 million into two investments. This includes investing $200 million into a Brazilian toll road subsidiary and $250 million to purchase Brazilian construction company OAS’ stake in Invepar a Brazilian operator of toll roads and airports. Brookfield Infrastructure’s habit of picking up distressed or struggling assets for bargain prices can be seen with its latest acquisition, where it has acquired Niska Gas Storage Partners (NYSE: NKA ) for $919 million. Natural gas storage is an industry that has fallen upon hard times with many operators struggling to remain profitable as they feel the pain of low natural gas prices and thin storage spreads. It wasn’t all that long ago when Niska was worth over $2 billion and the company’s assets are located in a range of key North American natural gas markets with 250 billion cubic feet of total natural gas storage capacity. Brookfield Infrastructure has the deep pockets necessary to restructure this business in order to make it more profitable and wait for a rebound in natural gas demand which will drive higher earnings. This acquisition program coupled with growing demand for infrastructure over the long term as the global economy starts to recover will boost Brookfield Infrastructure’s growth prospects. What investors need to be conscious of is that these types of assets that Brookfield Infrastructure invests in don’t create rapid short term growth. Instead for the reasons discussed they generate stable cash flows and long term inflation controlled growth, in other words “slow and steady wins the race”. Valuing Brookfield Infrastructure Partners Valuing a business such as Brookfield Infrastructure is never easy with it possessing a lot of moving parts across a range of economies. In order to get a grip on what Brookfield Infrastructure’s indicate fair value is I have used a discounted cash flow valuation with the following assumptions: Despite it targeting revenue growth of 10% annually I have dialed that down to between 6% to 7.5% over the next three years to take into account the uncertainty surrounding the global economy. I have assigned a terminal growth rate of 2% which is below the long-term global GDP growth rate of 2.4% to represent the uncertainty of the global economy. I have used a cost of equity of 10% calculated using the CAPM model and taking into account the risk associated with operating in emerging markets. I have used the 10 year treasury yield as the risk free rate. The weighted average cost of capital (WACC) used its 9% and this has been applied as the discount rate in accordance with DCF methodology. The end result is that I have arrived at an indicative fair value of $52 per share as the table setting out the key calculations and assumptions below shows. This represents a 16% premium over its current trading price and while this may be a relatively small premium it was calculated using a conservative valuation methodology for a business operating in heavily regulated and/or monopolistic markets with a wide economic moat. Investors should also not forget about that handy distribution which will continue to reward them with an almost 5% yield as they patiently wait for Brookfield Infrastructures share price to appreciate. This distribution also appears sustainable when is strong growth in funds flow from operations is considered in conjunction with a targeted 60% to 70% payout ratio. Bottom-line I don’t expect Brookfield Infrastructure to “blow out the lights” but it certainly shapes up as an investment with considerable potential for all the right reasons. It has a history of targeting growth through the acquisition of distressed or undervalued assets that a ripe to be restructured in industries that are protected by wide economic moats. There is also significant growing demand for these assets as the global economy continues to expand while the downside risk is mitigated by the diversification of its portfolio across different markets, industries and sectors. This effectively guarantees both earnings growth and rising asset values. While it is not risk free the long term potential reward far outweighs the risks for investors with it clearly undervalued offering investors potential upside of 16% along with a sustainable distribution yielding almost 5% that will continue to reward patient investors as they wait for its shares to appreciate in value. Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in BIP over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Brookfield Infrastructure Partners is fundamentally undervalued by the market. The market is not fully appreciating its growth prospects and is baking in a higher degree of risk than necessary for its short track record. It has set out on an investment phase with it targeting distressed and undervalued assets that can only accrue in value and ultimately boost cash flow and bottom-line growth. The defensive and/or regulated nature of its geographically diversified asset base reduces volatility. While not risk free the risk/reward equation is skewed in favor of the investor at this time. It is not every day that you find a defensive stock that is undervalued by the market particularly when it is paying a distribution that is yielding almost 5% but this is the case for Brookfield Infrastructure Partners (NYSE: BIP ). The market appears to be taking a conservative view of the partnership’s prospects because of its relatively short track record and less than stellar rack record with the shares up by only 9% over the last year. There are also fears about the overall health and outlook for the global economy which is applying pressure to companies like Brookfield Infrastructure that have global assets and operations in more vulnerable European and emerging markets. Despite this, I believe that Brookfield Infrastructure offers investors a tantalizing mixture of yield coupled with a solid defensive asset base and strong growth prospects. The strengths of its existing operations combined with its growth strategy focused on acquiring high quality assets at reasonable prices and the fact it is undervalued see it offering investors considerable upside at this time. Overview of the investment case Brookfield Infrastructure Partners operates a portfolio of geographically diversified high quality, long-life infrastructure and utilities assets. These assets span four continents and are located both in developed and emerging economies which helps to offset economic risk. They include utilities, energy, transport and communications infrastructure, all of which are highly regulated industries with steep barriers to entry that endows them with a wide economic moat. (click to enlarge) Source: Brookfield Infrastructure Partners. These assets provide essential products and services to the global economy, with the demand for those services being relatively inelastic because they are key components of modern economic activity. Demand for these assets and their utilization rates can only grow as the population grows and when the global economy is expanding. As a result, each of these factors protects Brookfield Infrastructure’s competitive advantage while allowing it to generate stable and growing cash flow while protecting its earnings. It isn’t hard to see how these characteristics have allowed Brookfield Infrastructure to deliver some solid financial results and growth since it was spun off from Brookfield Asset Management (NYSE: BAM ) in 2008. Source: Company filings. As you can see revenue has grown at a healthy clip with an impressive five year compound annual growth rate of 47%, while more importantly funds flow from operations has a five year CAGR of 14%. The value of Brookfield Infrastructure’s assets have also grown over that period with net-tangible-assets having a five year CAGR of 13%. This points to the solid future growth prospects of Brookfield Infrastructure particularly when we examine its growth prospects. Solid growth prospects targeting undervalued and or distressed assets Brookfield Infrastructure is seeking to position itself as a buyer of high quality assets with reliable cash flow while possessing a low cost of capital. To date this strategy is working well for the partnership with it able to leverage off its relationship with Brookfield Asset Management. In late 2014 it lead a consortium that acquired a 50% interest in France’s largest telecommunications tower business TDF for $2.2 billion, with $500 million being its share of the investment. This investment is expected to have a FFO yield of 12% to 15% and has diversified its business into telecommunications infrastructure, which can only support bottom-line growth. Particularly as the Eurozone’s economic recovery picks up steam thanks to the ECB’s stimulus package. It has built a considerable war chest for making further acquisitions and at the end of April 2015 had $3 billion in liquidity. Now with many emerging market governments and companies feeling considerable credit stress, Brookfield Infrastructure is well positioned to fill the gap left in those economies for the development, operations and maintenance of much needed infrastructure. This is one of the prime reasons that Brookfield Infrastructure has developed a solid portfolio of infrastructure, and in particular transportation, assets in South America. It is continuing to target South America as a key growth market, with it eyeing off further acquisitions in Brazil. Now with Brazil caught in an economic crisis and the government feeling the pressures associated with needing to kick start the economy and invest up to another $200 billion in infrastructure there are considerable opportunities for Brookfield Infrastructure. This includes the ability to use its war chest to acquire further distressed or undervalued assets from Brazilian companies that are struggling with significant debt burdens acquired from when they gorged themselves on debt during the boom years. These factors have seen it flag that it is targeting further acquisitions in Brazil with it set to deploy up to $450 million into two investments. This includes investing $200 million into a Brazilian toll road subsidiary and $250 million to purchase Brazilian construction company OAS’ stake in Invepar a Brazilian operator of toll roads and airports. Brookfield Infrastructure’s habit of picking up distressed or struggling assets for bargain prices can be seen with its latest acquisition, where it has acquired Niska Gas Storage Partners (NYSE: NKA ) for $919 million. Natural gas storage is an industry that has fallen upon hard times with many operators struggling to remain profitable as they feel the pain of low natural gas prices and thin storage spreads. It wasn’t all that long ago when Niska was worth over $2 billion and the company’s assets are located in a range of key North American natural gas markets with 250 billion cubic feet of total natural gas storage capacity. Brookfield Infrastructure has the deep pockets necessary to restructure this business in order to make it more profitable and wait for a rebound in natural gas demand which will drive higher earnings. This acquisition program coupled with growing demand for infrastructure over the long term as the global economy starts to recover will boost Brookfield Infrastructure’s growth prospects. What investors need to be conscious of is that these types of assets that Brookfield Infrastructure invests in don’t create rapid short term growth. Instead for the reasons discussed they generate stable cash flows and long term inflation controlled growth, in other words “slow and steady wins the race”. Valuing Brookfield Infrastructure Partners Valuing a business such as Brookfield Infrastructure is never easy with it possessing a lot of moving parts across a range of economies. In order to get a grip on what Brookfield Infrastructure’s indicate fair value is I have used a discounted cash flow valuation with the following assumptions: Despite it targeting revenue growth of 10% annually I have dialed that down to between 6% to 7.5% over the next three years to take into account the uncertainty surrounding the global economy. I have assigned a terminal growth rate of 2% which is below the long-term global GDP growth rate of 2.4% to represent the uncertainty of the global economy. I have used a cost of equity of 10% calculated using the CAPM model and taking into account the risk associated with operating in emerging markets. I have used the 10 year treasury yield as the risk free rate. The weighted average cost of capital (WACC) used its 9% and this has been applied as the discount rate in accordance with DCF methodology. The end result is that I have arrived at an indicative fair value of $52 per share as the table setting out the key calculations and assumptions below shows. This represents a 16% premium over its current trading price and while this may be a relatively small premium it was calculated using a conservative valuation methodology for a business operating in heavily regulated and/or monopolistic markets with a wide economic moat. Investors should also not forget about that handy distribution which will continue to reward them with an almost 5% yield as they patiently wait for Brookfield Infrastructures share price to appreciate. This distribution also appears sustainable when is strong growth in funds flow from operations is considered in conjunction with a targeted 60% to 70% payout ratio. Bottom-line I don’t expect Brookfield Infrastructure to “blow out the lights” but it certainly shapes up as an investment with considerable potential for all the right reasons. It has a history of targeting growth through the acquisition of distressed or undervalued assets that a ripe to be restructured in industries that are protected by wide economic moats. There is also significant growing demand for these assets as the global economy continues to expand while the downside risk is mitigated by the diversification of its portfolio across different markets, industries and sectors. This effectively guarantees both earnings growth and rising asset values. While it is not risk free the long term potential reward far outweighs the risks for investors with it clearly undervalued offering investors potential upside of 16% along with a sustainable distribution yielding almost 5% that will continue to reward patient investors as they wait for its shares to appreciate in value. Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in BIP over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News