Scalper1 News

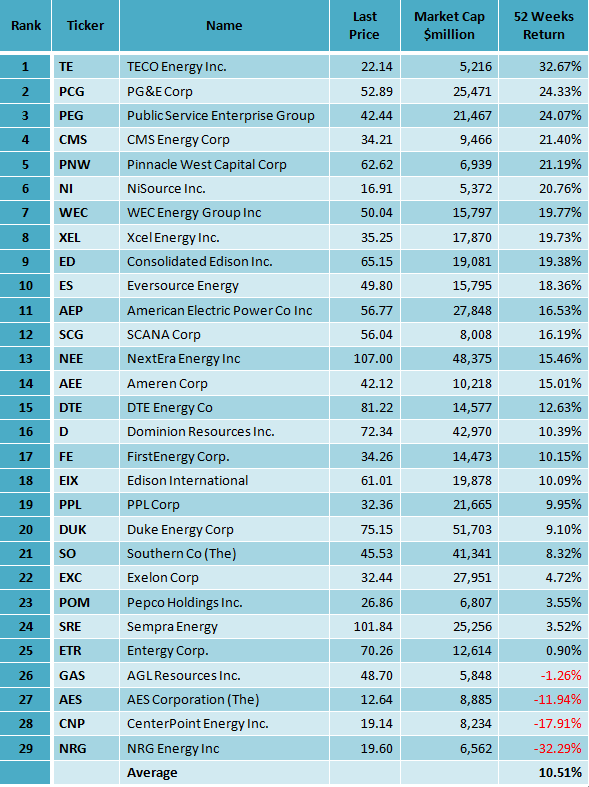

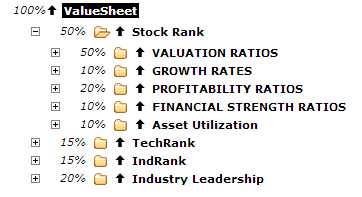

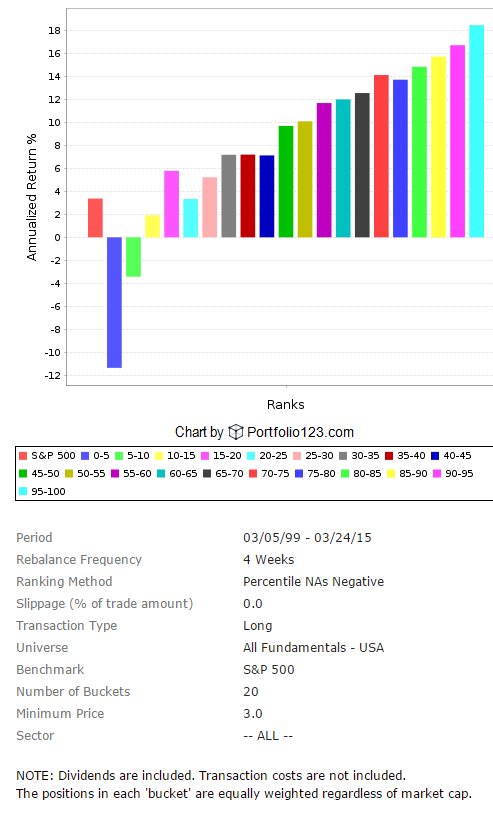

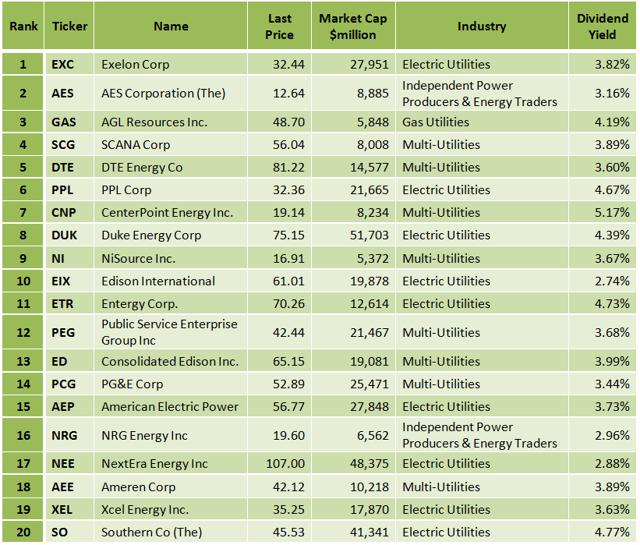

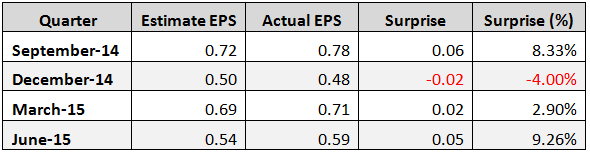

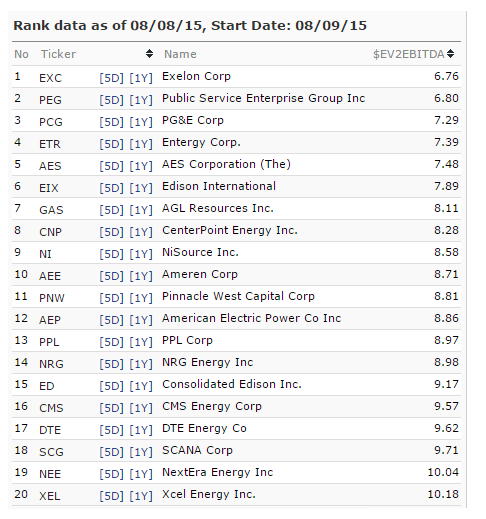

Summary Ranking the top twenty S&P 500 utility stocks according to a winning ranking system. Explanation and back-testing of the “ValueSheet” ranking system. Description and a buy recommendation for the first-ranked stock of the system: Exelon Corporation (EXC). S&P 500 utility stocks have given, on average, a similar return to that of the S&P 500 index over the last year. The average return of the 29 S&P 500 utility stocks that are included in the S&P 500 index (included dividends) in the last 52 weeks has been 10.51%, while the S&P 500 index has returned 9.77%. The table below shows all S&P 500 utility companies, ranked according to their 52 weeks return. A Ranking system sorts stocks from best to worst based on a set of weighted factors. Portfolio123 has a ranking system which allows the user to create complex formulas according to many different criteria. They also have highly useful several groups of pre-built ranking systems, I used one of them the “ValueSheet” in this article. The “ValueSheet” ranking system is quite complex, and it is taking into account many factors like; valuation ratios, growth rates, profitability ratios, financial strength, asset utilization, technical rank, industry rank, and industry leadership, as shown in Portfolio123’s chart below. In order to find out how such a ranking formula would have performed during the last 16 years, I ran a back-test, which is available by the Portfolio123’s screener. For the back-test, I took all the 6,651 stocks in the Portfolio123’s database. The back-test results are shown in the chart below. For the back-test, I divided the 6,651 companies into twenty groups according to their ranking. The chart clearly shows that the average annual return has a very significant positive correlation to the “ValueSheet” rank. The highest ranked group with the ranking score of 95-100, which is shown by the light blue column in the chart, has given by far the best return, an average annual return of about 18%, while the average annual return of the S&P 500 index during the same period was about 3.5% (the red column at the left part of the chart). Also, the second and the third group (scored: 90-95 and 85-90) have given superior returns. This brings me to the conclusion that the ranking system is very useful. After running the “ValueSheet” ranking system on all S&P 500 utility stocks on August 09, I discovered the twenty best stocks, which are shown in the table below. In this article, I will focus on the first-ranked stock; Exelon Corporation (NYSE: EXC ). (click to enlarge) On July 29, Exelon reported its second quarter 2015 results and narrowed its full-year operating earnings guidance to $2.35 to $2.55 per share. Exelon achieved earnings above its guidance range in the quarter, led by a strong financial performance at Constellation. The company beat EPS expectations in the last quarter by $0.05 (9.3%). The major drivers for the beat were reduced outages at ExGen’s nuclear plants and lower uncollectibles at Baltimore Gas & Electric. Revenue grew 5.1% to $6.51 billion in the period. Exelon showed earnings per share surprise in its last two-quarters after missing estimates in the previous quarter, as shown in the table below. Source: Yahoo Finance Despite low power prices and challenging market conditions in the wholesale power markets, I see healthy growth prospects for the company. The proposed all-cash acquisition, pending approvals, of Pepco (NYSE: POM ), will help to boost Exelon’s earnings growth rate. The merger continues to be conditioned upon approval by the Public Service Commission of the District of Columbia. Exelon expects the merger to be completed in the third quarter of 2015. On the regulated side, the forthcoming Pepco merger should bring opportunities for investment and operational improvement, as well as an additional regulated earnings stream to support the dividend. Also, the coming industry coal plant retirements will lower future reserve margins and would lead to higher electricity prices. In another development, the company plans, in September, to decide what nuclear plant will be retired due to uneconomic operational conditions. Exelon continues to evaluate the viability of three of its nuclear plants in Illinois (Byron, Quad Cities, and Clinton) given that the Illinois legislative session ended without a resolution on the low carbon portfolio. Valuation EXC’s stock has underperformed the market in the last few years. The stock is down 12.5% year-to-date while the S&P 500 index has increased 0.9%, and the Nasdaq Composite Index has gained 6.5%. Moreover, since the beginning of 2013, EXC’s stock has gained only 9.1% while the S&P 500 index has increased 45.7%, and the Nasdaq Composite Index has risen 67%. However, In my opinion, EXC’s stock is a clear value with the stock having faded more than its fundamentals and key catalysts. (click to enlarge) Chart: TradeStation Group, Inc. Exelon’s valuation metrics are excellent, the trailing P/E is very low at 11.97, the forward P/E is low at 13.40, and its price-to-sales ratio is also very low at 0.95. Furthermore, its Enterprise Value/EBITDA ratio is very low at 6.76, the lowest among all S&P 500 utility stocks. Source: Portfolio123 Exelon is paying a generous dividend. The forward annual dividend yield is pretty high at 3.82% and the payout ratio is at 45.8%. However, the annual rate of dividend growth over the past five years was negative at -10%. Summary Exelon delivered better than expected second quarter results and narrowed its full-year operating earnings guidance to $2.35 to $2.55 per share. Exelon achieved earnings above its guidance range in the quarter, led by a strong financial performance at Constellation. Despite low power prices and challenging market conditions in the wholesale power markets, I see healthy growth prospects for the company. The proposed all-cash acquisition, pending approvals, of Pepco, will help to boost Exelon’s earnings growth rate. Exelon has compelling valuation; its EV/EBITDA ratio of 6.76 is the lowest among all S&P 500 utility stocks. In my view, the recent retreat in its price offers an excellent opportunity to buy the stock at a cheap price. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Ranking the top twenty S&P 500 utility stocks according to a winning ranking system. Explanation and back-testing of the “ValueSheet” ranking system. Description and a buy recommendation for the first-ranked stock of the system: Exelon Corporation (EXC). S&P 500 utility stocks have given, on average, a similar return to that of the S&P 500 index over the last year. The average return of the 29 S&P 500 utility stocks that are included in the S&P 500 index (included dividends) in the last 52 weeks has been 10.51%, while the S&P 500 index has returned 9.77%. The table below shows all S&P 500 utility companies, ranked according to their 52 weeks return. A Ranking system sorts stocks from best to worst based on a set of weighted factors. Portfolio123 has a ranking system which allows the user to create complex formulas according to many different criteria. They also have highly useful several groups of pre-built ranking systems, I used one of them the “ValueSheet” in this article. The “ValueSheet” ranking system is quite complex, and it is taking into account many factors like; valuation ratios, growth rates, profitability ratios, financial strength, asset utilization, technical rank, industry rank, and industry leadership, as shown in Portfolio123’s chart below. In order to find out how such a ranking formula would have performed during the last 16 years, I ran a back-test, which is available by the Portfolio123’s screener. For the back-test, I took all the 6,651 stocks in the Portfolio123’s database. The back-test results are shown in the chart below. For the back-test, I divided the 6,651 companies into twenty groups according to their ranking. The chart clearly shows that the average annual return has a very significant positive correlation to the “ValueSheet” rank. The highest ranked group with the ranking score of 95-100, which is shown by the light blue column in the chart, has given by far the best return, an average annual return of about 18%, while the average annual return of the S&P 500 index during the same period was about 3.5% (the red column at the left part of the chart). Also, the second and the third group (scored: 90-95 and 85-90) have given superior returns. This brings me to the conclusion that the ranking system is very useful. After running the “ValueSheet” ranking system on all S&P 500 utility stocks on August 09, I discovered the twenty best stocks, which are shown in the table below. In this article, I will focus on the first-ranked stock; Exelon Corporation (NYSE: EXC ). (click to enlarge) On July 29, Exelon reported its second quarter 2015 results and narrowed its full-year operating earnings guidance to $2.35 to $2.55 per share. Exelon achieved earnings above its guidance range in the quarter, led by a strong financial performance at Constellation. The company beat EPS expectations in the last quarter by $0.05 (9.3%). The major drivers for the beat were reduced outages at ExGen’s nuclear plants and lower uncollectibles at Baltimore Gas & Electric. Revenue grew 5.1% to $6.51 billion in the period. Exelon showed earnings per share surprise in its last two-quarters after missing estimates in the previous quarter, as shown in the table below. Source: Yahoo Finance Despite low power prices and challenging market conditions in the wholesale power markets, I see healthy growth prospects for the company. The proposed all-cash acquisition, pending approvals, of Pepco (NYSE: POM ), will help to boost Exelon’s earnings growth rate. The merger continues to be conditioned upon approval by the Public Service Commission of the District of Columbia. Exelon expects the merger to be completed in the third quarter of 2015. On the regulated side, the forthcoming Pepco merger should bring opportunities for investment and operational improvement, as well as an additional regulated earnings stream to support the dividend. Also, the coming industry coal plant retirements will lower future reserve margins and would lead to higher electricity prices. In another development, the company plans, in September, to decide what nuclear plant will be retired due to uneconomic operational conditions. Exelon continues to evaluate the viability of three of its nuclear plants in Illinois (Byron, Quad Cities, and Clinton) given that the Illinois legislative session ended without a resolution on the low carbon portfolio. Valuation EXC’s stock has underperformed the market in the last few years. The stock is down 12.5% year-to-date while the S&P 500 index has increased 0.9%, and the Nasdaq Composite Index has gained 6.5%. Moreover, since the beginning of 2013, EXC’s stock has gained only 9.1% while the S&P 500 index has increased 45.7%, and the Nasdaq Composite Index has risen 67%. However, In my opinion, EXC’s stock is a clear value with the stock having faded more than its fundamentals and key catalysts. (click to enlarge) Chart: TradeStation Group, Inc. Exelon’s valuation metrics are excellent, the trailing P/E is very low at 11.97, the forward P/E is low at 13.40, and its price-to-sales ratio is also very low at 0.95. Furthermore, its Enterprise Value/EBITDA ratio is very low at 6.76, the lowest among all S&P 500 utility stocks. Source: Portfolio123 Exelon is paying a generous dividend. The forward annual dividend yield is pretty high at 3.82% and the payout ratio is at 45.8%. However, the annual rate of dividend growth over the past five years was negative at -10%. Summary Exelon delivered better than expected second quarter results and narrowed its full-year operating earnings guidance to $2.35 to $2.55 per share. Exelon achieved earnings above its guidance range in the quarter, led by a strong financial performance at Constellation. Despite low power prices and challenging market conditions in the wholesale power markets, I see healthy growth prospects for the company. The proposed all-cash acquisition, pending approvals, of Pepco, will help to boost Exelon’s earnings growth rate. Exelon has compelling valuation; its EV/EBITDA ratio of 6.76 is the lowest among all S&P 500 utility stocks. In my view, the recent retreat in its price offers an excellent opportunity to buy the stock at a cheap price. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News