Scalper1 News

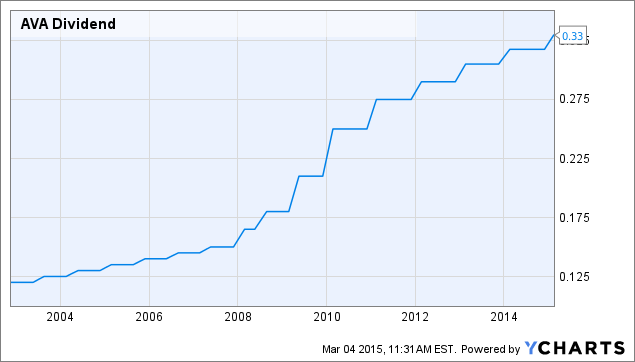

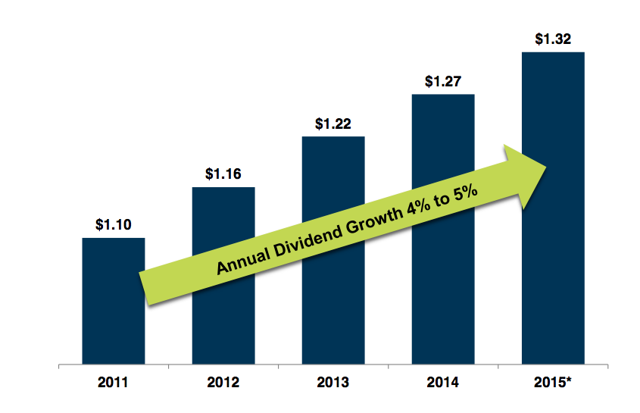

Currently, the shares sport a yield of 3.97%. For the last 13 years, the company has increased its dividend. Avista anticipates continuing to grow its dividend by 4-5% annually. My search for safe high-yield plays continues, and has brought me upon Avista Corp. (NYSE: AVA ). The diversified utilities player is in a solid spot right now, and boy, does its dividend look attractive. Avista’s operations consist of generation, transmission, and distribution of electricity in the Northwest US and Alaska. It’s common knowledge that utilities are a fairly stable sector, and this is one of the main things that drew me to Avista. A stable and safe industry is something I always look for in my search. The utilities sector, in particular, is my favorite place to search for good dividends, and with Avista, I believe I have found just that. AVA Dividend data by YCharts The company currently pays out a quarterly dividend of 33 cents a share. That gives the shares a yield of 3.97% at current levels. As can be seen from the chart above, Avista has seen 13 years of dividend growth, most recently raising it about 4% on February 6th. The payout ratio sits at about 68%, which, by my standards, is more than acceptable. Most of the time, I look for anything under 70%, and depending on the industry, up to 80% may be acceptable. 2014 was somewhat of a transitional year for the company. It sold off its indirect subsidiary Ecova, Inc. to Cofely USA for $335 million. On the other side of the spectrum, Avista closed a deal during the year to acquire Alaska Electric Light and Power Company. Both of these threw a twist on earnings for 2014. In total, the company actually reported earnings per share of $3.10 for the year. However, earnings for the year were actually $1.93 from continuing ops. The earnings from the continuing ops is what is important here, as that will be the comparison for this year. The company reported FY 14 and Q4 results on February 25th that missed the mark by a little. EPS came in at 51 cents versus the consensus of 55 cents. This was mostly due to the mild winter. In the release, CEO Scott Morris blamed the Q4 miss on the weather being warmer than last year and warmer than it typically is. Clearly, the weather is a factor for the company, but it can be seen from the slight miss that it does not effect earnings drastically. Going forward, the acquisition of Alaska ELP should be a near-term growth catalyst. The company only realized earnings from it for the second half of 2014, so it should be a nice boost already to 2015 results. Guidance has the segment contributing 8 to 12 cents to earnings this year. The company sees this segment as a opportune area of growth in the future, and I expect over the next few years, the results from this segment will improve greatly. The guidance the company has set for 2015 calls for EPS between $1.86 and $2.06. This is pretty broad, but the mid-point of $1.96 points to modest earnings growth of 1.55%. However, estimates from analysts have the company positing EPS of $1.98. A slow growth year is not a concern, as the long-term growth of earnings looks headed in the right direction. According to the company’s long-term plan, it seeing earnings and dividend growth of between 4-5% in the future. Finviz also estimates the 5-year long-term annual growth rate of earnings to be 5%. (Source: Avista Update ) Even with a fairly weak 2015, I would not be concerned in the slightest about dividend growth. Earnings over the next few years are still anticipated to grow nicely, and the dividend has plenty of room to grow with it. Another thing is that the shares look fairly attractive at these levels as well. The company is trading at just about 17 times earnings, which is a good bit lower than its peers. Excluding the outliers, the average among domestic diversified utilities is about 20 times earnings. Looking at this year, if Avista were to meet estimates, it will be trading at less than 17 times earnings. While it may not be grossly undervalued, compared with peers based on earnings the shares do appear a little undervalued. The shares are currently trading about 12% off their 52-week highs as well. In conclusion, I like Avista’s dividend a lot. It is somewhat of a less covered name, and it is important to note a good recent history of dividend increases. The company seems committed to this dividend growth, and the dividend should see about 4% annual growth over at least the next few years. Anyone looking for a safer high-yielding dividend growth play should definitely take Avista into consideration. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Always do your own research before investing. Scalper1 News

Currently, the shares sport a yield of 3.97%. For the last 13 years, the company has increased its dividend. Avista anticipates continuing to grow its dividend by 4-5% annually. My search for safe high-yield plays continues, and has brought me upon Avista Corp. (NYSE: AVA ). The diversified utilities player is in a solid spot right now, and boy, does its dividend look attractive. Avista’s operations consist of generation, transmission, and distribution of electricity in the Northwest US and Alaska. It’s common knowledge that utilities are a fairly stable sector, and this is one of the main things that drew me to Avista. A stable and safe industry is something I always look for in my search. The utilities sector, in particular, is my favorite place to search for good dividends, and with Avista, I believe I have found just that. AVA Dividend data by YCharts The company currently pays out a quarterly dividend of 33 cents a share. That gives the shares a yield of 3.97% at current levels. As can be seen from the chart above, Avista has seen 13 years of dividend growth, most recently raising it about 4% on February 6th. The payout ratio sits at about 68%, which, by my standards, is more than acceptable. Most of the time, I look for anything under 70%, and depending on the industry, up to 80% may be acceptable. 2014 was somewhat of a transitional year for the company. It sold off its indirect subsidiary Ecova, Inc. to Cofely USA for $335 million. On the other side of the spectrum, Avista closed a deal during the year to acquire Alaska Electric Light and Power Company. Both of these threw a twist on earnings for 2014. In total, the company actually reported earnings per share of $3.10 for the year. However, earnings for the year were actually $1.93 from continuing ops. The earnings from the continuing ops is what is important here, as that will be the comparison for this year. The company reported FY 14 and Q4 results on February 25th that missed the mark by a little. EPS came in at 51 cents versus the consensus of 55 cents. This was mostly due to the mild winter. In the release, CEO Scott Morris blamed the Q4 miss on the weather being warmer than last year and warmer than it typically is. Clearly, the weather is a factor for the company, but it can be seen from the slight miss that it does not effect earnings drastically. Going forward, the acquisition of Alaska ELP should be a near-term growth catalyst. The company only realized earnings from it for the second half of 2014, so it should be a nice boost already to 2015 results. Guidance has the segment contributing 8 to 12 cents to earnings this year. The company sees this segment as a opportune area of growth in the future, and I expect over the next few years, the results from this segment will improve greatly. The guidance the company has set for 2015 calls for EPS between $1.86 and $2.06. This is pretty broad, but the mid-point of $1.96 points to modest earnings growth of 1.55%. However, estimates from analysts have the company positing EPS of $1.98. A slow growth year is not a concern, as the long-term growth of earnings looks headed in the right direction. According to the company’s long-term plan, it seeing earnings and dividend growth of between 4-5% in the future. Finviz also estimates the 5-year long-term annual growth rate of earnings to be 5%. (Source: Avista Update ) Even with a fairly weak 2015, I would not be concerned in the slightest about dividend growth. Earnings over the next few years are still anticipated to grow nicely, and the dividend has plenty of room to grow with it. Another thing is that the shares look fairly attractive at these levels as well. The company is trading at just about 17 times earnings, which is a good bit lower than its peers. Excluding the outliers, the average among domestic diversified utilities is about 20 times earnings. Looking at this year, if Avista were to meet estimates, it will be trading at less than 17 times earnings. While it may not be grossly undervalued, compared with peers based on earnings the shares do appear a little undervalued. The shares are currently trading about 12% off their 52-week highs as well. In conclusion, I like Avista’s dividend a lot. It is somewhat of a less covered name, and it is important to note a good recent history of dividend increases. The company seems committed to this dividend growth, and the dividend should see about 4% annual growth over at least the next few years. Anyone looking for a safer high-yielding dividend growth play should definitely take Avista into consideration. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Always do your own research before investing. Scalper1 News

Scalper1 News