Scalper1 News

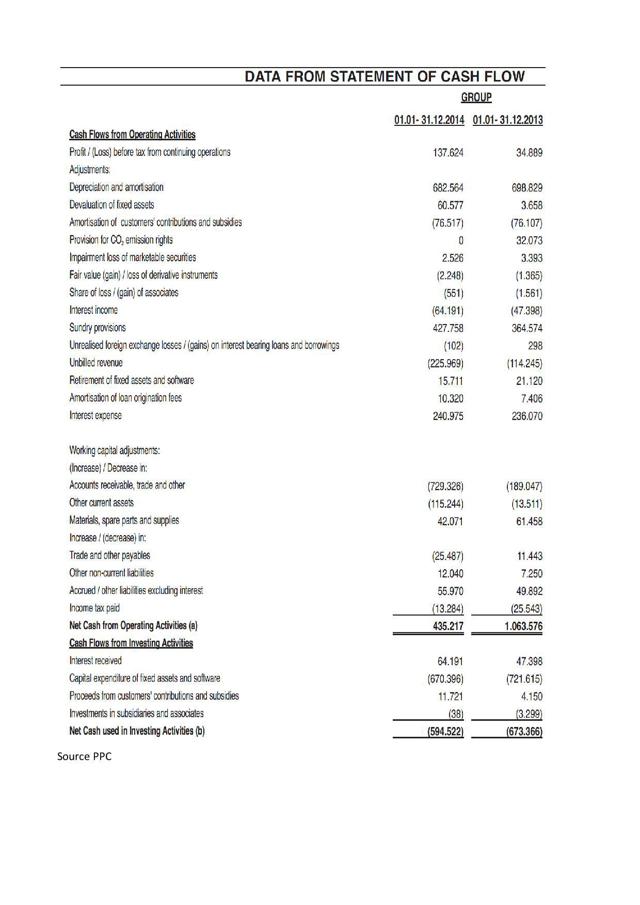

Greek stock market = adrenaline. There are some interesting value plays in this market. Nevertheless, Public Power Corporation does not look like one of them. Some investors have already decided it is time to bet on Greek stocks, some still hesitate, and for some it is unacceptable to even think about it. In one of my previous articles I have presented some thoughts on Greek telecommunication operator OTE. Today, I would like to continue by looking at Public Power Corporation of Greece ( OTC:PUPOF ), a Greek company engaged in the electricity generation, transmission and distribution; it owns lignite mines, conventional thermal and hydroelectric power plants. PPC trades with P/E (TTM) at 15.65. Czech power company CEZ trades with PE at 15.28, Spanish Iberdrola with PE at 17.59, Austrian Verbund at 38.8, Italian Enel at 86.0, German EON is in red and RWE has PE at 11.9. Comparing PPC with median valuation therefore indicates it does not trade with significant discount. Nevertheless, I would not draw strong conclusions from this type of comparison. I believe, it is more helpful to look at the cash flow of the Company: (click to enlarge) Operating cash flow decreased significantly in 2014. While the company earned EUR 1 billion in 2013, it generated only EUR 435 million in 2014. The reason is not a sharp decline in profitability, though. Operating cash flow declined mostly due to sharp increase in receivables, which mostly reflects deteriorating situation in the whole economy. PPC cut CapEx in 2014 but its cash flow after CapEx was still deeply in red. Needless to say, should this become a standard performance in the coming years, it is hard to find any value in the stock. What if the performance returned to a standard set in 2013? The company generated EUR 138 million after CapEx (and interest expenses). This is the cash flow that is available to principal payment and/or to shareholders. Let`s consider an optimistic scenario: This cash flow represents free cash flow to equity and the situation in the Greek economy soon returns back to stability. We can therefore apply risk free rate of 0,8 % (current yield of the German Bunds) and risk premium of only 5,5 % (see this for some discussion on market risk premiums). Based on the data from FT, PPC has quite high beta (1,55). In this scenario, the required rate of return (based on standard CAPM model) would reach 9,32 %. Now, let`s assume the free cash flow to equity will be constant – it will not grow in the future. The present value of this cash flow would then reach EUR 858 million. If the cash flow grew by 2 % annually, its present value would be EUR 1.09 billion. How do the presented estimates compare to the current market cap? Interesting enough, current market cap is at EUR 1.09 billion. My reading of this situation is that the market is extremely optimistic. Current market cap is hard to justify without assuming significant improvement in cash flow generation and a decline of the risk premium. There was some y-o-y improvement in the cash flow in Q1 2015 (and it was mostly due to working capital). But it is hard to extrapolate these results to the whole year. And a significant decrease of the market risk premium is currently only a finance fiction. OTE may be the last significantly undervalued stock in the world as far as its company-specific situation is concerned. I believe the same can hardly be said about PPC. Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Greek stock market = adrenaline. There are some interesting value plays in this market. Nevertheless, Public Power Corporation does not look like one of them. Some investors have already decided it is time to bet on Greek stocks, some still hesitate, and for some it is unacceptable to even think about it. In one of my previous articles I have presented some thoughts on Greek telecommunication operator OTE. Today, I would like to continue by looking at Public Power Corporation of Greece ( OTC:PUPOF ), a Greek company engaged in the electricity generation, transmission and distribution; it owns lignite mines, conventional thermal and hydroelectric power plants. PPC trades with P/E (TTM) at 15.65. Czech power company CEZ trades with PE at 15.28, Spanish Iberdrola with PE at 17.59, Austrian Verbund at 38.8, Italian Enel at 86.0, German EON is in red and RWE has PE at 11.9. Comparing PPC with median valuation therefore indicates it does not trade with significant discount. Nevertheless, I would not draw strong conclusions from this type of comparison. I believe, it is more helpful to look at the cash flow of the Company: (click to enlarge) Operating cash flow decreased significantly in 2014. While the company earned EUR 1 billion in 2013, it generated only EUR 435 million in 2014. The reason is not a sharp decline in profitability, though. Operating cash flow declined mostly due to sharp increase in receivables, which mostly reflects deteriorating situation in the whole economy. PPC cut CapEx in 2014 but its cash flow after CapEx was still deeply in red. Needless to say, should this become a standard performance in the coming years, it is hard to find any value in the stock. What if the performance returned to a standard set in 2013? The company generated EUR 138 million after CapEx (and interest expenses). This is the cash flow that is available to principal payment and/or to shareholders. Let`s consider an optimistic scenario: This cash flow represents free cash flow to equity and the situation in the Greek economy soon returns back to stability. We can therefore apply risk free rate of 0,8 % (current yield of the German Bunds) and risk premium of only 5,5 % (see this for some discussion on market risk premiums). Based on the data from FT, PPC has quite high beta (1,55). In this scenario, the required rate of return (based on standard CAPM model) would reach 9,32 %. Now, let`s assume the free cash flow to equity will be constant – it will not grow in the future. The present value of this cash flow would then reach EUR 858 million. If the cash flow grew by 2 % annually, its present value would be EUR 1.09 billion. How do the presented estimates compare to the current market cap? Interesting enough, current market cap is at EUR 1.09 billion. My reading of this situation is that the market is extremely optimistic. Current market cap is hard to justify without assuming significant improvement in cash flow generation and a decline of the risk premium. There was some y-o-y improvement in the cash flow in Q1 2015 (and it was mostly due to working capital). But it is hard to extrapolate these results to the whole year. And a significant decrease of the market risk premium is currently only a finance fiction. OTE may be the last significantly undervalued stock in the world as far as its company-specific situation is concerned. I believe the same can hardly be said about PPC. Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News