Scalper1 News

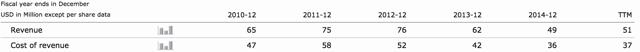

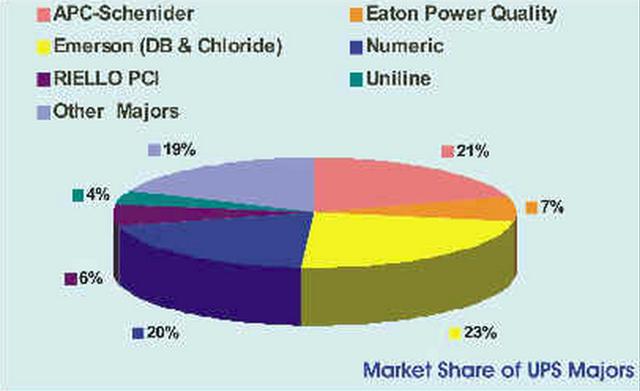

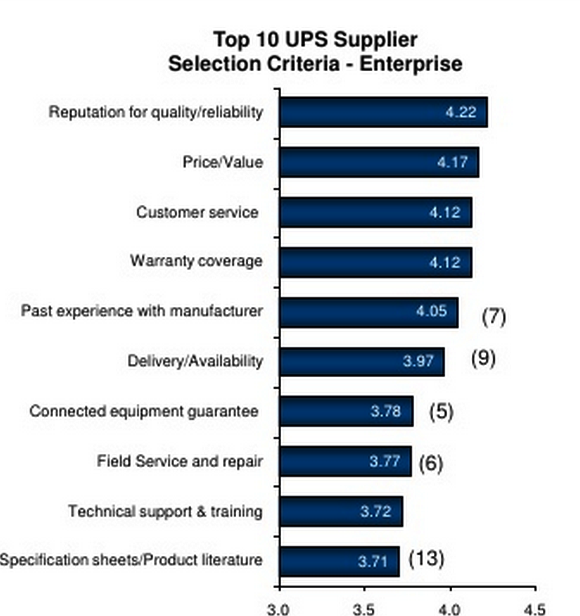

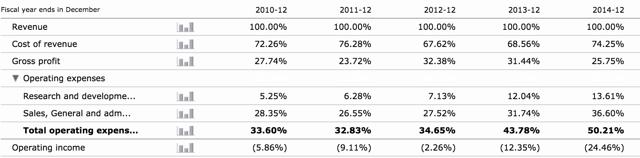

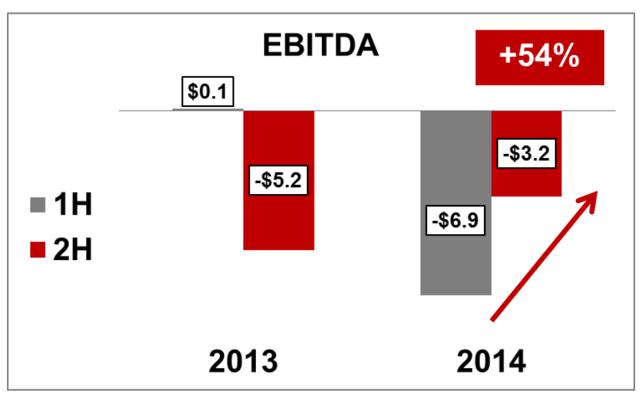

Summary Flywheel technology has been much hyped as the next big thing in the UPS space, although batteries have prevailed as the dominant solution. Wider market acceptance of flywheel technology would not necessarily result in upside, due too immense competition in a business where reliability and economics of scale are key. Significant loss of market share on a relative and absolute basis invalidates the bull thesis. Rapidly deteriorating financials in the most recent years suggests that their competitive situation has only become worse. 3x book value for a company that has never been profitable and has a declining top-line is just too much, a market cap at liquidation value is more appropriate. The first impression one gets from reading all the information on Active Power, Inc.(NASDAQ: ACPW )’ website is one of a business with a great product that is at the cusp of gaining market acceptance, as soon as these darn datacenter-architects would finally realize the benefits of flywheel-technology. They make a compelling case, where it not for the fact that: The technology is about 20 years old and market acceptance would surely have already taken place if the product really were superior. Rather than being a scrappy start-up, the company is a tiny player in a relatively mature industry, where long-term customer relations and scale are key. While touting their product’s perceived benefits they basically conceded that it’s not working out by offering the same product utilizing legacy technology Active Power Inc. builds so-called Uninterrupted Power Supplies (UPS). A UPS is an electrical apparatus that provides emergency power to a load when the main power source fails. A UPS differs from an auxiliary or emergency power system or standby generator in that it will provide near-instantaneous protection from input power interruptions, by supplying energy stored in batteries, supercapacitors, or flywheels. The on-battery runtime of most uninterruptible power sources is relatively short (only a few minutes) but sufficient to start a standby power source or properly shut down the protected equipment. In essence, they serve to bridge the time-gap between the occurrence of a power-outage and the start-up of a backup generator. It is a typical value-add business, with the overall addressable market estimated to be in the area of ~17B, with the sub segment of relatively large scale UPS with more than 150 kVA, the market that Active Power is targeting, around 4.6B. Most of these UPS’ utilize batteries to store energy. Active Power’s UPS’ on the other hand use flywheel technology. Instead of storing chemical energy, like batteries do, flywheels are brought to spin very fast, storing kinetic energy in the process, which can then be converted to electrical energy if need be. The bull thesis in essence, is that flywheel UPS’s While having larger upfront costs, have lower lifetime costs, as the maintenance intervals are larger; Are “greener” compared to batteries, as the latter end up being toxic waste; While runtime lies in the area of 10-15 seconds for flywheel UPS, compared to ~15 minutes for battery UPS, usually only a few seconds would be needed until the backup generator comes on-line. Combined these factors would make the market gradually shift to flywheel technology. Back in reality, the company, which has been in business for 15 years and never made a profit, saw a shrinking top line. (click to enlarge) Source: Morningstar In their 2010 10-K they state that their addressable market at the time was in the area of ~1.8B, compared to 4.6B in 2014. Using their revenue numbers in these years implies that their market share has actually dropped from around 3.6% in 2010 to 1% in 2014. This certainly doesn’t support the bull thesis, although market statistics on UPS are scarce, and it’s unclear how much of this is attributable to flywheel UPS gaining (or losing) traction or if the company plainly can’t compete. The UPS market is highly concentrated, with the bulk of the market share lying with Schneider-Electric (OTCPK: SBGSF ) and Emerson (NYSE: EMR ), both 40B market-cap behemoths. (click to enlarge) Source: VDC research The scrappy up-start picture isn’t supported by the fact that both of these companies massively invested in flywheel UPS themselves, With Schneider-Electric having bought APC, the until then US-market leader in the UPS market and Emerson’s acquisition of Liebert. Both of these subsidiaries offered extensive flywheel UPS products . Though Emerson at some point in the recent past opted to discontinue their flywheel product line, suggesting that the flywheel sub segment may be even more concentrated with Schneider Electric than the overall UPS market. Bottom line, these findings are still ambivalent as to whether the flywheel technology has gained traction in the market, but the significant reduction in market share AND absolute sales suggests a severe competitive disadvantage in a market that has more than doubled in the past four years. If one chooses to buy one of these, one wants to be really sure it will work. The lifetime of UPS are in the area of 15-20 years, and incur significant recurring service costs and warranty coverage. The slightly lower life time costs of flywheel UPS compared to UPS cost is simply a negligible criteria for customers compared to the vendors ability and reputation to service their products regularly and guarantee warranty coverage. Source: VDC research In the case of Active Power, there is substantial uncertainty as to whether the company will even be around in 10 years time, which greatly reduces their value proposition vs their peers. Bigger is simply better in this market. Financials As stated before, the company has never made a profit during it’s lifetime. In the most recent years it has additionally seen rapidly deteriorating operating margins as seen below: (click to enlarge) Source: Morningstar Yet they publish slides like this titles “gaining momentum”: (click to enlarge) witness the momentum To stay afloat, they regularly dilute their share count every 2 years: (click to enlarge) Source: Morningstar In spite of rapidly deteriorating financials, massive loss of market share on a relative and absolute basis in a market that has seen huge growth and severe competitive disadvantages versus their large peers that offer a substantially better value proposition, the company still trades at 3x book value, with a market cap of around $50M. My best guess as to why this is the case, is that they make a good case to the investing world of their superior product and tell a good story of how the break-out is right around the corner. The facts however tell the opposite story. Most of their assets are in the form of current assets, which makes their book value a decent proxy for liquidation value, a more appropriate yardstick of what this company should be trading for, implying 60% downside. I’ve used several sources throughout this analysis, most notably the 10-K’s of Active Power Inc, Schneider Electric and Emerson, as well as some research papers on the flywheel vs battery UPS debate from Mitsubishi , Schneider , datacenter dynamics and VDC research . Financial data was taken from Morningstar. Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Flywheel technology has been much hyped as the next big thing in the UPS space, although batteries have prevailed as the dominant solution. Wider market acceptance of flywheel technology would not necessarily result in upside, due too immense competition in a business where reliability and economics of scale are key. Significant loss of market share on a relative and absolute basis invalidates the bull thesis. Rapidly deteriorating financials in the most recent years suggests that their competitive situation has only become worse. 3x book value for a company that has never been profitable and has a declining top-line is just too much, a market cap at liquidation value is more appropriate. The first impression one gets from reading all the information on Active Power, Inc.(NASDAQ: ACPW )’ website is one of a business with a great product that is at the cusp of gaining market acceptance, as soon as these darn datacenter-architects would finally realize the benefits of flywheel-technology. They make a compelling case, where it not for the fact that: The technology is about 20 years old and market acceptance would surely have already taken place if the product really were superior. Rather than being a scrappy start-up, the company is a tiny player in a relatively mature industry, where long-term customer relations and scale are key. While touting their product’s perceived benefits they basically conceded that it’s not working out by offering the same product utilizing legacy technology Active Power Inc. builds so-called Uninterrupted Power Supplies (UPS). A UPS is an electrical apparatus that provides emergency power to a load when the main power source fails. A UPS differs from an auxiliary or emergency power system or standby generator in that it will provide near-instantaneous protection from input power interruptions, by supplying energy stored in batteries, supercapacitors, or flywheels. The on-battery runtime of most uninterruptible power sources is relatively short (only a few minutes) but sufficient to start a standby power source or properly shut down the protected equipment. In essence, they serve to bridge the time-gap between the occurrence of a power-outage and the start-up of a backup generator. It is a typical value-add business, with the overall addressable market estimated to be in the area of ~17B, with the sub segment of relatively large scale UPS with more than 150 kVA, the market that Active Power is targeting, around 4.6B. Most of these UPS’ utilize batteries to store energy. Active Power’s UPS’ on the other hand use flywheel technology. Instead of storing chemical energy, like batteries do, flywheels are brought to spin very fast, storing kinetic energy in the process, which can then be converted to electrical energy if need be. The bull thesis in essence, is that flywheel UPS’s While having larger upfront costs, have lower lifetime costs, as the maintenance intervals are larger; Are “greener” compared to batteries, as the latter end up being toxic waste; While runtime lies in the area of 10-15 seconds for flywheel UPS, compared to ~15 minutes for battery UPS, usually only a few seconds would be needed until the backup generator comes on-line. Combined these factors would make the market gradually shift to flywheel technology. Back in reality, the company, which has been in business for 15 years and never made a profit, saw a shrinking top line. (click to enlarge) Source: Morningstar In their 2010 10-K they state that their addressable market at the time was in the area of ~1.8B, compared to 4.6B in 2014. Using their revenue numbers in these years implies that their market share has actually dropped from around 3.6% in 2010 to 1% in 2014. This certainly doesn’t support the bull thesis, although market statistics on UPS are scarce, and it’s unclear how much of this is attributable to flywheel UPS gaining (or losing) traction or if the company plainly can’t compete. The UPS market is highly concentrated, with the bulk of the market share lying with Schneider-Electric (OTCPK: SBGSF ) and Emerson (NYSE: EMR ), both 40B market-cap behemoths. (click to enlarge) Source: VDC research The scrappy up-start picture isn’t supported by the fact that both of these companies massively invested in flywheel UPS themselves, With Schneider-Electric having bought APC, the until then US-market leader in the UPS market and Emerson’s acquisition of Liebert. Both of these subsidiaries offered extensive flywheel UPS products . Though Emerson at some point in the recent past opted to discontinue their flywheel product line, suggesting that the flywheel sub segment may be even more concentrated with Schneider Electric than the overall UPS market. Bottom line, these findings are still ambivalent as to whether the flywheel technology has gained traction in the market, but the significant reduction in market share AND absolute sales suggests a severe competitive disadvantage in a market that has more than doubled in the past four years. If one chooses to buy one of these, one wants to be really sure it will work. The lifetime of UPS are in the area of 15-20 years, and incur significant recurring service costs and warranty coverage. The slightly lower life time costs of flywheel UPS compared to UPS cost is simply a negligible criteria for customers compared to the vendors ability and reputation to service their products regularly and guarantee warranty coverage. Source: VDC research In the case of Active Power, there is substantial uncertainty as to whether the company will even be around in 10 years time, which greatly reduces their value proposition vs their peers. Bigger is simply better in this market. Financials As stated before, the company has never made a profit during it’s lifetime. In the most recent years it has additionally seen rapidly deteriorating operating margins as seen below: (click to enlarge) Source: Morningstar Yet they publish slides like this titles “gaining momentum”: (click to enlarge) witness the momentum To stay afloat, they regularly dilute their share count every 2 years: (click to enlarge) Source: Morningstar In spite of rapidly deteriorating financials, massive loss of market share on a relative and absolute basis in a market that has seen huge growth and severe competitive disadvantages versus their large peers that offer a substantially better value proposition, the company still trades at 3x book value, with a market cap of around $50M. My best guess as to why this is the case, is that they make a good case to the investing world of their superior product and tell a good story of how the break-out is right around the corner. The facts however tell the opposite story. Most of their assets are in the form of current assets, which makes their book value a decent proxy for liquidation value, a more appropriate yardstick of what this company should be trading for, implying 60% downside. I’ve used several sources throughout this analysis, most notably the 10-K’s of Active Power Inc, Schneider Electric and Emerson, as well as some research papers on the flywheel vs battery UPS debate from Mitsubishi , Schneider , datacenter dynamics and VDC research . Financial data was taken from Morningstar. Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News