Scalper1 News

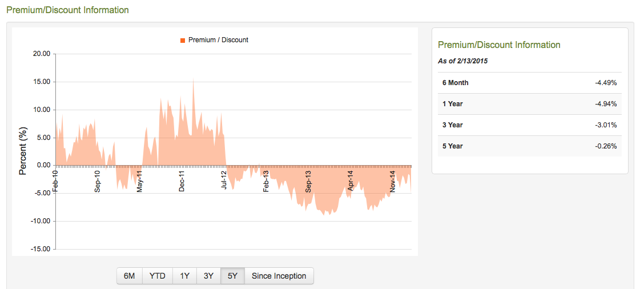

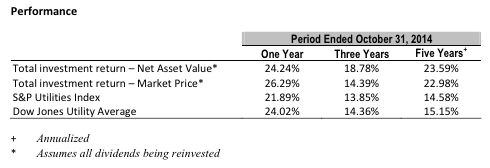

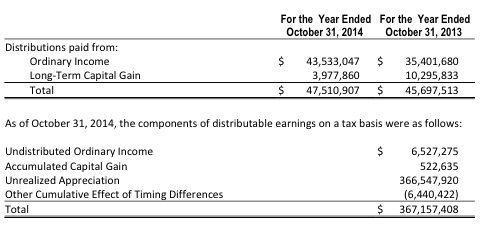

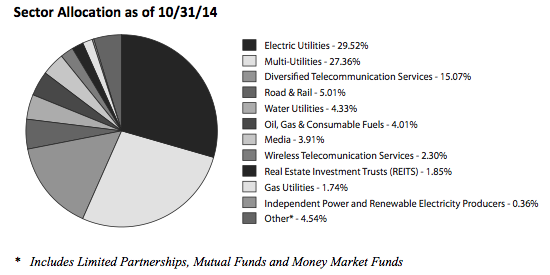

In a world of low-cost indexed ETFs, actively managed closed-end funds are largely unknown to most retail investors. Reaves Utility Income Fund offers an attractive proposition for those seeing to buy-and-hold over the long term. In this article, I present my top ten reasons to consider UTG for your income or DGI portfolio. Reaves Utility Income Fund (NYSEMKT: UTG ) is an actively managed closed-end fund that invests in utilities. The fund currently sports a hefty baseline expense ratio of 1.16%. Study after statistically-based study has shown that active funds with high expense ratios should be avoided ( Vanguard on indexing , Vanguard on expenses , ZeroHedge ). So why in the world would I be recommending that enterprising investors seeking income consider a long-term investment in UTG? I’ll give you ten reasons! Reason One: UTG’s yield is nearly triple the 10-Year Treasury’s. As of 2/17/2015, UTG yields 5.87% while the 10-year treasury yields 2.02%. The rate is also 250 basis points above the Utilities Select Sector SPDR ETF (NYSEARCA: XLU ) yield of 3.34%. The global demand for secure income has bid up the price of nearly every defensive asset class, whether it be bonds, income equities, or alternative assets. Not too many set-it-and-forget-it holdings can offer UTG’s level of income. Reason Two: UTG is abnormally cheap. Closed-end funds trade based on supply and demand. As such, the Market Price of a closed-end fund is always either at a premium or at a discount to Net Asset Value. The fund’s premium/discount as of 2/17/2015 closing is -5.24%. The first benefit of such a discount is an enhanced yield. At par, UTG yields 29 basis points less. The second and more exciting benefit is an improved risk-reward prospect. UTG’s discount is currently more attractive than its 6-month, 1-year, 3-year, and 5-year average discounts. On 2/4/2015, UTG closed at a premium/discount of -1.15%, indicating recent selling beyond Net Asset Value may have been overdone. One might expect premium/discount to trend back towards its historical averages, making you money in the process. (click to enlarge) (Source: CEF Connect UTG Pricing Information ) Reason Three: UTG has a track record of outperformance. Assuming reinvested dividends, on both a Net Asset Value or a Market Price basis… On a one-year, three-year, or five-year time frame… Compared to the S&P Utilities Index or the Dow Jones Utility Average… UTG wins. (Source: UTG’s 2014 Annual Report , dated 10/31/2014) Reason Four: UTG pays dividends every month. That means UTG compounds more quickly than a quarterly or annual dividend payer. When you account for monthly compounding, UTG’s current 5.87% yield is actually above 6% annualized . Over a generation, this sliver of added value can mean serious money. Reason Five: UTG utilizes healthy heaping of leverage. A closed-end fund’s asset base is fixed. Price is based on supply and demand rather than on fund inflows and outflows. Investors can’t panic sell and force the fund to sell holdings. Banks use this secure asset base as collateral to issue debt to UTG, creating leverage. UTG employs a fixed amount of leverage that is irrespective of its Net Asset Value growth. As the fund’s NAV has increased yearly, the percent leverage has decreased. According to CEF Connect , 23.4% of UTG’s NAV is leverage. When I say healthy , there are basically two negatives of leverage. First, leverage increases volatility compared to a similar unlevered investment. Secondly, leverage costs money, since the underwriting bank needs to make a profit. In my humble opinion, I avoid leverage over 33% or an interest expense over 1%. Reason Six: UTG’s distribution is safe. UTG’s dividends are primarily sourced from ordinary income. In 2014, ordinary income made up 90% of UTG’s dividend payments. To account for the remainder, UTG taps into capital gains. (UTG, like many closed-end funds, has a special exception to Section 19(b)(1) of the Securities Exchange Act of 1934 allowing distributions to be paid from capital gains.) Please kindly note the size of the Unrealized Appreciation account in the figure below: $366 million. Compare that with the $47 million that UTG paid in 2014 dividends. UTG could fund distributions for years with just unrealized gains, although I’d probably be long gone if they tried pulling that stunt. Compare this to other closed-end funds with 30% or more sourced from the dreaded Return of Capital and with continually-eroding Net Asset Values. (Source: UTG’s 2014 Annual Report , dated 10/31/2014) Reason Seven: UTG’s distribution is likely to grow. The fund has a strong track record of dividend increases. In the fund’s eleven-year history, UTG has increased its regular monthly dividend eight times. The most recent increase of 10% occurred in December 2014, which followed a 4.8% increase the year prior. Many of UTG’s holdings are habitually growing their dividends, which bodes well for the fund’s long-term prospects. Reason Eight: UTG diversifies the definition of utilities. UTG buys utility-like assets with high barriers to entry across a multitude of industries: renewable energy, oil pipelines, energy infrastructure, railroads, water, and real estate. But what really got me was their willingness to include the likes of Vodafone (NASDAQ: VOD ), Time Warner Cable (NYSE: TWC ), American Tower (NYSE: AMT ), and Annaly Capital (NYSE: NLY ). (Source: UTG’s 2014 Annual Report , dated 10/31/2014) Reason Nine: UTG’s management believes in long-term investing. The annual portfolio turnover ratio over the last five years has been 26%, 30%, 27%, 34%, and 53%. This level of commitment of the fund to its holdings is a strong signal of confidence, and allows the company to focus on of five- and ten-year trends rather than on quarterly noise. (Source: UTG’s 2014 Annual Report , dated 10/31/2014) Reason Ten: UTG is naturally hedged to currency risk. According to its 2014 report, 88% of its assets are invested in the U.S. By keeping a large majority of its assets and liabilities denominated in U.S. dollars, UTG can avoid variable earnings and costly hedging strategies. UTG won’t miss a dividend payment due to a swing in the Swiss franc or Russian ruble. Bonus Reason Eleven: UTG has been vetted by smart money. Bill Gross recommended UTG in the 2010 , 2012 , and 2014 Barron’s Roundtables. Guggenheim Investments holds UTG as a core position in its Infrastructure & MLP CEF Mutual Fund . Finally, Morgan Stanley, Bank of America, and Wells Fargo collectively own 871,000 shares of UTG, or roughly 3% of the float. Conclusion: Enterprising retail investors seeking consistent income should strongly consider Reaves Utility Income Fund. UTG has posted impressive total return numbers over the long haul. And for what it lacks by being a boring utility fund, UTG makes up for it with a fat monthly dividend that will make you smile. Disclosure: The author is long UTG. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: All figures in this article may contain calculation, typo, and other errors. Also, everybody has a unique investment style: different people panic sell at different losses and experience the pleasure of gains differently. Please take responsibility for your investments and perform your own necessary due diligence. Or just buy the S&P and sleep easy. Scalper1 News

In a world of low-cost indexed ETFs, actively managed closed-end funds are largely unknown to most retail investors. Reaves Utility Income Fund offers an attractive proposition for those seeing to buy-and-hold over the long term. In this article, I present my top ten reasons to consider UTG for your income or DGI portfolio. Reaves Utility Income Fund (NYSEMKT: UTG ) is an actively managed closed-end fund that invests in utilities. The fund currently sports a hefty baseline expense ratio of 1.16%. Study after statistically-based study has shown that active funds with high expense ratios should be avoided ( Vanguard on indexing , Vanguard on expenses , ZeroHedge ). So why in the world would I be recommending that enterprising investors seeking income consider a long-term investment in UTG? I’ll give you ten reasons! Reason One: UTG’s yield is nearly triple the 10-Year Treasury’s. As of 2/17/2015, UTG yields 5.87% while the 10-year treasury yields 2.02%. The rate is also 250 basis points above the Utilities Select Sector SPDR ETF (NYSEARCA: XLU ) yield of 3.34%. The global demand for secure income has bid up the price of nearly every defensive asset class, whether it be bonds, income equities, or alternative assets. Not too many set-it-and-forget-it holdings can offer UTG’s level of income. Reason Two: UTG is abnormally cheap. Closed-end funds trade based on supply and demand. As such, the Market Price of a closed-end fund is always either at a premium or at a discount to Net Asset Value. The fund’s premium/discount as of 2/17/2015 closing is -5.24%. The first benefit of such a discount is an enhanced yield. At par, UTG yields 29 basis points less. The second and more exciting benefit is an improved risk-reward prospect. UTG’s discount is currently more attractive than its 6-month, 1-year, 3-year, and 5-year average discounts. On 2/4/2015, UTG closed at a premium/discount of -1.15%, indicating recent selling beyond Net Asset Value may have been overdone. One might expect premium/discount to trend back towards its historical averages, making you money in the process. (click to enlarge) (Source: CEF Connect UTG Pricing Information ) Reason Three: UTG has a track record of outperformance. Assuming reinvested dividends, on both a Net Asset Value or a Market Price basis… On a one-year, three-year, or five-year time frame… Compared to the S&P Utilities Index or the Dow Jones Utility Average… UTG wins. (Source: UTG’s 2014 Annual Report , dated 10/31/2014) Reason Four: UTG pays dividends every month. That means UTG compounds more quickly than a quarterly or annual dividend payer. When you account for monthly compounding, UTG’s current 5.87% yield is actually above 6% annualized . Over a generation, this sliver of added value can mean serious money. Reason Five: UTG utilizes healthy heaping of leverage. A closed-end fund’s asset base is fixed. Price is based on supply and demand rather than on fund inflows and outflows. Investors can’t panic sell and force the fund to sell holdings. Banks use this secure asset base as collateral to issue debt to UTG, creating leverage. UTG employs a fixed amount of leverage that is irrespective of its Net Asset Value growth. As the fund’s NAV has increased yearly, the percent leverage has decreased. According to CEF Connect , 23.4% of UTG’s NAV is leverage. When I say healthy , there are basically two negatives of leverage. First, leverage increases volatility compared to a similar unlevered investment. Secondly, leverage costs money, since the underwriting bank needs to make a profit. In my humble opinion, I avoid leverage over 33% or an interest expense over 1%. Reason Six: UTG’s distribution is safe. UTG’s dividends are primarily sourced from ordinary income. In 2014, ordinary income made up 90% of UTG’s dividend payments. To account for the remainder, UTG taps into capital gains. (UTG, like many closed-end funds, has a special exception to Section 19(b)(1) of the Securities Exchange Act of 1934 allowing distributions to be paid from capital gains.) Please kindly note the size of the Unrealized Appreciation account in the figure below: $366 million. Compare that with the $47 million that UTG paid in 2014 dividends. UTG could fund distributions for years with just unrealized gains, although I’d probably be long gone if they tried pulling that stunt. Compare this to other closed-end funds with 30% or more sourced from the dreaded Return of Capital and with continually-eroding Net Asset Values. (Source: UTG’s 2014 Annual Report , dated 10/31/2014) Reason Seven: UTG’s distribution is likely to grow. The fund has a strong track record of dividend increases. In the fund’s eleven-year history, UTG has increased its regular monthly dividend eight times. The most recent increase of 10% occurred in December 2014, which followed a 4.8% increase the year prior. Many of UTG’s holdings are habitually growing their dividends, which bodes well for the fund’s long-term prospects. Reason Eight: UTG diversifies the definition of utilities. UTG buys utility-like assets with high barriers to entry across a multitude of industries: renewable energy, oil pipelines, energy infrastructure, railroads, water, and real estate. But what really got me was their willingness to include the likes of Vodafone (NASDAQ: VOD ), Time Warner Cable (NYSE: TWC ), American Tower (NYSE: AMT ), and Annaly Capital (NYSE: NLY ). (Source: UTG’s 2014 Annual Report , dated 10/31/2014) Reason Nine: UTG’s management believes in long-term investing. The annual portfolio turnover ratio over the last five years has been 26%, 30%, 27%, 34%, and 53%. This level of commitment of the fund to its holdings is a strong signal of confidence, and allows the company to focus on of five- and ten-year trends rather than on quarterly noise. (Source: UTG’s 2014 Annual Report , dated 10/31/2014) Reason Ten: UTG is naturally hedged to currency risk. According to its 2014 report, 88% of its assets are invested in the U.S. By keeping a large majority of its assets and liabilities denominated in U.S. dollars, UTG can avoid variable earnings and costly hedging strategies. UTG won’t miss a dividend payment due to a swing in the Swiss franc or Russian ruble. Bonus Reason Eleven: UTG has been vetted by smart money. Bill Gross recommended UTG in the 2010 , 2012 , and 2014 Barron’s Roundtables. Guggenheim Investments holds UTG as a core position in its Infrastructure & MLP CEF Mutual Fund . Finally, Morgan Stanley, Bank of America, and Wells Fargo collectively own 871,000 shares of UTG, or roughly 3% of the float. Conclusion: Enterprising retail investors seeking consistent income should strongly consider Reaves Utility Income Fund. UTG has posted impressive total return numbers over the long haul. And for what it lacks by being a boring utility fund, UTG makes up for it with a fat monthly dividend that will make you smile. Disclosure: The author is long UTG. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: All figures in this article may contain calculation, typo, and other errors. Also, everybody has a unique investment style: different people panic sell at different losses and experience the pleasure of gains differently. Please take responsibility for your investments and perform your own necessary due diligence. Or just buy the S&P and sleep easy. Scalper1 News

Scalper1 News