Scalper1 News

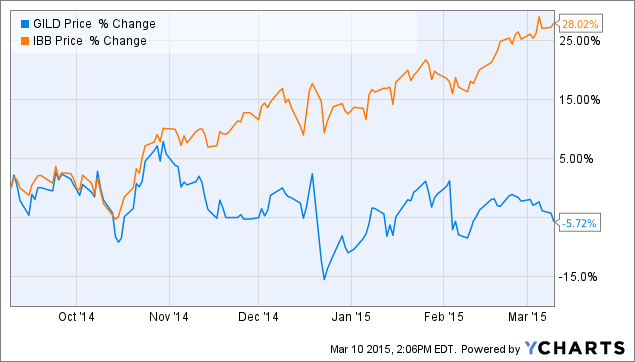

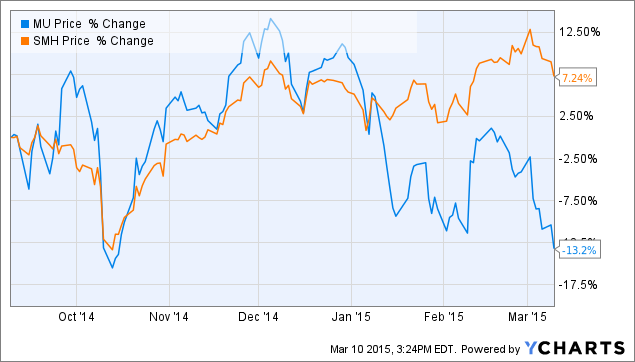

Summary As Warren Buffett opines, in the short run, the market is a voting machine, and in the long run, it is a weighing machine. The analyst community and many investors who follow it are so often late to the party regarding a popular stock, and so are doomed to long-term underperformance. Wall Street is not a friend of the individual investor. Early-stage investors and insiders use aggressive Wall Street buy ratings to offload positions bought at an earlier stage. The best way to outperform – focus less on the popular theme and more on the next sector rotation in the market. One-decision stocks. A new paradigm. Unlimited growth potential. Valuation doesn’t matter. This time (story, stock, product) it’s different. There isn’t any risk because _________________. These are all phrases to separate the individual investor from his or her money, much more often than not. So often, Wall Street research and ratings analysts are part of a sophisticated marketing machine that willingly, or unwillingly, promote its most popular stocks. Put another way, in the timeline of a winning stock, it is so often only after a long period of price appreciation, supported by improving fundamentals or an exciting story, that Wall Street research fully embraces the story and responds with ever-increasing price targets, unanimity of buy ratings, and aggressive bullish commentary. To be fair, fund managers that are now over-allocated to these stocks demand positive research to justify their posture. Peer and client pressure demands an over-allocation to the best-publicized stories on Wall Street and will with future IPOs like Snapchat and Uber. Non-investment is not an option in such stories. It is my hypothesis that this period, when a particular investment is considered as having the most certain outcome and margin of safety, that it has potentially the least of either. This is the most dangerous moment for the individual investor, as the increasing coverage and bullish targets lead those hunting for ideas to risk their money just as insiders and early investors are using the excitement and liquidity to exit or reduce exposure. Obviously, this does not apply to all stocks, but on a great majority of cases covering an investment period of intermediate and shorter, I would submit this tendency hurts long-term returns for the investor. I would further submit this has been most recently happening in the US tech sector, which has received a flood of positive excitement since last fall while experiencing simultaneous heavy insider selling. Does this mean I am claiming the NASDAQ bull market to be “over”? Not at all – but we are discussing where to sector allocate scarce resources – and I would consider more “out of favor” sectors first. Let’s examine some case studies to test this hypothesis, then I’ll discuss how the individual investor can improve long-term performance by following the analogy of former hockey superstar Wayne Gretzky and attempt as investors to “skate to where the puck is, and not where it’s been” – to ignore the most popular theme and story of the day – and search for the quiet new story being told. Gretzky, who I grew up with watching as a young Edmonton Oilers star, was always not only above every other ordinary NHLer, but he was also above every other superstar as well. Not only was he dominant on the ice, but he also made his linemates dominant too – he raised the level of their game so much. Yet, compared to others, he never seemed to skate especially hard, never got hit, and wasn’t especially big or strong. Gretzky seemed to have a rare ability to read the whole game from ice level, to understand what would happen next, who would do what, and where the puck would be. And magically, there he was to feed a perfect pass right on Jari Kurri’s stick for yet another goal. He never chased the puck. Yet, this is what the majority of investors do. They are so often like my beloved Toronto Maple Leafs, running around in their own zone, without an overall plan, futilely chasing the puck, before it wound up being deposited in their own net. Did they work hard as investors work very hard? Absolutely. Hear me out and this will make some sense. Case Study: Gilead Sciences (NASDAQ: GILD ) GILD data by YCharts GILD is an industry-leading biotech company with an amazing new drug Sovaldi. Sales, margins, profits and its future are off the charts. Gilead is one of several “must haves” for any US equity growth fund and numerous hedge funds. Yet, in spite of almost universal analyst praise and its peer ETF, the iShares Nasdaq Biotechnology ETF (NASDAQ: IBB ) scorching to ATHs, GILD has stalled in the $100 area, for many months, underperforming IBB by 30 percentage points (6-month chart). Look at the news flow around its late October high (Note I am a huge Bret Jensen fan – this is a sentiment case study). Surprised: Look at GILD’s analyst ratings . The thesis here is by the time a story is this well known to every analyst on the Street, well covered by the media, and popular for both hedge funds and individual investors, much of the near-term “easy money” has been made already by insiders and institutions early to the party. Am then I “bearish” on GILD or other popular stocks? No; the story, as Bret Jensen has outlined, is valid. However, when sentiment, ownership and analyst ratings are so heavily on one side, the intermediate-term risk may shift as shown to a long, flat to lower scenario. In other words, with every possible positive – and there are many to the story – what catalysts are left in the intermediate term? Let’s run briefly through a few more: Micron Tech. (NASDAQ: MU ) A very popular fund holding, MU is a dominant player in the semiconductor space, and a bull market leader for both the Market Vectors Semiconductor ETF (NYSEARCA: SMH ) and the NASDAQ as a whole. Here is a post typical of the sentiment around its December highs when MU received several analyst upgrades: MU data by YCharts Yet, in the last 6 months, MU is dramatically underperforming both the NASDAQ and the semiconductor space. I would again submit it’s due to its overwhelming popularity – and universal positive outlook from the analyst community – there is simply less room for Micron to blow past ever- heightened expectations . Important note: This is not an article debating the fundamentally strong story of GILD, MU, or even a possible very bright future for Tesla (NASDAQ: TSLA ). It is a discussion on the risk vs. return likely, as an investment for the individual investor, after an extended run-up and associated universally-positive coverage. It is possible; after an extended period of digestion and reduction in popularity/focus, both GILD and MU may become interesting investments once again. Conversely, several analyst downgrades would be constructive in this regard. I do note the substantial insider sales in both GILD and MU in the last 6 months, at about 20% of totals held. One of the most extreme examples is also a name I am short, Tesla Motors. Where my personal longer-term view, assuming neutral market inputs, for GILD and MU is they are (currently) in “no man’s land” – neither short opportunities nor compelling buys – I am outright bearish on TSLA’s current valuation. TSLA data by YCharts Tesla has been acclaimed as more than a pioneer electric car company. It has been heralded as a company that will change transportation preferences of the whole world and even how Americans access their power. Truly, Elon Musk is, as described, IMO – a visionary, a pioneer and a genius. The problem is, far more than GILD or MU, the expectation levels for this company are off the charts (and they have come down lately). For those who got in early, Tesla, MU and GILD have been fantastic investments. The thesis is, once each company’s attributes have been well telegraphed to the marketplace, much (or all) of the intermediate-term upside may be complete – and risk is now proportionally higher. For at the end of the day, we do not invest in companies, products, or sectors, we are making judgments on risk. Case Study – eBay (NASDAQ: EBAY ) eBay doesn’t dominate the most popular holdings list, doesn’t garner hundreds of comments on SA or other sites, and frankly it’s a little bit boring in comparison. Its ratings from analysts are decidedly more split , too. Yet, very quietly, without a word on CNBC, eBay is testing a 2-year horizontal range, notwithstanding the corrective market activity, and making a serious effort to break out to all-time highs (5-year chart shown for clarity). In sharp contrast to MU and GILD, I note the complete absence of insider selling at EBAY . EBAY data by YCharts And finally, from an area that is not only ignored, but also is overtly feared and loathed – emerging markets. Take a look at this chart of the iShares MSCI Philippines ETF (NYSEARCA: EPHE ) (Disclosure – Long EPHE); one would think this is a biotech – not an emerging market. Not only has this country ETF shaken off persistent emerging market weakness, it has broken out and is within about a point of all-time highs. EPHE data by YCharts In conclusion readers, this missive is a simple illustration – what is the best, exciting and popular “story” in the market – that may not be the best “investment”. Best wishes and skate towards that moving puck! Disclosure: The author is long EPHE. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Consult your advisor. Author is short TSLA. Scalper1 News

Summary As Warren Buffett opines, in the short run, the market is a voting machine, and in the long run, it is a weighing machine. The analyst community and many investors who follow it are so often late to the party regarding a popular stock, and so are doomed to long-term underperformance. Wall Street is not a friend of the individual investor. Early-stage investors and insiders use aggressive Wall Street buy ratings to offload positions bought at an earlier stage. The best way to outperform – focus less on the popular theme and more on the next sector rotation in the market. One-decision stocks. A new paradigm. Unlimited growth potential. Valuation doesn’t matter. This time (story, stock, product) it’s different. There isn’t any risk because _________________. These are all phrases to separate the individual investor from his or her money, much more often than not. So often, Wall Street research and ratings analysts are part of a sophisticated marketing machine that willingly, or unwillingly, promote its most popular stocks. Put another way, in the timeline of a winning stock, it is so often only after a long period of price appreciation, supported by improving fundamentals or an exciting story, that Wall Street research fully embraces the story and responds with ever-increasing price targets, unanimity of buy ratings, and aggressive bullish commentary. To be fair, fund managers that are now over-allocated to these stocks demand positive research to justify their posture. Peer and client pressure demands an over-allocation to the best-publicized stories on Wall Street and will with future IPOs like Snapchat and Uber. Non-investment is not an option in such stories. It is my hypothesis that this period, when a particular investment is considered as having the most certain outcome and margin of safety, that it has potentially the least of either. This is the most dangerous moment for the individual investor, as the increasing coverage and bullish targets lead those hunting for ideas to risk their money just as insiders and early investors are using the excitement and liquidity to exit or reduce exposure. Obviously, this does not apply to all stocks, but on a great majority of cases covering an investment period of intermediate and shorter, I would submit this tendency hurts long-term returns for the investor. I would further submit this has been most recently happening in the US tech sector, which has received a flood of positive excitement since last fall while experiencing simultaneous heavy insider selling. Does this mean I am claiming the NASDAQ bull market to be “over”? Not at all – but we are discussing where to sector allocate scarce resources – and I would consider more “out of favor” sectors first. Let’s examine some case studies to test this hypothesis, then I’ll discuss how the individual investor can improve long-term performance by following the analogy of former hockey superstar Wayne Gretzky and attempt as investors to “skate to where the puck is, and not where it’s been” – to ignore the most popular theme and story of the day – and search for the quiet new story being told. Gretzky, who I grew up with watching as a young Edmonton Oilers star, was always not only above every other ordinary NHLer, but he was also above every other superstar as well. Not only was he dominant on the ice, but he also made his linemates dominant too – he raised the level of their game so much. Yet, compared to others, he never seemed to skate especially hard, never got hit, and wasn’t especially big or strong. Gretzky seemed to have a rare ability to read the whole game from ice level, to understand what would happen next, who would do what, and where the puck would be. And magically, there he was to feed a perfect pass right on Jari Kurri’s stick for yet another goal. He never chased the puck. Yet, this is what the majority of investors do. They are so often like my beloved Toronto Maple Leafs, running around in their own zone, without an overall plan, futilely chasing the puck, before it wound up being deposited in their own net. Did they work hard as investors work very hard? Absolutely. Hear me out and this will make some sense. Case Study: Gilead Sciences (NASDAQ: GILD ) GILD data by YCharts GILD is an industry-leading biotech company with an amazing new drug Sovaldi. Sales, margins, profits and its future are off the charts. Gilead is one of several “must haves” for any US equity growth fund and numerous hedge funds. Yet, in spite of almost universal analyst praise and its peer ETF, the iShares Nasdaq Biotechnology ETF (NASDAQ: IBB ) scorching to ATHs, GILD has stalled in the $100 area, for many months, underperforming IBB by 30 percentage points (6-month chart). Look at the news flow around its late October high (Note I am a huge Bret Jensen fan – this is a sentiment case study). Surprised: Look at GILD’s analyst ratings . The thesis here is by the time a story is this well known to every analyst on the Street, well covered by the media, and popular for both hedge funds and individual investors, much of the near-term “easy money” has been made already by insiders and institutions early to the party. Am then I “bearish” on GILD or other popular stocks? No; the story, as Bret Jensen has outlined, is valid. However, when sentiment, ownership and analyst ratings are so heavily on one side, the intermediate-term risk may shift as shown to a long, flat to lower scenario. In other words, with every possible positive – and there are many to the story – what catalysts are left in the intermediate term? Let’s run briefly through a few more: Micron Tech. (NASDAQ: MU ) A very popular fund holding, MU is a dominant player in the semiconductor space, and a bull market leader for both the Market Vectors Semiconductor ETF (NYSEARCA: SMH ) and the NASDAQ as a whole. Here is a post typical of the sentiment around its December highs when MU received several analyst upgrades: MU data by YCharts Yet, in the last 6 months, MU is dramatically underperforming both the NASDAQ and the semiconductor space. I would again submit it’s due to its overwhelming popularity – and universal positive outlook from the analyst community – there is simply less room for Micron to blow past ever- heightened expectations . Important note: This is not an article debating the fundamentally strong story of GILD, MU, or even a possible very bright future for Tesla (NASDAQ: TSLA ). It is a discussion on the risk vs. return likely, as an investment for the individual investor, after an extended run-up and associated universally-positive coverage. It is possible; after an extended period of digestion and reduction in popularity/focus, both GILD and MU may become interesting investments once again. Conversely, several analyst downgrades would be constructive in this regard. I do note the substantial insider sales in both GILD and MU in the last 6 months, at about 20% of totals held. One of the most extreme examples is also a name I am short, Tesla Motors. Where my personal longer-term view, assuming neutral market inputs, for GILD and MU is they are (currently) in “no man’s land” – neither short opportunities nor compelling buys – I am outright bearish on TSLA’s current valuation. TSLA data by YCharts Tesla has been acclaimed as more than a pioneer electric car company. It has been heralded as a company that will change transportation preferences of the whole world and even how Americans access their power. Truly, Elon Musk is, as described, IMO – a visionary, a pioneer and a genius. The problem is, far more than GILD or MU, the expectation levels for this company are off the charts (and they have come down lately). For those who got in early, Tesla, MU and GILD have been fantastic investments. The thesis is, once each company’s attributes have been well telegraphed to the marketplace, much (or all) of the intermediate-term upside may be complete – and risk is now proportionally higher. For at the end of the day, we do not invest in companies, products, or sectors, we are making judgments on risk. Case Study – eBay (NASDAQ: EBAY ) eBay doesn’t dominate the most popular holdings list, doesn’t garner hundreds of comments on SA or other sites, and frankly it’s a little bit boring in comparison. Its ratings from analysts are decidedly more split , too. Yet, very quietly, without a word on CNBC, eBay is testing a 2-year horizontal range, notwithstanding the corrective market activity, and making a serious effort to break out to all-time highs (5-year chart shown for clarity). In sharp contrast to MU and GILD, I note the complete absence of insider selling at EBAY . EBAY data by YCharts And finally, from an area that is not only ignored, but also is overtly feared and loathed – emerging markets. Take a look at this chart of the iShares MSCI Philippines ETF (NYSEARCA: EPHE ) (Disclosure – Long EPHE); one would think this is a biotech – not an emerging market. Not only has this country ETF shaken off persistent emerging market weakness, it has broken out and is within about a point of all-time highs. EPHE data by YCharts In conclusion readers, this missive is a simple illustration – what is the best, exciting and popular “story” in the market – that may not be the best “investment”. Best wishes and skate towards that moving puck! Disclosure: The author is long EPHE. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Consult your advisor. Author is short TSLA. Scalper1 News

Scalper1 News