Scalper1 News

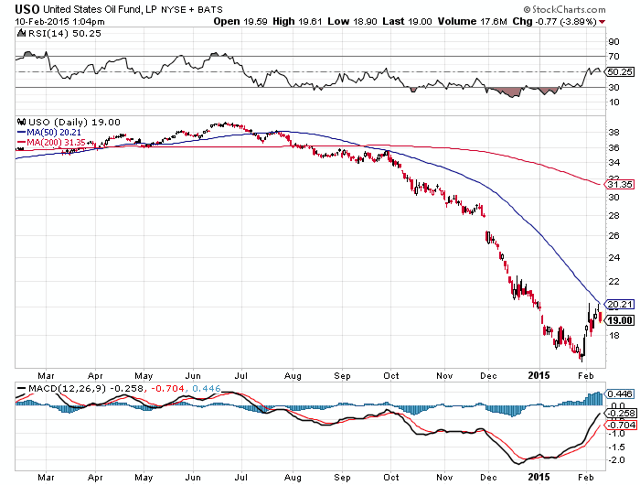

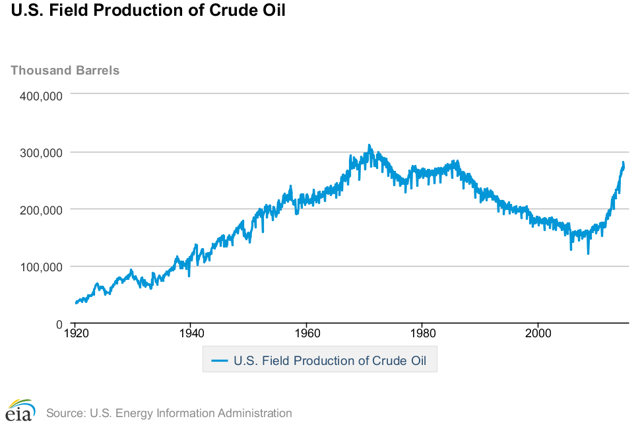

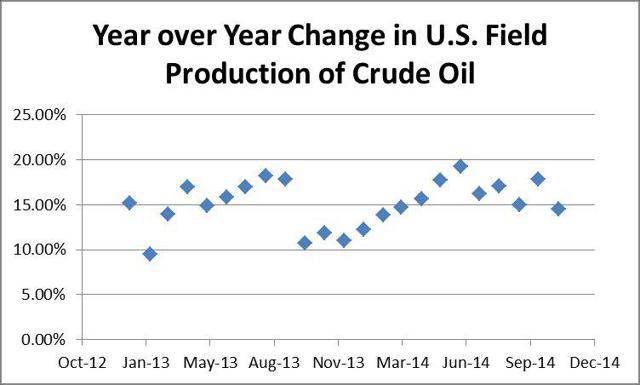

Summary After months of straight declines, oil prices seemed to bounce back starting in February. An increase in the RSI, though encouraging, is still not indicative of a broader correction. The 50-day moving average seems to be a resistance line. Oil production is still increasing. Since topping around June, oil prices have been in a steady and precipitous decline. Though the reasons have been speculated upon (mainly the debate is whether this is caused by low demand or high inventory), what is more important for speculators in the oil market is where prices are going. Around the beginning of February, prices have reversed their long and persistent decline by finally showing a rally. While this gives hope to many investors, especially those who bought oil companies hoping for a quick recovery, there are signs that there is still more pain to come. RSI and Technical Expectations (click to enlarge) To follow oil prices and technical indicators, I have shown a chart of the United States Oil Fund (NYSEARCA: USO ). A clear downtrend is apparent starting in June and continuing all the way to January. Since last month, the decline slowed noticeably, and starting in February, there is a decent correction forming. While the recent price increase is a case for optimism, a closer analysis reveals that the bear market may not be hibernating quite yet. Firstly, in bear markets, RSI tends to oscillate between 10 and 60. RSI is currently at around 50, and for real hope that this market is over, a value over 60 has to be there. Secondly, the most recent prices are showing that the 50-day moving average is unable to be surpassed, as USO hit that value, but then retraced after touching it. That said, a breakout is still possible, but with RSI hitting a wall below 60 and the price retracing at the 50-day moving average, the bear market is still well in place. Minor corrections are a part of bear markets, and this minor correction seems like exactly that, not a breakout. Fundamental Expectations The biggest factor that analysts are looking at right now is oil production. Once production finally decreases, we may then finally see the price of oil increase. While rig count can give a clue about production, it is not itself production, and production can still increase while rig counts are falling. Thus, the recent analysis by Citigroup ought to be concerning for any oil investors. It recently stated that: Despite global declines in spending that have driven up oil prices in recent weeks, oil production in the U.S. is still rising, wrote Edward Morse, Citigroup’s global head of commodity research. Brazil and Russia are pumping oil at record levels, and Saudi Arabia, Iraq and Iran have been fighting to maintain their market share by cutting prices to Asia. The market is oversupplied, and storage tanks are topping out. The same article noted that prices could fall as low as $20 per barrel. Clearly, these analysts are not buying this recent correction, nor should you. The low prices are here, and they are not going anywhere quite yet. Should We Trust Citigroup’s Analysis The question then becomes whether Citigroup is offering valid analysis, or is simply trying to change market sentiment to its benefit. To answer this question, I looked at the U.S. Field Production of Crude Oil offered by the EIA. (click to enlarge) The large increase in production since 2010 is obvious. The question now is whether US producers have taken steps to cut production now that oil prices have fallen so dramatically. To this end, a graph of year-over-year changes in production is shown. (click to enlarge) Clearly up to the latest data taken, no slowdown is found. In fact, not even a loss of momentum is apparently present. Production is increasing as quickly as it ever has, and based on this data, production is still not declining. December and January may show changes, but clearly the oil industry has a long way to go if production is going to be significantly cut in response to oil prices. Summary and Action to Take Oil is definitely not for the faint of heart right now. While I am uncertain about whether prices will actually fall to $20, I am fairly confident that oil prices are not poised for a sustainable rise quite yet. I would stick clear of USO for now, though outright shorting seems like an excessively risky move. Conversely, now would be a great time to load up on oil companies that are well poised to weather this low price environment. The way I would do this is with companies that have low debt and a good coverage ratio on their dividend. Helmerich & Payne (NYSE: HP ) is a great way to play a future correction, as it has very low debt and a current yield above 4%. There are other great companies to play the correction, though even staying put would be apt until we see further evidence that prices should rise. I would wait until production starts to decrease before investing in USO. Disclosure: The author is long HP. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary After months of straight declines, oil prices seemed to bounce back starting in February. An increase in the RSI, though encouraging, is still not indicative of a broader correction. The 50-day moving average seems to be a resistance line. Oil production is still increasing. Since topping around June, oil prices have been in a steady and precipitous decline. Though the reasons have been speculated upon (mainly the debate is whether this is caused by low demand or high inventory), what is more important for speculators in the oil market is where prices are going. Around the beginning of February, prices have reversed their long and persistent decline by finally showing a rally. While this gives hope to many investors, especially those who bought oil companies hoping for a quick recovery, there are signs that there is still more pain to come. RSI and Technical Expectations (click to enlarge) To follow oil prices and technical indicators, I have shown a chart of the United States Oil Fund (NYSEARCA: USO ). A clear downtrend is apparent starting in June and continuing all the way to January. Since last month, the decline slowed noticeably, and starting in February, there is a decent correction forming. While the recent price increase is a case for optimism, a closer analysis reveals that the bear market may not be hibernating quite yet. Firstly, in bear markets, RSI tends to oscillate between 10 and 60. RSI is currently at around 50, and for real hope that this market is over, a value over 60 has to be there. Secondly, the most recent prices are showing that the 50-day moving average is unable to be surpassed, as USO hit that value, but then retraced after touching it. That said, a breakout is still possible, but with RSI hitting a wall below 60 and the price retracing at the 50-day moving average, the bear market is still well in place. Minor corrections are a part of bear markets, and this minor correction seems like exactly that, not a breakout. Fundamental Expectations The biggest factor that analysts are looking at right now is oil production. Once production finally decreases, we may then finally see the price of oil increase. While rig count can give a clue about production, it is not itself production, and production can still increase while rig counts are falling. Thus, the recent analysis by Citigroup ought to be concerning for any oil investors. It recently stated that: Despite global declines in spending that have driven up oil prices in recent weeks, oil production in the U.S. is still rising, wrote Edward Morse, Citigroup’s global head of commodity research. Brazil and Russia are pumping oil at record levels, and Saudi Arabia, Iraq and Iran have been fighting to maintain their market share by cutting prices to Asia. The market is oversupplied, and storage tanks are topping out. The same article noted that prices could fall as low as $20 per barrel. Clearly, these analysts are not buying this recent correction, nor should you. The low prices are here, and they are not going anywhere quite yet. Should We Trust Citigroup’s Analysis The question then becomes whether Citigroup is offering valid analysis, or is simply trying to change market sentiment to its benefit. To answer this question, I looked at the U.S. Field Production of Crude Oil offered by the EIA. (click to enlarge) The large increase in production since 2010 is obvious. The question now is whether US producers have taken steps to cut production now that oil prices have fallen so dramatically. To this end, a graph of year-over-year changes in production is shown. (click to enlarge) Clearly up to the latest data taken, no slowdown is found. In fact, not even a loss of momentum is apparently present. Production is increasing as quickly as it ever has, and based on this data, production is still not declining. December and January may show changes, but clearly the oil industry has a long way to go if production is going to be significantly cut in response to oil prices. Summary and Action to Take Oil is definitely not for the faint of heart right now. While I am uncertain about whether prices will actually fall to $20, I am fairly confident that oil prices are not poised for a sustainable rise quite yet. I would stick clear of USO for now, though outright shorting seems like an excessively risky move. Conversely, now would be a great time to load up on oil companies that are well poised to weather this low price environment. The way I would do this is with companies that have low debt and a good coverage ratio on their dividend. Helmerich & Payne (NYSE: HP ) is a great way to play a future correction, as it has very low debt and a current yield above 4%. There are other great companies to play the correction, though even staying put would be apt until we see further evidence that prices should rise. I would wait until production starts to decrease before investing in USO. Disclosure: The author is long HP. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News