Scalper1 News

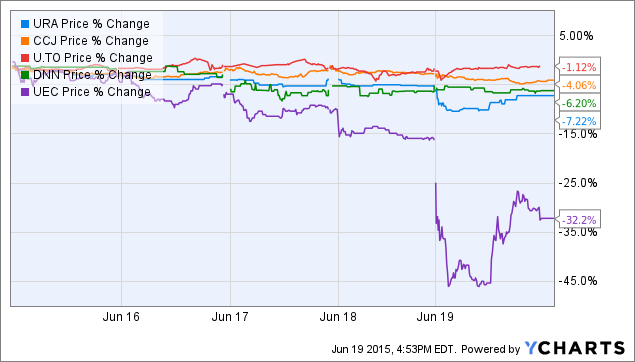

Summary Uranium’s price is still in the $35-$40 range. The Global X Uranium ETF declined by 7.22% this week, as Uranium Energy Corp’s price collapse dragged it down. Uranium Energy Corp. is the fourth biggest holding in URA’s portfolio. If the share price of Uranium Energy Corp. keeps on falling, share price of the Global X Uranium ETF may retest the $9.5 level. The Global X Uranium ETF (NYSEARCA: URA ) created a new historical low, as the $10 support level didn’t resist. URA closed at $9.9 last week, but it reached an intraday low at $9.53 during Friday trading. The breakage of the support level was initiated by the collapse of Uranium Energy Corp’s (NYSEMKT: UEC ) share price. The uranium price still moves in the $35-$40 range, as the restart of idle Japanese reactors takes longer than originally expected. Although application for restart of another reactor was submitted, restart of the Sendai 1 and Sendai 2 reactors was delayed . The long term fundamentals remain strong, but the market lacks enthusiasm and the short term outlook for uranium prices is questionable. Share prices of uranium producers were declining over the last week. Shares of Cameco (NYSE: CCJ ) declined by 4.06%, shares of Denison Mines (NYSEMKT: DNN ) declined by 7.22% and shares of Uranium Participation ( OTCPK:URPTF ) declined by 1.12%. But it was Uranium Energy, that dragged share price of the ETF below the $10 line. Shares of Uranium Energy Corp. declined by 32.2%. At one point in early Friday trading, its share price was 45% below its Monday levels. Uranium Energy is URA’s fourth biggest holding and it represented 10.09% of its assets, as of Thursday, June 18. This is why the Friday’s developments were really bad for URA and it is questionable what to expect next. UEC is an uranium mining and exploration company that owns Palangama in-situ recovery uranium mine and it develops Goliad in-situ recovery uranium mine. Moreover, the company owns processing facility at Hobson. UEC was probably the best performing company of the whole uranium sector over the last two months. Its share price started to grow in late April and it almost doubled in a couple of days. The problem is that there was no reason for such a growth. UEC released its Q2 2015 financial results on March 12 and another news release is dated May 27, when the company announced that it received permits for expansion of the Palangana ISR mine. The huge move happened more than one month after the first news release and approximately one month before the second one. Moreover the uranium price was declining during the whole April and it bottomed in the middle of May. Everything has changed last week. On Thursday in the evening, The Street Sweeper published an article that states that Uranium Energy is significantly overvalued, it has virtually no production, it has only limited cash and it has almost no stocks of uranium for sale left. Author of the article has also expressed suspicion that the share price was pumped up by a series of promotions. The article probably scared a couple of shareholders, as the UEC share price opened 13% lower on Friday. The share price reached its low of $1.55 at 10:18 a.m. Although the share price recovered in the afternoon trading, it closed at $1.96, down by 19%. More than 17 million shares were traded on Friday, although the average trading volume over the last 3 months has been only 1.8 million shares per day, according to Yahoo Finance. UEC released a short statement where it said that the allegations are unfounded and have absolutely no merit. But they didn’t specify which of the allegations were unfounded, as most of them can be supported by UEC’s financial statements. UEC was worth more than $250 million only a couple of days ago. It is really a lot of money for a company that is deep in red numbers year after year, with no change in sight. It seems to me that a speculator or a group of speculators recognized that shares of UEC are overvalued and they orchestrated a bear raid. The question is whether the share price will stabilize in the $2 area, whether it will be pushed back up, or whether it will decline back to its early April levels of approximately $1.5. As I stated above, the share price of UEC increased by 100% on no news, therefore a decline to the $1.5 area would make sense. The development of UEC’s share price may have quite a big impact on URA’s share price, as we could see on Friday. UEC still represents 7.69% of URA’s portfolio. Conclusion The near term development of URA’s share price may be affected by the UEC affair. It is not probable that UEC will return to its recent highs anytime soon. Although UEC started this week positively and it recovered a part of Friday’s losses, the question is whether the share price will stabilize or whether it will keep on falling. I suppose that the second option is more probable, as UEC is still quite expensive. If UEC falls back to $1.5, URA will probably retest the $9.5 level. This is the Friday’s intraday low that occurred when UEC traded at $1.55. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Uranium’s price is still in the $35-$40 range. The Global X Uranium ETF declined by 7.22% this week, as Uranium Energy Corp’s price collapse dragged it down. Uranium Energy Corp. is the fourth biggest holding in URA’s portfolio. If the share price of Uranium Energy Corp. keeps on falling, share price of the Global X Uranium ETF may retest the $9.5 level. The Global X Uranium ETF (NYSEARCA: URA ) created a new historical low, as the $10 support level didn’t resist. URA closed at $9.9 last week, but it reached an intraday low at $9.53 during Friday trading. The breakage of the support level was initiated by the collapse of Uranium Energy Corp’s (NYSEMKT: UEC ) share price. The uranium price still moves in the $35-$40 range, as the restart of idle Japanese reactors takes longer than originally expected. Although application for restart of another reactor was submitted, restart of the Sendai 1 and Sendai 2 reactors was delayed . The long term fundamentals remain strong, but the market lacks enthusiasm and the short term outlook for uranium prices is questionable. Share prices of uranium producers were declining over the last week. Shares of Cameco (NYSE: CCJ ) declined by 4.06%, shares of Denison Mines (NYSEMKT: DNN ) declined by 7.22% and shares of Uranium Participation ( OTCPK:URPTF ) declined by 1.12%. But it was Uranium Energy, that dragged share price of the ETF below the $10 line. Shares of Uranium Energy Corp. declined by 32.2%. At one point in early Friday trading, its share price was 45% below its Monday levels. Uranium Energy is URA’s fourth biggest holding and it represented 10.09% of its assets, as of Thursday, June 18. This is why the Friday’s developments were really bad for URA and it is questionable what to expect next. UEC is an uranium mining and exploration company that owns Palangama in-situ recovery uranium mine and it develops Goliad in-situ recovery uranium mine. Moreover, the company owns processing facility at Hobson. UEC was probably the best performing company of the whole uranium sector over the last two months. Its share price started to grow in late April and it almost doubled in a couple of days. The problem is that there was no reason for such a growth. UEC released its Q2 2015 financial results on March 12 and another news release is dated May 27, when the company announced that it received permits for expansion of the Palangana ISR mine. The huge move happened more than one month after the first news release and approximately one month before the second one. Moreover the uranium price was declining during the whole April and it bottomed in the middle of May. Everything has changed last week. On Thursday in the evening, The Street Sweeper published an article that states that Uranium Energy is significantly overvalued, it has virtually no production, it has only limited cash and it has almost no stocks of uranium for sale left. Author of the article has also expressed suspicion that the share price was pumped up by a series of promotions. The article probably scared a couple of shareholders, as the UEC share price opened 13% lower on Friday. The share price reached its low of $1.55 at 10:18 a.m. Although the share price recovered in the afternoon trading, it closed at $1.96, down by 19%. More than 17 million shares were traded on Friday, although the average trading volume over the last 3 months has been only 1.8 million shares per day, according to Yahoo Finance. UEC released a short statement where it said that the allegations are unfounded and have absolutely no merit. But they didn’t specify which of the allegations were unfounded, as most of them can be supported by UEC’s financial statements. UEC was worth more than $250 million only a couple of days ago. It is really a lot of money for a company that is deep in red numbers year after year, with no change in sight. It seems to me that a speculator or a group of speculators recognized that shares of UEC are overvalued and they orchestrated a bear raid. The question is whether the share price will stabilize in the $2 area, whether it will be pushed back up, or whether it will decline back to its early April levels of approximately $1.5. As I stated above, the share price of UEC increased by 100% on no news, therefore a decline to the $1.5 area would make sense. The development of UEC’s share price may have quite a big impact on URA’s share price, as we could see on Friday. UEC still represents 7.69% of URA’s portfolio. Conclusion The near term development of URA’s share price may be affected by the UEC affair. It is not probable that UEC will return to its recent highs anytime soon. Although UEC started this week positively and it recovered a part of Friday’s losses, the question is whether the share price will stabilize or whether it will keep on falling. I suppose that the second option is more probable, as UEC is still quite expensive. If UEC falls back to $1.5, URA will probably retest the $9.5 level. This is the Friday’s intraday low that occurred when UEC traded at $1.55. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News