Scalper1 News

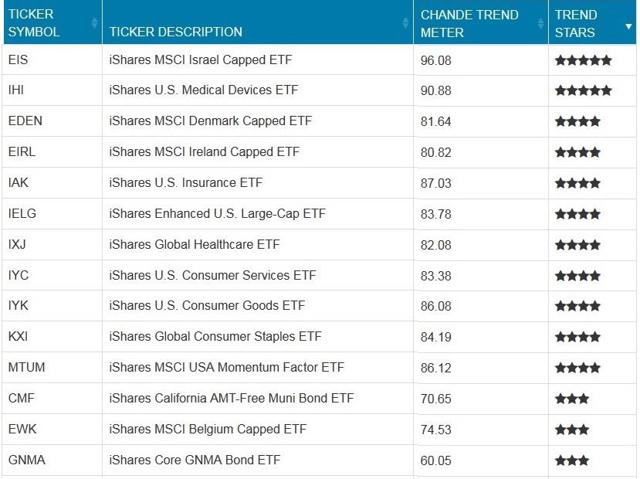

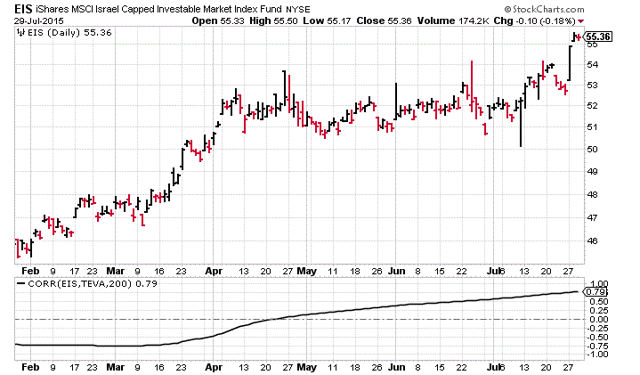

Summary The Top 3 iShares ETFs in our data base are EIS, IHI and EDEN. Large exposure to the health care area, in one form or another, is the common factor among the three ETFs. This sector has strong fundamentals driven by government mandated health reforms pushing managements to action. Introduction July was a choppy month in the markets, with Greece driving the headlines. The markets sold off during the Greek rebellion, rallied in relief when Greece agreed to tough bailout conditions, and sold off quickly heading into the Federal Reserve’s FOMC meeting. Then it bounced again, when the FOMC issued a dovish statement after its meeting. During this volatility, the three iShares ETFs that rose to the top of our medium-term rankings (see Figure 1) were the iShares MSCI Israel Capped ETF (NYSEARCA: EIS ), the iShares U.S. Medical Devices ETF (NYSEARCA: IHI ) the iShares MSCI Denmark Capped Investable Market Index ETF (BATS: EDEN ). The common factor uniting all three top iShares ETFs is the dominant exposure to the health care area in their portfolios. (click to enlarge) Figure 1: The best trending iShares ETFs from the ETFmeter.com database. (Chart courtesy ETFmeter.com ) The Common Factor EIS has approximately 26% of its assets in Teva Pharmaceuticals (NYSE: TEVA ). The world’s largest manufacturer of generic drugs this week announced it had purchased Allergan’s generic drug business. The deal just adds depth to its generics portfolio plus more growth opportunities, and pushed TEVA to a new high following its major breakout in early 2014. For EIS, its top 10 holdings account for nearly 70% of its assets, and add exposure to Israeli banks, industrials, telecom, and materials. The correlation between the performance of EIS and TEVA is a strong 79% (see Figure 2). (click to enlarge) Figure 2: Teva Pharmaceuticals is the largest holding of EIS, and the correlation between the two is 0.79 and rising (see lower graph). (Chart Courtesy StockCharts.com and ETFmeter.com) Medtronic, Abbot Labs and Thermo Fisher Scientific are the three top holdings of the iShares U.S. Medical Devices ETF, accounting for more than 30% of the ETFs assets. Almost 82% of the fund’s assets are in just 20 stocks. In our analysis, eight of the top 20 stocks are rising strongly. Its best performing stocks this month are Bard (NYSE: CR ) and Intuitive Surgical (NASDAQ: ISRG ). The long-term correlation between IHI and Medtronic (NYSE: MDT ), its largest holding, is 0.94 (see Figure 3). (click to enlarge) Figure 3: Medtronic is the largest holding of IHI, and the correlation between the two is 0.94 (see lower graph). (Chart Courtesy StockCharts.com and ETFmeter.com) The EDEN iShares Denmark ETF has broken out to new highs, and it has Novo Nordisk (NYSE: NVO ) to thank for it. A bit more than 22% of the ETF’s assets were in Novo Nordisk, with its top 10 holdings accounting for some 64% of the assets, scattered amongst the mega shippers and brewers. Novo Nordisk focuses on diabetes drugs and assorted pharmaceuticals. Lately, the 200-day correlation between EDEN and NVO is about 0.98, which means that the ups and downs of EDEN have closely followed the fortunes of NVO (see Figure 4). (click to enlarge) Figure 4: Novo Nordisk is the largest holding of EDEN, and the correlation between the two is 0.98 (see lower graph). (Chart Courtesy StockCharts.com and ETFmeter.com) Looking Ahead Health care stocks have been amongst the best performers for the past several years. Health care reform in the U.S. has pushed managements into action, and the fundamental drivers for the sector are likely to remain strong for the foreseeable future. Thus, these iShares ETFs are likely to have a wind in their sails far beyond the horizon. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The Top 3 iShares ETFs in our data base are EIS, IHI and EDEN. Large exposure to the health care area, in one form or another, is the common factor among the three ETFs. This sector has strong fundamentals driven by government mandated health reforms pushing managements to action. Introduction July was a choppy month in the markets, with Greece driving the headlines. The markets sold off during the Greek rebellion, rallied in relief when Greece agreed to tough bailout conditions, and sold off quickly heading into the Federal Reserve’s FOMC meeting. Then it bounced again, when the FOMC issued a dovish statement after its meeting. During this volatility, the three iShares ETFs that rose to the top of our medium-term rankings (see Figure 1) were the iShares MSCI Israel Capped ETF (NYSEARCA: EIS ), the iShares U.S. Medical Devices ETF (NYSEARCA: IHI ) the iShares MSCI Denmark Capped Investable Market Index ETF (BATS: EDEN ). The common factor uniting all three top iShares ETFs is the dominant exposure to the health care area in their portfolios. (click to enlarge) Figure 1: The best trending iShares ETFs from the ETFmeter.com database. (Chart courtesy ETFmeter.com ) The Common Factor EIS has approximately 26% of its assets in Teva Pharmaceuticals (NYSE: TEVA ). The world’s largest manufacturer of generic drugs this week announced it had purchased Allergan’s generic drug business. The deal just adds depth to its generics portfolio plus more growth opportunities, and pushed TEVA to a new high following its major breakout in early 2014. For EIS, its top 10 holdings account for nearly 70% of its assets, and add exposure to Israeli banks, industrials, telecom, and materials. The correlation between the performance of EIS and TEVA is a strong 79% (see Figure 2). (click to enlarge) Figure 2: Teva Pharmaceuticals is the largest holding of EIS, and the correlation between the two is 0.79 and rising (see lower graph). (Chart Courtesy StockCharts.com and ETFmeter.com) Medtronic, Abbot Labs and Thermo Fisher Scientific are the three top holdings of the iShares U.S. Medical Devices ETF, accounting for more than 30% of the ETFs assets. Almost 82% of the fund’s assets are in just 20 stocks. In our analysis, eight of the top 20 stocks are rising strongly. Its best performing stocks this month are Bard (NYSE: CR ) and Intuitive Surgical (NASDAQ: ISRG ). The long-term correlation between IHI and Medtronic (NYSE: MDT ), its largest holding, is 0.94 (see Figure 3). (click to enlarge) Figure 3: Medtronic is the largest holding of IHI, and the correlation between the two is 0.94 (see lower graph). (Chart Courtesy StockCharts.com and ETFmeter.com) The EDEN iShares Denmark ETF has broken out to new highs, and it has Novo Nordisk (NYSE: NVO ) to thank for it. A bit more than 22% of the ETF’s assets were in Novo Nordisk, with its top 10 holdings accounting for some 64% of the assets, scattered amongst the mega shippers and brewers. Novo Nordisk focuses on diabetes drugs and assorted pharmaceuticals. Lately, the 200-day correlation between EDEN and NVO is about 0.98, which means that the ups and downs of EDEN have closely followed the fortunes of NVO (see Figure 4). (click to enlarge) Figure 4: Novo Nordisk is the largest holding of EDEN, and the correlation between the two is 0.98 (see lower graph). (Chart Courtesy StockCharts.com and ETFmeter.com) Looking Ahead Health care stocks have been amongst the best performers for the past several years. Health care reform in the U.S. has pushed managements into action, and the fundamental drivers for the sector are likely to remain strong for the foreseeable future. Thus, these iShares ETFs are likely to have a wind in their sails far beyond the horizon. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News