< div id=" articleText" legibility =" 156.36831517184" > As Deere & Service’s( NYSE: DE) 2016 has advanced, its own administration has lowered full-year profits and also cash flow projections. On top of that, competitors like Caterpillar Inc. (NYSE: FELINE) in development machines as well as AGCO Company (NYSE: AGCO) are both observing weakening disorders. That pointed out, each one of the inventories stated are outperforming the S&P 500 on a year-to-date manner as I compose.

Exactly what’s happening with Deere in 2016, and performs that is actually inadequate relative performance suggest that is actually time to purchase the stock?

| < table perimeter=" 0 | ” > | < tbody legibility

| =” 1″ |

| |

| > Metric Q4 2015 Q1 2016 Q2 & 2016 |

Agriculture & Turf Net |

Sales( 6%) | ( 6%) | |

|

( 6%) Development & Forestry |

Internet Sales | ( 4%) | ( 9%) | ( 12%) |

| < tr readability=" 2" > Worldwide Financial Companies |

Earnings ($ millions) |

$ 550 |

$ 525 |

$ 480 |

|

Complete |

Internet Sales |

( 5%) | ( 7%) | ( 7%) |

|

Web Revenue ($ billions) |

$ 1.4 | $ 1.3 | $ 1.2 |

Net sales amounts are actually readjusted for currency. Data resource: Deere & & Firm discussions.

Nevertheless, the phone numbers don’t tell the total image, and also Deere’s leads are really challenged in each segment.

Construction & & forestry As you can easily view above

, currency-adjusted net purchases advice is actually trending adversely in 2016. On top of that, Caterpillar disclosed a 19% decrease in building business sales in its own latest 1st quarter, along with” declines in construction task pertaining to oil and also gas” outcoming in” availability from construction devices for other functions.” The leading pricing pressure felt by Caterpillar( partly therefore from suppliers aggressively decreasing supply) is probably to be actually influencing Deere too. Up until problems strengthen along with oil & fuel capital expense, this’s challenging to see a significant improvement in Deere’s ton of moneys.< img lesson= "articleImgLg" alt= "Gettyimages" src=" https://g.foolcdn.com/editorial/images/207376/gettyimages-166370460_large.jpg"/ > Future eras from planters in a corn industry. Farming & territory Agriculture is actually Deere’s center operation( responsible for almost 80 % from equipment

purchases in the very first fifty percent) and essential to its

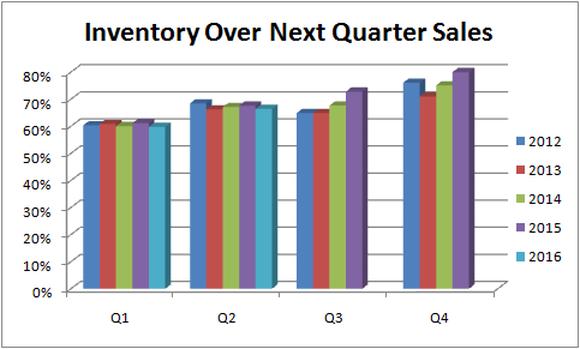

long-lasting development. Unfortunately, the heading net sales designs do not tell the total story. Although altered web sales growth support has actually stayed the very same, Deere referenced a much less favorable item mix of purchases in the second fourth. Essentially, sizable agrarian equipment purchases (which often be actually higher-margin products) are actually going to pieces, while tiny as well as mid-size tractors are, baseding on AGCO Corporation’s first-quarter earnings launch, generating much higher sales, assisting to partly make up for the decrease in huge agrarian equipment. Having said that, just what benefits overall sales isn’t automatically great for the business’s frame, so do not be misleaded by Deere’s maintenance from underlying farming & territory sales direction. On a brighter note, Deere does show up to be actually handling its own total inventory rather effectively. Here is actually a consider inventory levels broken down by the following quarter’s purchases. As you may & observe under, the proportion started

climbing– relative to previous years– throughout 2015, yet the initial two fourths from 2016 have observed similar ratios to previous years– Deere is actually decreasing inventory properly. Figure for Q2 is actually compiled utilizing anaylst estimations available. Information source: Deere & Firm presentations.

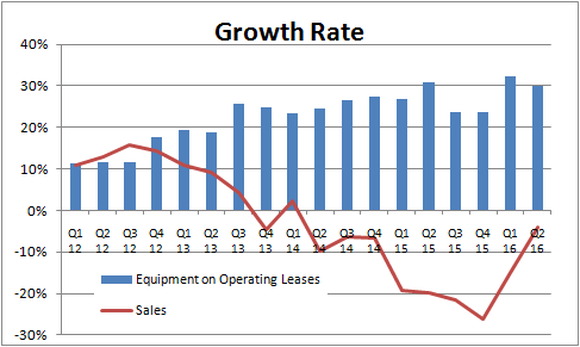

Worldwide financial companies This is arguably one of the most problematic segment for Deere &, and as you can easily find in the 1st desk, administration has lessened full-year net profit

expectations through$ 70 million( 12%) already in 2016. The reasons are threefold: Less advantageous financing spreadings Increased stipulations for credit report reductions Much higher reductions on residual income values There is little bit of Deere may do about rate of interest motions, however in the tools this carries functioning leases( instead of buying equipment, and given the weak point in the market, this’s unpreventable that credit report reductions will certainly improve while recurring values are probably to be compelled.< img lesson=" articleImgLg "alt =" Deere "src=" https://www.scalper1.com/wp-content/uploads/2016/06/deere-2_large.png"/ > Picture resource: Deere & Business presentations. Deere’s administration lifted its own 2016 forecast credit loss provision to 0.23%, compared with 0.17% in the end from April. That is actually still listed below the 10-year standard from 0.26%, yet that is actually little alleviation as economic solutions have actually grown in relevance to Deere as tools leases have actually increased. On top of that, the step-by-step rise in credit history reduction provisions is actually injuring success. To be actually reasonable, Deere’s control is responding through” significantly limiting our short-term lease services, as well as enhancing danger sharing along with dealership, “but until end-market health conditions strengthen, the company & nbsp; is actually probably to observe & nbsp; even more tension on its monetary earnings. All-time low pipe Till the agrarian field– indicating crop rates– switches upwards, that’s most likely Deere will certainly continuously face headwinds in every three segments

. Control is actually creating the appropriate actions, and Deere’s inventory administration is actually the most effective in its own course, but tension continuouslies improve its own company. Mindful clients would be best advised to monitor end-market states before purchasing supply in Deere. A top secret billion-dollar stock option The planet’s biggest tech firm neglected to present you something, but a handful of Exchange analysts and also the Moron didn’t miss out on a beat: There’s a little firm that is actually powering their

new gadgets and also the coming reformation in modern technology

. And also our company presume its own sell rate has nearly unrestricted area to compete early, in-the-know real estate investors! To become among all of them,< a href =" http://www.fool.com/mms/mark/ecap-foolcom-apple-wearable?aid=6965&source=irbeditxt0000017&ftm_cam=rb-wearable-d&ftm_pit=2691&ftm_veh=article_pitch&utm_campaign=article&utm_medium=feed&utm_source=nasdaq "rel =" nofollow" > simply go here.

The views as well as opinions conveyed herein are the perspectives and opinions from the writer and also perform&certainly not essentially indicate&those from Nasdaq, Inc.

< a rel=" nofollow" href=" http://articlefeeds.nasdaq.com/~r/nasdaq/symbols/~3/TjG6o4FSXLA/time-to-buy-deere-company-stock-cm630463" >

Newest Contents Plantations International