Scalper1 News

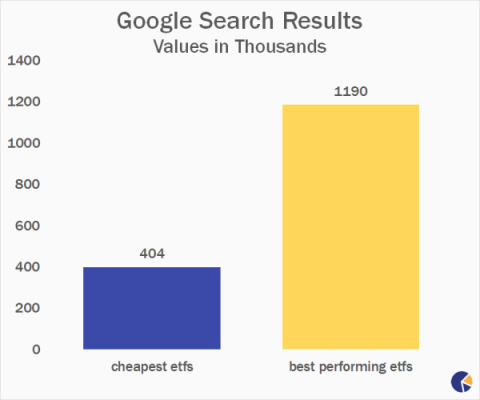

Bonds, dividend investing, ETF investing, currencies “}); $$(‘#article_top_info .info_content div’)[0].insert(bottom: $(‘mover’)); } $(‘article_top_info’).addClassName(test_version); } SeekingAlpha.Initializer.onDOMLoad(function() setEvents();); In a recent post I talked about the intertemporal conundrum, the problem of time in a portfolio. That is, we live in a dynamic world where our financial lives aren’t necessarily one clean “long-term” . Because of this we often obsess over the short-term and end up doing detrimental short-term actions in what is essentially a failed attempt to create certainty in an uncertain financial world. It isn’t totally irrational to think about the short-term, however, this article from Fund Reference shows just how bad the problem is. Here are just two examples of how bad the current state of affairs is: That is even worse than I would have expected. For every person who is thinking about the “long-term” there are almost 20 who are thinking about the “short-term”. And the chart on expenses relative to performance shows that we’re basically just chasing performance and downplaying the importance of fees. Yet the data shows this is precisely the wrong way to think about the financial markets. Yes, we’re all active investors . But the smart active investors maximize efficiencies by reducing portfolio frictions like taxes and fees while maintaining a realistic perspective of your investing time horizon. The obsession with the super short-term is almost certainly detrimental to your wealth. Share this article with a colleague Scalper1 News

Bonds, dividend investing, ETF investing, currencies “}); $$(‘#article_top_info .info_content div’)[0].insert(bottom: $(‘mover’)); } $(‘article_top_info’).addClassName(test_version); } SeekingAlpha.Initializer.onDOMLoad(function() setEvents();); In a recent post I talked about the intertemporal conundrum, the problem of time in a portfolio. That is, we live in a dynamic world where our financial lives aren’t necessarily one clean “long-term” . Because of this we often obsess over the short-term and end up doing detrimental short-term actions in what is essentially a failed attempt to create certainty in an uncertain financial world. It isn’t totally irrational to think about the short-term, however, this article from Fund Reference shows just how bad the problem is. Here are just two examples of how bad the current state of affairs is: That is even worse than I would have expected. For every person who is thinking about the “long-term” there are almost 20 who are thinking about the “short-term”. And the chart on expenses relative to performance shows that we’re basically just chasing performance and downplaying the importance of fees. Yet the data shows this is precisely the wrong way to think about the financial markets. Yes, we’re all active investors . But the smart active investors maximize efficiencies by reducing portfolio frictions like taxes and fees while maintaining a realistic perspective of your investing time horizon. The obsession with the super short-term is almost certainly detrimental to your wealth. Share this article with a colleague Scalper1 News

Scalper1 News