Scalper1 News

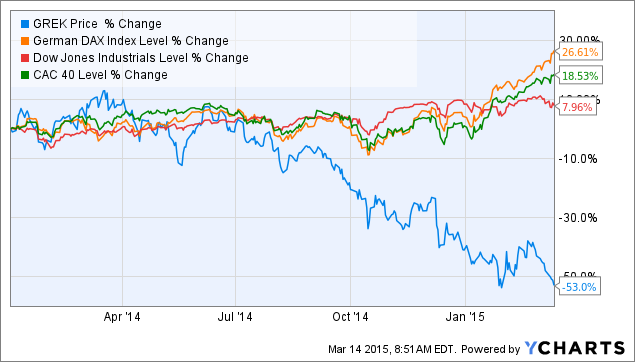

Summary The Global X FTSE Greece 20 ETF has declined by more than 50% since the beginning of 2014. The Greek government seems to understand the negative impacts of the potential grexit and they will have to fulfill the conditions of their Eurozone partners in the end. The Greek share market will grow significantly after the current problems are resolved. The growth will be strengthened by the European QE. The Greek share market represented by the Global X FTSE Greece 20 ETF (NYSEARCA: GREK ) has declined by more than 50% since the beginning of 2014. A major part of the decline happened in the second half of 2014 and in 2015 and it was caused by the renewed concerns about the potential grexit. The GREK share price behaved in line with the major markets (chart below) from the beginning. The problems started during the summer months and culminated in December and January when a political crisis led to early elections. The elections were won by Syriza, a party with a strong and loud anti-austerity rhetoric. Their way to power was paved by refusing the austerity measures and by a lot of unrealistic promises to the electorate. The new Greek government, led by prime minister Alexis Tsipras, initially demanded another debt writedown as well as a renegotiation of terms of the bailout program. After four weeks full of furious negotiations and a free fall of the Greek financial markets, the Greek government promised reforms, promised that it will not introduce any unilateral measures that would negatively impact the fiscal targets set by the “troika” and it declared its intention to fulfill its financial obligations. As a result, the bailout program should be extended by another four months. But a new list of reforms must be accepted by the Eurozone finance ministers before another financial aid disbursement. The proposed reforms were rejected by the Eurozone partners on March 9 and there is a threat of a Greek default as soon as this month. Although the initial reaction of the Greek representatives was highly negative, ranging from demands for German war reparations to threats of flooding Europe with immigrants. But on Friday, Tsipras reassured that Greece will hold its word given in February. It is more evidence that the Greek government realizes the painful consequences of the potential grexit. All the screaming and kicking around is just theatre for the Greek electorate. The grexit and the Greek default would lead to an immediate decline of the purchasing power of Greek citizens. The unemployment rate would grow above the current 25% level and the bank sector would be on the brink of a total collapse. Any chances of the current Greek government for a future re-election would drop to values close to zero. Yes, the grexit could be positive for Greece from a long term point of view. But the long term positives are not a sure thing. The only sure thing is huge pain in the short term. The most probable scenario is that the Greek government will keep on screaming and kicking, so that it can show their voters that they want to keep their promises and they fight for Greece, but they will surrender in the end in order to avoid the grexit and the responsibility for it. The Eurozone partners may make some minor compromises in order to give Syriza an opportunity to show their voters some “success”. But any major reliefs are highly improbable. The economy of the Eurozone is stronger than in 2012 and what is more important, the European financial sector is much better prepared for a potential grexit. The grexit is a much bigger threat for Greece than for the Eurozone today. As I wrote above, I expect that the situation will calm down and Greece will stay in the Eurozone. This is why I see a huge investment opportunity in Greek shares. As the chart below shows, GREK increased rapidly after its bottom in May 2012. It grew from $8.85 on June 1, 2012, to $18.80 on October 22, 2012. That’s more than 100% in less than five months. Yes, the historical results are no guarantee of future results, but history tends to repeat itself. Moreover, there is another powerful card in play this time. The European QE. The QEs led to inflation of a share market bubble in the USA. The same process has started in Europe now. And a lot of investors will direct their money into cheap Greek shares, after the situation around Greece calms down a little. I admit, I have no idea where the bottom will be and when it will come. It is possible that GREK will retest the 2012 lows in the coming weeks and it is possible that the bottom is somewhere near the current price level. Everything will depend on the progress of the Eurozone – Greece negotiations. The longer the negotiations last, the more the market’s nervousness will grow and the lower GREK will fall. The best solution is to wait until any kind of solution is reached and initiate a position in GREK. It may mean buying shares 10% or 20% above the bottom, but there will likely still be a huge upside remaining. Conclusion Although the Greek government is very loud and very aggressive, Tsipras seems to realize the negative impacts of the grexit on Greece and the future political careers of him and his party. I believe that Greece will surrender and fulfill the demands of its partners. In this case we can expect a huge increase of the GREK share price. It increased by more than 100% in less than five months, back in 2012. Similar gains are possible this time, given the supporting effects of the European QE. The best way to play this situation is to wait until the current complications between Greece and its Eurozone partners are resolved and initiate a long position. It may mean losing some initial gains of the bull run, but there should be still more than enough profits left. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The Global X FTSE Greece 20 ETF has declined by more than 50% since the beginning of 2014. The Greek government seems to understand the negative impacts of the potential grexit and they will have to fulfill the conditions of their Eurozone partners in the end. The Greek share market will grow significantly after the current problems are resolved. The growth will be strengthened by the European QE. The Greek share market represented by the Global X FTSE Greece 20 ETF (NYSEARCA: GREK ) has declined by more than 50% since the beginning of 2014. A major part of the decline happened in the second half of 2014 and in 2015 and it was caused by the renewed concerns about the potential grexit. The GREK share price behaved in line with the major markets (chart below) from the beginning. The problems started during the summer months and culminated in December and January when a political crisis led to early elections. The elections were won by Syriza, a party with a strong and loud anti-austerity rhetoric. Their way to power was paved by refusing the austerity measures and by a lot of unrealistic promises to the electorate. The new Greek government, led by prime minister Alexis Tsipras, initially demanded another debt writedown as well as a renegotiation of terms of the bailout program. After four weeks full of furious negotiations and a free fall of the Greek financial markets, the Greek government promised reforms, promised that it will not introduce any unilateral measures that would negatively impact the fiscal targets set by the “troika” and it declared its intention to fulfill its financial obligations. As a result, the bailout program should be extended by another four months. But a new list of reforms must be accepted by the Eurozone finance ministers before another financial aid disbursement. The proposed reforms were rejected by the Eurozone partners on March 9 and there is a threat of a Greek default as soon as this month. Although the initial reaction of the Greek representatives was highly negative, ranging from demands for German war reparations to threats of flooding Europe with immigrants. But on Friday, Tsipras reassured that Greece will hold its word given in February. It is more evidence that the Greek government realizes the painful consequences of the potential grexit. All the screaming and kicking around is just theatre for the Greek electorate. The grexit and the Greek default would lead to an immediate decline of the purchasing power of Greek citizens. The unemployment rate would grow above the current 25% level and the bank sector would be on the brink of a total collapse. Any chances of the current Greek government for a future re-election would drop to values close to zero. Yes, the grexit could be positive for Greece from a long term point of view. But the long term positives are not a sure thing. The only sure thing is huge pain in the short term. The most probable scenario is that the Greek government will keep on screaming and kicking, so that it can show their voters that they want to keep their promises and they fight for Greece, but they will surrender in the end in order to avoid the grexit and the responsibility for it. The Eurozone partners may make some minor compromises in order to give Syriza an opportunity to show their voters some “success”. But any major reliefs are highly improbable. The economy of the Eurozone is stronger than in 2012 and what is more important, the European financial sector is much better prepared for a potential grexit. The grexit is a much bigger threat for Greece than for the Eurozone today. As I wrote above, I expect that the situation will calm down and Greece will stay in the Eurozone. This is why I see a huge investment opportunity in Greek shares. As the chart below shows, GREK increased rapidly after its bottom in May 2012. It grew from $8.85 on June 1, 2012, to $18.80 on October 22, 2012. That’s more than 100% in less than five months. Yes, the historical results are no guarantee of future results, but history tends to repeat itself. Moreover, there is another powerful card in play this time. The European QE. The QEs led to inflation of a share market bubble in the USA. The same process has started in Europe now. And a lot of investors will direct their money into cheap Greek shares, after the situation around Greece calms down a little. I admit, I have no idea where the bottom will be and when it will come. It is possible that GREK will retest the 2012 lows in the coming weeks and it is possible that the bottom is somewhere near the current price level. Everything will depend on the progress of the Eurozone – Greece negotiations. The longer the negotiations last, the more the market’s nervousness will grow and the lower GREK will fall. The best solution is to wait until any kind of solution is reached and initiate a position in GREK. It may mean buying shares 10% or 20% above the bottom, but there will likely still be a huge upside remaining. Conclusion Although the Greek government is very loud and very aggressive, Tsipras seems to realize the negative impacts of the grexit on Greece and the future political careers of him and his party. I believe that Greece will surrender and fulfill the demands of its partners. In this case we can expect a huge increase of the GREK share price. It increased by more than 100% in less than five months, back in 2012. Similar gains are possible this time, given the supporting effects of the European QE. The best way to play this situation is to wait until the current complications between Greece and its Eurozone partners are resolved and initiate a long position. It may mean losing some initial gains of the bull run, but there should be still more than enough profits left. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News