Scalper1 News

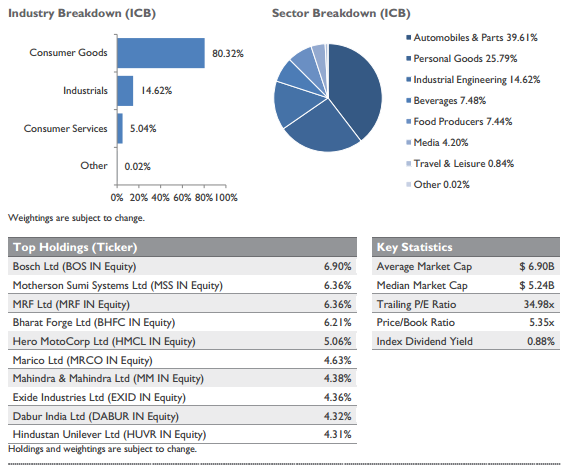

After Narendra Modi’s political party won the general election in May 2014, the Indian economy set off in a new, promising direction. Favorable demographics and foreign direct investments will be the long-term tailwinds. Tumbling inflation makes consumers more confident in spending. It is estimated that by 2030, India is likely to surpass the USA and China and become the world’s largest consumer market. Economists and investors have turned optimistic about the prospects of the Indian economy since Narendra Modi’s political party won one of the largest elections in the country’s history last May. Before Modi became a Prime Minister, he led one of the fastest growing states in the country, so many people believe his government will be able to push through the most critical reforms to liberalize local industries and revive economic growth. According to the International Monetary Fund, the reform plan of the new Prime Minister is promising, although the key is going to be implementation . In its latest World Economic Outlook, the IMF forecasts that India will grow at 6.3% this year and 6.5% in 2016, when it is likely to overtake China. In contrast to the accelerating Indian economy, the Chinese economy is still projected to struggle with its decelerating growth rate. In 2015, China’s growth rate is expected to slow to 6.8%, while a year ago it reached 7.4%. One should not forget that India is the second most populous country in the world, with over 1.27 billion people (17.5% of the world’s population), and is projected to be the world’s most populous country by 2025. What is more interesting is that more than 50% of the Indian population is below the age of 25, and it is expected that, in 2020, the average age of an Indian will be 29 years, compared to 37 for China and 48 for Japan. This population composition together with Modi’s ambitious ‘ Make in India ‘ program to attract foreign direct investments will undoubtedly support the ongoing rapid expansion of India’s middle class consumer market. A very good piece of news for the Indian economy is that the great fall in global crude oil prices, 60% in the last six months, has helped to finally tame the long-standing high inflation rate. In particular, the rising prices of food have slowed, which frees up more disposable income for India’s middle classes to spend on other goods and services. The improving optimism of Indian consumers can be evidenced by the following graph showing the recent progress of consumer confidence. (click to enlarge) According to Rachna Nath, head of retail and consumer at PwC India, consumers are still hesitant about making big luxury purchases despite the record values of the index. Consumers are positively bullish because of what the new government is doing right now, but all of them will say that we also need to see it translate on the ground. However, Indians do seem prepared to splash out on some premium fast-moving consumer goods, like foodstuffs, for example. Just a few years ago the Indian market was dominated by basic glucose biscuits. Today, higher-end varieties have grown popular. On the back of better incomes, the overall FMCG market is anticipated to expand at a CAGR of 14.7% to 110.4 billion dollars during 2012 and 2020. By that year, some reports even predict that India will become the world’s third largest middle class consumer market just behind China and the US, which it will likely surpass by the end of the next decade. Probably the best suited ETF for the trends highlighted above is the EGShares India Consumer ETF (NYSEARCA: INCO ), which is designed to track the Indxx India Consumer Index measuring the market performance of 30 Indian consumer sector companies. Since Narendra Modi assumed the office of Prime Minister in late May, the fund has added more than 34%, while two major Indian equity benchmarks, the CNX Nifty and the S&P BSE SENSEX, have gained 20 and 19% respectively. Since the beginning of this year, the fund has yet outperformed both indices by more than 6%. Moreover, most of the time, shares of the fund trade at a modest discount to NAV. Last year, there were 211 out of 252 trading days when the fund’s market price was below the reported net asset value, and this year, there have already been so far 26 such days. Presumably, the most significant INCO’s drawback lies in it’s liquidity as the fund was launched relatively recently and has a little over 52 million dollars assets under management. The picture below displays key statistics of INCO’s portfolio as of 12/31/2014. Source: EGShares India Consumer ETF’s factsheet Over the long-term, the highly inclusive sector of automobiles & parts in INCO should not only benefit from rapidly growing car and two-wheeler manufacturing industry , but also from the intended investments into infrastructure, which can be directly grasped through another ETF – the EGShares India Infrastructure ETF (NYSEARCA: INXX ). Nevertheless, one should be aware that many investors currently perceive these infrastructure projects to have unfavorable risk-reward relationships . On the other hand, it wouldn’t be a mistake to purchase the WisdomTree India Earnings ETF (NYSEARCA: EPI ), iShares MSCI India ETF (BATS: INDA ), iShares S&P India Nifty 50 Index ETF (NASDAQ: INDY ), PowerShares India Portfolio ETF (NYSEARCA: PIN ), or any other ETF, which provides exposure to the broader Indian equity market, as Modi’s reforms concern the economy as a whole. Disclosure: The author is long INCO. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

After Narendra Modi’s political party won the general election in May 2014, the Indian economy set off in a new, promising direction. Favorable demographics and foreign direct investments will be the long-term tailwinds. Tumbling inflation makes consumers more confident in spending. It is estimated that by 2030, India is likely to surpass the USA and China and become the world’s largest consumer market. Economists and investors have turned optimistic about the prospects of the Indian economy since Narendra Modi’s political party won one of the largest elections in the country’s history last May. Before Modi became a Prime Minister, he led one of the fastest growing states in the country, so many people believe his government will be able to push through the most critical reforms to liberalize local industries and revive economic growth. According to the International Monetary Fund, the reform plan of the new Prime Minister is promising, although the key is going to be implementation . In its latest World Economic Outlook, the IMF forecasts that India will grow at 6.3% this year and 6.5% in 2016, when it is likely to overtake China. In contrast to the accelerating Indian economy, the Chinese economy is still projected to struggle with its decelerating growth rate. In 2015, China’s growth rate is expected to slow to 6.8%, while a year ago it reached 7.4%. One should not forget that India is the second most populous country in the world, with over 1.27 billion people (17.5% of the world’s population), and is projected to be the world’s most populous country by 2025. What is more interesting is that more than 50% of the Indian population is below the age of 25, and it is expected that, in 2020, the average age of an Indian will be 29 years, compared to 37 for China and 48 for Japan. This population composition together with Modi’s ambitious ‘ Make in India ‘ program to attract foreign direct investments will undoubtedly support the ongoing rapid expansion of India’s middle class consumer market. A very good piece of news for the Indian economy is that the great fall in global crude oil prices, 60% in the last six months, has helped to finally tame the long-standing high inflation rate. In particular, the rising prices of food have slowed, which frees up more disposable income for India’s middle classes to spend on other goods and services. The improving optimism of Indian consumers can be evidenced by the following graph showing the recent progress of consumer confidence. (click to enlarge) According to Rachna Nath, head of retail and consumer at PwC India, consumers are still hesitant about making big luxury purchases despite the record values of the index. Consumers are positively bullish because of what the new government is doing right now, but all of them will say that we also need to see it translate on the ground. However, Indians do seem prepared to splash out on some premium fast-moving consumer goods, like foodstuffs, for example. Just a few years ago the Indian market was dominated by basic glucose biscuits. Today, higher-end varieties have grown popular. On the back of better incomes, the overall FMCG market is anticipated to expand at a CAGR of 14.7% to 110.4 billion dollars during 2012 and 2020. By that year, some reports even predict that India will become the world’s third largest middle class consumer market just behind China and the US, which it will likely surpass by the end of the next decade. Probably the best suited ETF for the trends highlighted above is the EGShares India Consumer ETF (NYSEARCA: INCO ), which is designed to track the Indxx India Consumer Index measuring the market performance of 30 Indian consumer sector companies. Since Narendra Modi assumed the office of Prime Minister in late May, the fund has added more than 34%, while two major Indian equity benchmarks, the CNX Nifty and the S&P BSE SENSEX, have gained 20 and 19% respectively. Since the beginning of this year, the fund has yet outperformed both indices by more than 6%. Moreover, most of the time, shares of the fund trade at a modest discount to NAV. Last year, there were 211 out of 252 trading days when the fund’s market price was below the reported net asset value, and this year, there have already been so far 26 such days. Presumably, the most significant INCO’s drawback lies in it’s liquidity as the fund was launched relatively recently and has a little over 52 million dollars assets under management. The picture below displays key statistics of INCO’s portfolio as of 12/31/2014. Source: EGShares India Consumer ETF’s factsheet Over the long-term, the highly inclusive sector of automobiles & parts in INCO should not only benefit from rapidly growing car and two-wheeler manufacturing industry , but also from the intended investments into infrastructure, which can be directly grasped through another ETF – the EGShares India Infrastructure ETF (NYSEARCA: INXX ). Nevertheless, one should be aware that many investors currently perceive these infrastructure projects to have unfavorable risk-reward relationships . On the other hand, it wouldn’t be a mistake to purchase the WisdomTree India Earnings ETF (NYSEARCA: EPI ), iShares MSCI India ETF (BATS: INDA ), iShares S&P India Nifty 50 Index ETF (NASDAQ: INDY ), PowerShares India Portfolio ETF (NYSEARCA: PIN ), or any other ETF, which provides exposure to the broader Indian equity market, as Modi’s reforms concern the economy as a whole. Disclosure: The author is long INCO. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News