Scalper1 News

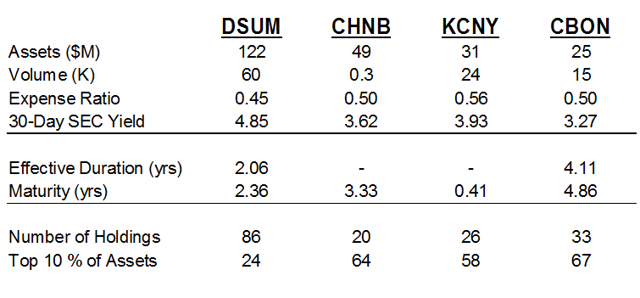

Summary Three new ETFs open up China’s onshore bond market to individual investors. CBON offers a longer duration portfolio and a lower yield due to China’s flat yield curve; CHNB has shorter maturity and higher yield. KCNY has the highest yield and shortest duration of the three new funds, but it still yields less than DSUM, a 3-year-old fund covering the offshore bond market. A small opening in China’s bond market led to a flurry of activity in the ETF world last year, with three Chinese bond ETFs launching in late 2014. These new funds are trying to grab market share from the largest Chinese offshore bond ETF, the PowerShares Chinese Yuan Dim Sum Bond ETF (NYSEARCA: DSUM ), which has faced little competition since its launch in 2011. Dim sum bonds are renminbi-denominated bonds that trade offshore. Issuers are usually Chinese firms, but there are also foreign companies that have issued renminbi bonds, including McDonald’s (NYSE: MCD ). The market for new dim sum bonds has shrunk in 2015 as traders increasingly expect a weaker Chinese yuan. Interest rates on interbank loans using offshore yuan in Hong Kong have tripled from last year while average interest rates on yuan bonds have risen 30 percent. Last year, Chinese government bonds sold at a premium in Hong Kong; this year, they sell at a discount due to investors’ expectations of weaker yuan. Borrowers have been opting for U.S. dollar bonds instead due to lowering borrowing costs. Offshore bond investors are also more wary of Chinese debt given the situation with Chinese developer Kaisa. The firm missed a loan and a bond payment, and recently found a white knight that will rescue it, pending everything goes well. However, the firm still may need to restructure its debt , and offshore bond holders are last in line unable to take the quick legal action available to mainland creditors who have already successfully frozen Kaisa’s assets. The bonds in this case are U.S. dollar denominated, but it highlights the risk for foreign investors who are now demanding higher interest payments. The newer funds, the Global X GF China Bond ETF (NYSEARCA: CHNB ), the KraneShares E Fund China Commercial Paper ETF (NYSEARCA: KCNY ), and the Market Vectors ChinaAMC China Bond ETF (NYSEARCA: CBON ), all offer exposure to onshore bonds traded on mainland exchanges in China. While the funds offer direct access, it comes through partnering with firms that are RQFII (renminbi-qualified foreign institutional investors). Most likely, China will open its markets faster than these funds attract assets, but if not, it’s possible the funds could run into quota limits. All three firms use sub-advisors: GF International, China AMC, and E Fund, as noted in the funds’ names. The Chinese bond market is not completely open to foreign investors yet, and the number of securities available to these funds is limited. All three have more than 50 percent of assets in the top 10 holdings and the number of holdings ranges from 20 to 33, an extremely small number for a bond fund. Here’s more data from the provider websites: DSUM , KCNY , CBON , CHNB . (click to enlarge) Currently, the main risk faced by these bonds is credit risk and depreciation in the Chinese yuan. The Chinese currency is effectively pegged to the U.S. dollar, and official policy is to maintain a stable currency. Nevertheless, each time China’s forex reserves have fallen, the currency has weakened. Chinese reserves peaked in June of last year and pressure on the yuan has been rising as Chinese investors increasingly move capital abroad, thanks in part to reforms that have opened up the financial system. Chinese investors swap yuan for dollars and invest abroad, causing the yuan to drop. They are also swapping yuan for dollars and immediately buying yuan in Hong Kong because the offshore yuan is cheaper. This arbitrage also causes the forex reserves of China to decline. Tight credit conditions in China have pushed yields higher on many forms of debt, as has been seen in the dim sum bond market. The People’s Bank of China (PBOC) might lower interest rates this year to help the slowing Chinese economy, a widely expected move following weaker-than-expected trade data from January. A cut in interest rates would be good news for bond investors hoping for capital gains, but it could also increase the depreciation pressure on the yuan. As for credit risk, all three of the onshore funds hold state-owned and government debt unlikely to default. Conclusion This doesn’t appear to be the best time to buy Chinese debt, but for investors who are long-term bullish on China and the yuan, these are funds to keep an eye on. All three could be winners in the long run as China opens its capital account and the yuan plays a larger role in global finance. Investors who expect a rising or stable yuan in the near term should consider the funds right now since the PBOC might ease as soon as March and these funds could see capital gains as yields decline. For investors interested in liquidity and yield, DSUM is the best choice. It’s diversified, yields nearly 5 percent, and shares are actively traded. For investors who want to bet on a cut in rates, the higher-duration CBON is a better choice. Shares aren’t as heavily traded, so investors need to watch the bid/ask spread and deviation from NAV. From a risk/reward perspective, KCNY appears the best bet as it holds short-term commercial paper. China’s yield curve is flat at the moment, and investors can receive a relatively high yield for such a low-duration portfolio. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Three new ETFs open up China’s onshore bond market to individual investors. CBON offers a longer duration portfolio and a lower yield due to China’s flat yield curve; CHNB has shorter maturity and higher yield. KCNY has the highest yield and shortest duration of the three new funds, but it still yields less than DSUM, a 3-year-old fund covering the offshore bond market. A small opening in China’s bond market led to a flurry of activity in the ETF world last year, with three Chinese bond ETFs launching in late 2014. These new funds are trying to grab market share from the largest Chinese offshore bond ETF, the PowerShares Chinese Yuan Dim Sum Bond ETF (NYSEARCA: DSUM ), which has faced little competition since its launch in 2011. Dim sum bonds are renminbi-denominated bonds that trade offshore. Issuers are usually Chinese firms, but there are also foreign companies that have issued renminbi bonds, including McDonald’s (NYSE: MCD ). The market for new dim sum bonds has shrunk in 2015 as traders increasingly expect a weaker Chinese yuan. Interest rates on interbank loans using offshore yuan in Hong Kong have tripled from last year while average interest rates on yuan bonds have risen 30 percent. Last year, Chinese government bonds sold at a premium in Hong Kong; this year, they sell at a discount due to investors’ expectations of weaker yuan. Borrowers have been opting for U.S. dollar bonds instead due to lowering borrowing costs. Offshore bond investors are also more wary of Chinese debt given the situation with Chinese developer Kaisa. The firm missed a loan and a bond payment, and recently found a white knight that will rescue it, pending everything goes well. However, the firm still may need to restructure its debt , and offshore bond holders are last in line unable to take the quick legal action available to mainland creditors who have already successfully frozen Kaisa’s assets. The bonds in this case are U.S. dollar denominated, but it highlights the risk for foreign investors who are now demanding higher interest payments. The newer funds, the Global X GF China Bond ETF (NYSEARCA: CHNB ), the KraneShares E Fund China Commercial Paper ETF (NYSEARCA: KCNY ), and the Market Vectors ChinaAMC China Bond ETF (NYSEARCA: CBON ), all offer exposure to onshore bonds traded on mainland exchanges in China. While the funds offer direct access, it comes through partnering with firms that are RQFII (renminbi-qualified foreign institutional investors). Most likely, China will open its markets faster than these funds attract assets, but if not, it’s possible the funds could run into quota limits. All three firms use sub-advisors: GF International, China AMC, and E Fund, as noted in the funds’ names. The Chinese bond market is not completely open to foreign investors yet, and the number of securities available to these funds is limited. All three have more than 50 percent of assets in the top 10 holdings and the number of holdings ranges from 20 to 33, an extremely small number for a bond fund. Here’s more data from the provider websites: DSUM , KCNY , CBON , CHNB . (click to enlarge) Currently, the main risk faced by these bonds is credit risk and depreciation in the Chinese yuan. The Chinese currency is effectively pegged to the U.S. dollar, and official policy is to maintain a stable currency. Nevertheless, each time China’s forex reserves have fallen, the currency has weakened. Chinese reserves peaked in June of last year and pressure on the yuan has been rising as Chinese investors increasingly move capital abroad, thanks in part to reforms that have opened up the financial system. Chinese investors swap yuan for dollars and invest abroad, causing the yuan to drop. They are also swapping yuan for dollars and immediately buying yuan in Hong Kong because the offshore yuan is cheaper. This arbitrage also causes the forex reserves of China to decline. Tight credit conditions in China have pushed yields higher on many forms of debt, as has been seen in the dim sum bond market. The People’s Bank of China (PBOC) might lower interest rates this year to help the slowing Chinese economy, a widely expected move following weaker-than-expected trade data from January. A cut in interest rates would be good news for bond investors hoping for capital gains, but it could also increase the depreciation pressure on the yuan. As for credit risk, all three of the onshore funds hold state-owned and government debt unlikely to default. Conclusion This doesn’t appear to be the best time to buy Chinese debt, but for investors who are long-term bullish on China and the yuan, these are funds to keep an eye on. All three could be winners in the long run as China opens its capital account and the yuan plays a larger role in global finance. Investors who expect a rising or stable yuan in the near term should consider the funds right now since the PBOC might ease as soon as March and these funds could see capital gains as yields decline. For investors interested in liquidity and yield, DSUM is the best choice. It’s diversified, yields nearly 5 percent, and shares are actively traded. For investors who want to bet on a cut in rates, the higher-duration CBON is a better choice. Shares aren’t as heavily traded, so investors need to watch the bid/ask spread and deviation from NAV. From a risk/reward perspective, KCNY appears the best bet as it holds short-term commercial paper. China’s yield curve is flat at the moment, and investors can receive a relatively high yield for such a low-duration portfolio. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News