Best Performing Vanguard Mutual Funds Of Q2 2015

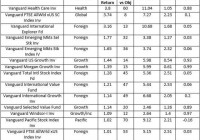

The second quarter performance will surely be the one that Vanguard would love to forget. While the best gain in the quarter rose to 15.9%, Vanguard’s top gain in the second quarter was just 3.8%. Vanguard’s top quarterly gain lagged its peers like Fidelity, BlackRock (NYSE: BLK ), Wells Fargo (NYSE: WFC ) and American Funds to name a few. Vanguard’s lackluster performance does reflect the dismal second quarter that the markets endured. Amid high volatility, the Dow failed to end in the green in the first half of 2015 while S&P 500 managed to gain just 0.2%. The Dow was the only benchmark in the first quarter to end in the red, but S&P 500 joined the blue-chip index in negative territory in the second quarter. The S&P 500 thus ended its nine-quarter winning trend, but the Nasdaq managed to extend its winning streak to 10 quarters. It was tough period for mutual funds. Only four of the mutual fund categories could post above a 10% gain in the first half. This is less than half of the 81% gains scored by mutual funds in the first quarter. These losses however owed a lot to the selloff on the eve of the quarter’s end. Of the 257 funds under the study, 156 funds ended in negative territory. The magnitude of the loss was higher compared to the gains. Simple average calculation revealed that while 101 funds gained an average 0.8%, the average loss for 156 funds was about 1.8%. Vanguard’s Q2, Lags Q1 Performance Vanguard’s second quarter performance also compares unfavorably with the gains in first quarter. In the first quarter, the Vanguard Pacific Stock Index Fund (MUTF: VPACX ) returned 8% and was the top gainer. VPACX had then managed to beat the broader Diversified Pacific/Asia’s first quarter return of 7.4%. In fact if we look at the top 15 gainers in first quarter, the minimum gain of 4.7% is higher than the best gain of second quarter. The average gain of 5.9% for the top 15 funds in first quarter has this time dropped to Vanguard is among the world’s largest mutual fund companies and has a robust $2.4 trillion invested in the US. Vanguard commenced its business in 1975 and launched the first index mutual fund for individual investors in 1976, named Vanguard 500 Index Fund. According to Morningstar data, Vanguard’s total return in 2015 as of Jun 30 is 2%, just ahead of the category average of 1.9%. Of the total assets, 47% were invested in domestic stocks, 10.1% in international stock, 19% in taxable bond and about 4.4% in municipal bond. For Vanguard, none of the assets carried sales load. Top 15 Performing Vanguard Mutual Funds of Q2 2015 Below we present the top 15 Vanguard mutual funds with the best returns of Q2 2015: (click to enlarge) Note: The list excludes the same funds with different classes, and institutional funds have been excluded. Funds having minimum initial investment above $5000 have been excluded. Q2 % Rank vs Objective* equals the percentage the fund falls among its peers. Here, 1 being the best and 99 being the worst. As evident, the Foreign category dominated the top 15 gainers’ list. This is justified given the fact that the Foreign category of mutual funds dominated the gains in the second quarter and the overall first half of 2015 as well. While Japan Stock funds led the gains till the end of the second quarter, Health and China followed next. The top 10 list for categories is also dominated by the foreign funds as apart from Japan and China, Diversified Pacific/Asia, Foreign Small/Mid Growth, Foreign Small/Mid Blend, Foreign Small/Mid Value and Foreign Large Growth all featured in the list. Europe Stock ranked 9 th in the 10 list. So, it was no surprise to have the Vanguard Health Care Fund (MUTF: VGHCX ) to be the top performer of Q2 for Vanguard funds. This Zacks Mutual Fund Rank #4 (Sell) was then followed by the Vanguard FTSE All-World ex-US Small Capital Index Fund (MUTF: VFSVX ) , the Vanguard International Explorer Fund (MUTF: VINEX ) , the Vanguard Emerging Markets Select Stock Fund (MUTF: VMMSX ) and the Vanguard Emerging Markets Stock Index Fund (MUTF: VEIEX ) . All of these funds are from the Global/Foreign category. While VMMSX also carries a Sell rank, VINEX and VFSVX carry a Zacks Mutual Fund Rank #1 (Strong Buy), VEIEX holds a Zacks Mutual Fund Rank #3 (Hold). Separately, the Vanguard International Growth Fund (MUTF: VWIGX ) , again from the Foreign category, carried a Zacks Mutual Fund Rank #2 (Buy). A total of 10 funds in the list belonged to Foreign, Global, Pacific or European category. Apart from Health, Growth and Growth/Income joined the list. Growth funds such as the V anguard U.S. Growth Portfolio (MUTF: VWUSX ) , the Vanguard Morgan Growth Fund (MUTF: VMRGX ) , the Vanguard Selected Value Fund (MUTF: VASVX ) and the Vanguard Windsor Fund (MUTF: VWNDX ) made it to the list. Here, VWUSX, VMRGX and VWNDX carry a Strong Buy rank, VASVX has a Zacks Mutual Fund Rank #3. Vanguard is definitely looking for an improved third quarter. John Hollyer, the head of global risk management at Vanguard, stated that the biggest risk for the capital markets is rising rates. Link to the original article on Zacks.com