The ETF Monkey Vanguard Core Portfolio: Weathering The Storm And A Rebalance

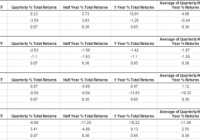

Summary Since the inception of the model portfolio on 6/30/15, the markets have endured a turbulent period, with all 3 major U.S. averages in correction territory. The situation with foreign stocks, particularly those of emerging markets, has been even worse. In this article, we will evaluate both how the portfolio has held up and what lessons can be learned. I will also rebalance the portfolio for the first time, both explaining the rationale and assessing the cost of doing so. Back on July 1, I wrote an article presenting the ETF Monkey Vanguard Core Portfolio . Readers unfamiliar with the article may wish to review it before proceeding further. However, I will offer a quick summary here. That article linked to three previous articles I had written featuring suggested “core” Vanguard ETFs for Domestic Stocks, Bonds, and Foreign Stocks, as follows: Vanguard Total Stock Market ETF (NYSEARCA: VTI ) Vanguard FTSE All-World ex-U.S. ETF (NYSEARCA: VEU ) Vanguard Total Bond Market ETF (NYSEARCA: BND ) I next reviewed various Vanguard target-date funds to offer suggested weightings for various age groups, based on professionally-designed portfolios. Finally, I selected one of those age groups and built a theoretical $50,000 portfolio, developing it via an Excel spreadsheet and tracking it on Google Finance. The model portfolio was “purchased” as of the closing price of the three ETFs on June 30, 2015. As a reference point to evaluate the overall performance of the portfolio, the S&P 500 index closed that day at 2,063.11. I had not planned to write a follow-up article until the end of the 3rd quarter, using 9/30/15 as my point of comparison. That, however, was before the extreme turmoil that hit the markets during August. Emerging markets, led by China, dropped precipitously. In turn, this led to a sharp drop in U.S. markets culminating on 8/24/15, with a 1,000+ point drop in the Dow at the open and the day ending with all 3 major U.S. averages in correction territory. The S&P 500 closed the day at 1,893.21, 8.24% lower than the reference point for my model portfolio. Evaluating the ETF Monkey Vanguard Core Portfolio So how did the portfolio perform over that period? Here’s a picture of the Google Finance page for the portfolio as of the close on 8/24/15. Have a look, and then I will offer a few comments. (click to enlarge) First, the portfolio received two dividends totaling $34.88 from BND between 6/30 and 8/24, raising our original cash balance of $24.65 after all purchases to the current $59.53. Overall the portfolio decreased by 7.79%, a decrease of .45% less than the S&P 500 index. Let’s break that down. Domestic Stocks – VTI, which comprised 55.67% of our starting portfolio, decreased by 8.34%, roughly equal with the S&P 500. Remembering that we incurred a $7.95 commission to purchase the ETF, this is basically market performance. Foreign Stocks – VEU, which comprised 27.20% of our starting portfolio, decreased by 12.08%. VEU is approximately 19% in emerging markets, including a 5.4% weighting in China. This ETF was hit especially hard by the extreme weakness in those markets since 6/30. Bonds – BND, which comprised 17.08% of our starting portfolio, actually increased by .84%, providing some much-needed stability. Including the dividends, we have actually earned a return of 1.25% to-date. This is notable given the supposedly bad timing to be in bonds, in view of the “inevitable” rise in interest rates. I might note that, because I strictly followed the Vanguard target-date weightings, the portfolio basically held no cash. At the time the portfolio was built, many commentators suggested holding at least a modest percentage in cash. Clearly, a cash cushion would have been helpful in the short term. Overall, however, I am satisfied with the results. During a particularly turbulent stretch in emerging markets–and with no cash cushion–the portfolio has done a little better than the S&P 500. Actively Rebalancing the Portfolio However, this leads nicely to our next topic, that of periodically rebalancing a portfolio to stay true to one’s investment goals. Here are the same values displayed in the Google Finance picture shown above, but moved into Excel to allow for a little analysis. (click to enlarge) Here is what I want you to notice: Our domestic stock allocation is still very close to our target. At 55.27%, it is a mere .23% off our target of 55.50%. In terms of dollars, it is only $106.73 away from the desired target when evaluated against our overall (though lower) portfolio balance. If you think about this intuitively, it makes sense. Although VTI has decreased in value by 8.34%, our overall portfolio has declined by 7.79%. As a result, our relative weighting in VTI has barely moved. VEU and BND, however, are another story. VEU has declined by a particularly brutal 12.08%, while BND has actually increased slightly in value. As a result, VEU is now underweight by 1.06% (25.94% vs. our target of 27.00%). In contrast, BND is overweight by 1.16% (18.66% vs. our target of 17.50%). Based on this, I executed two trades to rebalance our portfolio, as follows: I sold 5 shares of BND at $82.02, generating $402.15 in cash ($410.10 – $7.95 commission). I bought 10 shares of VEU at $42.77, spending $435.65 ($427.70 + $7.95 commission). Here’s how the portfolio looks now: (click to enlarge) You will notice that our cash balance has dropped by $33.50, the net of the two transactions. You will also notice that our overall portfolio value has dropped by $15.90, the total amount of the commissions to execute the two transactions. This is a graphic representation of the concept that, unless one can trade commission-free, all rebalancing transactions do take their toll on our total return. NOTE: In the “real world,” I probably would not have executed a rebalancing transaction for such a small dollar amount unless I could have done it commission-free. With a portfolio of this size, I likely would have waited until I was $1,000 – $1,500 out of balance before doing anything. However, I felt that this was a good time to do this as a learning exercise. Summary and Conclusion So there you have it, the first performance update and rebalancing of the ETF Monkey Vanguard Core Portfolio. Here are my three takeaways from this period: Overall, I was happy with the performance of the portfolio. During a period of severe market turmoil in both domestic and foreign stocks, particularly in the emerging markets, the portfolio held up reasonably well. There are benefits to being properly diversified in various asset classes, even those that are supposedly out of favor. In the case of BND, not only did it offer some stability during this turbulent period, it even provided funds to rebalance into a beaten down asset class, foreign stocks. That it is beneficial to actively rebalance the portfolio when one or more asset classes vary greatly from the desired weighting. However, one must be mindful of the costs involved and act accordingly. Happy investing! Disclosure: I am/we are long VTI, BND, VEU. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: I am not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes, and to consult with their personal tax or financial advisors as to its applicability to their circumstances. Investing involves risk, including the loss of principal.