New Backtests For ETFReplay Portfolio

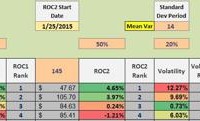

Independent research, long/short equity, dividend investing, ETF investing “}); $$(‘#article_top_info .info_content div’)[0].insert({bottom: $(‘mover’)}); } $(‘article_top_info’).addClassName(test_version); } SeekingAlpha.Initializer.onDOMLoad(function(){ setEvents();}); I am frequently asked about various strategy and portfolio performance metrics and backtests. A reader recently asked if there are any current backtests for the ETFReplay 6/3/3 Portfolio so I decided now is the appropriate time to provide updated results. The strategy background is available here and is updated monthly on Scott’s Investments , including a real-time simulated portfolio spreadsheet here . The ETFReplay portfolio is also provided free to subscribers of Portfolio123 , simply search “ETFReplay” in the Ready-to-Go Portfolio section. The backtested results below are hypothetical and do not account for commissions or taxes, so real results would be lower. The first test was conducted using ETFReplay.com , the initial inspiration for the portfolio. The backtest invests in the Screener’s picks on the close of the first day of the next period. Picks are updated monthly and the top 4 ETFs are purchased/held. ETFs must also be ranked above the iShares 1-3 Year Treasury Bond ETF (NYSEARCA: SHY ) in order to qualify for purchase. This test is nearly identical to the 6/3/3 system I update each month with the exception that the test does not require ETFs drop out of the top 5 before being sold. This was a qualification I added to the strategy to limit turnover. The benchmark for the test is the Vanguard Balanced Index Fund Inv ( VBINX): (click to enlarge) (click to enlarge) The strategy has performed well in total, but has lagged a 60/40 benchmark in the last 3+ years. The Pure Momentum ETFReplay Portfolio was added to my monthly updates in 2014. It purchases 4 ETFs each month based on 6 month returns, and has no cash filter. Backtested returns are below: (click to enlarge) (click to enlarge) We see similarly strong early results, with returns lagging versus the 60/40 benchmark the past 2+ years. Disclosures: None Share this article with a colleague