CVY Brings Equities And Bonds To Create A Balanced Portfolio

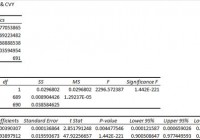

Summary I’m taking a look at CVY as a candidate for inclusion in my ETF portfolio. I like the idea behind the ETF, but I’m not sold on using it over the portfolios I can create myself. The yields on the ETF are extremely high which may make it more appealing for retiring investors seeking income without touching their portfolios. The overall risk level isn’t bad at all, though the returns have been fairly moderate through my testing period. Investors should be seeking to improve their risk adjusted returns. I’m a big fan of using ETFs to achieve the risk adjusted returns relative to the portfolios that a normal investor can generate for themselves after trading costs. I’m working on building a new portfolio and I’m going to be analyzing several of the ETFs that I am considering for my personal portfolio. A substantial portion of my analysis will use modern portfolio theory, so my goal is to find ways to minimize costs while achieving diversification to reduce my risk level. In this article I’m reviewing the Guggenheim Multi-Asset Income ETF (NYSEARCA: CVY ). What does CVY do? CVY attempts to track the investment results of an index Zack’s Multi-Asset Income Index. The ETF falls under the category of “Large Value.” Does CVY provide diversification benefits to a portfolio? Each investor may hold a different portfolio, but I use the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) as the basis for my analysis. I believe SPY, or another large cap U.S. fund with similar properties, represents the reasonable first step for many investors designing an ETF portfolio. Therefore, I start my diversification analysis by seeing how it works with SPY. I start with an ANOVA table: (click to enlarge) The correlation is about 88%, which is low enough that I’m expecting to see some diversification benefits, but higher than I would like to see for having a unique tracking index. Standard deviation of daily returns (dividend adjusted, measured since January 2012) The standard deviation is going to make a stronger case for investing in CVY. For the period I’ve chosen, the standard deviation of daily returns was .698 %. For SPY, it was 0.748% over the same period. This may be a benefit of the mixed assets that the ETF is holding. Mixing it with SPY I also run comparison on the standard deviation of daily returns for the portfolio assuming that the portfolio is combined with the S&P 500. For research, I assume daily rebalancing because it dramatically simplifies the math. With a 50/50 weighting in a portfolio holding only SPY and CVY, the standard deviation of daily returns across the entire portfolio is 0.701%. The risk level on the portfolio drops relative to only holding SPY because of both the lower deviation from CVY and the correlation. Based solely on this information, it would appear an investor thinking about going all in on CVY could put about half in SPY and retain a similar risk level as long as the risk is measured in the daily volatility. If the position in SPY is raised to 80% while CVY is used at 20% the standard deviation of daily returns increases to .724%. At 5%, the standard deviation of the portfolio would have been 0.741%. If an investor was basing their decision solely on risk level, there could be significant incentives to using a large position in a relatively stable ETF like CVY. However, CVY has substantially underperformed SPY in the period, and I would expect that to be a long term trend because of the less aggressive portfolio that CVY is holding. Why I use standard deviation of daily returns I don’t believe historical returns have predictive power for future returns, but I do believe historical values for standard deviations of returns relative to other ETFs have some predictive power on future risks and correlations. While poor liquidity could impact the reliability of statistics, the ETF had 0 days with no trading volume, so price movements should be recorded as they happened. The average volume is currently around 330,000 shares per day. Yield & Taxes The distribution yield is 6.40%. It is a fairly massive yield, which may be an attractive factor for retirees hoping to live off the distributions. The high distributions will limit the growth rate of the investment in the fund, but for retirees that are concerned about overreacting to movements in the market, a high distribution ETF with lower volatility makes sense. Expense Ratio The ETF is posting .84% for a net expense ratio and .89% for the gross ratio, which is higher than I’d like to see. Unfortunately, most ETFs have expense ratios higher than I’d like to see. There may be some legitimate reasons for a high expense ratio, but I find ETFs with lower expense ratios to be substantially more attractive. One of the reasons I’m overhauling my portfolio is to get away from funds that have higher expense ratios. Market to NAV The ETF is trading at a .18% discount to NAV currently. I think any ETF is significantly less attractive when it trades above NAV. The discount looks very nice, but the discount is also less than one fourth of the annual expense ratio. In that context, the discount becomes less attractive as a feature of total return for a long term investor. Largest Holdings The diversification within the holdings is substantial. Due to the combination of equities and other funds included in the profile, I’ve prepared two charts for the holdings. The first shows the equity holdings and the second shows the other funds. (click to enlarge) (click to enlarge) Investing in the ETF is largely relying on modern portfolio theory. Making an investment requires a belief that markets are at least somewhat efficient so that the companies within the portfolio will be reasonably priced. Conclusion I love the idea of a diversified ETF that can deliver everything investors are seeking within a single ETF. However, I’d rather go with SPY (or an equivalent) and just eliminate the bond position entirely if I had to pick only one ETF. The lower standard deviation is great, but I think I can reach that point by composing a portfolio with individual selections of ETFs. The portfolio’s expense ratio can be justified, at least to some extent, by the excellent internal diversification and the very high turnover ratio. That turnover ratio is currently listed at 180%. Even though I don’t like high turnover ratios, I recognize that they do create more costs in running the ETF. I’m looking for a simple and stable ETF. While this one offers an appealing combination of lower standard deviation and moderate correlation, I don’t feel that the selection represents a superior position to what I can create. That’s the problem in a nutshell. The ETF did a solid job of diversifying, but it doesn’t seem to be a suitable replacement for an entire portfolio compared with just holding something like SPY. If an investor intends to hold several ETFs rather than one, then they can build the portfolio to their exact risk specifications. This ETF may be a great fit for any investors that want the exact risk factors the ETF has selected. The large yields and strong volumes may make the ETF much more appealing for retiring investors seeking strong yields for current income. For me, those benefits simply aren’t enough. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. The analyst holds a diversified portfolio including mutual funds or index funds which may include a small long exposure to the stock.