NRG Energy – Adding Value With A Business Restructuring

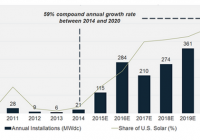

Summary NRG Energy’s dream of building one of the first integrated fossil fuel and clean energy businesses will go unfulfilled. NRG Energy plans to spit off its clean energy business in a few months time, forming what will be known as “GreenCo.”. While the fossil fuel and clean energy business have many synergies, a separation of these two businesses is likely more viable in the current investment atmosphere. NRG Energy’s clean energy business will have to compete with ultra-competitive solar companies as a standalone company, which could prove to be a large obstacle. Over the past few years, NRG Energy (NYSE: NRG ) has stood out in its attempt to become the first major integrated fossil fuel and renewable energy company. While the company has successfully integrated these two businesses to some extent, there have been many obstacles that have limited NRG Energy’s overall success in this endeavor. There are many aspects of the distributed solar business, in particular, that do not mix well with the traditional fossil fuel power business. While these two businesses are not at odds in theory, the relatively unproven distributed solar business has made investors wary. As such, the company decided to split off its clean energy business into what will be known as “GreenCo.” Here is a chart explaining why NRG Energy is planning to split off its clean energy business. (click to enlarge) Source: NRG Energy Integration Problems NRG Energy’s plan to integrate a large clean energy business was not flawed in theory. NRG Energy could use the comparatively vast resources from its fossil fuel business to help catalyze its burgeoning clean energy business. This would put the company at a financial advantage against pure play clean energy companies like Vivint Solar (NYSE: VSLR ). However, the downsides associated with such integration seem to be outweighing the benefits. One of the main problems with this strategy is that fossil fuel and clean energy investors are generally of different mindsets. Fossil fuel investors are usually more interested in more stable businesses, whereas clean energy investors are more interested in growth. While NRG Energy’s clean energy business has enormous growth potential, many fossil fuel investors are likely off-put by the segment’s more risky nature. On the flip side, many clean energy investors are likely put-off by NRG Energy’s relatively low growth fossil fuel business. While there are indeed many investors that find the combination of businesses attractive, it seems as if separating these two businesses would attract more investors on balance. In addition, both the fossil fuel and clean energy businesses require a huge amount of attention. Pure-play distributed solar companies like SolarCity (NASDAQ: SCTY ) already have their hands full just managing their specific businesses. In NRG Energy’s case, distributed solar is just one segment in a larger business portfolio. It is unlikely that the company would be able to invest the optimal amount of time and energy into all of its businesses. While many synergies certainly do exist in NRG Energy’s fossil fuel and clean energy businesses, it seems as though separating the businesses would unlock more value due to the combination of current investor sentiment and limited attention/resources. Pure-Play Approach NRG Energy’s pure-play approach will likely attract more investors over the long-run. However, this also means that its renewable spin-off will be competing against the likes of SolarCity, Vivint Solar, etc, with much less assistance. The big financial advantage of NRG Energy’s clean energy businesses will mostly disappear once the company is spun-off from its fossil fuels business(NRG Energy is planning to give the GreenCo a financial limit of $125M in 2016). With that being said, NRG Energy’s clean energy business is still doing relatively well, and will likely succeed even without the help of the company’s main business. NRG Energy believes that there is ~$1B that can be unlocked by spinning off its clean energy business, which could very well be true given the benefits of separation. As investors will likely favor this strategy, as was mentioned before, NRG Energy is likely going down the correct path. Shareholders should benefit from the company’s planned pure-play approach, especially given the increasing complexities of the clean energy business. While CEO David Crane’s integrated energy plan was sound in principle, it may have been too early to implement this as investors have not fully committed to the idea. Obstacles While there are definitely many positives associated with a clean energy spin-off, the company could find it difficult to adjust as a pure play. Also, the company may have more trouble financing its operations as was mentioned before. Whereas the NRG Energy’s clean energy business currently has an advantage in financing due to its relationship with NRG Energy’s fossil fuel business, this will no longer be the case after the spin-off occurs. Competing against well-established companies like SolarCity and Vivint Solar could prove to be more difficult than expected. Regardless, the distributed solar market in particular is still incredibly underpenetrated, which means that NRG Energy’s GreenCo has great growth opportunities. Conclusion While NRG Energy’s grand plan to integrate massive fossil fuel and clean energy businesses has been derailed, the company is still undervalued at a market capitalization of $5.1B . Given that most of the company’s growth potential lies in its clean energy segment, NRG Energy may no longer be undervalued after it splits off its clean energy business. In theory, the synergies of NRG Energy’s fossil fuel and clean energy business should have outweighed the negatives of such integration. With that being said, investors are still largely uncomfortable with this idea, thus making the planned spin-off a smart decision for shareholders.