Warning Lights Flashing Brightly At REC Silicon ASA

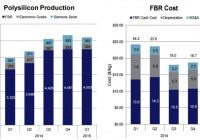

REC Silicon is an industry leading FBR poly vendor but the Q1 results show many red flags. The company’s sales dropped dramatically as the company shipped product into inventory in light of the steep ASP drops in Q1. We discuss why REC Silicon ASA is a stock to avoid. There are three top tier polysilicon manufacturers in the US – Hemlock Semiconductor, Wacker Chemie, and REC Silicon ASA (OTCPK: RNWEF ). While Wacker and Hemlock are part of larger companies, REC Silicon is the only major independent polysilicon company manufacturing polysilicon in the US. The Company, headquartered in Moses Lake, Washington, is listed on the Oslo exchange under the ticker REC. In The US, the Company’s ADS trades under the ticker RNWEF. REC Silicon ASA is a long standing polysilicon manufacturer and has pioneered the low cost polysilicon manufacturing method called Fluidized Bed Reactor, or FBR. It took the Company many years to perfect the FBR process and, in the recent past, the Company has demonstrated one of the lowest cash costs for producing polysilicon. At the current cash cost structure of sub $11 per kg, REC Silicon appears to be second only to DAQO New Energy (NYSE: DQ ) in terms of polysilicon costs. In 2014, the Company reached a joint venture agreement with Youser Group in China to build a FBR polysilicon facility in Yulin, China. While the Company’s FBR leadership and the China JV appears to be good news, recently announced first quarter results do not inspire confidence in the Company’s future. REC Silicon reported abysmal first quarter revenues of $74.4 million, compared to $126.2 million in the previous quarter. EBITDA declined from $38M in Q4 to $24.8 million in Q1. The Company attributed the sales decrease and lower EBITDA to lower sales volumes and lower prices. On the positive side, REC seems to be executing well on the production side (image below) and the Company’s FBR cash production cost continues to come in at sun-$11 per kg. (click to enlarge) However, the production information is one of the few positives to come out of the Company’s earnings call. The Company’s product sales, both in polysilicon and silicon gas sales, have underperformed guidance. In terms of silicon gas sales, the Company claimed that its sales dipped (image below) due to US west coast port slowdown issues. However, given that the port strike has been an ongoing factor for many months, we believe that competitive issues played a larger part in the decline than the Company is willing to admit. In terms of polysilicon sales, the Company claimed that prices ranged from $15 to $18 a kg in the first quarter and the Company decided not to accept business at this low level because it expects polysilicon pricing to firm up during the second half of the year. Readers should note that the Company’s claimed price range is well below that of the $18+ ASP reported by DAQO New Energy in the recent earnings call. While the FBR poly produced by REC Silicon has commanded lower ASPs than Siemens poly that most of the industry produces, the gap between the prices has been increasing in the recent quarters. Instead of selling at the low prices of poly the company saw in Q1, the Company decided to produce and hold its product in inventory. In a stunning development, the Company held about half the product it manufactured in the last quarter in its inventory (see image below). (click to enlarge) Holding this amount of product in inventory has immediate balance sheet implications. The Company’s cash position declined dramatically in the quarter as can be seen in its cash (see image below). Unfortunately, for the Company, polysilicon prices declined further in Q2 compared to Q1. Given its cash position, the Company cannot afford to build further inventory, which implies that the Company will likely end up selling its product at even lower prices than what the Company could have gotten in Q1. Further complicating the financial picture is the forecasted expiration of “process-in-trade” loophole that the Company has been using to export its polysilicon production to China. This loophole appears set to expire in August of this year and the Company is lobbying US Congress and China’s Department of Commerce, MOFCOM, to extend this deadline. If this deadline is not extended, the Company is faced with tariffs as high as 57% which essentially make the Company’s polysilicon sales in China untenable. With about 80% of the Company’s market residing in China, the Company’s business is unlikely to survive such a development. Deciding to hold product in inventory seems to indicate that the Company is optimistic about its prospects in extending the deadline or having the tariffs reduced but we consider this a risky bet. Even if the Company is able to get a favorable decision in terms of this tariff, new polysilicon production coming online (see image below) in 2015 is likely to put a cap on the upside to ASP improvements in the second half of the year. Given these capacity improvements, and given the discount that FBR poly is trading compared to Siemens poly, we think it is likely that the Company’s ASP in 2015 may not exceed the $15-$18 level the Company witnessed in the first quarter. This level of pricing can put considerable burden on the Company’s P&L and dramatically impact the Company’s future. While the Company does not have any major debts becoming due in the near term (see image below), we find the Company’s near-term future tenuous at best. Given the likely low polysilicon prices, impending new capacity, FBR poly price discount, and the Company’s cash position, investors in the Company may be looking at an abyss. Our View on RNWEF: Avoid. Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks. Disclosure: The author is long DQ. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.