Best And Worst: Small Cap Value ETFs, Mutual Funds And Key Holdings

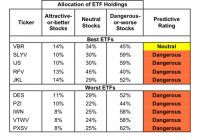

Summary Small Cap Value ranks 11th in 2Q15. Based on an aggregation of ratings of 16 ETFs and 287 mutual funds. VBR is our top rated Small Cap Value ETF and SPSCX is our top rated Small Cap Value mutual fund. The Small Cap Value style ranks 11th out of the 12 fund styles as detailed in our 2Q15 Style Rankings report . It gets our Dangerous rating, which is based on aggregation of ratings of 16 ETFs and 287 mutual funds in the Small Cap Value style. Figures 1 and 2 show the five best and worst rated ETFs and mutual funds in the style. Not all Small Cap Value style ETFs and mutual funds are created the same. The number of holdings varies widely (from 14 to 1511). This variation creates drastically different investment implications and, therefore, ratings. Investors should not buy any Small Cap Value style ETFs or mutual funds because only one gets an Attractive-or-better rating, but it has below $100 million in total net assets. If you must have exposure to this style, you should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fund fees. Active management has a long history of not paying off. Figure 1: ETFs with the Best & Worst Ratings – Top 5 (click to enlarge) * Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity. Direxion Value Line Small and Mid Cap High Dividend ETF (NYSEARCA: VLSM ) and First Trust Mid Cap Value AlphaDEX ETF (NYSEARCA: FNK ) are excluded from Figure 1 because their total net assets are below $100 million and do not meet our liquidity minimums. Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5 (click to enlarge) * Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity. Vanguard Small-Cap Value ETF (NYSEARCA: VBR ) is the top-rated Small Cap Value ETF and Sterling Capital Behavioral Small Cap Value (MUTF: SPSCX ) is the top-rated Small Cap Value mutual fund. Both earn a Neutral rating. One of our favorite stocks held by VBR is Goodyear Tire and Rubber Company (NASDAQ: GT ). In 2014, Goodyear earned an after-tax operating profit ( NOPAT ) of almost $1.4 billion, its highest ever in our model. Despite a 7% revenue decline, the company’s NOPAT was up over 11% year over year. Longer term, NOPAT has risen by 24% compounded annually since 2009. This is a direct result of cost of sales that declined 26% and SGA that declined 4% from 2011, bringing total expenses down by 21%. All of this expense trimming has raised Goodyear’s after-tax margins to almost 8%, up from 4% in 2012 and its return on invested capital ( ROIC ) from under 6% in 2012 to 9% today. Goodyear Tire was our Stock Pick of the Week several weeks ago. Despite the positive growth of the business, the stock is undervalued. If Goodyear can grow NOPAT by just 1% compounded annually for the next 10 years , the company is worth $37/share – a 19% upside from current levels. It will be difficult for Goodyear to fail to beat expectations as low as these when considering the company’s historical profit growth rate since 2000 is 18% compounded annually. PowerShares Fundamental Pure Small Value Portfolio (NYSEARCA: PXSV ) is the worst rated Small Cap Value ETF and Aston River Road Independent Value Fund (MUTF: ARIVX ) is the worst rated Small Cap Value mutual fund. PXSV earns a Dangerous rating and ARIVX earns a Very Dangerous rating. One of the worst rated stocks held by Small Cap Value funds is Almost Family Inc. (NASDAQ: AFAM ). Almost Family provides home health services throughout the United States. Since 2010, Almost Family’s NOPAT has declined from $32 million to $15 million in 2014, a decline of 17% compounded annually. ROIC has also seen a similar decline, down from 19% to 5% over the same timeframe. Almost Family has also generated negative economic earnings for the past two years. Considering the lack of growth shown above, AFAM is currently overvalued. To justify its current price of $39/share, the company would need to grow NOPAT by 15% compounded annually for the next 11 years . This seems very optimistic given that AFAM’s NOPAT has declined since 2010. Figures 3 and 4 show the rating landscape of all Small Cap Value ETFs and mutual funds. Figure 3: Separating the Best ETFs From the Worst ETFs (click to enlarge) Figure 4: Separating the Best Mutual Funds From the Worst Funds (click to enlarge) Sources Figures 1-4: New Constructs, LLC and company filings Disclosure: David Trainer and Allen L. Jackson receive no compensation to write about any specific stock, style, style or theme. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.