Pair Trading Opportunity – AGL Resources And Piedmont Natural Gas

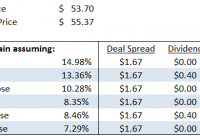

Summary Two deals in the same sector with similar conditions and similar payment methods — the perfect situation for implementing a pair trading strategy. Because of regulation, this will be a very long process. So the pair trading strategy is more profitable than a classic merger arbitrage. In my opinion, if the authorities block one of the transactions the other merger will automatically have a lot problems. This risk should be hedged. I have to admit it: I hate mergers with a lot of regulatory conditions and economic intervention . I’m not a lawyer, so I’m not an expert in terms and conditions and I avoid these transactions. However, we can sometimes see very good opportunities in the M&A markets because of similar deals pursuant to the same antitrust approvals. On Aug. 24, 2015, Southern Company (NYSE: SO ) and AGL Resources (NYSE: GAS ) announced a merger agreement. Sometime later, on Oct. 26, 2015, Duke Energy (NYSE: DUK ) and Piedmont Natural Gas (NYSE: PNY ) approved another merger agreement with similar terms and conditions. Both transactions will be paid in cash, and their size is comparable: $12 billion and $6.7 billion, respectively. In this article, I will only assess the terms and conditions of both mergers. If you want to understand more about the financial performance of the companies, check our these articles: Buyers Duke is the largest electric utility in the United States. It serves 7.3 million customers, located in the Southeast and Midwest. It has an enterprise value of $88.01 billion and $1.38 billion cash on the balance sheet; its ROA is 2.83%. You can check some more numbers here. Source: I nvestor Presentation . It is a mature company, with an interesting dividend yield as well as a high payout ratio: Source: Investor Presentation. You can only see this type of payout ratio in mature industries. Merger arbitrage analysts might say that they like this transaction or not, but the fact is that the sector is in a phase of consolidation and mergers will occur. Southern serves more than 4.5 million customers, and it is the leader in the southeast portion of the United States. It has an enterprise value of $67.48 billion and $1.12 billion in cash; its ROA is 3.74%. You can check some more numbers here. Source: Investor Presentation . I would like to mention that the buyers are very big players. Their size is comparable, and the only difference is that they operate in different areas. The negotiation process with the authorities will be the same. Because of this fact, the merger spread should be similar. Targets and Transitions Benefits Piedmont has one million customers in portions of North Carolina, South Carolina, and Tennessee. It has a better ROA than its acquirer (3.54%), and it is also more than 10 times smaller than Duke. The transaction is an interesting move. Duke’s objective is to enhance its regulated business mix. What’s more, this merger creates a strong platform for future growth. AGL is based in Atlanta. It provides energy services to 5.5 million utility customers (including over one million retail customers served by the SouthStar Energy Services joint venture). Its ROA is 3.84%, which is better than that of the buyer. This transaction is a little better than the other one. It is accretive to ongoing EPS in the first full year, and it will create a strong credit profile. Source: Investor Presentation . Overall, the targets are very similar. It looks like a copied transaction, both in size (“same customer base”) and in value. As mentioned earlier, because of this fact the merger spread should be approximately the same. Terms, Conditions and Timing If you are interested, you can read the merger agreement of Duke’s transaction here and that of Southern here . Both mergers are pursuant to the shareholders’ approval. I did not read about any shareholders complaining about the price paid. So, I’m not worried about these conditions. It is more important, in this case, to assess the regulatory conditions. Southern’s transaction is subject to the following regulatory conditions: – The receipt of antitrust clearance in the United States (Hart-Scott-Rodino Act) – The approval of the FCC – The approval of the California Public Utilities Commission, Georgia Public Service Commission, Illinois Commerce Commission, Maryland Public Service Commission, New Jersey Board of Public Utilities and Virginia State Corporation Commission and other approvals required under applicable state laws. Source: Merger Agreement. Duke’s transaction is subject to the following antitrust conditions: – The receipt of antitrust clearance in the United States (Hart-Scott-Rodino Act) – “The merger is subject to the approval of the NCUC. The Company and Duke Energy expect to file in or around January 2016 a joint application for approval by the NCUC of the merger. Section 62-111(a) of the North Carolina General Statutes provides that no merger or combination affecting a public utility may be made through acquisition or control by stock purchase or otherwise without written approval from the NCUC. Under this statute, such approval shall be given if justified by the public convenience and necessity. The Company is a public utility under North Carolina law and two of Duke Energy’s subsidiaries are also public utilities under North Carolina law. Source: Merger Agreement. I do not think that any merger arbitrageur will tell you the outcome of these mergers. It is a very technical question that you might only be able to answer if you have worked approving mergers for a while. So I would not implement a classic merger arbitrage strategy here. I do not like gambling. The pair trading strategy that I will explain below reduces the exposure to these regulatory risks. Overall, the mergers will take a long time because of these regulatory conditions. Both transactions are said to close in the second quarter of 2016. Pair Trading Strategy and Conclusion Duke will pay $60 per share in cash, so the merger arbitrage spread is 5.24% ($60/$57.01 (close on Dec. 11, 2015) – 1). What’s more, we have to include four quarterly dividends paid by Piedmont (0.33 per share; I included the fourth quarterly dividend of 2015 but not that of 2016). So, the merger contribution is $61.32, and the calculated spread is 7.56% ($61.32/$57.01 – 1). Southern will pay an amount of $66.00 per share in cash, so the merger arbitrage spread is 5.21% ($66/$62.73 (close on Dec. 11, 2015) – 1). However, if we include the four quarterly dividends that AGL distributes (0.51 per shares), the merger contribution becomes $68.04, and the calculated spread is 8.46%($68.04/$62.73 – 1). The most recent evolution of the calculated spread can be seen in the following figure: Source: Maudes Capital. I would like to mention that the spread of both companies is somewhat correlated. It makes sense because of the facts explained above. In the future, the evolution will be similar so that you can perfectly implement a pair trading strategy. Today, I would buy PNY shares, and use the same amount of money to short sell GAS. You can make more than 1% return in a short period of time. The best thing in this idea is that you eliminate the regulatory risk included in both transactions. If one merger does not close, the other merger will have a lot of issues as well, and the spread will be enlarged. This means that you hedge the loss in one merger with the gains in the other transaction. To make a long story short, these transactions have a lot of regulatory conditions, and the classic merger arbitrage strategy is not a good idea. The pair trading strategy provides a better risk/return ratio. What’s more, both mergers are necessary moves in the same sector, and therefore good M&A ideas. I believe that both transactions will close, but I do not like playing with regulatory conditions. So, I prefer to hedge the risk. Note: At the moment there are some other merger arbitrage and pair trading investments like this one — you can read about them here , here , and here .