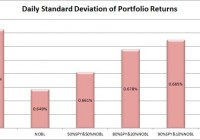

Summary I’m taking a look at NOBL as a candidate for inclusion in my ETF portfolio. For having “Dividend” in the name, the yield isn’t as strong as I expected. The portfolio has been fairly steady, lower deviation of returns than SPY. The expense ratio is my only real concern here, because the gross and net are not the same. I’m hoping the net stays put. I’m not assessing any tax impacts. Investors should check their own situation for tax exposure. How to read this article : If you’re new to my ETF articles, just keep reading. If you have read this intro to my ETF articles before, skip down to the line of asterisks. This section introduces my methodology. By describing my method initially, investors can rapidly process each ETF analysis to gather the most relevant information in a matter of minutes. My goal is to provide investors with immediate access to the data that I feel is most useful in making an investment decision. Some of the information I provide is readily available elsewhere, and some requires running significant analysis that, to my knowledge, is not available for free anywhere else on the internet. My conclusions are also not available anywhere else. What I believe investors should know My analysis relies heavily on Modern Portfolio Theory. Therefore, I will be focused on the statistical implications of including a fund in a portfolio. Since the potential combinations within a portfolio are practically infinite, I begin by eliminating ETFs that appear to be weak relative to the other options. It would be ideal to be able to run simulations across literally billions of combinations, but it is completely impractical. To find ETFs that are worth further consideration I start with statistical analysis. Rather than put readers to sleep, I’ll present the data in charts that only take seconds to process. I include an ANOVA table for readers that want the deeper statistical analysis, but readers that are not able to read the ANOVA table will still be able to understand my entire analysis. I believe there are two methods for investing. Either you should know more than the other people performing analysis so you can make better decisions, or use extensive diversification and math to outperform most investors. Under CAPM (Capital Asset Pricing Model), it is assumed every investor would hold the same optimal portfolio and combine it with the risk free asset to reach their preferred spot on the risk and return curve. Do you know anyone that is holding the exact same portfolio you are? I don’t know of anyone else with exactly my exposure, though I do believe there are some investors that are holding nothing but SPY. In general, I believe most investors hold a portfolio that has dramatically more risk than required to reach their expected (under economics, disregarding their personal expectations) level of returns. In my opinion, every rational investor should be seeking the optimal combination of risk and reward. For any given level of expected reward, there is no economically justifiable reason to take on more risk than is required. However, risk and return can be difficult to explain. Defining “Risk” I believe the best ways to define risk come from statistics. I want to know the standard deviation of the returns on a portfolio. Those returns could be measured daily, weekly, monthly, or annually. Due to limited sample sizes because some of the ETFs are relatively new, I usually begin by using the daily standard deviation. If the ETF performs well enough to stay on my list, the next levels of analysis will become more complex. Ultimately, we probably shouldn’t be concerned about volatility in our portfolio value if the value always bounced back the following day. However, I believe that the vast majority of the time the movement today tells us nothing about the movement tomorrow. While returns don’t dictate future returns, volatility over the previous couple years is a good indicator of volatility in the future unless there is a fundamental change in the market. Defining “Returns” I see return as the increase over time in the value known as “dividend adjusted close”. This value is provided by Yahoo. I won’t focus much on historical returns because I think they are largely useless. I care about the volatility of the returns, but not the actual returns. Predicting returns for a future period by looking at the previous period is akin to placing a poker bet based on the cards you held in the previous round. Defining “Risk Adjusted Returns” Based on my definitions of risk and return, my goal is to maximize returns relative to the amount of risk I experienced. It is easiest to explain with an example: Assume the risk free rate is 2%. Assume SPY is the default portfolio. Then the risk level on SPY is equal to one “unit” of risk. If SPY returns 6%, then the return was 4% for one unit of risk. If a portfolio has 50% of the risk level on SPY and returns 4%, then the portfolios generated 2% in returns for half of one unit of risk. Those two portfolios would be equal in providing risk adjusted returns. Most investors are fueled by greed and focused very heavily on generating returns without sufficient respect for the level of risk. I don’t want to compete directly in that game, so I focus on reducing the risk. If I can eliminate a substantial portion of the risk, then my returns on a risk adjusted basis should be substantially better. Belief about yields I believe a portfolio with a stronger yield is superior to one with a weaker yield if the expected total return and risk is the same. I like strong yields on portfolios because it protects investors from human error. One of the greatest risks to an otherwise intelligent investor is being caught up in the mood of the market and selling low or buying high. When an investor has to manually manage their portfolio, they are putting themselves in the dangerous situation of responding to sensationalistic stories. I believe this is especially true for retiring investors that need money to live on. By having a strong yield on the portfolio it is possible for investors to live off the income as needed without selling any security. This makes it much easier to stick to an intelligently designed plan rather than allowing emotions to dictate poor choices. In the recent crash, investors that sold at the bottom suffered dramatic losses and missed out on substantial gains. Investors that were simply taking the yield on their portfolio were just fine. Investors with automatic rebalancing and an intelligent asset allocation plan were in place to make some attractive gains. Personal situation I have a few retirement accounts already, but I decided to open a new solo 401K so I could put more of my earnings into tax advantaged accounts. After some research, I selected Charles Schwab as my brokerage on the recommendation of another analyst. Under the Schwab plan “ETF OneSource” I am able to trade qualifying ETFs with no commissions. I want to rebalance my portfolio frequently, so I have a strong preference for ETFs that qualify for this plan. Schwab is not providing me with any compensation in any manner for my articles. I have absolutely no other relationship with the brokerage firm. Because this is a new retirement account, I will probably begin with a balance between $9,000 and $11,000. I intend to invest very heavily in ETFs. My other accounts are with different brokerages and invested in different funds. Views on expense ratios Some analysts are heavily opposed to focusing on expense ratios. I don’t think investors should make decisions simply on the expense ratio, but the economic research I have covered supports the premise that overall higher expense ratios within a given category do not result in higher returns and may correlate to lower returns. The required level of statistical proof is fairly significant to determine if the higher ratios are actually causing lower returns. I believe the underlying assets, and thus Net Asset Value, should drive the price of the ETF. However, attempting to predict the price movements of every stock within an ETF would be a very difficult and time consuming job. By the time we want to compare several ETFs, one full time analyst would be unable to adequately cover every company. On the other hand, the expense ratio is the only thing I believe investors can truly be certain of prior to buying the ETF. Taxes I am not a CPA or CFP. I will not be assessing tax impacts. Investors needing help with tax considerations should consult a qualified professional that can assist them with their individual situation. The rest of this article By disclosing my views and process at the top of the article, I will be able to rapidly present data, analysis, and my opinion without having to explain the rationale behind how I reached each decision. The rest of the report begins below: ******** (NYSEARCA: NOBL ): ProShares S&P 500 Dividend Aristocrats ETF Tracking Index: S&P 500 Dividend Aristocrats Index Allocation of Assets: At least 80% (under normal circumstances) Morningstar Category: Large Blend Time period starts: November 2013 Time period ends: December 2014 Portfolio Std. Deviation Chart: (click to enlarge) (click to enlarge) Correlation: 94.40% Returns over the sample period: (click to enlarge) Liquidity (Average shares/day over last 10): Around 178,000 Days with no change in dividend adjusted close: 5 Days with no change in dividend adjusted close for SPY: 0 Yield: 1.6% Distribution Yield Expense Ratio: .35% Net and .70% Gross Discount or Premium to NAV: .08% premium Holdings: (click to enlarge) Further Consideration: Yes Conclusion: For a dividend yield ETF, the yield was lower than I expected. However, the ETF has very strong liquidity which reinforces the correlation. While I’d love to see lower levels of correlation, I don’t expect to see low levels in an ETF designed to invest in several large dividend companies. The cross over between SPY and NOBL is going force correlation to be fairly high. ETF investors may be more impressed with the lower standard deviation of returns. The 5 days in which dividend adjusted close didn’t change were not reflecting any liquidity problems, as volume was not 0 for any of the days in my sample. The Net expense ratio isn’t bad, but I would want to look into provisions that would keep it from increasing. At a .35% net expense ratio I’m interested, but if that were to climb, my interest level would fade pretty rapidly. I have no problem with the holdings, though I prefer a little more diversification. I can’t complain too much though with the positions being around 2%. The standard deviation of returns was fairly interesting to me given how the stock ended up with almost exactly the same gains as SPY and very high correlation. I put together a little bit of theory on that in the section below. Be warned, it’s written for people that are already familiar with statistics and enjoy the theory. I put it after the conclusion because I believe it will confuse many readers and the information is not necessary to understand my analysis. For the statistics lovers The stock trades at around $50.00 rather than around $200 for SPY. The lower share price means smaller deviations in value (by fractions of a cent) may be rounded down to nothing. This could result in a slightly lower standard deviation of returns. Some readers thinking about the bell curve may recognize that this could be a double edged sword for the standard deviation. While rounding towards the mean would reduce the standard deviation, when the scale tips in the other direction the rounding could increase the standard deviation. The reason I expect those factors to not offset perfectly is because the bell curve is tallest in the middle. If the population was a standard normal distribution, the values should be rounded towards the center more often than they would be rounded away. On the other hand, each time that it is rounded away from the mean produces more standard deviation than the times in which it is rounded towards the mean. I don’t expect the factors to offset perfectly, but it is beyond my knowledge to know which way it would tilt the deviation because of the two opposing forces.