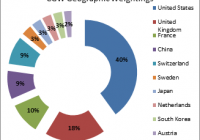

Global water resources are poorly managed, if at all and population growth is creating stresses on existing water resources. Advanced and newly emerged market economies are addressing the problem via private sector investment. Guggenheim, Invesco and First Trust offer funds specializing in the water management industry. In the famous opening scene of ‘Lawrence of Arabia’, Lieutenant Lawrence (Peter O’Toole) is shocked to see a man shot dead simply for drawing water from a well without having permission. Lawrence, a naive newcomer to the unforgiving desert argues with the Sheik (Omar Sharif) who shot the man. The Sheik ends the argument: ” He was nothing. The well is everything… he knew that, ” he said angrily. Although this may be taken as mere Hollywood drama, wars have been actually been fought over water. ‘Water Conflicts’ have occurred in the desert regions of North East Africa, Central Asia and the Middle East. The United Nations Department of Economic and Social Development declared 2005 – 2015 an International Decade for Action, designated “Water for Life” . According to the UN: … Around 1.2 billion people, or almost one-fifth of the world’s population, live in areas of physical scarcity, and 500 million people are approaching this situation. Another 1.6 billion people, or almost one quarter of the world’s population, face economic water shortage… …Water use has been growing at more than twice the rate of population increase in the last century… …There is enough freshwater on the planet for seven billion people but it is distributed unevenly and too much of it is wasted, polluted and unsustainably managed . In fact: Around 700 million people in 43 countries suffer today from water scarcity. By 2025, 1.8 billion people will be living in countries or regions with absolute water scarcity, and two-thirds of the world’s population could be living under water stressed conditions. With the existing climate change scenario, almost half the world’s population will be living in areas of high water stress by 2030, including between 75 million and 250 million people in Africa. In addition, water scarcity in some arid and semi-arid places will displace between 24 million and 700 million people. Thanks to the deep ‘reservoir’ of Exchange Traded Funds managed and organized by the world’s largest investment firms, there is likely to be ‘a capital’ solution to the problem, and thus presents a patient investor with a conduit to profit from a water management industry buildout. There are three listed funds to be found in Seeking Alpha ETF pool. All three came to the market in 2007. In order of 1 year performance are the Guggenheim S&P Global Water Index ETF (NYSEARCA: CGW ) , the Invesco PowerShares Global Water Portfolio (NYSEARCA: PIO ) and the First Trust ISE Water Index Fund (NYSEARCA: FIW ) . The main features are described below: Fund Manager and Symbol Tracking Index Investment Strategy Year to Date 1 Year 3 Years Fees and Expenses Recent Price Distribution Yields Guggenheim: CGW S&P Global Water Index Passive 1.85% -3.46% 13.71% 0.65% $28.34 1.77% Invesco: PIO NASDAQ OMX Global Water Index Active 3.66% -1.39% 15.31% 0.76% $23.07 1.27% First Trust: FIW ISE Market Cap weighted Index Passive -6.62% -8.88% 11.91% 0.59% $29.94 0.71% ( Data from Guggenheim, Invesco and First Trust Websites) Two of the three funds, Guggenheim’s CGW and Invesco’s PIO are globally diversified, whereas, of the First Trust Fund’s 36 holdings, 33 are U.S. based, with one Brazilian, one U.K. and one Grand Cayman Island based company. As far as the two globally diversified funds, CGW and PIO, the two charts demonstrate that the top sector weightings are nearly identical. ( Data from Guggenheim and Invesco ) Needless to say, there are only a limited number of holdings which fit the category. Guggenheim’s CGW has over 50 holdings, Invesco’s PIO has 35 holdings and First Trust’s FIW has 35 holdings. It’s reasonable to conclude that there’s some overlap between funds. Indeed, on closer inspection, only seven of the First Trust Fund’s holdings may be found in either the Guggenheim or Invesco funds. On the other hand 24 of the 35 Invesco fund holdings are also holdings of the Guggenheim fund; that is to say almost half of the Guggenheim fund’s holdings are also holdings in the Invesco fund. This is in spite of the fact that each fund tracks a different index in this asset subclass. Further, as demonstrated in the geographical weightings charts, the top seven heaviest weighted regions of both Guggenheim’s CGW and Invesco’s PIO are identical. On the other hand, First Trust’s FIW is virtually a U.S. centric water industry fund and the most unique of the three. ( Data From Guggebheim, Invesco and First Trust) All three funds have similar performance over the past three years. Hence, what should an investor consider to be the deciding factor as to which fund to invest in? A strange as it may sound, it might be best to ignore the usual metrics and to investigate where the worst water shortages exits, where the worst water pollution exit and which governments will be quick to respond. One notable example which has made headlines recently has been concerns about the water pollution in Brazil, particularly in Rio de Janeiro, host city to the 2016 summer Olympic Games. It just so happens that Companhia de Saneamento Basico do Estado de Sao Paulo ( OTC:CSBJF ) accounts for 1.365% of the Invesco fund and 1.01% of the Guggenheim fund. Just briefly: The Company is engaged in the provision of basic and environmental sanitation services in the State of Sao Paulo, as well as it supplies treated water and sewage services on a wholesale basis. The Company operates two segments: water supply and sewage services. It operates water and sewage services in approximately 364 municipalities of the State of Sao Paulo . -(Reuters) Although Rio is several hundred miles to the north in the neighboring state, having the eyes of the world suddenly focused on the polluted waters of Rio, it would be reasonable to expect the Brazilian government to budget funds towards water cleanup before the Olympic games begin. A second example may be found in China’s remarkable economic miracle, lifting millions out of poverty and driving economic growth the world over. However, it was not without environmental costs. Air and water quality issues have been largely ignored as the economy develop. Both Guggenheim and Invesco allocate 9% towards China. Below is a table of companies common to both. Company Name (Symbol/Exchange) Business Weighting Beijing Enterprises Water Group ( OTC:BJWTY ) Water Reclamation, Desalination, Sewage Treatment, Consultancy Services; global as well as domestic projects. CGW: 2.04% PIO: 4.01% China Everbright Water ( OTCPK:BOTRF ) Water Reclamation, Industrial Waste Water Treatment, Sludge Treatment CGW: 2.52% PIO: 0.595% China Water Industry Group (1129.HK/Hong Kong) Water Supply, Sewage Treatment, Water Infrastructure Construction; at least 7 water/sewage related subsidiaries CGW: 0.14% PIO: 0.449% (Overlap of CGW and PIO China Exposure) Not every holding is a ‘pure-play’ water resource management company. For example, Guggenheim’s CGW has a 2.4% position in Guangdong Investment ( OTCPK:GGDVY ), a property developer with a subsidiary holding in water resource management. Also, Invesco’s PIO has a position in China Longyuan Power Group Corp Ltd ( OTCPK:CLPXY ), an electric power generating company focusing on wind and coal power, and a position in First Solar (NASDAQ: FSLR ) the well-known photovoltaic panel manufacturer. Neither company seems to be directly related to the water industry, however, First Solar does offer liquid separation recycling solutions and Longyuan Power generates electricity from ‘tidal power’. Lastly are those water concerns here in the United States, most notably California. It’s been well publicized that California reservoirs are critically low and that wells are drilling into deep aquifers which took tens of thousands of years to form and will take hundreds of years to replenish. First Trust’s FIW fund does have positions in California Water Utilities through California Water Services Group (NYSE: CWT ) and its subsidiaries: The Company through its wholly owned subsidiaries provides water utility and other related services in California, Washington, New Mexico and Hawaii… …The Company’s business consists of the production, purchase, storage, treatment, testing, distribution and sale of water for domestic, industrial, public and irrigation uses, and for fire protection. It also provides non-regulated water- related services under agreements with municipalities and other private companies. The non-regulated services include full water system operation, billing and meter reading services. – (Reuters) Another California Water Utility Service Company is American States Water (NYSE: AWR ), the parent company of Golden State Water Company whose business is in: The purchase, production and distribution of water in 75 communities in 10 counties in the State of California… …GSWC’s water utility operations have a diversified customer base, residential and commercial customers account for the GSWC’s water sales and revenues. -(Reuters) Also, American States Utilities , another wholly owned subsidiary of AWR is contracted by the U.S. government to supply water services to military installations. To sum up, those fortunate enough to be living in advanced economy nations have plentiful access to high quality potable water. However, poor management, growing population which demands water as well as agricultural products will certainly bring about changes in the way water is purposed and distributed. So the investor has choices in this very specialized area. The First Trust Fund focuses on the domestic U.S. water industry. No doubt between California and the U.S. Federal Government funds can be made available, should the situation worse. However, the drought problem in the United States may resolve itself should normal rain and snow falls resume. On the other hand, heavily polluted waterways, critical to the health and well-being of the general populations in Brazil and China will not simply resolve themselves and will require spending and many years of new infrastructure construction. Hence the Guggenheim CGW and Invesco PIO fund are better positioned for global solutions. The main risk in those two funds is whether the governing bodies of newly emerged nations consider environmental issues a top priority. Hence all three funds have the potential to provide good returns, and likewise all three incur risks. The ultimate risk, however, will be the accrued cost of ignoring the haphazard way water resources are managed the world over. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.