In A Rising Natural Gas Market Dynegy Is Worth Considering

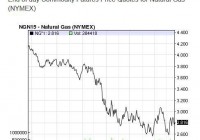

Summary DYN is an electricity generation company with coal fired power plants. The Utility sector is a very challenging space right now for a variety of reasons. Experts project a 19% upside at current price levels. Dynegy (NYSE: DYN ) is an electricity generation company whose generation portfolio is primarily coal fired power plants. The company is weathering a difficult business environment for Utilities. Coal fired plants cannot compete with natural gas fired plants at such low natural gas prices. However, if the price of natural gas rises to historical norms, then DYN’s coal fleet will see operating margins increase, which will have a positive impact on DYN’s stock value. Market Overview and Trends: The electricity market is going through a challenging period of government regulation, low electricity prices, increased churn and demand stagnation. The increasing concern for climate change has spurred a wave of regulation in the Utility sector. Not only are these regulations fluid and complex, they are expensive. Cross-State Air Pollution Rule , MATS , CO2 Emissions , and Byproducts, Wastes, Hazardous Materials and Contamination, just to name a few. The price for electricity is set by baseload generation facilities which are natural gas fueled Combined Cycle Gas Turbines (CCGTs) which historically have had lower operating margins than coal fueled facilities, but with natural gas prices at near historic lows, CCGTs produce power at lower prices than coal. When CCGTs produce at a lower price than coal, coal facilities stop producing and start losing money. Innovations in how consumers measure and exchange electricity have become much more sophisticated over the last 20 years. For example, in the ERCOT market, people have the ability to switch retail providers instantly through the Internet. It has never been easier for a retail customer or business customer to switch providers, because of this, the industry is experiencing increased rates of customer churn. Energy efficiency across many levels of society have caused the general demand for electricity to grow at slower rates than ever before. People use more electricity than ever, but increases in efficiency have caused the growth rate for the electricity market as a whole to slow. * from the NASDAQ Business Positioning and Summary: Dynegy is primarily an electricity generation company. The company’s fleet consists of 15 power plants in five states. All nine of Dynegy’s baseload generation plants are coal and are located in the state of Illinois. The lion’s share of the other generation facilities are fueled by natural gas. As a final point, it is worth noting that DYN does not provide dividends. (click to enlarge) * from the 10-k Growth Strategy: from the 10-k Customer Focus: DYN’s commercial strategy seeks to lock in near-term cash flows while preserving the ability to capture higher values long-term as power markets improve. Further the company reduces market risk by linking generation directly to customer load which reduces the need to hedge. In the wholesale and retail spaces DYN plans little change. Continuous Improvement: The company has invested approximately $1 billion towards ensuring their facilities are safe, reliable, cost-efficient and environmentally compliant. The company also continues to employ their three year cost and performance improvement initiative, also known as PRIDE, which is expected to finish a year ahead of schedule. PRIDE’s targets were $135 million in operation improvements and $165 million in balance sheet efficiencies. Capital Allocation: The company’s foremost capital allocation strategy is to maintain an appropriate leverage and liquidity profile and to make the necessary capital investments to maintain the safety, compliance and reliability of our fleet. Additionally the company plans to expand their first lien collateral program to include additional hedging counterparties and lines of credit. Risk Management: Competition: There is increasing regional competition in the power markets due to an increase in the penetration and economic viability of distributed and renewable energy sources. The company plans to stay competitive by maintaining a low cost of production through managed fuel costs and reliability. Further the ability to compete effectively will be impacted by regulatory reforms designed to reduce GHG emissions. Current and Future Government Regulation: DYN is subject to a myriad of government regulations and environmental laws. The legal landscape is complex and ever changing and DYN will have to stay up to code on all of these issues. Here is a list of the major issues which impact DYN: The Clean Air Act, Cross-State Air Pollution Rule, MATS rule, NAAQS, The Clean Water Act, Coal Combustion Residuals, Climate Change. Market Liquidity and Counterparty Risk: The company transacts hedges in the Natural Gas, Coal and Power markets. If any of the counterparties experience deteriorating credit, then DYN’s hedges may not be honored. This would adversely impact the company. DYN tries to manage this risk by only transacting hedges with highly liquid counterparties and also by diversifying hedges across many different counterparties. Natural Gas Market Exposure: DYN purchases fuel for its Natural Gas power generation facilities under short-term contracts or on the spot market. As a result the company faces the risks of supply interruptions and fuel price volatility. Further profitable operation of the company’s coal-fired generation facilities is dependent upon coal prices and coal transportation rates. The company tries to mitigate these risks by entering into long-term transportation and supply contracts. Expert Opinion: (click to enlarge) * from Yahoo Finance The experts following DYN have moved from bearish sentiments in 2010-2012, to bullish in 2013-2015. Analysts have a median price target of $39.50 per share which gives the company a 19.33% upside at the current price of $33.31 per share. * from Yahoo Finance Analysts project DYN revenues to grow 22.1% between 2015 and 2016. Further the company has shown extremely strong sales growth of 86.7% and 158.3% year-over-year for the current quarter and the quarter ending Sept. 15th, respectively. Out of context the sales numbers look extremely bullish, however, they are more inline with expected levels and DYN had a poor year last year. Recent News: Dynegy Amends Employment Agreement with CEO Robert Flexon Dynegy Completes Duke Midwest Acquisition ; Transformational Growth for company Dynegy Completes EquiPower and Brayton Point Acquisitions from Energy Capital Partners C onclusion : Dynegy is an electricity generation company which derives much of its revenues from coal fired generation. Coal fired generation margins increase as the price of natural gas increases. I would recommend Dynegy to an investor looking for a very specific type of risk exposure. The investor needs to be looking for an asset that produces a predictable valuation, has less volatility in value than the general market and wants to gain from an increase in natural gas prices. Currently the beta of DYN is 0.11, which means that movement of DYN’s stock is relatively independent to the movements of the market at large. Further, natural gas prices have moved whip-saw market with a high bound of $3.1 and a low of $2.60 since the beginning of 2015. Additionally the experts see a 19% upside with DYN’s current stock price. So, if you find that you are an investor who wishes to gain an indirect and conservative exposure to a rising natural gas market, consider DYN. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.