Scalper1 News

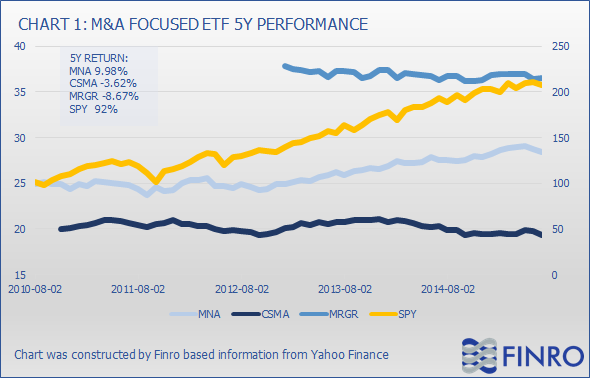

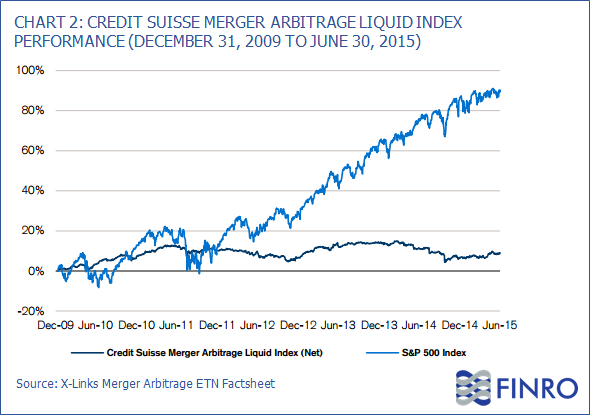

Summary Special events are investing can significantly increase the portfolio return. Many investors interested in the returns of special events investing don’t want to trade these events actively. Here is why ETFs following special events indexes are not a good enough substitution. It is widely accepted that special situations investing can drive higher returns in the long run than a simple long-only investing methodology. For most investors engaging in merger arbitrage, spin-off and IPOs require too much time and effort, so they prefer to use ETFs to mimic this kind of investing. The rationale is easy to articulate in these cases: M&A, spin-offs, and IPOs were extremely successful strategies to many funds, so I, as a common investor, could copy their moves by investing in these ETFs. Well, not exactly. M&A Focused ETFs In the merger arbitrage area, there are three ETFs trying to generate excess return by engaging in merger arbitrage strategy; however, as shown in the table below, all three ETFs generated inferior performance compared to the popular SPDR S&P 500 ETF (NYSEARCA: SPY ) in every period. Symbol Name 3M 6M YTD 1Y 2Y 5Y SPY SPDR S&P 500 ETF -1.75% 1.61% 1.16% 7.29% 22.80% 92% MNA IQ Merger Arbitrage ETF -2.56% -0.53% 1.11% 3.52% 6.93% 9.98% CSMA Credit Suisse X-Links Merger Arbtrg ETN -1.97% 0.15% -0.21% -2.95% -6.72% -3.09% MRGR ProShares Merger -0.84% -0.19% 0.91% -0.16% -3.35% -8.38% Source: Table constructed by Finro based on information from Yahoo Finance The largest fund and best-performing ETF in the merger arbitrage focused ETFs is MNA, the IQ Merger Arbitrage ETF that generated only ~10% return over the last 5 years which is extremely lower than SPY’s 92%. The chart below illustrates it best as the three M&A ETFs are mostly flat over the last five years while SPY climbs. Does it mean that investors should not engage in merger arbitrage strategies to generate an excess return from special situations? Of course not, however, the passive investment offered by these ETFs probably does not fit the merger arbitrage investment strategy profile. Active funds and managers who use this approach can pick and choose the deals they want to engage in and how much funding to allocate to each deal. However, ETFs (and ETNs) are required to follow a particular index in a passive investment methodology that is probably hard to fit a merger arbitrage strategy into. This is presented best in Chart 2 below, which shows the inherent problem with merger arbitrage ETFs – the indexes they follow don’t offer any added value over the S&P 500. In this example, the Credit Suisse Merger Arbitrage Liquid Index is relatively flat from Dec-09 while S&P is a bit more volatile, but it drives more than a 90 percent return on the same period. Spin-Off and IPO-Focused ETFs The other two areas mentioned at the beginning, spin-offs and IPOs, present a different story. IPO and Spin-Off ETFs invest in long-only positions in the stock of companies that have recently gone public or spun off from parent companies. These strategies are a better fit in a passive investment methodology that is a simple long in most cases. As shown in the table below, the two IPO ETFs differ in performance. While First Trust US IPO ETF (NYSEARCA: FPX ) beat SPY in most time periods chosen, the Renaissance IPO ETF (NYSEARCA: IPO ) offers inferior returns in most periods. The Guggenheim Spin-Off ETF (NYSEARCA: CSD ) provides exposure to the vibrant spin-off sector that has been very popular lately, but it also suffers from slightly inferior returns compared to SPY in the shorter periods studied. Symbol Name 3M 6M YTD 1Y 2Y 5Y SPY SPDR S&P 500 ETF -1.75% 1.61% 1.16% 7.29% 22.80% 92% IPO Renaissance IPO ETF 1.20% 0.22% 1.75% 4.36% 14.16% N/A FPX First Trust US IPO ETF -4.88% 9.50% 9.31% 15.51% 31.04% 179.90% CSD Guggenheim Spin-Off ETF -6.90% -4.06% -2.41% -1.62% 11.42% 130% Source: Table constructed by Finro based on information from Yahoo Finance Market Vectors Global Spin-Off ETF (NYSEARCA: SPUN ), a new Spin-Off ETF, started trading in June. It has generated a slightly better return since its inception than CSD in the same time period: -6.7% and -7.3%, respectively. Final Thoughts Special events investing is a tremendous way to achieve an excess return for a portfolio by monetizing mergers and acquisitions, spin-offs or IPOs. There are some ETFs following indexes of merger arbitrage, spin-offs or IPOs. However, most of them do not outperform SPY, and that is a huge disadvantage. While I firmly believe every investor should allocate some of his or her portfolios to special events investing, I think, as presented above, that active investment strategies like those require active investment decisions. Except FPX and IPO investing, engaging in active investment strategies through passive investment vehicles just doesn’t work – to monetize these events, investors should actively invest in them selectively. The FPX holds the top-ranked 100 newly traded companies for the first 1,000 days on the market – which is a more simple methodology to follow through an ETF than the other strategies. Investors can use the FPX for an IPO exposure without the need to actively trade these events. Other than this particular example, I believe investors should trade actively when trying to engage in active strategies like M&As and spin-offs. Disclosure: I am/we are long SPY. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: The information provided in this article is for informational purposes only and should not be regarded as investment advice or a recommendation regarding any particular security or course of action. This information is the writer’s opinion about the companies mentioned in the article. Investors should conduct their due diligence and consult with a registered financial adviser before making any investment decision. Lior Ronen and Finro are not registered financial advisers and shall not have any liability for any damages of any kind whatsoever relating to this material. By accepting this material, you acknowledge, understand and accept the foregoing. Scalper1 News

Summary Special events are investing can significantly increase the portfolio return. Many investors interested in the returns of special events investing don’t want to trade these events actively. Here is why ETFs following special events indexes are not a good enough substitution. It is widely accepted that special situations investing can drive higher returns in the long run than a simple long-only investing methodology. For most investors engaging in merger arbitrage, spin-off and IPOs require too much time and effort, so they prefer to use ETFs to mimic this kind of investing. The rationale is easy to articulate in these cases: M&A, spin-offs, and IPOs were extremely successful strategies to many funds, so I, as a common investor, could copy their moves by investing in these ETFs. Well, not exactly. M&A Focused ETFs In the merger arbitrage area, there are three ETFs trying to generate excess return by engaging in merger arbitrage strategy; however, as shown in the table below, all three ETFs generated inferior performance compared to the popular SPDR S&P 500 ETF (NYSEARCA: SPY ) in every period. Symbol Name 3M 6M YTD 1Y 2Y 5Y SPY SPDR S&P 500 ETF -1.75% 1.61% 1.16% 7.29% 22.80% 92% MNA IQ Merger Arbitrage ETF -2.56% -0.53% 1.11% 3.52% 6.93% 9.98% CSMA Credit Suisse X-Links Merger Arbtrg ETN -1.97% 0.15% -0.21% -2.95% -6.72% -3.09% MRGR ProShares Merger -0.84% -0.19% 0.91% -0.16% -3.35% -8.38% Source: Table constructed by Finro based on information from Yahoo Finance The largest fund and best-performing ETF in the merger arbitrage focused ETFs is MNA, the IQ Merger Arbitrage ETF that generated only ~10% return over the last 5 years which is extremely lower than SPY’s 92%. The chart below illustrates it best as the three M&A ETFs are mostly flat over the last five years while SPY climbs. Does it mean that investors should not engage in merger arbitrage strategies to generate an excess return from special situations? Of course not, however, the passive investment offered by these ETFs probably does not fit the merger arbitrage investment strategy profile. Active funds and managers who use this approach can pick and choose the deals they want to engage in and how much funding to allocate to each deal. However, ETFs (and ETNs) are required to follow a particular index in a passive investment methodology that is probably hard to fit a merger arbitrage strategy into. This is presented best in Chart 2 below, which shows the inherent problem with merger arbitrage ETFs – the indexes they follow don’t offer any added value over the S&P 500. In this example, the Credit Suisse Merger Arbitrage Liquid Index is relatively flat from Dec-09 while S&P is a bit more volatile, but it drives more than a 90 percent return on the same period. Spin-Off and IPO-Focused ETFs The other two areas mentioned at the beginning, spin-offs and IPOs, present a different story. IPO and Spin-Off ETFs invest in long-only positions in the stock of companies that have recently gone public or spun off from parent companies. These strategies are a better fit in a passive investment methodology that is a simple long in most cases. As shown in the table below, the two IPO ETFs differ in performance. While First Trust US IPO ETF (NYSEARCA: FPX ) beat SPY in most time periods chosen, the Renaissance IPO ETF (NYSEARCA: IPO ) offers inferior returns in most periods. The Guggenheim Spin-Off ETF (NYSEARCA: CSD ) provides exposure to the vibrant spin-off sector that has been very popular lately, but it also suffers from slightly inferior returns compared to SPY in the shorter periods studied. Symbol Name 3M 6M YTD 1Y 2Y 5Y SPY SPDR S&P 500 ETF -1.75% 1.61% 1.16% 7.29% 22.80% 92% IPO Renaissance IPO ETF 1.20% 0.22% 1.75% 4.36% 14.16% N/A FPX First Trust US IPO ETF -4.88% 9.50% 9.31% 15.51% 31.04% 179.90% CSD Guggenheim Spin-Off ETF -6.90% -4.06% -2.41% -1.62% 11.42% 130% Source: Table constructed by Finro based on information from Yahoo Finance Market Vectors Global Spin-Off ETF (NYSEARCA: SPUN ), a new Spin-Off ETF, started trading in June. It has generated a slightly better return since its inception than CSD in the same time period: -6.7% and -7.3%, respectively. Final Thoughts Special events investing is a tremendous way to achieve an excess return for a portfolio by monetizing mergers and acquisitions, spin-offs or IPOs. There are some ETFs following indexes of merger arbitrage, spin-offs or IPOs. However, most of them do not outperform SPY, and that is a huge disadvantage. While I firmly believe every investor should allocate some of his or her portfolios to special events investing, I think, as presented above, that active investment strategies like those require active investment decisions. Except FPX and IPO investing, engaging in active investment strategies through passive investment vehicles just doesn’t work – to monetize these events, investors should actively invest in them selectively. The FPX holds the top-ranked 100 newly traded companies for the first 1,000 days on the market – which is a more simple methodology to follow through an ETF than the other strategies. Investors can use the FPX for an IPO exposure without the need to actively trade these events. Other than this particular example, I believe investors should trade actively when trying to engage in active strategies like M&As and spin-offs. Disclosure: I am/we are long SPY. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: The information provided in this article is for informational purposes only and should not be regarded as investment advice or a recommendation regarding any particular security or course of action. This information is the writer’s opinion about the companies mentioned in the article. Investors should conduct their due diligence and consult with a registered financial adviser before making any investment decision. Lior Ronen and Finro are not registered financial advisers and shall not have any liability for any damages of any kind whatsoever relating to this material. By accepting this material, you acknowledge, understand and accept the foregoing. Scalper1 News

Scalper1 News