Mosaic MOS is set to release fourth-quarter 2016 results before the opening bell on Feb 7.

Mosaic reported earnings of 11 cents per share in the third-quarter 2016, down from 45 cents per share recorded a year ago. Earnings, barring one-time items, were 33 cents per share that topped the Zacks Consensus Estimate of 11cents.

Let’s see how things are shaping up prior to this announcement.

Factors to Consider

Mosaic expects phosphates sales volumes in the band of 2.1 million to 2.4 million tons for fourth-quarter 2016 against the year-ago recorded figure of 2.2 million tons. The segment gross margin rate is expected to be in the upper single digits.

Potash sales volumes have been forecasted in the range of 1.9 million to 2.1 million tons for the fourth quarter, compared with the year-ago recorded figure of 1.9 million tons and the gross margin rate is anticipated to be in the mid-teens.

Total sales volumes for the International Distribution segment are expected to range from 1.7 to 1.9 million tons for the fourth quarter. The segment gross margin is estimated to be around $ 20 per ton.

Mosaic has outperformed the Zacks categorized Fertilizers industry over the past three months. The company’s shares have gained around 28.3% over this period, compared with the 21% gain recorded by the industry.

Mosaic is taking actions to cut costs amid a challenging environment through its $ 575 million cost-cutting program, leading to an improvement in its operating cost structure. Gains from the company’s cost-cutting actions offset headwinds from lower fertilizer prices in the third quarter and are expected to do so in the fourth.

Mosaic is also well positioned to benefit from the rising global demand for fertilizers. Potash demand is expected to rise with the signing of new deals with Chinese customers. The deals are expected to trigger pent-up demand from other major consumer markets including India. Moreover, the company sees a more stable operating environment in 2017 and anticipates higher demand for both phosphate and potash.

Mosaic is also expected to benefit from its efforts to boost production capacity and acquisitions. The buyout of CF Industries’ assets has expanded Mosaic’s phosphate business and production capacity in Florida. The acquisition will bring the company’s annual phosphates capacity to roughly 11.5 million tons.

Moreover, the acquisition of Archer Daniels Midland Company’s fertilizer distribution business has expanded its annual distribution capability to around 6 million metric tons of crop nutrients from roughly 4 million metric tons. The recently announced $ 2.5 billion buyout of Brazil-based Vale S.A.’s Vale Fertilizantes business is also expected to make Mosaic the leading fertilizer manufacturing and distribution company in Brazil.

However, Mosaic faces a challenging operating environment in the agriculture space. The company is also exposed to a difficult pricing environment. Its phosphate and potash margins declined in the last reported quarter, hurt by lower prices. The company is also exposed to volatility in costs of key raw materials.

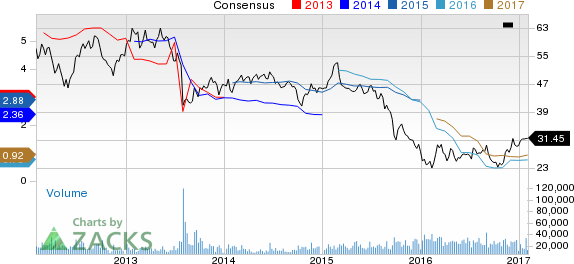

Mosaic Company (The) Price and Consensus

Mosaic Company (The) Price and Consensus | Mosaic Company (The) Quote

Earnings Whispers

Our proven model shows that Mosaic is likely to beat earnings because it has the right combination of the two key ingredients.

Zacks ESP : The Earnings ESP for Mosaic is +33.33% as the Most Accurate estimate stands at 16 cents while the Zacks Consensus Estimate is pegged at 12 cents. A favorable Zacks ESP serves as a meaningful and leading indicator of a likely positive earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter .

Zacks Rank : Mosaic currently carries a Zacks Rank #3 (Hold). Note that stocks with a Zacks Rank of #1 (Strong Buy), 2 (Buy) or 3 have a significantly higher chance of beating earnings.

We caution against Sell-rated stocks (#4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

The combination of Mosaic’s Zacks Rank #3 and positive ESP makes us reasonably confident of an earnings beat.

Stocks to consider

Here are some stocks in the basic materials space that you may want to consider, as our model shows they have the right combination of elements to post an earnings beat this quarter:

Intrepid Potash Inc IPI has an Earnings ESP of +20% and carries a Zacks Rank #2.

Iamgold Corporation IAG has an Earnings ESP of +100% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here .

Kraton Corporation KRA has an Earnings ESP of +3.23% and a Zacks Rank #2.

The Best Place to Start Your Stock Search

Today, you are invited to download the full list of 220 Zacks Rank #1 “Strong Buy” stocks – absolutely free of charge. Since 1988, Zacks Rank #1 stocks have nearly tripled the market, with average gains of +26% per year. Plus, you can access the list of portfolio-killing Zacks Rank #5 “Strong Sells” and other private research. See these stocks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kraton Corporation (KRA): Free Stock Analysis Report

Mosaic Company (The) (MOS): Free Stock Analysis Report

Intrepid Potash, Inc (IPI): Free Stock Analysis Report

Iamgold Corporation (IAG): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International