Scalper1 News

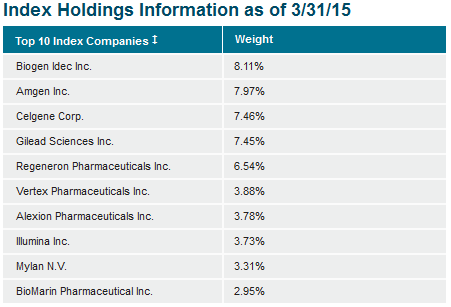

Summary New leveraged biotechnology ETFs to hedge or capitalize on market moves. Focus on ProShares’s new leveraged/inverse NASDAQ Biotechnology ETFs. Additionally, ProShares added leveraged/inverse Oil & Gas and homebuilder funds as well. By Todd Shriber & Tom Lydon For over five years, the ProShares Ultrashort Nasdaq Biotechnology (NasdaqGM: BIS ) and the ProShares Ultra Nasdaq Biotechnology (NasdaqGM: BIB ) cornered the market for leveraged biotechnology exchange traded funds. In the span of three weeks, the number of leveraged biotech ETFs has tripled. In late May, Direxion introduced the Direxion Daily S&P Biotech Bull Shares (NYSEArca: LABU ) and the Direxion Daily S&P Biotech Bear Shares (NYSEArca: LABD ) . Today, ProShares, the largest issuer of inverse and leveraged ETFs, launched the UltraPro NASDAQ Biotechnology (NasdaqGM: UBIO) and the UltraPro Short NASDAQ Biotechnology (NasdaqGM: ZBIO) . The UltraPro NASDAQ Biotechnology will attempt to deliver three times the daily performance of the NASDAQ Biotechnology Index while the UltraPro Short NASDAQ Biotechnology will seek to deliver three times the daily inverse performance of that index. The NASDAQ Biotechnology Index is the underlying benchmark for the iShares Nasdaq Biotechnology ETF (NasdaqGS: IBB ) , the largest biotech ETF by assets. Maryland-based ProShares introduced four leveraged ETFs today, including a pair of leveraged homebuilders funds, a niche rival Direxion is also eyeing . The Ultra Homebuilders & Supplies (NYSEArca: HBU) and the UltraShort Homebuilders & Supplies (NYSEArca: HBZ) will offer double leverage on the Dow Jones U.S. Select Home Construction Index. That is the underlying benchmark for the $2.1 billion iShares U.S. Home Construction ETF (NYSEArca: ITB ) . ProShares also introduced two double-leveraged equity-based energy ETFs today. Those new funds are the Ultra Oil & Gas Exploration & Production (NYSEArca: UOP) and the UltraShort Oil & Gas Exploration & Production (NYSEArca: SOP) . UOP will seek to deliver double the daily returns of the S&P Oil & Gas Exploration & Production Select Industry Index while SOP will attempt to deliver double the daily inverse returns of that index. That index is the underlying benchmark for the $1.6 billion SPDR S&P Oil & Gas Exploration & Production ETF (NYSEArca: XOP ) . On May 29, Direxion introduced triple-leveraged answers to XOP , the Direxion Daily S&P Oil & Gas Exploration & Production Bull Shares (NYSEArca: GUSH ) and the Direxion Daily S&P Oil & Gas Exploration & Production Bear Shares (NYSEArca: DRIP ) . NASDAQ Biotech Index Top Holdings as of March 31, 2015 Table Courtesy: ProShares Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary New leveraged biotechnology ETFs to hedge or capitalize on market moves. Focus on ProShares’s new leveraged/inverse NASDAQ Biotechnology ETFs. Additionally, ProShares added leveraged/inverse Oil & Gas and homebuilder funds as well. By Todd Shriber & Tom Lydon For over five years, the ProShares Ultrashort Nasdaq Biotechnology (NasdaqGM: BIS ) and the ProShares Ultra Nasdaq Biotechnology (NasdaqGM: BIB ) cornered the market for leveraged biotechnology exchange traded funds. In the span of three weeks, the number of leveraged biotech ETFs has tripled. In late May, Direxion introduced the Direxion Daily S&P Biotech Bull Shares (NYSEArca: LABU ) and the Direxion Daily S&P Biotech Bear Shares (NYSEArca: LABD ) . Today, ProShares, the largest issuer of inverse and leveraged ETFs, launched the UltraPro NASDAQ Biotechnology (NasdaqGM: UBIO) and the UltraPro Short NASDAQ Biotechnology (NasdaqGM: ZBIO) . The UltraPro NASDAQ Biotechnology will attempt to deliver three times the daily performance of the NASDAQ Biotechnology Index while the UltraPro Short NASDAQ Biotechnology will seek to deliver three times the daily inverse performance of that index. The NASDAQ Biotechnology Index is the underlying benchmark for the iShares Nasdaq Biotechnology ETF (NasdaqGS: IBB ) , the largest biotech ETF by assets. Maryland-based ProShares introduced four leveraged ETFs today, including a pair of leveraged homebuilders funds, a niche rival Direxion is also eyeing . The Ultra Homebuilders & Supplies (NYSEArca: HBU) and the UltraShort Homebuilders & Supplies (NYSEArca: HBZ) will offer double leverage on the Dow Jones U.S. Select Home Construction Index. That is the underlying benchmark for the $2.1 billion iShares U.S. Home Construction ETF (NYSEArca: ITB ) . ProShares also introduced two double-leveraged equity-based energy ETFs today. Those new funds are the Ultra Oil & Gas Exploration & Production (NYSEArca: UOP) and the UltraShort Oil & Gas Exploration & Production (NYSEArca: SOP) . UOP will seek to deliver double the daily returns of the S&P Oil & Gas Exploration & Production Select Industry Index while SOP will attempt to deliver double the daily inverse returns of that index. That index is the underlying benchmark for the $1.6 billion SPDR S&P Oil & Gas Exploration & Production ETF (NYSEArca: XOP ) . On May 29, Direxion introduced triple-leveraged answers to XOP , the Direxion Daily S&P Oil & Gas Exploration & Production Bull Shares (NYSEArca: GUSH ) and the Direxion Daily S&P Oil & Gas Exploration & Production Bear Shares (NYSEArca: DRIP ) . NASDAQ Biotech Index Top Holdings as of March 31, 2015 Table Courtesy: ProShares Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News