In afternoon trading on Monday, Materials stocks are the best performing sector, up 0.2%. Within that group, CF Industries Holdings Inc (Symbol: CF) and International Flavors & Fragrances Inc. (Symbol: IFF) are two of the day’s stand-outs, showing a gain of 2.6% and 2.1%, respectively. Among the high volume ETFs , one ETF closely following materials stocks is the Materials Select Sector SPDR ETF (Symbol: XLB), which is up 0.4% on the day, and up 6.06% year-to-date. CF Industries Holdings Inc, meanwhile, is down 3.62% year-to-date, and International Flavors & Fragrances Inc. is up 14.50% year-to-date. Combined, CF and IFF make up approximately 3.1% of the underlying holdings of XLB.

The next best performing sector is the Consumer Products sector, losing just 0.1%. Among large Consumer Products stocks, Nike (Symbol: NKE) and Johnson Controls International plc (Symbol: JCI) are the most notable, showing a gain of 1.2% and 1.2%, respectively. One ETF closely tracking Consumer Products stocks is the iShares U.S. Consumer Goods ETF ( IYK ), which is flat on the day in midday trading, and up 8.89% on a year-to-date basis. Nike, meanwhile, is up 15.46% year-to-date, and Johnson Controls International plc is up 2.55% year-to-date. NKE makes up approximately 3.3% of the underlying holdings of IYK.

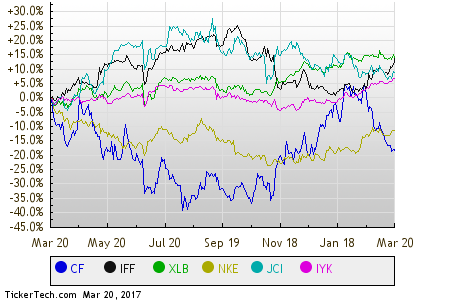

Comparing these stocks and ETFs on a trailing twelve month basis, below is a relative stock price performance chart, with each of the symbols shown in a different color as labeled in the legend at the bottom:  Here’s a snapshot of how the S&P 500 components within the various sectors are faring in afternoon trading on Monday. As you can see, one sector is up on the day, while eight sectors are down.

Here’s a snapshot of how the S&P 500 components within the various sectors are faring in afternoon trading on Monday. As you can see, one sector is up on the day, while eight sectors are down.

| Sector | % Change |

|---|---|

| Materials | +0.2% |

| Consumer Products | -0.1% |

| Technology & Communications | -0.1% |

| Healthcare | -0.2% |

| Industrial | -0.2% |

| Financial | -0.3% |

| Services | -0.8% |

| Utilities | -0.8% |

| Energy | -0.8% |

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International