Scalper1 News

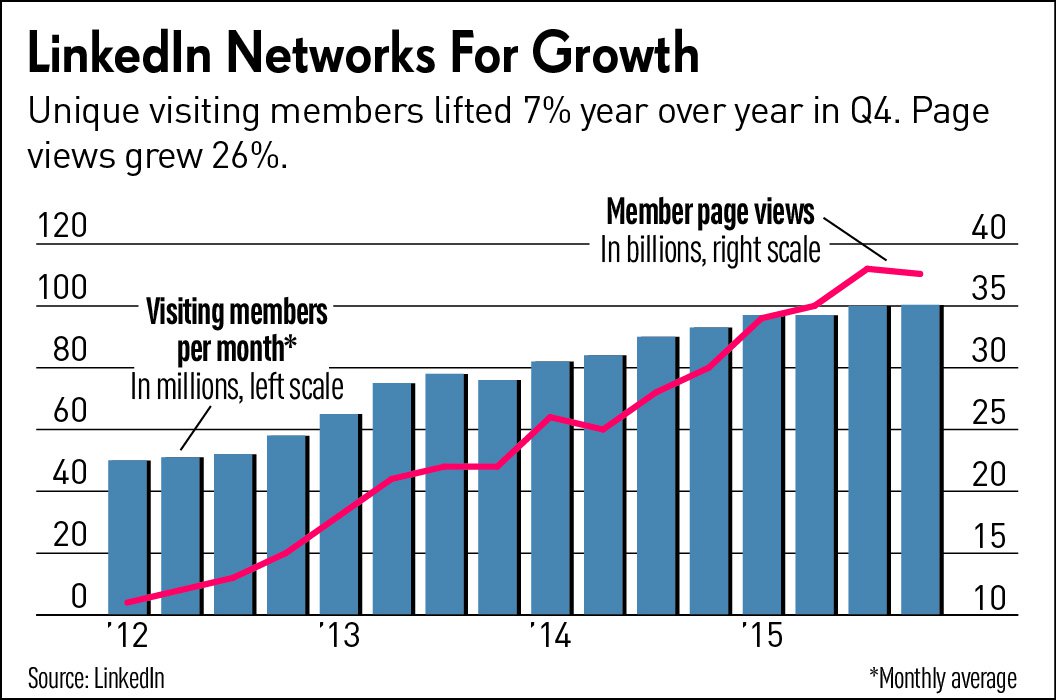

LinkedIn ( LNKD ) stock crashed to a three-year low early Friday after the company late Thursday gave guidance far below the Wall Street consensus estimate, while also reporting fourth-quarter earnings that beat. LinkedIn reported Q4 revenue of $862 million, topping the consensus estimate of $857.6 million and up 34% from the year-earlier quarter. The networking site for professionals reported earnings per share minus items of 94 cents, soundly above the consensus estimate of 78 cents, as polled by Thomson Reuters. LinkedIn stock gapped down 40% in early trading in the stock market today , near 113, its lowest price since January 2013. LinkedIn estimated Q1 revenue guidance at $820 million, well below the consensus of $866.8 million. It projects EPS of 55 cents, below the consensus of 74 cents. During the conference call, LinkedIn acknowledged that a reshuffling of product strategy will impact short-term revenue growth in favor of the long term. “We’re making good progress on our initiatives,” LinkedIn CFO Steve Sordello said in the conference call. “Our focus is on investing intelligently to capture the large, addressable opportunity ahead of us.” The earnings came at a challenging time for LinkedIn as it digests an acquisition and undergoes a workforce rebalancing, while also introducing new products. In December, LinkedIn rolled out its new mobile app, Voyager, designed to be faster and more intuitive for users. In April, LinkedIn paid $1.5 billion for Lynda.com, a video training website. LinkedIn said Q4 revenue from Lynda.com, which it puts in the category of Learning & Development, was $48.6 million, up 18% from the previous quarter. “We enter 2016 with increased focus on core initiatives that will drive leverage across our portfolio of products,” LinkedIn CEO Jeff Weiner said in the conference call after earnings posted. The business social network ended Q4 with 414 million members, up 19% from the year-earlier quarter and up 18 million from Q3. It topped the consensus estimate of 409 million. Unique visiting members grew 7% year over year to an average of 100 million per month, which is flat with Q3. That’s down from growth of 11% in Q3 and suggests LinkedIn is struggling to boost user activity on the website. The total number of page views among users in Q4 hit 37 billion, up 26% year over year but down 1 billion from Q3. LinkedIn has three revenue streams. The largest is Talent Solutions, used by companies to recruit employees. Revenue rose 45% to $535 million. Marketing Solutions, which sells ads, rose 20% to $183 million. Premium Subscriptions, fees paid by users for enhanced services, increased 19% to $144 million. For the year, LinkedIn expects revenue in a range between $3.6 billion and $3.65 billion. The consensus among analysts is $3.9 billion. It expects EPS in the range of $3.05-$3.20 per share, below the consensus of $3.67. “Our strategy in 2016 will increasingly focus on a narrower set of high value, high impact initiatives with the goal of strengthening and driving leverage across our entire portfolio of businesses,” Weiner said in the conference call. “Our roadmap will be supported by greater emphasis on simplicity, prioritization, and ultimate ROI and investment impact.” LinkedIn earnings contrast sharply with those of Facebook ( FB ), which continued to show it’s king of social media with a fourth quarter report last week that soundly beat expectations on booming mobile ad revenue. Facebook revenue rose 52% to $5.84 billion from the year-earlier period. Monthly active users on Facebook came in at 1.59 billion. Twitter ( TWTR ) is set to report earnings after the close on Feb. 10. Twitter stock has lost about 60% of its value in the past 12 months on worries about slowing user growth and rising competition for online ad revenue. Image provided by Shutterstock . Scalper1 News

LinkedIn ( LNKD ) stock crashed to a three-year low early Friday after the company late Thursday gave guidance far below the Wall Street consensus estimate, while also reporting fourth-quarter earnings that beat. LinkedIn reported Q4 revenue of $862 million, topping the consensus estimate of $857.6 million and up 34% from the year-earlier quarter. The networking site for professionals reported earnings per share minus items of 94 cents, soundly above the consensus estimate of 78 cents, as polled by Thomson Reuters. LinkedIn stock gapped down 40% in early trading in the stock market today , near 113, its lowest price since January 2013. LinkedIn estimated Q1 revenue guidance at $820 million, well below the consensus of $866.8 million. It projects EPS of 55 cents, below the consensus of 74 cents. During the conference call, LinkedIn acknowledged that a reshuffling of product strategy will impact short-term revenue growth in favor of the long term. “We’re making good progress on our initiatives,” LinkedIn CFO Steve Sordello said in the conference call. “Our focus is on investing intelligently to capture the large, addressable opportunity ahead of us.” The earnings came at a challenging time for LinkedIn as it digests an acquisition and undergoes a workforce rebalancing, while also introducing new products. In December, LinkedIn rolled out its new mobile app, Voyager, designed to be faster and more intuitive for users. In April, LinkedIn paid $1.5 billion for Lynda.com, a video training website. LinkedIn said Q4 revenue from Lynda.com, which it puts in the category of Learning & Development, was $48.6 million, up 18% from the previous quarter. “We enter 2016 with increased focus on core initiatives that will drive leverage across our portfolio of products,” LinkedIn CEO Jeff Weiner said in the conference call after earnings posted. The business social network ended Q4 with 414 million members, up 19% from the year-earlier quarter and up 18 million from Q3. It topped the consensus estimate of 409 million. Unique visiting members grew 7% year over year to an average of 100 million per month, which is flat with Q3. That’s down from growth of 11% in Q3 and suggests LinkedIn is struggling to boost user activity on the website. The total number of page views among users in Q4 hit 37 billion, up 26% year over year but down 1 billion from Q3. LinkedIn has three revenue streams. The largest is Talent Solutions, used by companies to recruit employees. Revenue rose 45% to $535 million. Marketing Solutions, which sells ads, rose 20% to $183 million. Premium Subscriptions, fees paid by users for enhanced services, increased 19% to $144 million. For the year, LinkedIn expects revenue in a range between $3.6 billion and $3.65 billion. The consensus among analysts is $3.9 billion. It expects EPS in the range of $3.05-$3.20 per share, below the consensus of $3.67. “Our strategy in 2016 will increasingly focus on a narrower set of high value, high impact initiatives with the goal of strengthening and driving leverage across our entire portfolio of businesses,” Weiner said in the conference call. “Our roadmap will be supported by greater emphasis on simplicity, prioritization, and ultimate ROI and investment impact.” LinkedIn earnings contrast sharply with those of Facebook ( FB ), which continued to show it’s king of social media with a fourth quarter report last week that soundly beat expectations on booming mobile ad revenue. Facebook revenue rose 52% to $5.84 billion from the year-earlier period. Monthly active users on Facebook came in at 1.59 billion. Twitter ( TWTR ) is set to report earnings after the close on Feb. 10. Twitter stock has lost about 60% of its value in the past 12 months on worries about slowing user growth and rising competition for online ad revenue. Image provided by Shutterstock . Scalper1 News

Scalper1 News