< div id =" articleText" readability =" 107.33035714286" > During the third-quarter economic 2016 conference phone call, Lindsay Organization‘s < a href=" http://www.nasdaq.com/symbol/lnn" > LNN President and also President Rick Parod explained that even however difficult agrarian market shapes are going to continue in the near phrase, the stabilization of products as well as recalibration of ranch input prices signal that farmer sentiments will definitely boost towards investment. This, consequently, will definitely induce need for the business’s watering devices and irrigation-management channel.

Lindsay’s portions dropped down 1% belowing its own profits launch on Jun 30. The provider disclosed an 18% drop in adjusted incomes to 90 cents each reveal as a result of to greater overhead.

The irrigation-equipment maker reported a 12% fall in revenues to $ 141 million, as each watering and commercial infrastructure profits fell in the fourth. Domestic watering revenues lessened 15% as a result of lesser device volume as well as decreased market rates while international irrigation earnings climbed 4%. While purchases improved in numerous markets, Brazil as well as various other markets experienced decreases.

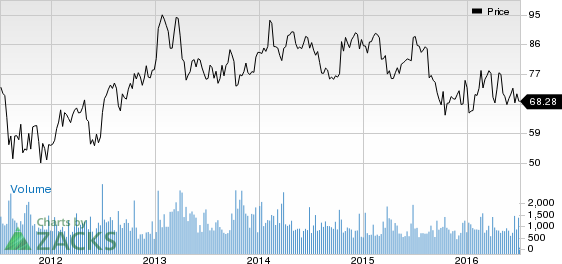

LINDSAY CORP Price

< a href= "https://www.zacks.com/stock/chart/LNN/fundamental/price" rel =" nofollow "> < a href=" https://www.zacks.com/stock/chart/LNN/fundamental/price" rel=" nofollow" > LINDSAY CORP Price |< a href="

https://www.zacks.com/stock/quote/LNN” rel= “nofollow” > LINDSAY CORPORATION Quote Parod is regarded that lesser commodity costs and also reduced farm profit will affect planter views concerning funds products acquisitions. The USDA’s present projection for 2016 web ranch income is actually $ 54.8 billion, down 3% from the previous year. This also denotes a dive of nearly 56% coming from the document high collection in 2013. In the international field, Brazil remains a near-term obstacle with slow-moving FINAME financing for devices investments and notable federal government distress. Nevertheless, on a beneficial note, he added that South america has actually been a superb growth vehicle driver over the last few years and as economical conditions improve, this will resume its own development trajectory. Belowing Brexit, an economic anxiety has actually been actually made in the UNITED KINGDOM Nonetheless, Lindsay generates an insufficient 1% from its earnings from the U.K, though revenues in Europe are actually around 10%. Lindsay Corporation possesses a dodging policy in position for large buck designated or large non-dollar designated transactions and also for overseas assets. Infrastructure portion earnings minimized in the sector predominantly as a result of less larger Street Zipper unit jobs accomplished as compared with the prior year. Parod states that the current passage from the Motorway Costs offers a tough ground for potential development from road-safety items purchases and Street Zipper Units sales as well as leases. It has contributed in the recent rise in existing order excess. Backlog at Could 31, 2016 was $ 61.2 million contrasted to $ 53.2 thousand in Could 31, 2015. He also incorporated that the property development of the Street Zipper Device possible task pipeline is actually favorable. Lindsay remains to acknowledge profit from the water-related accomplishments finished over recent few years. These achievements have actually helped the company boost its own total margins, given step-by-step revenue and also earnings originated from non-agricultural markets and provided channels for potential development. While these smaller sized strategic businesses currently hold much higher SG&An operate costs in comparison to the firm’s primary pivot watering company, these add-ons opening this properly in the watering market. Going ahead, the provider expects the water-related businesses acquired to additional take advantage of SG&An expenditures and to generate desirable development rates and working margins. Despite near-term headwinds, long-term styles continue to be beneficial for Lindsay being obligated to pay to boosted agrarian creation for the growing population, higher food manufacturing, dependable water use and system upgrades as well as growth. Lindsay Firm is actually a leading developer and also manufacturer of self-propelled center pivot and lateral-move irrigation systems. It comes from the machinery-farming market along with Alamo Group, Inc. < a href =" http://www.nasdaq.com/symbol/alg" > ALG, AGCO Corporation AGCO and also Deere & & Provider DE

Want the most up to date suggestions coming from Zacks Investment Analysis? Today, you can easily download and install 7 Optimal Equities for the Upcoming 30 Days. < a href =" https://www.zacks.com/registration/pfp/?ALERT=RPT_7BST_LP203&ADID=ZCOM_ANALYSTBLOG_TEXTLINK_7BEST "rel =" nofollow "> Hit >>

in order to get this free of cost report > > Want the current recommendations off Zacks Investment Research study? Today, you can easily download 7 Ideal Supplies for the Next 30 Times. < a href =" http://www.zacks.com/registration/pfp/?ALERT=RPT_7BST_LP194&ADID=NASDAQ_CONTENT_ZER_ARTCAT_ANALYST_BLOG&cid=CS-NASDAQ-FT-222542 "rel =" nofollow ">

Click to receive this & totally free document

DEERE & Carbon Monoxide (DE): Free Supply Evaluation Record

Report LINDSAY CORPORATION (LNN): Free Stock Evaluation Report

http://www.zacks.com/” rel =” nofollow “> Zacks Financial investment Study The point of views and also viewpoints expressed within are actually the views as well as opinions from the author as well as do not necessarily express those of Nasdaq, Inc.

Newest Articles Plantations International