Scalper1 News

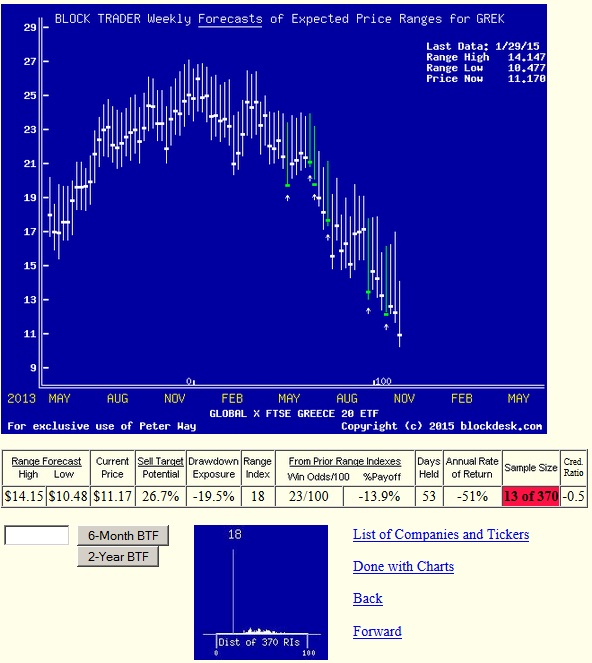

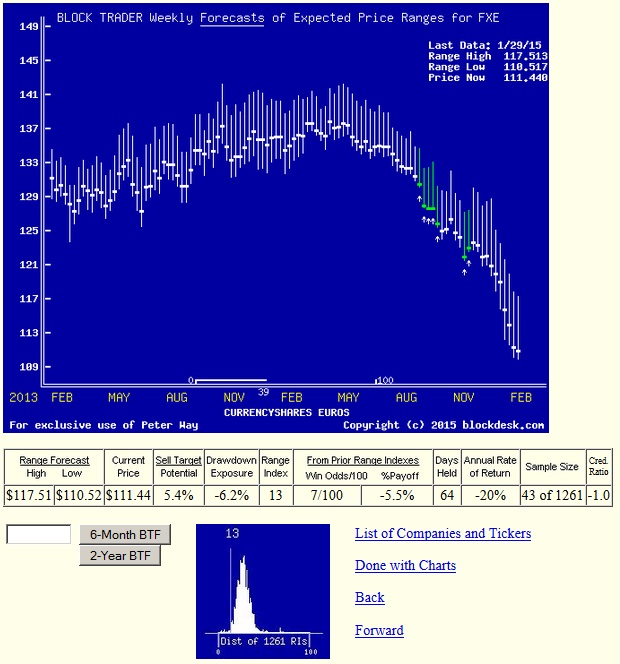

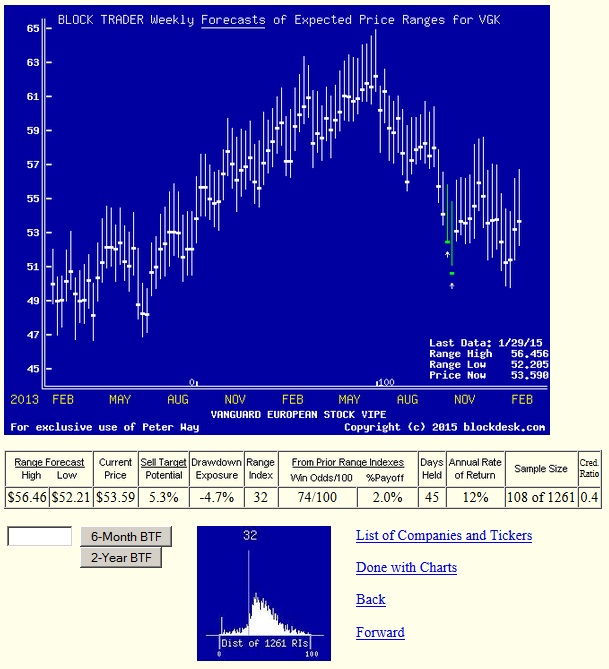

Summary Electing a “popular” populist government, the economically suffering population of Greece has brought the country’s future and involvement with the ECM to a showdown. This first, possibly of several, such confrontations makes clear that a common currency, the Euro, is only going to work where participants accept common rules of economic behavior. The ECB has told Greece the rules of the game, and Greece refuses to give up its National Sovereignty. The ECM’s February 28 deadline for Greece’s conformity is DOA. Greek PM Tspiras and ECM leaders (Germany’s Merkel) now are locked in the “chicken” game of who takes the blame (and loss) for a Greek national debt default. The Euro? or the (reverted-to) Drachma? US market-makers for the Greek ETF and the Euro ETF see no winners. A forecast for crumbling co-ordination of Europe’s economies? Greece: The Fat’s in the Fire; who takes the “fall”? Greece apparently has lived for years without the internal economic disciplines necessary to maintain a sound currency. Hiding behind a smokescreen of the “Euro” currency has finally pushed the European Common Market leaders’ patience to a point of resolution. Now it is apparent that for the ECM to actually work, bringing together several national interests in the expanding rivalry for world trade competition, its members have to either have productive internal disciplines, or become wards of those states that do. Many notable European countries made this assessment early in the ECM’s formation, and said “thanks, but no thanks” to the proposition of carrying the undisciplined nations via a common currency and common debts related to it. Not all Common-Market members are committed to acceptance and support of the Eurodollar. Not so strangely, those several nations unwilling to play the Euro-currency game were nations quite able to compete and support themselves without the encumbrance of being enablers to the undisciplined. We are amateur observers of international politics, incompetent to suggest how the Greece vs. ECM tussle will eventuate. But we do have the ability to track how the expectations of far-better-informed observers are trending. Ones who are willing to put some wallet-skin in the game, more than just mouth-skin. They are the market-makers [MMs] who help big-money-fund world investors shift the emphasis of their portfolios in search of capital-growth opportunities. Because the investment amounts are large they often stretch the capacity of established markets at times and prices to which other portfolio managers [PMs] are willing to commit. The MMs will commit temporary capital investments from their own funds to make up the differences if the risks involved can be adequately protected by hedging actions. What that price-change protection will cost gets included in the transaction price of the whole block trade being attempted. If it is too large for the PM issuing the trade order, the transaction is killed. When the cost is acceptable, the trade order is filled at a single price per share in its entirety. What the cost will be depends upon the buyer and seller of the protection coming to agreement upon just how much the trade order issue may change in price during the life of the hedge. These days the MMs are typically publicly-owned “investment banks” with extensive borrowing capacities well beyond the reach of 20th century exchange specialists and private hedging and arbitrage firms. Today’s MMs have for decades maintained world-wide information-gathering systems staffed 24x7x365 with reporters and researchers whose principal assignment is to keep the block trade desks (insurance buyers) and proprietary trade desks (insurance sellers) at least as well informed as the fund clients, and better, if possible. The MM firms bring to the transaction party skills and resources in information technology, arbitrage, and hedging that often are beyond those of their clients. What is paid for the price change insurance, and accepted by fund PMs tells just how far those concerned believe the issue’s prices might move. Because the insurance includes equally well-informed buyers and sellers, the resulting expectations are often not simply symmetrical expressions of uncertainty. The balance between upside and downside price change prospects can be a useful guide to coming actual price changes. In addition, the trends in how those price change ranges are moving brings further insights to each proposition. So what’s the current Greek and Euro picture? Not surprising, here is the past two years’ track of expectations for the Global X FTSE Greece 20 ETF (NYSEARCA: GREK ). The heavy-dot market price separates each once-a-week vertical line price range forecast into upside and downside price change prospects. (used with permission) Which looks a lot like the way prospects for the Euro are being reflected in the Currency Shares Euro ETF (NYSEARCA: FXE ). A similar trend of expectations, with more noise, appears in the Vanguard FTSE Europe ETF (NYSEARCA: VGK ), which tracks the index of stocks in Developed Countries of Europe. My first professional employ in the investment business after graduate school was at an eponymously-named NYC investment counsel firm led by a renowned economist. He once remarked “Only in America do they teach Economics, everywhere else they teach Political Economics.” At present there are political economic actions being undertaken by the ECB that have short to intermediate-term stimulating impact for Europe. The dream of a competitively-united “common market” provides the focus for such actions, through the ECB – at least at this point in time. But the potential for the dream’s accomplishment is getting a wake-up call from Greece where national identity and determination is being presented as a lever to achieve even further escape from real-world disciplines. Now other Common Market nations (as differentiated from “Eurodollar” nations) are further forced to anticipate becoming one of two coming alignments: Greece gets away with making the rest of the ECM be its present “sugar-daddy” and becomes the model for other like-minded states, for the rest of the Community to support (in perpetuity?), or The ECM forces Greece to accept its original terms, leading to a clear recognition of the National Sovereignty issues involved by all members, with potential voluntary departures of members essential to the ECM’s continuity. Conclusion This may be the inverse of a win-win situation. At present the professional investment community seems to think that’s possible, given their read of VGK. It is another example of ETFs being a part of the economic outlook. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Electing a “popular” populist government, the economically suffering population of Greece has brought the country’s future and involvement with the ECM to a showdown. This first, possibly of several, such confrontations makes clear that a common currency, the Euro, is only going to work where participants accept common rules of economic behavior. The ECB has told Greece the rules of the game, and Greece refuses to give up its National Sovereignty. The ECM’s February 28 deadline for Greece’s conformity is DOA. Greek PM Tspiras and ECM leaders (Germany’s Merkel) now are locked in the “chicken” game of who takes the blame (and loss) for a Greek national debt default. The Euro? or the (reverted-to) Drachma? US market-makers for the Greek ETF and the Euro ETF see no winners. A forecast for crumbling co-ordination of Europe’s economies? Greece: The Fat’s in the Fire; who takes the “fall”? Greece apparently has lived for years without the internal economic disciplines necessary to maintain a sound currency. Hiding behind a smokescreen of the “Euro” currency has finally pushed the European Common Market leaders’ patience to a point of resolution. Now it is apparent that for the ECM to actually work, bringing together several national interests in the expanding rivalry for world trade competition, its members have to either have productive internal disciplines, or become wards of those states that do. Many notable European countries made this assessment early in the ECM’s formation, and said “thanks, but no thanks” to the proposition of carrying the undisciplined nations via a common currency and common debts related to it. Not all Common-Market members are committed to acceptance and support of the Eurodollar. Not so strangely, those several nations unwilling to play the Euro-currency game were nations quite able to compete and support themselves without the encumbrance of being enablers to the undisciplined. We are amateur observers of international politics, incompetent to suggest how the Greece vs. ECM tussle will eventuate. But we do have the ability to track how the expectations of far-better-informed observers are trending. Ones who are willing to put some wallet-skin in the game, more than just mouth-skin. They are the market-makers [MMs] who help big-money-fund world investors shift the emphasis of their portfolios in search of capital-growth opportunities. Because the investment amounts are large they often stretch the capacity of established markets at times and prices to which other portfolio managers [PMs] are willing to commit. The MMs will commit temporary capital investments from their own funds to make up the differences if the risks involved can be adequately protected by hedging actions. What that price-change protection will cost gets included in the transaction price of the whole block trade being attempted. If it is too large for the PM issuing the trade order, the transaction is killed. When the cost is acceptable, the trade order is filled at a single price per share in its entirety. What the cost will be depends upon the buyer and seller of the protection coming to agreement upon just how much the trade order issue may change in price during the life of the hedge. These days the MMs are typically publicly-owned “investment banks” with extensive borrowing capacities well beyond the reach of 20th century exchange specialists and private hedging and arbitrage firms. Today’s MMs have for decades maintained world-wide information-gathering systems staffed 24x7x365 with reporters and researchers whose principal assignment is to keep the block trade desks (insurance buyers) and proprietary trade desks (insurance sellers) at least as well informed as the fund clients, and better, if possible. The MM firms bring to the transaction party skills and resources in information technology, arbitrage, and hedging that often are beyond those of their clients. What is paid for the price change insurance, and accepted by fund PMs tells just how far those concerned believe the issue’s prices might move. Because the insurance includes equally well-informed buyers and sellers, the resulting expectations are often not simply symmetrical expressions of uncertainty. The balance between upside and downside price change prospects can be a useful guide to coming actual price changes. In addition, the trends in how those price change ranges are moving brings further insights to each proposition. So what’s the current Greek and Euro picture? Not surprising, here is the past two years’ track of expectations for the Global X FTSE Greece 20 ETF (NYSEARCA: GREK ). The heavy-dot market price separates each once-a-week vertical line price range forecast into upside and downside price change prospects. (used with permission) Which looks a lot like the way prospects for the Euro are being reflected in the Currency Shares Euro ETF (NYSEARCA: FXE ). A similar trend of expectations, with more noise, appears in the Vanguard FTSE Europe ETF (NYSEARCA: VGK ), which tracks the index of stocks in Developed Countries of Europe. My first professional employ in the investment business after graduate school was at an eponymously-named NYC investment counsel firm led by a renowned economist. He once remarked “Only in America do they teach Economics, everywhere else they teach Political Economics.” At present there are political economic actions being undertaken by the ECB that have short to intermediate-term stimulating impact for Europe. The dream of a competitively-united “common market” provides the focus for such actions, through the ECB – at least at this point in time. But the potential for the dream’s accomplishment is getting a wake-up call from Greece where national identity and determination is being presented as a lever to achieve even further escape from real-world disciplines. Now other Common Market nations (as differentiated from “Eurodollar” nations) are further forced to anticipate becoming one of two coming alignments: Greece gets away with making the rest of the ECM be its present “sugar-daddy” and becomes the model for other like-minded states, for the rest of the Community to support (in perpetuity?), or The ECM forces Greece to accept its original terms, leading to a clear recognition of the National Sovereignty issues involved by all members, with potential voluntary departures of members essential to the ECM’s continuity. Conclusion This may be the inverse of a win-win situation. At present the professional investment community seems to think that’s possible, given their read of VGK. It is another example of ETFs being a part of the economic outlook. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News