< div id =" articleText" legibility=" 127.40947436729" >< img course= "articleImgLg" alt =" Gettyimages" src =" https://www.scalper1.com/wp-content/uploads/2016/06/gettyimages-494224104_large.jpg"/ > China potash stocks are operating higher and also that has actually been actually getting cargos from Russia, indicating it is actually in no hurry to authorize pricing arrangements along with North The United States’s significant three manufacturers. Image resource

: Getty Images. Points typically aren’t looking suitable for potash producers. That is actually already June as well as China still hasn’t already signed a buy prices from potash shippings for the year, and also the technique factors are actually going that merely may not authorize one at all. That indicates that potash costs, which were at $ 315 a tonne when it authorized its own last arrangement along with Northern American advertising group Canpotex in March 2015, might have much additionally to drop.

PotashCorp (NYSE: FLOWERPOT), as one from the globe’s major developers of the plant nutrient, as well as one from the three members from Canpotex, possesses a great deal riding on the outcome from the rates settlements. Its initial quarter results disclosed back in April were actually struck hard by China’s agreement deferrals considering that this caused other markets to end up being even more hesitant about loading their very own storehouses along with additional product. PotashCorp mentioned section incomes rolled additional than 50% to $ 322 thousand as sales volumes of 1.8 million tonnes dropped effectively brief from the 2.3 million tonnes marketed in the year ago duration.

This had not been far better for the various other two members of Canpotex either, Agrium (NYSE: AGU) or Mosaic (NYSE: MONTHS), additionally endured purchases amounts shortages.

The clubby potash market was thrown into distress in 2013 when Russian potash producer Uralkali < a href =" http://www.fool.com/investing/general/2013/07/31/potash-gets-pulverized-but-its-not-as-bad-as-it-lo.aspx?&utm_campaign=article&utm_medium=feed&utm_source=nasdaq" rel=" nofollow "> finished its circulation contract along with Belaruskali, its joint venture companion in Belarusian Potash Corp., or BPC, a cartel that managed about 43% from global potash exports.

Depending on to Bloomberg, the potash market’s weak points are worsened by desires that India may curtail purchases while Brazil, one more top market for the crop nutrient, is being actually injured by an unreliable economic climate, with pricing certainly there diving to around $ 220 each tonne. So China doesn’t have to rush into any type of arrangements presently given that its stocks are actually presently above common levels and also its personal potash producers are going for complete ability. Even more, Russia has actually been actually supplying to it some 120,000 tonnes of potash monthly.

Therefore if costs are actually going to drop, there excellents main reason to think they might go as reduced as $ 200 a tonne, maybe reduced, as the Canpotex participants were all disclosing low discovered rates. PotashCorp mentioned in April its own recognized cost was just $ 178 every tonne on a worldwide basis, effectively below the $ 284 it had realized in the previous year’s initial quarter; Mosaic stated ordinary selling rates from $ 207 each tonne; and Agrium mentioned this got$ 199 every tonne.

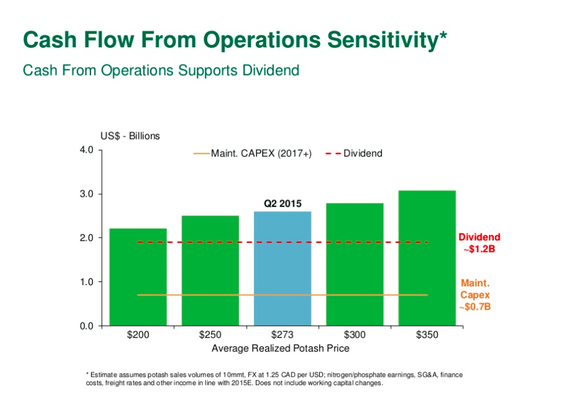

< img course=" articleImgLg" alt= "Monitor Chance" src=" https://www.scalper1.com/wp-content/uploads/2016/06/screen-shot-2016-06-07-at-120623-am_large.png"/ > Graphic source: PotashCorp expert presentation, Scotiabank Fertilizers & & Chemicals Event, Sept. 22, 2015.

That low rates atmosphere also possesses effects for PotashCorp’s dividend, which it pays out $ 1.2 billion yearly. As the potash miner has on its own taken note, at $ 200 every tonne, the reward is scarcely lasting. It is going to likely try to preserve it for at some point, but if rates continues to cascade lower, there may be stress to reduce the returns.

It’s certainly not all ruin and also gloom, however. Although Variety is anticipating prices of in between $ 180 and also $ 200 each tonne for the second quarter, that is additionally foreseing the back one-half of the year to become much more secure. As well as Agrium noted India introduced improvements to its plant nutrient aid course for the 2016-2017 growing year as well as pointed out the brand-new policy “enhances the bring in financials aspects and also ought to assist enhanced import demand in the second half of 2016.” Moreover, South america’s potash imports in the initial fourth were up a surprising TWENTY% from a year ago.

Agrium strongly believes the marketplace has actually reached the base from the pattern and also is actually poised for brand-new development. Perhaps, but all indicators appear to suggest because there’s still a ton of awful potash producers are actually going to must cope with, and with all of them trading between 15 as well as 18 times future revenues, there might be time however in order to get them at a discount.

A top secret billion-dollar inventory possibility

The globe’s most significant tech provider overlooked to reveal you one thing, however a handful of Wall surface Road experts as well as the Moron didn’t miss out on a beat: There is actually a tiny company that’s powering their new gadgets and the coming reformation in technology. And our team assume its own stock rate has virtually infinite space to operate for early in-the-know financiers! To become some of all of them, < a href

=” http://www.fool.com/mms/mark/ecap-foolcom-apple-wearable?aid=6965&source=irbeditxt0000017&ftm_cam=rb-wearable-d&ftm_pit=2691&ftm_veh=article_pitch&utm_campaign=article&utm_medium=feed&utm_source=nasdaq” rel=” nofollow” > only visit this site. The viewpoints as well as viewpoints conveyed within are actually the perspectives and also point of views of the writer and also do not automatically reflect those of Nasdaq, Inc.

Newest Contents Plantations International