Scalper1 News

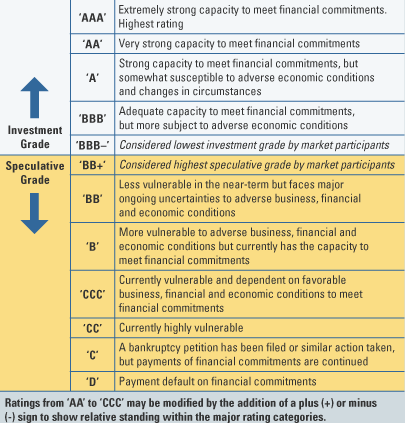

Summary IShares recently listed a new USD hedged high yield bond ETF. This fund is composed of Canadian dollar, British pound sterling, and Euro denominated corporate junk bonds. This fund may be useful to an investor looking for international fixed income exposure without the foreign exchange risk. The Fund On July 28th, iShares from Blackrock (NYSE: BLK ) listed a new ETF, the iShares Currency Hedged Global ex USD High Yield Bond ETF (NYSEARCA: HHYX ). As stated in the fund’s prospectus, this fund seeks to invest in corporate junk bonds …while mitigating exposure to fluctuations between the value of the component currencies and the U.S. dollar. HHYX seeks to track the Markit iBoxx Global Developed Markets ex-US High Yield (USD Hedged) Index . HHYX principally invests in another iShares fund, and/or the components of that fund, the iShares Global ex USD High Yield Corporate Bond ETF (BATS: HYXU ). The difference between the two is that, while both achieve exposure to non-USD denominated high yield bonds, only HHYX actually protects and hedges against the foreign exchange risk associated with international investing. In this article, I will briefly go over the components of the new fund and the structure of the currency hedging strategy used by this fund. Components Geography: The top five geographic areas of exposure in HHYX are: Italy (22.23%) United Kingdom (15.22%) Germany (14.87%) France (12.36%) Spain (5.97%) Investors may also note that 1.36% of the exposure comes from Greece. Remember that HHYX is strictly exposed to corporate junk bonds, and not municipal or government debt. That being said, I think most investors are aware that there is some concern in the market about the status of Italy’s debt levels. Sovereign debt is at an all time high in Italy, and there are some analysts saying that Italy will be the “next Greece.” For these reasons, I see the large exposure to Italy as one of the principle risks. Sectors: The most represented sectors in the fund are: Financials (18.85%) Telecommunication (17.10%) Capital Goods (16.91%) Consumer Cyclical (16.75%) Consumer Non-cyclical (9.40%) Grades: The primary credit ratings of the underlying investments are BB (63.67%) and B (30.71%). As far as where these credit ratings are derived from, iShares states that: Credit quality ratings on underlying securities of the fund are received from S&P, Moody’s and Fitch and converted to the equivalent S&P major rating category. From the S&P’s Credit Ratings website, here is how the various ratings are described: Of course, there are many risks associated with speculative grade junk bonds, but I will assume that if you are seeking exposure to them, then you have some understanding of these risks. How the Currency Hedge Works: In order to hedge against fluctuations of exchange rates between the USD and other currencies, HHYX shorts forward contracts for each of the non-dollar currencies in the portfolio. What this means is that if one of the underlying currencies in the portfolio loses value compared to the USD, the losses will be offset by the gains from the forward contracts. It is important to realize that the forward contracts will offset and limit, but not necessarily eliminate, losses from foreign exchange risk. It should be also noted that the inverse of this is also true. If the underlying currency of one of the portfolio’s investments gains value compared to the U.S. dollar, the gains would be offset by a loss from the forward contract. In other words, the investor would not benefit from the foreign exchange, whereas he or she would if they had purchased the asset using converted U.S. dollars. Conclusion: This article is not necessarily intended to encourage or discourage investors from investing in international high yield bonds. However, if one is inclined to do so, I believe that this new ETF is a reasonable way to gain exposure. I do have concerns about the large allocation towards Italian debt, but the underlying index could possibly rebalance if the situation deteriorated further. Arguably, it is a benefit that the fund is geared towards the higher-end of speculative grade debt. In short, if an investor is seeking to diversify his or her portfolio with exposure to international speculative grade corporate debt, this new ETF may be a worth further investigation. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: This article is not intended to be a buy/sell recommendation, it is simply offered as an analysis of a new exchange traded product that some investors may find useful for their portfolios. Scalper1 News

Summary IShares recently listed a new USD hedged high yield bond ETF. This fund is composed of Canadian dollar, British pound sterling, and Euro denominated corporate junk bonds. This fund may be useful to an investor looking for international fixed income exposure without the foreign exchange risk. The Fund On July 28th, iShares from Blackrock (NYSE: BLK ) listed a new ETF, the iShares Currency Hedged Global ex USD High Yield Bond ETF (NYSEARCA: HHYX ). As stated in the fund’s prospectus, this fund seeks to invest in corporate junk bonds …while mitigating exposure to fluctuations between the value of the component currencies and the U.S. dollar. HHYX seeks to track the Markit iBoxx Global Developed Markets ex-US High Yield (USD Hedged) Index . HHYX principally invests in another iShares fund, and/or the components of that fund, the iShares Global ex USD High Yield Corporate Bond ETF (BATS: HYXU ). The difference between the two is that, while both achieve exposure to non-USD denominated high yield bonds, only HHYX actually protects and hedges against the foreign exchange risk associated with international investing. In this article, I will briefly go over the components of the new fund and the structure of the currency hedging strategy used by this fund. Components Geography: The top five geographic areas of exposure in HHYX are: Italy (22.23%) United Kingdom (15.22%) Germany (14.87%) France (12.36%) Spain (5.97%) Investors may also note that 1.36% of the exposure comes from Greece. Remember that HHYX is strictly exposed to corporate junk bonds, and not municipal or government debt. That being said, I think most investors are aware that there is some concern in the market about the status of Italy’s debt levels. Sovereign debt is at an all time high in Italy, and there are some analysts saying that Italy will be the “next Greece.” For these reasons, I see the large exposure to Italy as one of the principle risks. Sectors: The most represented sectors in the fund are: Financials (18.85%) Telecommunication (17.10%) Capital Goods (16.91%) Consumer Cyclical (16.75%) Consumer Non-cyclical (9.40%) Grades: The primary credit ratings of the underlying investments are BB (63.67%) and B (30.71%). As far as where these credit ratings are derived from, iShares states that: Credit quality ratings on underlying securities of the fund are received from S&P, Moody’s and Fitch and converted to the equivalent S&P major rating category. From the S&P’s Credit Ratings website, here is how the various ratings are described: Of course, there are many risks associated with speculative grade junk bonds, but I will assume that if you are seeking exposure to them, then you have some understanding of these risks. How the Currency Hedge Works: In order to hedge against fluctuations of exchange rates between the USD and other currencies, HHYX shorts forward contracts for each of the non-dollar currencies in the portfolio. What this means is that if one of the underlying currencies in the portfolio loses value compared to the USD, the losses will be offset by the gains from the forward contracts. It is important to realize that the forward contracts will offset and limit, but not necessarily eliminate, losses from foreign exchange risk. It should be also noted that the inverse of this is also true. If the underlying currency of one of the portfolio’s investments gains value compared to the U.S. dollar, the gains would be offset by a loss from the forward contract. In other words, the investor would not benefit from the foreign exchange, whereas he or she would if they had purchased the asset using converted U.S. dollars. Conclusion: This article is not necessarily intended to encourage or discourage investors from investing in international high yield bonds. However, if one is inclined to do so, I believe that this new ETF is a reasonable way to gain exposure. I do have concerns about the large allocation towards Italian debt, but the underlying index could possibly rebalance if the situation deteriorated further. Arguably, it is a benefit that the fund is geared towards the higher-end of speculative grade debt. In short, if an investor is seeking to diversify his or her portfolio with exposure to international speculative grade corporate debt, this new ETF may be a worth further investigation. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: This article is not intended to be a buy/sell recommendation, it is simply offered as an analysis of a new exchange traded product that some investors may find useful for their portfolios. Scalper1 News

Scalper1 News