Scalper1 News

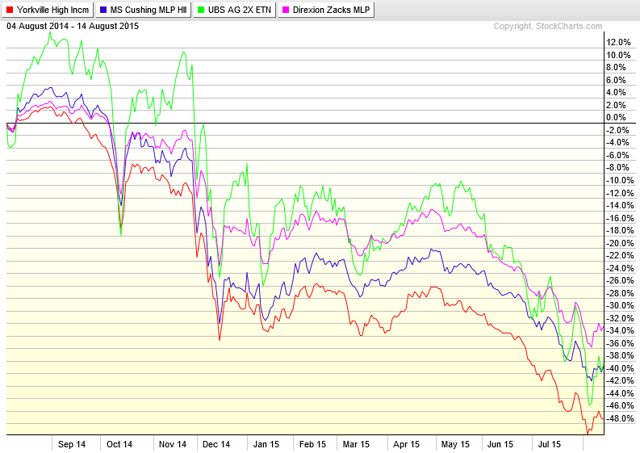

UBS ETRACS has a new leveraged ETN tracking the S&P MLP index. The ETN holds the top eight weighted MLPs from the index. This is a speculative choice for income and it will likely be very volatile. On July 14th, ETRACS newest ETN started trading on the NYSE Arca. The fund is the ETRACS 2xMonthly Leveraged S&P MLP Index ETN (NYSEARCA: MLPV ). UBS (NYSE: UBS ) has a fair selection of MLP ETNs already, and MLPV will be the ninth addition to their list in the MLP category of ETNs. This security is an unsecured debt note that tracks the S&P MLP index with 2x leverage. The S&P MLP index tracks the leading partnerships trading on the NYSE and Nasdaq, which includes both MLPs and LLCs. The index tracks 79 companies in total. The leverage in this fund is reset on a monthly basis instead of daily. Distributions are made quarterly and linked 2x to the index. Here are some features of MLPV. Market Cap-19.2 million Expense Ratio-0.95% 2x Index Yield-12.49% Maturity Date-7/14/2045 Here are the holdings of the ETN and the percentage weighted. MLPV only holds the top eight out of the 79 total constituents that the index tracks. Enterprise Products Partners LP EPD 14.78 Energy Transfer Equity LP ETE 11.25 Energy Transfer Partners LP ETP 8.08 Magellan Midstream Partners LP MMP 6.43 Plains All American Pipeline LP PAA 6.19 Williams Partners LP WPZ 4.54 Buckeye Partners LP BPL 3.61 MarkWest Energy Partners LP MWE 3.61 Here is how MLPV compares to some similar funds. Ticker Symbol Yield Expense Ratio MLPV 12.49% 0.95% ETRACS 2xMonthly Leveraged Long Alerian MLP Infrastructure Index ETN MLPL 15.02% 0.85% iPath S&P MLP ETN IMLP 5.55% 0.80% This ETN might appease people who are chasing yield at the expense of high volatility and risk. It is definitely not the kind of fund you should use if you are seeking stable and conservative income. The downturn in the oil price last year has pummeled many MLPs, including IMLP which tracks the same index as MLPV. The one year chart below shows the four highest yielding MLP ETFs. (click to enlarge) The expense ratio of .95% is much too high for my liking, but the lowest ratio for any available MLP ETF is only .45% and some even have fees as high as 5-8%, which is extremely high for any ETF. The fund that has the .45% ER is the Global X MLP & Energy Infrastructure ETF (NYSEARCA: MLPX ), but it has a drastically lower yield of 2.66% when compared to most other MLP funds. The MLP ETF I like most for finding a balance between high yield and a decent expense ratio is the Direxion Zacks MLP High Income Shares ETF ( ZMLP) which currently yields 11.33% with an net expense ratio of .65%. With that said, one should only invest in this or any MLP with the expectation of volatility. With oil prices currently depressed, this might be a relatively safer time to initiate a position in these high yielding securities. This fund is structured as an ETN rather than an ETF, and there is good reason for this. The nature of MLPs gives them the advantage of legally escaping corporate taxes, but if the partnerships are in an ETF, then the corporate tax applies to the ETF itself and thus cancels out the tax advantage of MLPs. The drawback to the ETN however, is that the distributions are considered taxable income, which is not the case when an MLP is held individually. The tax consequences of owning MLPs can be very tricky, so it is always best to consult a tax professional before investing in any MLP or MLP fund and make sure you know exactly how you will be taxed. Due to the leverage used in this ETN, I consider it speculative income and potential investors should be aware of the risks. In addition to the leverage, MLPs present volatility due to being exposed to the energy sector. In the short time that MLPV has been trading, the underlying index has seen a bit of a sell-off which resulted in a price decline in the ETN. This dip might make for a good buying opportunity, but the volatility and risk should not be underestimated. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

UBS ETRACS has a new leveraged ETN tracking the S&P MLP index. The ETN holds the top eight weighted MLPs from the index. This is a speculative choice for income and it will likely be very volatile. On July 14th, ETRACS newest ETN started trading on the NYSE Arca. The fund is the ETRACS 2xMonthly Leveraged S&P MLP Index ETN (NYSEARCA: MLPV ). UBS (NYSE: UBS ) has a fair selection of MLP ETNs already, and MLPV will be the ninth addition to their list in the MLP category of ETNs. This security is an unsecured debt note that tracks the S&P MLP index with 2x leverage. The S&P MLP index tracks the leading partnerships trading on the NYSE and Nasdaq, which includes both MLPs and LLCs. The index tracks 79 companies in total. The leverage in this fund is reset on a monthly basis instead of daily. Distributions are made quarterly and linked 2x to the index. Here are some features of MLPV. Market Cap-19.2 million Expense Ratio-0.95% 2x Index Yield-12.49% Maturity Date-7/14/2045 Here are the holdings of the ETN and the percentage weighted. MLPV only holds the top eight out of the 79 total constituents that the index tracks. Enterprise Products Partners LP EPD 14.78 Energy Transfer Equity LP ETE 11.25 Energy Transfer Partners LP ETP 8.08 Magellan Midstream Partners LP MMP 6.43 Plains All American Pipeline LP PAA 6.19 Williams Partners LP WPZ 4.54 Buckeye Partners LP BPL 3.61 MarkWest Energy Partners LP MWE 3.61 Here is how MLPV compares to some similar funds. Ticker Symbol Yield Expense Ratio MLPV 12.49% 0.95% ETRACS 2xMonthly Leveraged Long Alerian MLP Infrastructure Index ETN MLPL 15.02% 0.85% iPath S&P MLP ETN IMLP 5.55% 0.80% This ETN might appease people who are chasing yield at the expense of high volatility and risk. It is definitely not the kind of fund you should use if you are seeking stable and conservative income. The downturn in the oil price last year has pummeled many MLPs, including IMLP which tracks the same index as MLPV. The one year chart below shows the four highest yielding MLP ETFs. (click to enlarge) The expense ratio of .95% is much too high for my liking, but the lowest ratio for any available MLP ETF is only .45% and some even have fees as high as 5-8%, which is extremely high for any ETF. The fund that has the .45% ER is the Global X MLP & Energy Infrastructure ETF (NYSEARCA: MLPX ), but it has a drastically lower yield of 2.66% when compared to most other MLP funds. The MLP ETF I like most for finding a balance between high yield and a decent expense ratio is the Direxion Zacks MLP High Income Shares ETF ( ZMLP) which currently yields 11.33% with an net expense ratio of .65%. With that said, one should only invest in this or any MLP with the expectation of volatility. With oil prices currently depressed, this might be a relatively safer time to initiate a position in these high yielding securities. This fund is structured as an ETN rather than an ETF, and there is good reason for this. The nature of MLPs gives them the advantage of legally escaping corporate taxes, but if the partnerships are in an ETF, then the corporate tax applies to the ETF itself and thus cancels out the tax advantage of MLPs. The drawback to the ETN however, is that the distributions are considered taxable income, which is not the case when an MLP is held individually. The tax consequences of owning MLPs can be very tricky, so it is always best to consult a tax professional before investing in any MLP or MLP fund and make sure you know exactly how you will be taxed. Due to the leverage used in this ETN, I consider it speculative income and potential investors should be aware of the risks. In addition to the leverage, MLPs present volatility due to being exposed to the energy sector. In the short time that MLPV has been trading, the underlying index has seen a bit of a sell-off which resulted in a price decline in the ETN. This dip might make for a good buying opportunity, but the volatility and risk should not be underestimated. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News