Scalper1 News

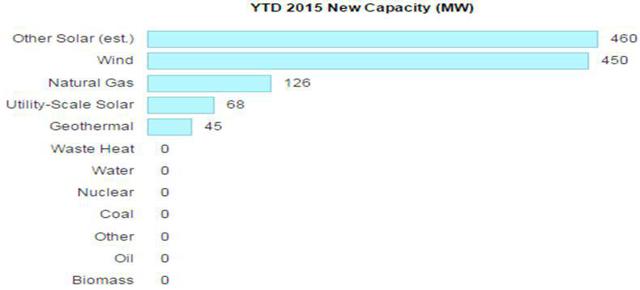

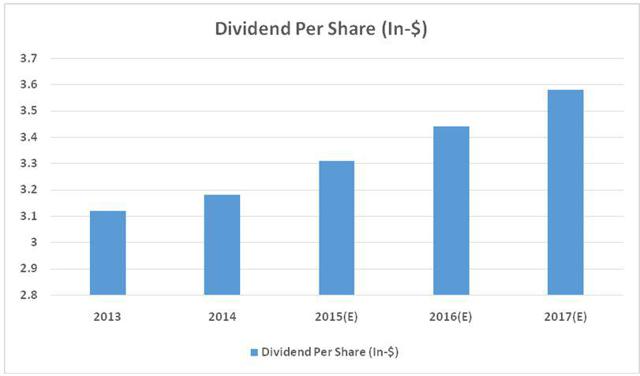

Summary Company’s share repurchase plan will grow its future EPS and expand its ROE. DUK’s strong growth prospects cast a positive outlook on its cash flow position, which means more upside for dividends. Analysts are bullish on the company’s future growth prospects and have projected future sales base growth of 4.72%. In recent quarters, Duke Energy (NYSE: DUK ) has been repositioning its business around regulated business operations by repatriating cash from the international segment and selling its competitive business assets. The company is moving ahead with its intelligent strategic growth plans that involve getting an extended, regulated renewable energy generation asset base; such plans will benefit the company in the long run, as DUK’s revenue and cash flow growth will improve, which will reduce shareholder risk. Owing to the company’s strong strategic growth prospects, I believe its future cash flows will remain strong to support its shareholder-friendly dividend payment policy. The company offers a dividend yield of 4.35%, and its dividend growth is expected to improve in future. DUK’s Strategic Growth Drivers Remain Intact In the past few years, given the increasing environment protection concerns, utility companies have directed their focus on increasing their renewable energy generating resources. In fact, research data indicates that year-to-date, the overall new energy generation capacity of the U.S. Utility Industry is significantly comprised of renewable sources such as solar, wind and natural gas, as shown in the chart below. (click to enlarge) Source: Cleantechnica.com Following this industry norm, DUK is actively seeking all available opportunities to expand its renewable energy generation asset base. In fact, the company has invested more than $4 billion in several green energy projects over the last decade. But to further accelerate its dependence on renewable energy generation sources, DUK has recently accelerated investments in several solar, biomass and natural gas energy generation projects, which are expected to yield the company almost 6000MW by 2020. The company has recently presented a case before state regulators in order to seek permission to use swine waste for biogas production at two of its sites. If DUK’s proposal to purchase swine waste for biogas production gets past regulatory restrictions, the company will achieve half of its 2020 goal of producing 6000MW. And as far as solar energy generation sources are concerned, currently, DUK is running several solar energy generation operations in Canada and Latin America, and to further extend its reliance on the solar facility, the company is planning to get a solar power generation base in Florida. According to the plan, it will install at least a 500MW solar power generation fleet in Florida by 2024, which will increase the overall solar power generation capacity of Florida State by three-folds. I believe this new solar power plant in Florida will not only speed up DUK’s process of adopting solar energy generation technology, but will also improve its ability to better serve the rising power generation demand in Florida. Moreover, the company has highlighted that it will use almost $1.1 billion cash reserves to convert its North Carolina-based 12.8GW coal-fired power plant into a natural gas plant, as part of its plan to have a large, regulated, renewable energy generation asset base. Although the conversion might take four-to-five years, I believe that with the complete retirement of the coal-powered plant into a natural gas plant, DUK will have increased the chances of making huge investments to build additional gas pipelines by entering into a new joint venture, which will help the company serve more service territories with its expanded natural gas generation operations. Since both solar and natural gas generation operations are part of DUK’s regulated asset base, I believe these increased growth investments in both operations will better the company’s future revenues and will provide stability to its cash flow base. Moreover, with the recent sale of its non-regulated Midwest assets, DUK has affirmed its focus on increasing its regulated asset base. Moreover, using the Midwest Assets sale proceeds of $2.8 billion , the company has initiated a share repurchase plan of $1.5 billion , which I believe will better DUK’s EPS growth in the near term. Furthermore, the company’s management has affirmed that the rest of the proceeds will be used for repayment of debt. Given the fact that the company’s capital spending is also high due to ongoing growth projects, I believe the sale of Midwest assets is an intelligent step by DUK, as it is aimed at improving the company’s credit outlook and strengthening its balance sheet position. In addition, DUK’s plan to access $2.7 billion of unremitted international business earnings in the next 8 years will positively affect the company’s performance. In 2015, the company plans to repatriate $1.2 billion from its international business. The $2.8 billion in cash proceeds from the sale of the Midwest assets and expected cash repatriation from international business will allow the company to fund its planned growth investment, and eliminate the need to issue equity until 2017, which will positively affect its EPS. On the other hand, the company recently recommended full excavation of 12 more coal ash basins in North Carolina, bringing the total number of basins that the company is expected to close in the state to 24. Earlier, the company stated that the cost of complying with the North Carolina Coal Ash Management Act is estimated to be approximately $3.5 billion. However, as a result of the excavation of 12 more coal ash basins, I believe the estimated cost for excavation will increase going forward. I believe the company will provide an updated cost estimate during the 2Q15 earnings call, therefore, I recommend investors to keep track of the upcoming earnings call. Cash Returns Another important stock price driver for DUK is its policy of returning cash as dividends to its shareholders. In fact, the company’s healthy dividend payments under its attractive dividend payment policy have earned it a current dividend yield of 4.35% . Moreover, DUK’s regular dividend hikes have earned it a current dividend growth rate of 2% per year, whereas its earnings have been growing in a range of nearly 4%-to-6%. Given its increased focus on getting an extended regulated asset base, DUK’s future cash flows will become more stable, which makes me believe that the company will continue to grow future dividends, in-line with the earnings growth level, which will boost its investor confidence and will better its stock price performance. The following chart shows DUK’s dividend per share payments in the past two years; also, the chart includes my estimates for future dividend payments. (*Note = Dividend per share from 2015 onwards have been calculated by Equity Watch) (click to enlarge) Source: Company’s Yearly Earnings Reports & Equity Watch Estimates Risks The company will remain exposed to the risk of sudden changes in regulatory restrictions. In addition, any laxness exhibited by DUK’s management during the execution of its planned and currently running strategic growth projects might hamper its future growth potentials. Furthermore, unforeseen negative economic changes, foreign currency headwinds and adverse weather conditions are key risks that might restrict its stock price performance in the years ahead. Conclusion The company’s on-track strategic efforts, including getting a broader, renewable energy generating, regulated asset base with hefty growth investments in several energy generation projects make me bullish on the stock. Moreover, DUK’s recently announced share repurchase plan, well supported by the sale of Midwest assets, will grow the company’s future EPS and will expand its ROE. Furthermore, DUK’s strong growth prospects cast a positive outlook on its cash flow position, which means more upside for the company’s dividends. Analysts are also bullish on the company’s future growth prospects, and have projected future sales base growth of 4.72% , well above the industry median of 2.15%. In addition, analysts’ earnings growth rate forecasts are also strong, as shown in the chart below. Due to all the aforementioned factors, I am bullish on DUK. (click to enlarge) Source: Nasdaq.com Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Company’s share repurchase plan will grow its future EPS and expand its ROE. DUK’s strong growth prospects cast a positive outlook on its cash flow position, which means more upside for dividends. Analysts are bullish on the company’s future growth prospects and have projected future sales base growth of 4.72%. In recent quarters, Duke Energy (NYSE: DUK ) has been repositioning its business around regulated business operations by repatriating cash from the international segment and selling its competitive business assets. The company is moving ahead with its intelligent strategic growth plans that involve getting an extended, regulated renewable energy generation asset base; such plans will benefit the company in the long run, as DUK’s revenue and cash flow growth will improve, which will reduce shareholder risk. Owing to the company’s strong strategic growth prospects, I believe its future cash flows will remain strong to support its shareholder-friendly dividend payment policy. The company offers a dividend yield of 4.35%, and its dividend growth is expected to improve in future. DUK’s Strategic Growth Drivers Remain Intact In the past few years, given the increasing environment protection concerns, utility companies have directed their focus on increasing their renewable energy generating resources. In fact, research data indicates that year-to-date, the overall new energy generation capacity of the U.S. Utility Industry is significantly comprised of renewable sources such as solar, wind and natural gas, as shown in the chart below. (click to enlarge) Source: Cleantechnica.com Following this industry norm, DUK is actively seeking all available opportunities to expand its renewable energy generation asset base. In fact, the company has invested more than $4 billion in several green energy projects over the last decade. But to further accelerate its dependence on renewable energy generation sources, DUK has recently accelerated investments in several solar, biomass and natural gas energy generation projects, which are expected to yield the company almost 6000MW by 2020. The company has recently presented a case before state regulators in order to seek permission to use swine waste for biogas production at two of its sites. If DUK’s proposal to purchase swine waste for biogas production gets past regulatory restrictions, the company will achieve half of its 2020 goal of producing 6000MW. And as far as solar energy generation sources are concerned, currently, DUK is running several solar energy generation operations in Canada and Latin America, and to further extend its reliance on the solar facility, the company is planning to get a solar power generation base in Florida. According to the plan, it will install at least a 500MW solar power generation fleet in Florida by 2024, which will increase the overall solar power generation capacity of Florida State by three-folds. I believe this new solar power plant in Florida will not only speed up DUK’s process of adopting solar energy generation technology, but will also improve its ability to better serve the rising power generation demand in Florida. Moreover, the company has highlighted that it will use almost $1.1 billion cash reserves to convert its North Carolina-based 12.8GW coal-fired power plant into a natural gas plant, as part of its plan to have a large, regulated, renewable energy generation asset base. Although the conversion might take four-to-five years, I believe that with the complete retirement of the coal-powered plant into a natural gas plant, DUK will have increased the chances of making huge investments to build additional gas pipelines by entering into a new joint venture, which will help the company serve more service territories with its expanded natural gas generation operations. Since both solar and natural gas generation operations are part of DUK’s regulated asset base, I believe these increased growth investments in both operations will better the company’s future revenues and will provide stability to its cash flow base. Moreover, with the recent sale of its non-regulated Midwest assets, DUK has affirmed its focus on increasing its regulated asset base. Moreover, using the Midwest Assets sale proceeds of $2.8 billion , the company has initiated a share repurchase plan of $1.5 billion , which I believe will better DUK’s EPS growth in the near term. Furthermore, the company’s management has affirmed that the rest of the proceeds will be used for repayment of debt. Given the fact that the company’s capital spending is also high due to ongoing growth projects, I believe the sale of Midwest assets is an intelligent step by DUK, as it is aimed at improving the company’s credit outlook and strengthening its balance sheet position. In addition, DUK’s plan to access $2.7 billion of unremitted international business earnings in the next 8 years will positively affect the company’s performance. In 2015, the company plans to repatriate $1.2 billion from its international business. The $2.8 billion in cash proceeds from the sale of the Midwest assets and expected cash repatriation from international business will allow the company to fund its planned growth investment, and eliminate the need to issue equity until 2017, which will positively affect its EPS. On the other hand, the company recently recommended full excavation of 12 more coal ash basins in North Carolina, bringing the total number of basins that the company is expected to close in the state to 24. Earlier, the company stated that the cost of complying with the North Carolina Coal Ash Management Act is estimated to be approximately $3.5 billion. However, as a result of the excavation of 12 more coal ash basins, I believe the estimated cost for excavation will increase going forward. I believe the company will provide an updated cost estimate during the 2Q15 earnings call, therefore, I recommend investors to keep track of the upcoming earnings call. Cash Returns Another important stock price driver for DUK is its policy of returning cash as dividends to its shareholders. In fact, the company’s healthy dividend payments under its attractive dividend payment policy have earned it a current dividend yield of 4.35% . Moreover, DUK’s regular dividend hikes have earned it a current dividend growth rate of 2% per year, whereas its earnings have been growing in a range of nearly 4%-to-6%. Given its increased focus on getting an extended regulated asset base, DUK’s future cash flows will become more stable, which makes me believe that the company will continue to grow future dividends, in-line with the earnings growth level, which will boost its investor confidence and will better its stock price performance. The following chart shows DUK’s dividend per share payments in the past two years; also, the chart includes my estimates for future dividend payments. (*Note = Dividend per share from 2015 onwards have been calculated by Equity Watch) (click to enlarge) Source: Company’s Yearly Earnings Reports & Equity Watch Estimates Risks The company will remain exposed to the risk of sudden changes in regulatory restrictions. In addition, any laxness exhibited by DUK’s management during the execution of its planned and currently running strategic growth projects might hamper its future growth potentials. Furthermore, unforeseen negative economic changes, foreign currency headwinds and adverse weather conditions are key risks that might restrict its stock price performance in the years ahead. Conclusion The company’s on-track strategic efforts, including getting a broader, renewable energy generating, regulated asset base with hefty growth investments in several energy generation projects make me bullish on the stock. Moreover, DUK’s recently announced share repurchase plan, well supported by the sale of Midwest assets, will grow the company’s future EPS and will expand its ROE. Furthermore, DUK’s strong growth prospects cast a positive outlook on its cash flow position, which means more upside for the company’s dividends. Analysts are also bullish on the company’s future growth prospects, and have projected future sales base growth of 4.72% , well above the industry median of 2.15%. In addition, analysts’ earnings growth rate forecasts are also strong, as shown in the chart below. Due to all the aforementioned factors, I am bullish on DUK. (click to enlarge) Source: Nasdaq.com Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News