Scalper1 News

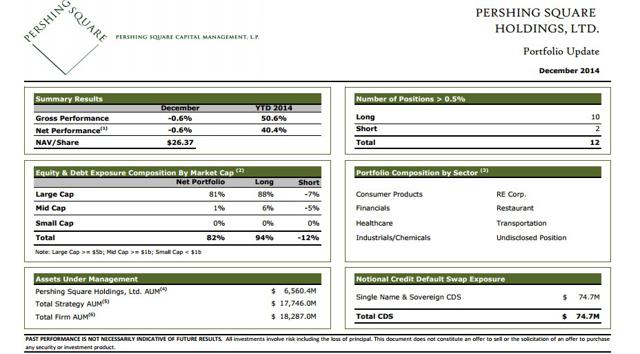

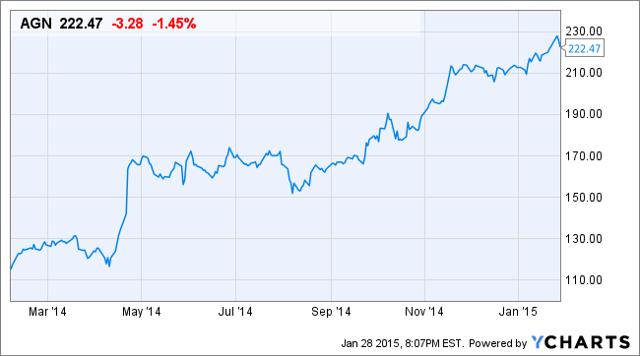

Originally Published on January 28, 2015 Bill Ackman wears an almost punchably smug expression. He looks as if he thinks that he is the smartest guy in any room. All the more grating is the fact that, in most rooms, he is right. He has reasons to be smug, having just came off of his best year ever, returning over 40% to his investors. Anyone can invest alongside him via Pershing Square Holdings (PSH). It costs $24.26 as of this writing which is over an 8% discount to its NAV per share of $26.43. Here are additional details from last month (including a slightly more dated NAV): (click to enlarge) Top positions include Allergan (NYSE: AGN ), Air Products (NYSE: APD ), Canadian Pacific (NYSE: CP ), Restaurant Brands International (NYSE: QSR ), Platform Specialty (NYSE: PAH ), Howard Hughes (NYSE: HHC ), and Zoetis (NYSE: ZTS ). Do such investments as managed by Ackman deserve a substantial discount? Evidence suggests that they do not. Ackman’s largest position, AGN, has been a spectacular success. That outcome is due to Ackman’s efforts to get it sold to Valeant (NYSE: VRX ). Pershing/VRX’s joint efforts led Actavis (NYSE: ACT ) to sign a definitive merger agreement with AGN. Ackman’s cost basis is about $129 per share on purchases that began in February of last year. He has made about $2.7 billion on this investment thus far. While much of this opportunity has already been captured there is still a double digit annualized net return on the spread between the AGN market price and the deal’s consideration. Target / Acquirer Tickers Parity Spread Return Allergan / Actavis AGN / ACT $230.09 $7.74 13% It appears that everything Ackman did with regards to AGN was perfectly legal. While AGN claimed that he violated securities laws, such a claim was a corporate defense designed to fend off an unsolicited bid. In 2014, Ackman successfully fended off insider trading accusations in court, entrenched management in a takeover battle, and the capital markets with spectacular outperformance. While we are endlessly reminded that past performance does not guarantee future results, it is a good indication that Pershing Square deserves a premium instead of a discount. What are PSH’s competitors in the world of conveniently available access to top hedge fund managers? Two are reinsurers, David Einhorn’s Greenlight Capital Re (NASDAQ: GLRE ) and Dan Loeb’s Third Point Re (NYSE: TPRE ). GLRE trades at a premium of almost nine percent and TPRE trades at a premium of almost four percent. If PSH trades up to an average of these two premiums, it would constitute a gain of over 16% from today’s price. While it is likely that all three fund managers would strenuously object to this characterization, they are peers of one another and have earned similar premiums. But more than anyone else, Ackman makes his own luck. You can share in that good luck by buying PSH. Disclosure: The author is long AGN, QSR. Additional disclosure: Chris DeMuth Jr is a portfolio manager at Rangeley Capital. Rangeley invests with a margin of safety by buying securities at deep discounts to their intrinsic value and unlocking that value through corporate events. In order to maximize total returns for our investors, we reserve the right to make investment decisions regarding any security without further notification except where such notification is required by law. Scalper1 News

Originally Published on January 28, 2015 Bill Ackman wears an almost punchably smug expression. He looks as if he thinks that he is the smartest guy in any room. All the more grating is the fact that, in most rooms, he is right. He has reasons to be smug, having just came off of his best year ever, returning over 40% to his investors. Anyone can invest alongside him via Pershing Square Holdings (PSH). It costs $24.26 as of this writing which is over an 8% discount to its NAV per share of $26.43. Here are additional details from last month (including a slightly more dated NAV): (click to enlarge) Top positions include Allergan (NYSE: AGN ), Air Products (NYSE: APD ), Canadian Pacific (NYSE: CP ), Restaurant Brands International (NYSE: QSR ), Platform Specialty (NYSE: PAH ), Howard Hughes (NYSE: HHC ), and Zoetis (NYSE: ZTS ). Do such investments as managed by Ackman deserve a substantial discount? Evidence suggests that they do not. Ackman’s largest position, AGN, has been a spectacular success. That outcome is due to Ackman’s efforts to get it sold to Valeant (NYSE: VRX ). Pershing/VRX’s joint efforts led Actavis (NYSE: ACT ) to sign a definitive merger agreement with AGN. Ackman’s cost basis is about $129 per share on purchases that began in February of last year. He has made about $2.7 billion on this investment thus far. While much of this opportunity has already been captured there is still a double digit annualized net return on the spread between the AGN market price and the deal’s consideration. Target / Acquirer Tickers Parity Spread Return Allergan / Actavis AGN / ACT $230.09 $7.74 13% It appears that everything Ackman did with regards to AGN was perfectly legal. While AGN claimed that he violated securities laws, such a claim was a corporate defense designed to fend off an unsolicited bid. In 2014, Ackman successfully fended off insider trading accusations in court, entrenched management in a takeover battle, and the capital markets with spectacular outperformance. While we are endlessly reminded that past performance does not guarantee future results, it is a good indication that Pershing Square deserves a premium instead of a discount. What are PSH’s competitors in the world of conveniently available access to top hedge fund managers? Two are reinsurers, David Einhorn’s Greenlight Capital Re (NASDAQ: GLRE ) and Dan Loeb’s Third Point Re (NYSE: TPRE ). GLRE trades at a premium of almost nine percent and TPRE trades at a premium of almost four percent. If PSH trades up to an average of these two premiums, it would constitute a gain of over 16% from today’s price. While it is likely that all three fund managers would strenuously object to this characterization, they are peers of one another and have earned similar premiums. But more than anyone else, Ackman makes his own luck. You can share in that good luck by buying PSH. Disclosure: The author is long AGN, QSR. Additional disclosure: Chris DeMuth Jr is a portfolio manager at Rangeley Capital. Rangeley invests with a margin of safety by buying securities at deep discounts to their intrinsic value and unlocking that value through corporate events. In order to maximize total returns for our investors, we reserve the right to make investment decisions regarding any security without further notification except where such notification is required by law. Scalper1 News

Scalper1 News