The earnings release of Caterpillar, Inc. CAT is scheduled to be announced before the opening bell on Jan 26. It is a much-awaited event as the world’s largest manufacturer of construction and mining equipment is often considered an economic bellwether. Caterpillar’s results in the past few quarters, reflects a weak mining industry, low oil prices , a stronger U.S. dollar and China’s economic woes. Notably, the company’s adjusted earnings plunged 19% to 85 cents per share in the last quarter.

Earnings Whispers

Our proven model shows that Caterpillar is likely to beat earnings in the to-be-reported quarter because it has the right combination of two key ingredients – a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), which have a significantly higher chance of beating earnings.

Zacks ESP: Caterpillar’s Earnings ESP is +1.54% as the Most Accurate estimate of 66 cents is pegged higher than the Zacks Consensus Estimate of 65 cents. A positive ESP serves as a meaningful and leading indicator of a likely positive earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Caterpillar carries a Zacks Rank #3. The combination of the company’s favorable Zacks Rank with a positive ESP makes us confident of an earnings beat.

Notably, the stocks having a Zacks Rank #4 and 5 (Sell-rated stocks) should never be considered going into an earnings announcement, especially when the company is seeing negative estimate revisions.

Surprise History

In the last quarter, Caterpillar’s earnings beat the Zacks Consensus Estimate by 13.33%. Going by the earnings surprise history, Caterpillar beat estimates in the last four quarters, leading to an overall positive average surprise of 8.53%.

Caterpillar Inc. Price and EPS Surprise

Caterpillar Inc. Price and EPS Surprise | Caterpillar Inc. Quote

Price Performance

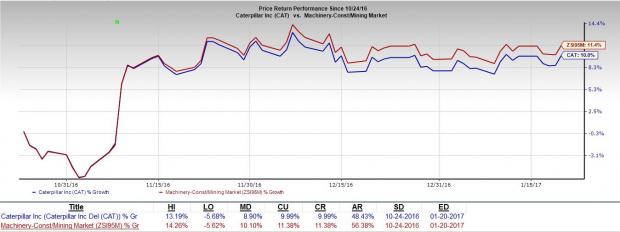

In the past three months, the Caterpillar stock has underperformed the Zacks Categorized Machinery – Construction/Mining industry. The company has delivered a return of 10%, while the industry gained 11.4%.

What’s Driving the Better-Than-Expected Earnings?

The company will benefit from the recent pick up in construction-related activity. Construction in Asia Pacific is improving consistently and the EAME construction industry has also witnessed positive growth lately.

Additionally, leading indicators of U.S. non-residential construction signal robust conditions ahead for the domestic construction industry. To counter the effect of weak end markets on its top line, Caterpillar remains committed to its goal of reducing costs, such that the decline in operating profit is no more than 25-30% of the decline in sales and revenues.

Some Other Promising Stocks

Caterpillar is not the only company looking up this earnings season. Here are some other stocks in the industrial products sector that you may want to consider as our model shows they have the right combination of elements to post an earnings beat this quarter:

Deere & Company DE has an Earnings ESP of +13.73% and sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Ingersoll-Rand Plc IR has an Earnings ESP of +1.09% and carries a Zacks Rank #3.

AGCO Corporation AGCO , a Zacks Rank #3 stock has an Earnings ESP of +5.63%.

Zacks’ Top Investment Ideas for Long-Term Profit

How would you like to see our best recommendations to help you find today’s most promising long-term stocks? Starting now, you can look inside our portfolios featuring stocks under $ 10, income stocks, value investments and more. These picks, which have double and triple-digit profit potential, are rarely available to the public. But you can see them now. Click here >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Ingersoll-Rand PLC (Ireland) (IR): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International